Preparing for the CPA Exam requires a comprehensive understanding of Area I – Tax Compliance and Planning for Individuals and Personal Financial Planning. This segment focuses on tax regulations, compliance requirements, and strategies for tax planning specific to individuals. Key elements include tax return preparation, tax laws, and effective personal financial management. Mastery of this area is essential for accurate tax compliance and effective financial decision-making, critical for achieving a high CPA score.

Learning Objectives

In studying “Area I – Tax Compliance and Planning for Individuals and Personal Financial Planning” for the CPA exam, you should understand the tax laws and regulations governing individual income tax compliance and planning. Analyze tax planning strategies, including income deferral, deductions, and credits, to minimize tax liability. Evaluate various tax forms, filing requirements, and the implications of recent tax law changes. Additionally, explore personal financial planning concepts such as retirement planning, estate planning, and risk management. Apply your understanding to interpreting tax scenarios, making informed decisions, and solving case-based questions in CPA exam practice sections.

1. Tax Compliance for Individuals

- Definition: Tax compliance involves understanding and following the rules and regulations established by tax authorities, ensuring that individuals correctly file their taxes, pay the appropriate amount, and comply with deadlines.

- Key Focus: It includes learning about income reporting, claiming deductions and credits, calculating tax liability, and submitting tax forms accurately.

- Goal: Ensure adherence to all legal requirements, reduce penalties, and avoid audits.

2. Tax Planning for Individuals

- Definition: Tax planning is the strategic process of analyzing financial situations to minimize tax liabilities within the boundaries of the law.

- Key Strategies:

- Income Deferral: Shifting income to future years to lower the current year’s taxable income.

- Deductions and Credits: Identifying and maximizing allowable deductions (e.g., mortgage interest) and credits (e.g., Child Tax Credit) to reduce taxable income and liability.

- Goal: Optimize financial decisions to pay the least amount of tax possible while remaining compliant.

3. Personal Financial Planning

- Definition: Personal financial planning refers to managing an individual’s finances to meet their life goals, focusing on accumulating, preserving, and distributing wealth effectively.

- Key Areas:

- Retirement Planning: Saving and investing in retirement accounts to ensure sufficient funds during retirement, considering tax implications.

- Estate Planning: Strategizing the distribution of assets upon death, minimizing estate taxes, and protecting family wealth.

- Risk Management: Protecting assets through insurance, which helps manage potential financial risks.

- Goal: Provide long-term financial security and optimize wealth growth while considering tax implications.

