Preparing for the CPA Exam requires a comprehension of Area II – Entity Tax Compliance. This segment emphasizes tax laws, filing requirements, and strategic planning related to businesses and entities. Core topics include corporate tax returns, partnership taxation, and compliance obligations for various business structures. Understanding these concepts is vital for managing entity tax issues and making informed business decisions, contributing significantly to achieving a high CPA score.

Learning Objectives

“In studying ‘Area II – Entity Tax Compliance’ for the CPA exam, focus on understanding tax laws and regulations affecting business entities, including corporations, partnerships, and S corporations. Analyze entity-level tax planning strategies, such as income deferral, deductions, and credits to optimize tax positions. Review various tax forms, filing requirements, and implications of recent tax law changes affecting entities. Explore compliance issues like corporate taxation, partnership allocations, and multi-state tax matters. Apply your knowledge to interpret tax scenarios, make informed decisions, and effectively address entity-specific case-based questions in CPA exam practice sections.”

1. Introduction to Entity Tax Compliance

Entity Tax Compliance involves understanding the tax obligations and regulations specific to different business entities, including corporations, partnerships, and S corporations. It encompasses various tax aspects such as income reporting, deductions, credits, and compliance with federal and state requirements. CPA candidates must master these areas to interpret tax scenarios and address case-based questions effectively.

2. Tax Laws Affecting Business Entities

- Corporations: Corporations are subject to double taxation, meaning they pay taxes on earnings and shareholders pay taxes on dividends. CPA candidates should understand corporate tax rates, allowable deductions, and credits.

- Partnerships: Partnerships are treated as pass-through entities, meaning income and losses pass to partners, who report them on individual tax returns. Candidates must analyze partnership allocations, contributions, and distributions.

- S Corporations: S corporations also pass income and losses through to shareholders but have unique restrictions, such as a limit on the number of shareholders and allowable types of shareholders.

- LLCs (Limited Liability Companies): Depending on elections made by the LLC and its number of members, it may be taxed as a sole proprietorship, partnership, or corporation, each with distinct compliance requirements.

3. Entity-Level Tax Planning Strategies

Entity-level tax planning strategies aim to optimize tax positions for different entities, focusing on income deferral, deductions, and credits:

- Income Deferral: Deferring income to future tax years can reduce immediate tax liability. CPA candidates should review installment sales, advance payment deferral, and bonus depreciation rules.

- Deductions: Understanding deductible business expenses, such as operating expenses, salaries, and benefits, is crucial. The CPA exam may test candidates on specific deductions like the Qualified Business Income (QBI) deduction.

- Tax Credits: Candidates should understand how to apply credits such as the Research and Development (R&D) Tax Credit, Energy Tax Credits, and others that reduce the tax liability of entities directly.

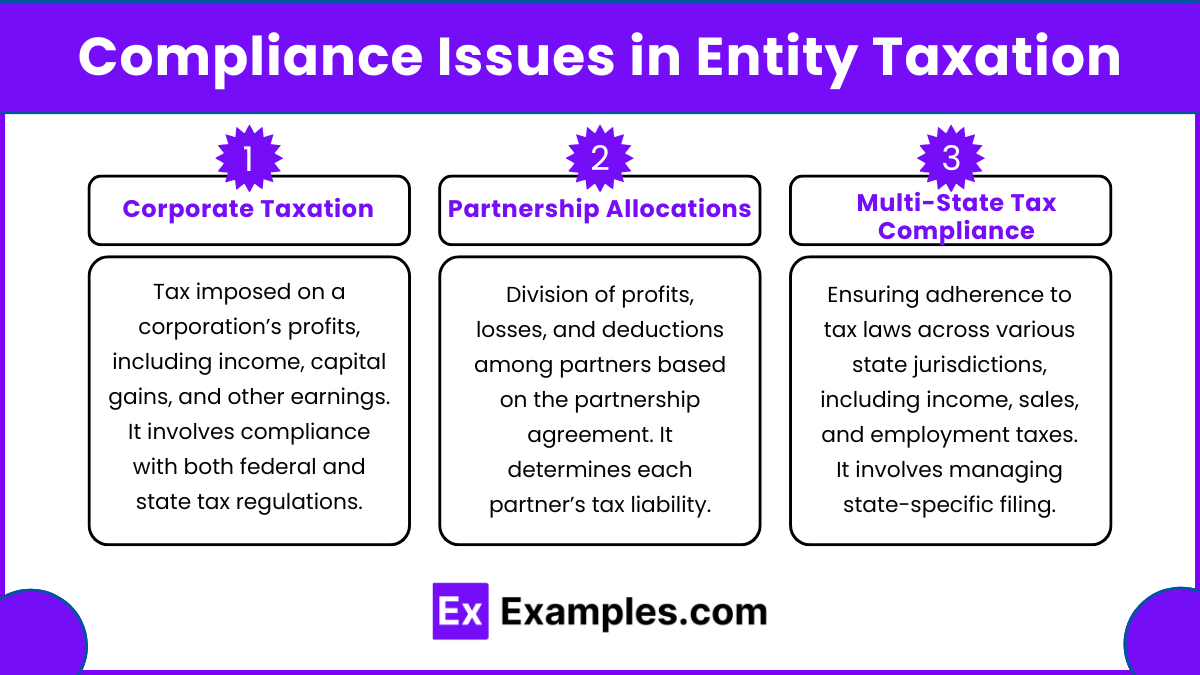

4. Compliance Issues in Entity Taxation

- Corporate Taxation: Includes compliance with corporate tax forms (e.g., Form 1120) and estimated tax payments. Candidates should be familiar with adjustments, tax schedules, and tax reconciliation for C corporations.

