On the CPA Exam, Federal Taxation of Individuals covers essential topics crucial for understanding personal tax obligations and compliance. You’ll explore income classifications, filing statuses, and deductions, along with credits and exclusions. This area emphasizes the calculation of taxable income, the determination of tax liabilities, and the impact of various adjustments. Understanding the intricacies of tax planning strategies, residency rules, and reporting requirements is key to mastering the Regulation (REG) section of the exam. Proficiency in these concepts is essential for success in tax preparation and advisory roles.

Learning Objectives

In studying “Area IV – Federal Taxation of Individuals” for the CPA Exam, you should learn to understand the key components of individual income tax, including gross income, deductions, exemptions, and tax credits. Recognize taxable and non-taxable income sources and apply the appropriate filing status rules. Analyze allowable deductions for Adjusted Gross Income (AGI) and distinguish between itemized deductions and the standard deduction. Evaluate the treatment of capital gains, losses, and various tax credits, such as education and child-related credits. Understand how alternative minimum tax (AMT) works and the impact of self-employment taxes. Additionally, develop proficiency in calculating an individual’s total tax liability, applying tax rates, and ensuring compliance with filing deadlines and reporting requirements.

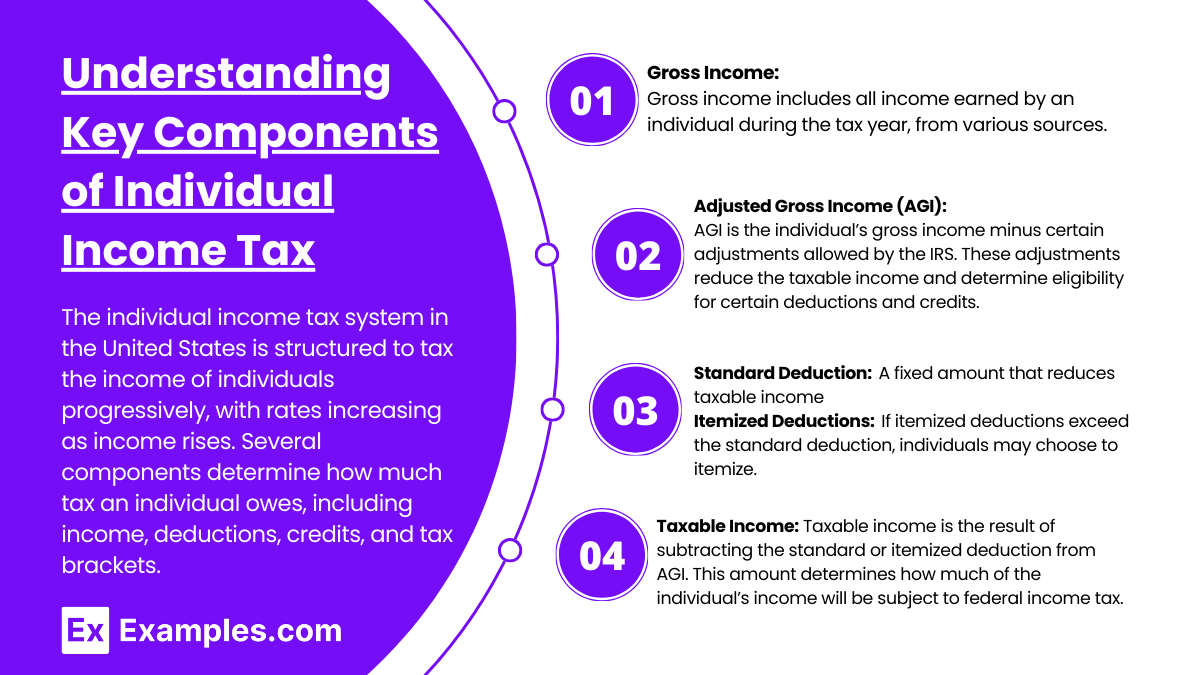

Understanding Key Components of Individual Income Tax

The individual income tax system in the United States is structured to tax the income of individuals progressively, with rates increasing as income rises. Several components determine how much tax an individual owes, including income, deductions, credits, and tax brackets. Knowing these components helps individuals understand how taxes are calculated and how to plan effectively.

