Preparing for the CPA Exam requires a deep understanding of "Area II – Select Balance Sheet Accounts." Mastery of the complexities of assets, liabilities, and equity accounts is essential. This knowledge equips you to accurately assess financial positions, critical for maintaining compliance and transparency, key to achieving a high CPA score.

Learning Objective

In studying "Area II – Select Balance Sheet Accounts" for the CPA Exam, you should aim to master the key components and principles underlying assets, liabilities, and equity accounts. Learn to accurately analyze and evaluate the accounting treatments and disclosures related to cash, receivables, inventory, property, plant, and equipment, and intangible assets. Explore the complexities of liabilities including bonds, leases, and pensions. Additionally, understand the equity section's role in reflecting the residual interest in assets after deducting liabilities. Apply this knowledge to ensure proper classification, measurement, and presentation in financial statements, crucial for accurate reporting and compliance in professional practice.

Overview of Balance Sheet Accounts

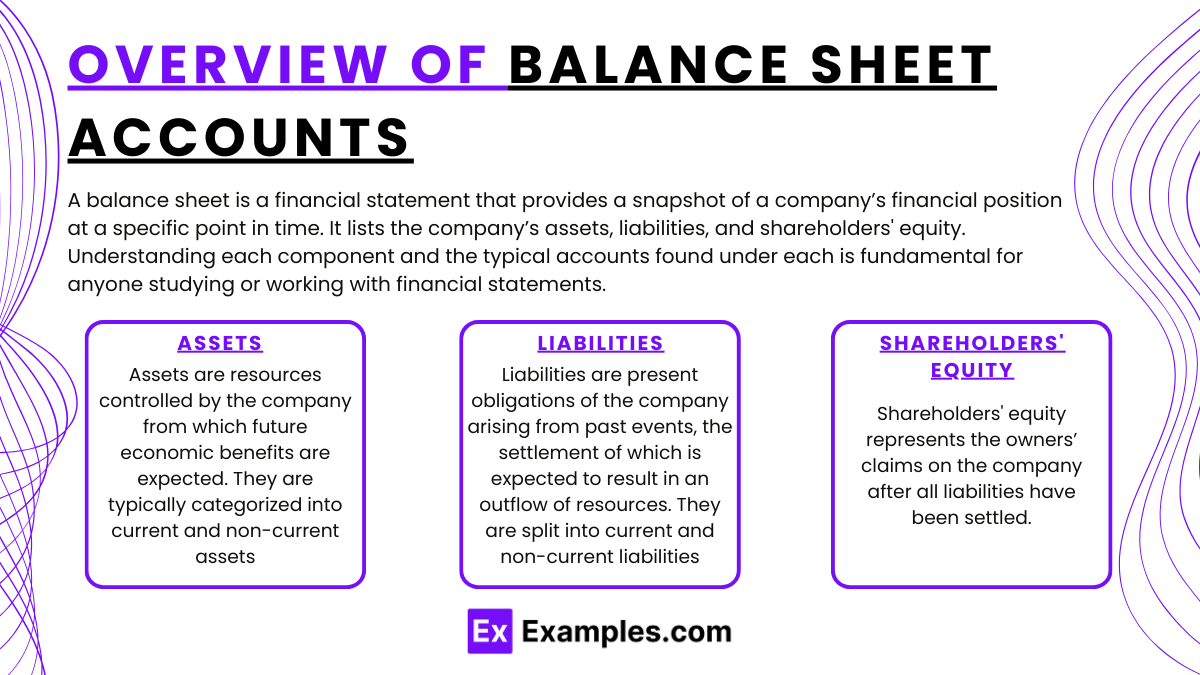

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It lists the company’s assets, liabilities, and shareholders' equity. Understanding each component and the typical accounts found under each is fundamental for anyone studying or working with financial statements. Here’s an overview of the main balance sheet accounts:

Assets

Assets are resources controlled by the company from which future economic benefits are expected. They are typically categorized into current and non-current assets:

Current Assets: Includes cash, receivables, inventory, and prepaid expenses.

Non-Current Assets: Consists of property, plant, and equipment (PPE), intangible assets, long-term investments, and deferred tax assets.

Liabilities

Liabilities are present obligations of the company arising from past events, the settlement of which is expected to result in an outflow of resources. They are split into current and non-current liabilities:

Current Liabilities: Comprises accounts payable, short-term debt, accrued liabilities, and unearned revenue.

Non-Current Liabilities: Includes long-term debt, deferred tax liabilities, and pension obligations.

Shareholders' Equity

Shareholders' equity represents the owners’ claims on the company after all liabilities have been settled. It includes:

Common Stock: Capital received from issuing shares.

Retained Earnings: Accumulated profits not distributed as dividends.

Additional Paid-in Capital: Excess received over the par value of shares.

Treasury Stock: Repurchased shares not canceled.

Detailed Analysis of Asset Accounts

A detailed analysis of asset accounts on a balance sheet offers insight into the resources a company controls that are expected to provide future economic benefits. These assets are categorized as current and non-current, each serving different operational roles. Here’s a closer look at these categories and the typical accounts included within them:

Current Assets

Current assets are those that the company expects to convert into cash, sell, or consume within one year or within the operating cycle, whichever is longer. These include:

Cash and Cash Equivalents: Includes readily convertible short-term investments.

Accounts Receivable: Money owed by customers, potentially adjusted for doubtful accounts.

Inventory: Consists of raw materials, work-in-progress, and finished goods, valued using methods like FIFO or LIFO.

Prepaid Expenses: Payments made in advance for future goods or services.