- Partnership Allocations: Partnerships allocate income, gains, losses, deductions, and credits among partners based on the partnership agreement. Understanding guaranteed payments, special allocations, and distribution rules is critical.

- Multi-State Tax Compliance: Business entities often have tax obligations in multiple states. CPA candidates must understand apportionment rules, nexus criteria, and sales tax compliance to address multi-state taxation effectively.

Examples

Example 1. Understanding the Role of Area II – Entity Tax Compliance in Corporations:

In preparing for the CPA exam, mastering Area II – Entity Tax Compliance is essential for candidates focusing on corporate taxation. This area emphasizes understanding corporate tax forms, calculating tax liabilities, and applying specific deductions and credits to reduce overall tax burden. The knowledge gained from this section aids in determining correct tax positions and ensuring compliance with both federal and state regulations for corporations.

Example 2. Analyzing Partnerships in Area II – Entity Tax Compliance:

For partnerships, Area II – Entity Tax Compliance provides guidance on managing tax allocations, income distributions, and partner-specific tax treatments. CPA candidates learn to handle unique challenges like special allocations, guaranteed payments, and managing each partner’s basis in the partnership. This section helps identify compliance requirements and filing processes critical to partnership taxation.

Example 3. Multi-State Tax Issues within Area II – Entity Tax Compliance:

In the CPA exam, Area II – Entity Tax Compliance covers multi-state tax issues affecting business entities operating in different jurisdictions. Candidates are expected to understand apportionment rules, establish nexus criteria, and comply with sales tax regulations across states. This knowledge is crucial in addressing questions that involve multi-state income tax returns and ensuring proper allocation of income among states.

Example 4. Recent Tax Law Changes and Area II – Entity Tax Compliance:

Preparing for the CPA exam requires candidates to stay updated with recent tax law changes, especially those impacting Area II – Entity Tax Compliance. Understanding legislative modifications that influence corporate tax rates, deductions, and credits is vital. These changes can significantly affect how business entities plan their tax strategies and file returns, making it an integral part of exam preparation.

Example 5. Applying Area II – Entity Tax Compliance in Practice Scenarios:

The CPA exam often includes practice scenarios that test candidates’ ability to apply Area II – Entity Tax Compliance concepts. This involves analyzing case-based questions on partnership allocations, multi-state apportionment, or calculating net operating losses for corporations. By interpreting these scenarios accurately, candidates can demonstrate their understanding of entity-level tax compliance and strategies.

Practice Questions

Question 1

Which of the following is typically required for a corporation to determine its tax liability under federal income tax regulations?

A) Filing Form 1040

B) Calculating Adjusted Gross Income (AGI)

C) Filing Form 1120

D) Using the standard deduction

Correct Answer: C) Filing Form 1120

Explanation:

Corporations must file Form 1120, the U.S. Corporation Income Tax Return, to report income, gains, losses, deductions, and credits. This form is crucial for determining the corporation’s tax liability under federal income tax laws. Form 1040 is for individual taxpayers, and Adjusted Gross Income (AGI) applies to individual tax returns, not corporations. Corporations cannot claim the standard deduction, which is only available to individual taxpayers.

Question 2

Which type of entity is generally subject to double taxation under federal tax law?

A) S Corporation

B) Sole Proprietorship

C) C Corporation

D) Partnership

Correct Answer: C) C Corporation

Explanation:

C Corporations are subject to double taxation, meaning the corporation pays taxes on its income at the entity level, and shareholders also pay taxes on dividends received. S Corporations, Sole Proprietorships, and Partnerships are typically pass-through entities, where income is only taxed once at the individual level. This makes C Corporations unique in terms of how their income is taxed, emphasizing the need for effective tax compliance and planning.

Question 3

What is the primary tax compliance requirement for a partnership in the U.S.?

A) Paying self-employment taxes

B) Filing Form 1065

C) Paying corporate income tax

D) Filing Form W-2 for partners

Correct Answer: B) Filing Form 1065

Explanation:

Partnerships are required to file Form 1065, the U.S. Return of Partnership Income, to report the partnership’s income, deductions, and credits. While partnerships do not pay income tax at the entity level, Form 1065 ensures compliance by detailing each partner’s share of the partnership’s income. Self-employment taxes are paid by individual partners, not the partnership itself. Partnerships do not pay corporate income tax, nor do they file Form W-2, which is used for employee wages.