1. Gross Income

Gross income includes all income earned by an individual during the tax year, from various sources.

Examples of Gross Income:

- Wages, Salaries, and Tips

- Investment Income: Interest, dividends, and capital gains

- Business Income: Self-employment or rental property income

- Retirement Income: Social Security, pensions, and withdrawals from retirement accounts

- Alimony and Unemployment Benefits (subject to limitations)

2. Adjusted Gross Income (AGI)

AGI is the individual’s gross income minus certain adjustments allowed by the IRS. These adjustments reduce the taxable income and determine eligibility for certain deductions and credits.

Examples of Adjustments to Income:

- Contributions to Traditional IRAs

- Student Loan Interest Deduction

- Health Savings Account (HSA) Contributions

- Educator Expenses for Teachers

Formula: AGI = Gross Income−Adjustments to Income

3. Standard Deduction vs. Itemized Deductions

After calculating AGI, individuals can either take the standard deduction or itemize deductions.

a. Standard Deduction:

- A fixed amount that reduces taxable income.

- For 2023, the standard deduction amounts are:

- $13,850 for single filers

- $27,700 for married couples filing jointly

b. Itemized Deductions:

- If itemized deductions exceed the standard deduction, individuals may choose to itemize.

- Common Itemized Deductions:

- State and Local Taxes (SALT): Limited to $10,000

- Mortgage Interest on primary and secondary homes

- Charitable Contributions

- Medical Expenses exceeding 7.5% of AGI.

4. Taxable Income

Taxable income is the result of subtracting the standard or itemized deduction from AGI. This amount determines how much of the individual’s income will be subject to federal income tax.

Formula: Taxable Income = AGI−Standard or Itemized Deduction.

Recognizing Taxable and Non-Taxable Income Sources

The IRS requires individuals to report taxable income on their returns, but certain types of income are non-taxable and do not need to be included. Understanding which income is subject to tax helps taxpayers comply with federal laws while taking advantage of exclusions and exemptions.

1. Taxable Income Sources

Taxable income includes any earnings or gains that increase an individual’s wealth and are subject to federal income tax. The following are common examples:

a. Earned Income

- Wages, Salaries, and Tips: Income from employment.

- Self-Employment Income: Profits from freelance work or business activities.

Example: A salaried employee earning $50,000 annually must report this income.

b. Investment Income

- Interest Income: Earned from savings accounts, bonds, or certificates of deposit (CDs).

- Dividends: Payments to shareholders from corporate profits.

- Qualified Dividends are taxed at long-term capital gains rates.

- Ordinary Dividends are taxed as regular income.

- Capital Gains: Profits from selling assets like stocks or real estate.

Example: Interest earned on a savings account is taxable.

c. Retirement Income

- Social Security Benefits: Up to 85% may be taxable, depending on total income.

- Pension and Annuities: Distributions are generally taxable.

- Withdrawals from Traditional IRAs and 401(k)s: Taxed as ordinary income.

Example: A retiree withdrawing $10,000 from a traditional IRA must report it as income.

d. Business and Rental Income

- Rental Income: From leasing property.

- Business Income: Profits from self-employment or small businesses.

e. Other Taxable Income

- Alimony (Pre-2019 Agreements): Alimony received from divorce settlements finalized before 2019.

- Gambling Winnings: Casinos and lotteries must report winnings, and individuals must include them on their tax returns.

- Unemployment Compensation: Fully taxable in most cases.

- Debt Forgiveness: Canceled debt is often considered taxable income.

2. Non-Taxable Income Sources

The IRS excludes certain types of income from taxation. These exclusions provide financial relief and promote specific social or economic goals.

a. Gifts and Inheritances

- Gifts: Money or property received as a gift is not taxable to the recipient.

- Inheritances: Amounts received from an estate are generally tax-exempt, though the estate itself may be subject to estate tax.

Example: A person receiving a $10,000 gift from a friend does not owe tax on it.

b. Life Insurance Proceeds

Death Benefits: Proceeds paid to a beneficiary are non-taxable.