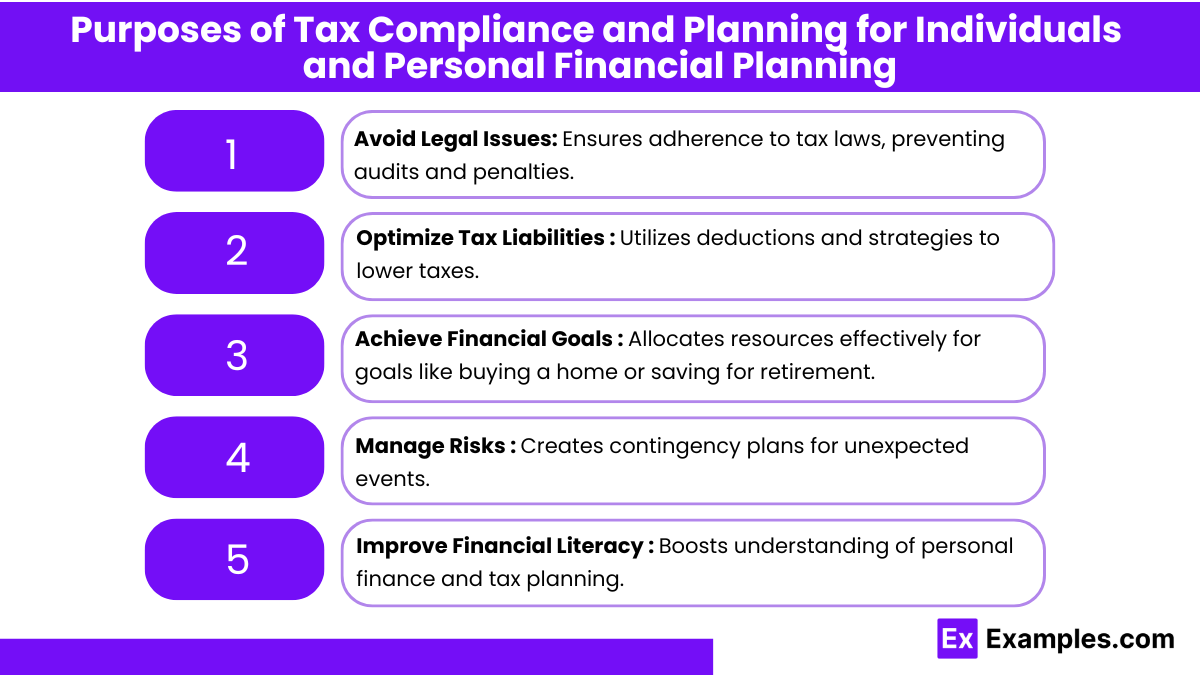

Purposes of Tax Compliance and Planning for Individuals and Personal Financial Planning

- Avoid Legal Issues: “Tax Compliance and Planning for Individuals and Personal Financial Planning” ensures adherence to legal tax obligations, preventing audits, penalties, or legal actions.

- Optimize Tax Liabilities: Helps individuals utilize deductions, credits, and strategies to reduce tax liabilities.

- Achieve Financial Goals: Supports effective allocation of resources to achieve short-term and long-term goals, like buying a house, saving for education, or retirement.

- Manage Risks: Reduces financial risks by creating contingency plans for unexpected events like medical emergencies or unemployment.

- Improve Financial Literacy: Enhances understanding of financial management and tax planning, fostering better personal financial decisions.

Types of Tax Compliance and Planning for Individuals and Personal Financial Planning

- Income Planning

- Individuals must manage various sources of income—salary, bonuses, dividends, rental income, and capital gains. Tax-efficient strategies like deferring income or contributing to pre-tax retirement accounts (e.g., 401(k), IRA) help lower taxable income while boosting retirement savings.

- Tax Planning

- Tax planning involves:

- Deductions: Deductions reduce taxable income (e.g., mortgage interest, student loans).

- Credits: Tax credits (e.g., Earned Income Tax Credit, Child Tax Credit) reduce the tax bill dollar-for-dollar.

- Exemptions: Exemptions exclude certain types of income from taxation.

- Tax-Deferred Accounts: Contributing to accounts like 401(k)s, IRAs, and Health Savings Accounts (HSAs) allows tax deferral, meaning taxes are paid later, typically at a lower rate.

- Tax planning involves:

- Investment Planning

- Investment decisions should consider after-tax returns. For example:

- Capital Gains Strategy: Holding investments for over a year qualifies them for lower long-term capital gains tax rates.

- Tax-Efficient Mutual Funds and ETFs: These investments are structured to minimize taxable distributions, maximizing growth potential.

- Investment decisions should consider after-tax returns. For example:

- Retirement Planning

- Traditional IRA vs. Roth IRA: Contributions to a Traditional IRA are tax-deductible, but withdrawals are taxed. Roth IRA contributions are after-tax, but withdrawals are tax-free.

- Employer-Sponsored Retirement Plans: Contributing to 401(k)s, 403(b)s, or pensions allows individuals to save for retirement while reducing current taxable income.

- Estate and Legacy Planning

- Estate planning involves designating how assets are distributed after death. Effective planning includes:

- Wills and Trusts: These legal documents ensure the distribution of assets as intended and can minimize estate taxes.