Non-Current Assets

These are assets that are not expected to be turned into cash, sold, or consumed within one year of the balance sheet date. Non-current assets include:

Property, Plant, and Equipment (PPE): Tangible assets used in operations, recorded at cost and depreciated over time (except land).

Intangible Assets: Includes rights like patents and trademarks, amortized over useful lives, and goodwill which is tested for impairment.

Long-term Investments: Investments in other entities or assets for long-term purposes, accounted for by methods such as cost or equity.

Deferred Tax Assets: Arise from overpaid taxes or carryforward losses available to reduce future taxable income.

Analysis of Liability Accounts

An analysis of liability accounts on a balance sheet is crucial for understanding the financial obligations a company owes, which must be settled through the transfer of economic benefits such as cash, goods, or services. Liabilities are categorized as either current or non-current, each reflecting the timing and nature of the obligations.

Current Liabilities

Current liabilities are those obligations that are due within one year or within the normal operating cycle of the business, whichever is longer. They include:

Accounts Payable: Debts to vendors for goods and services received on credit.

Accrued Liabilities: Expenses incurred but not yet paid, such as wages and taxes.

Short-term Debt: Debts due within a year, including bank loans and lines of credit.

Unearned Revenue: Payments received in advance for services or products to be delivered.

Non-Current Liabilities

Non-current liabilities are those obligations that are due beyond one year. They reflect the long-term financial strategy of the company and include:

Long-term Debt: Financial obligations due after more than one year, such as bonds and long-term leases.

Deferred Tax Liabilities: Taxes accrued but not due immediately, stemming from timing differences in income and expense recognition.

Pension Liabilities: Future retirement benefits owed to employees, dependent on actuarial assessments.

Examples

Example 1: Cash Reconciliation

A company reconciles its cash balance at the end of the month by matching the cash balance in its accounting records to the bank statements, adjusting for any discrepancies due to timing differences in deposits and withdrawals, checks issued but not yet cashed, and bank fees.

Example 2: Valuation of Accounts Receivable

A company evaluates its accounts receivable at year-end and establishes an allowance for doubtful accounts based on historical collection rates and the current economic environment. This allowance is used to present a realistic and achievable receivable balance on the balance sheet.

Example 3: Inventory Costing

A manufacturing company uses the FIFO (First-In, First-Out) method to value its inventory. This method assumes that the inventory items purchased or produced first are sold first and leaves items purchased or produced last remaining in inventory at the end of the accounting period.

Example 4: Depreciation of Property, Plant, and Equipment

A company purchases a piece of machinery for 10,000. It applies straight-line depreciation, resulting in an annual depreciation expense of $9,000, which is systematically charged to expense over the useful life of the asset.

Example 5: Recording Lease Obligations

A company enters a lease agreement for office space with a term of 5 years. Under the new lease accounting standard (ASC 842), the company recognizes a right-of-use asset and a lease liability on its balance sheet, calculated based on the present value of the lease payments over the lease term.

Practice Questions

Question 1:

What is the effect of writing off an uncollectible account on the allowance method for accounts receivable?

A. Decreases total assets

B. Increases total assets

C. Has no effect on total assets

D. Increases expenses

Answer: C

Explanation:

Step 1: Understanding the Question

This question assesses the impact of writing off an uncollectible account when using the allowance method on total assets.

Step 2: Analyzing Each Option

A is incorrect because the write-off is made against the allowance for doubtful accounts, not directly against assets.

B is incorrect because writing off an account does not increase assets.

C is correct because the write-off affects only the allowance for doubtful accounts and accounts receivable, with no net effect on total assets.

D is incorrect as the expense was already recorded when the allowance was established.

Step 3: Conclusion

Writing off an uncollectible account when using the allowance method adjusts accounts within receivables but does not affect the total assets on the balance sheet.

Question 2:

Which inventory valuation method assigns the cost of the most recently acquired items to ending inventory during a period of rising prices?

A. FIFO (First-In, First-Out)

B. LIFO (Last-In, First-Out)

C. Weighted Average

D. Specific Identification

Answer: A

Explanation:

Step 1: Understanding the Question

This question asks about the inventory valuation method that results in the most recently acquired items being included in ending inventory under rising prices.

Step 2: Analyzing Each Option

A is correct as FIFO assumes the items purchased first are sold first, so the most recently purchased (and presumably higher-cost) items remain in inventory.

B is incorrect because LIFO assigns the most recent costs to the cost of goods sold, not ending inventory.

C spreads costs across all items and is therefore not focused solely on recent acquisitions.

D applies to specific items but doesn’t typically focus on the timing of costs in the same way FIFO does.

Step 3: Conclusion

FIFO results in the newest, and usually higher-priced items, remaining in ending inventory, which can lead to higher reported inventory values during inflationary periods.

Question 3:

Under which of the following conditions would a company report the lowest depreciation expense in the first year?

A. Straight-line depreciation

B. Double declining balance

C. Sum-of-the-years'-digits

D. Units of production

Answer: A

Explanation:

Step 1: Understanding the Question

This question asks which depreciation method would result in the lowest depreciation expense in the first year of an asset's life.

Step 2: Analyzing Each Option

A is correct as straight-line depreciation spreads the cost evenly over the life of the asset, resulting in lower annual depreciation compared to accelerated methods.

B and C are forms of accelerated depreciation, which result in higher initial depreciation expenses.

D depends on usage and could vary, but generally, it’s not lower than straight-line unless usage is exceptionally low.

Step 3: Conclusion

Straight-line depreciation typically results in the lowest depreciation expense in the first year because it equally divides the asset's cost over its useful life.