Example: A $100,000 life insurance payout to a beneficiary is not reported as income.

c. Social Security Benefits (Low-Income Taxpayers)

For individuals with limited income, Social Security benefits may not be taxable.

d. Certain Scholarships and Fellowships

- Qualified Scholarships: Amounts used for tuition, books, and required fees are non-taxable.

- Room and Board: Amounts used for housing are taxable.

Example: A student receiving a $5,000 scholarship for tuition does not include it as income.

e. Workers’ Compensation

Payments for Work-Related Injuries: These benefits are non-taxable.

f. Welfare and Public Assistance

TANF (Temporary Assistance for Needy Families) and other welfare benefits are not subject to tax.

Example: A family receiving food stamps does not report the value as income.

g. Child Support

Child support payments are not taxable for the recipient and not deductible for the payer.

h. Municipal Bond Interest

Interest earned on municipal bonds is exempt from federal income tax and may also be exempt from state and local taxes.

Example: A taxpayer earning $2,000 in municipal bond interest does not include it in taxable income.

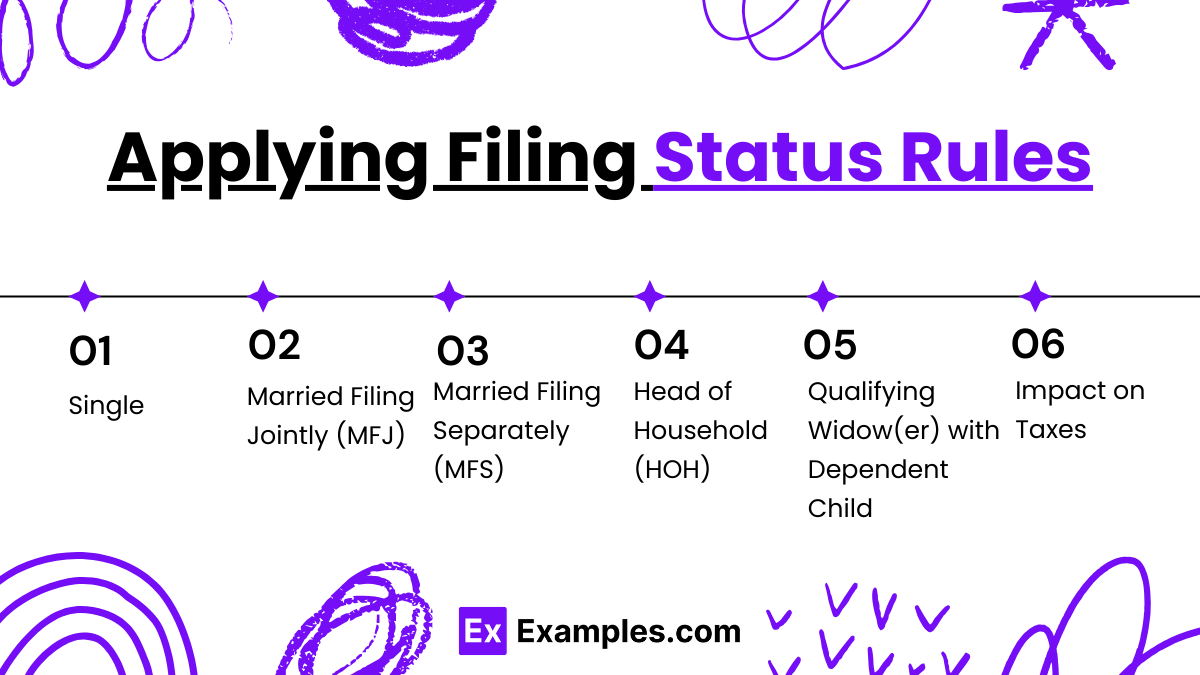

Applying Filing Status Rules

- Single:

- For individuals unmarried and not qualifying for other statuses.

- Standard Deduction (2023): $13,850.

- Married Filing Jointly (MFJ):

- For married couples combining income on one return.

- Standard Deduction: $27,700. Both spouses are jointly liable for taxes.

- Married Filing Separately (MFS):

- Each spouse reports income separately; some tax credits may be reduced or unavailable.

- Standard Deduction: $13,850 per spouse. Limits liability to individual income.