- Gifting Strategy: Annual gifting limits allow individuals to transfer wealth tax-free to heirs or charitable organizations.

- Estate planning involves designating how assets are distributed after death. Effective planning includes:

Examples

Example 1. Understanding Tax Filing Requirements

In the context of Area I – Tax Compliance and Planning for Individuals and Personal Financial Planning, it’s essential to recognize the fundamental tax filing requirements for individuals. This includes identifying the types of income that must be reported, filing statuses available, and applicable deadlines. Knowing these basics is crucial for proper compliance and strategic financial planning, ensuring individuals avoid penalties while optimizing their tax obligations.

Example 2. Tax Deductions and Credits Management

A key aspect of Area I – Tax Compliance and Planning for Individuals and Personal Financial Planning is effectively managing tax deductions and credits. By identifying eligible deductions like mortgage interest, education expenses, and medical costs, individuals can reduce taxable income. Additionally, leveraging tax credits such as the Child Tax Credit or the Earned Income Tax Credit can further minimize tax liabilities, contributing to better financial outcomes.

Example 3. Retirement Planning and Tax Implications

In Area I – Tax Compliance and Planning for Individuals and Personal Financial Planning, strategic retirement planning plays a pivotal role. By understanding the tax implications of different retirement accounts—such as traditional IRAs, Roth IRAs, and 401(k)s—individuals can optimize their contributions and withdrawals to maximize savings and minimize tax liabilities over time.

Example 4. Personal Financial Goals and Tax Strategies

Area I – Tax Compliance and Planning for Individuals and Personal Financial Planning emphasizes the importance of aligning personal financial goals with tax strategies. By analyzing short-term and long-term financial objectives, individuals can implement tax-efficient strategies that support savings growth, investment returns, and overall financial well-being.

Example 5. Estate Planning Considerations

Estate planning is a vital part of Area I – Tax Compliance and Planning for Individuals and Personal Financial Planning. It involves understanding how to manage estate taxes, gifting strategies, and beneficiary designations to ensure assets are transferred efficiently to heirs. Proper estate planning can help individuals achieve their legacy goals while minimizing tax burdens on beneficiaries.

Practice Questions

Question 1

Which of the following is included in the calculation of taxable income for individuals?

A) Child support payments received

B) Life insurance death benefits

C) Salary and wages from employment

D) Gifts received from family members

Correct Answer: C) Salary and wages from employment

Explanation:

Taxable income includes all forms of compensation for work performed, including salary and wages. These are subject to federal income tax and must be reported on an individual’s tax return. Child support payments and gifts are generally excluded from taxable income, while life insurance death benefits are not considered taxable income if received by the beneficiary as a lump sum.

Question 2

Which of the following retirement accounts allows individuals to make tax-deductible contributions?

A) Roth IRA

B) Traditional IRA

C) Health Savings Account (HSA)

D) Coverdell Education Savings Account

Correct Answer: B) Traditional IRA

Explanation:

Contributions made to a Traditional IRA are tax-deductible, which reduces an individual’s taxable income in the year of contribution. Roth IRA contributions are made with after-tax dollars and are not tax-deductible. HSAs and Coverdell ESAs, while offering tax advantages, are primarily designed for healthcare and education expenses, respectively, not general retirement savings.

Question 3

Which of the following is a benefit of using a Health Savings Account (HSA) for personal financial planning?

A) Contributions are taxed at the ordinary income tax rate.

B) Distributions for qualified medical expenses are tax-free.

C) Contributions are limited to individuals over age 65.

D) Only employer contributions are allowed.

Correct Answer: B) Distributions for qualified medical expenses are tax-free

Explanation:

An HSA allows individuals to make pre-tax contributions that grow tax-free. When funds are withdrawn to pay for qualified medical expenses, distributions are also tax-free, providing a triple tax advantage. Contributions can be made by both individuals and employers, and there is no age restriction for contributions, although individuals must be enrolled in a high-deductible health plan to be eligible.