- Head of Household (HOH):

- For unmarried individuals who support a qualifying dependent and pay more than half the household costs.

- Standard Deduction: $20,800. Offers lower tax rates than Single status.

- Qualifying Widow(er) with Dependent Child:

- Available for two years after a spouse’s death if supporting a child.

- Standard Deduction: $27,700, similar to MFJ.

- Impact on Taxes:

- Filing status affects deductions, tax brackets, and eligibility for credits.

- Joint filers benefit from lower tax brackets, while separate filers limit liability but lose access to some credits.

Examples

Example 1: Sale of Real Estate

When an individual sells real estate, such as a home or rental property, the transaction may result in capital gains or losses. If the property is sold for more than its purchase price (adjusted basis), the seller may owe capital gains tax on the profit. Understanding the rules for primary residence exclusion and investment property taxation is crucial for accurate reporting and tax planning.

Example 2: 1031 Like-Kind Exchange

A 1031 exchange allows investors to defer capital gains taxes on the sale of an investment property by reinvesting the proceeds into a similar property. This transaction must meet specific requirements, such as identifying a replacement property within a certain timeframe. This provision encourages investment in real estate while postponing immediate tax liabilities, making it a popular strategy among real estate investors.

Example 3: Inheritance of Property

When individuals inherit property, such as real estate or stocks, they receive a step-up in basis. This means that the property is valued at its fair market value at the date of the decedent’s death rather than the original purchase price. If the heir sells the inherited property, they may only pay capital gains tax on the appreciation that occurs after the inheritance, which can significantly reduce tax liability.

Example 4: Property Depreciation

For rental properties and business assets, depreciation allows property owners to deduct the cost of the property over its useful life from their taxable income. This non-cash deduction helps reduce taxable income, reflecting the property’s wear and tear. Understanding how to calculate and apply depreciation is essential for property owners to maximize their tax benefits and ensure compliance with IRS regulations.

Example 5: Capital Gains Tax on Investment Property

When an individual sells an investment property, the profit generated is typically subject to capital gains tax. This includes short-term capital gains (for properties held for one year or less) and long-term capital gains (for properties held for more than one year), which are taxed at different rates. Understanding the implications of capital gains tax on property transactions is critical for investors and property owners when making decisions about selling or holding their investments.

Practice Questions

Question 1

Which of the following types of income is generally considered taxable for federal income tax purposes?

A) Gifts received from family members

B) Interest earned on a savings account

C) Inheritances received from a deceased relative

D) Life insurance proceeds

Correct Answer: B) Interest earned on a savings account.

Explanation: Interest earned on a savings account is considered taxable income and must be reported on an individual’s tax return. This income is categorized as ordinary income and is subject to federal income tax. In contrast, gifts and inheritances are generally not subject to federal income tax for the recipient, and life insurance proceeds are typically not taxed, making option B the correct choice.

Question 2

What is the primary purpose of the standard deduction for individual taxpayers?

A) To provide a tax credit for certain expenses

B) To simplify the tax filing process by reducing taxable income

C) To increase the tax rate for higher income levels

D) To encourage taxpayers to itemize their deductions

Correct Answer: B) To simplify the tax filing process by reducing taxable income.

Explanation: The standard deduction is a fixed dollar amount that reduces the income on which individuals are taxed. It simplifies the tax filing process by allowing taxpayers to claim this deduction instead of itemizing individual deductions, which can be time-consuming and complex. By lowering taxable income, it helps to reduce the overall tax liability for individuals who do not have significant itemizable expenses. Options A, C, and D do not accurately represent the purpose of the standard deduction.

Question 3

Which of the following is an example of a tax credit?

A) The standard deduction

B) The Child Tax Credit

C) Home mortgage interest deduction

D) State income tax deduction

Correct Answer: B) The Child Tax Credit.

Explanation: A tax credit directly reduces the amount of tax owed, providing a dollar-for-dollar reduction in tax liability. The Child Tax Credit is a specific example that allows eligible taxpayers to claim a credit for each qualifying child, thereby reducing their overall tax burden. In contrast, the standard deduction and various deductions (like mortgage interest and state income tax) reduce taxable income but do not directly reduce tax owed, making option B the correct answer.