Preparing for the CFA Exam requires a thorough understanding of “Fiscal Policy,” a fundamental aspect of economic policy analysis. Mastery of government spending, taxation, and budgeting processes is essential. This knowledge elucidates how fiscal measures impact economic stability, growth, and public welfare, critical for achieving a high CFA score.

Learning Objective

In studying “Fiscal Policy” for the CFA Exam, you should aim to understand the mechanisms of government spending, taxation, and budget deficits and their impact on the economy. Analyze how these fiscal tools influence economic growth, inflation, and unemployment. Evaluate the principles behind expansionary and contractionary fiscal policies and their timing and effectiveness during different economic cycles. Additionally, explore how fiscal decisions affect public debt and economic stability. Apply this knowledge to assess fiscal policy’s role in financial markets, predict policy outcomes, and interpret their implications for investment and economic forecasting in preparation for the CFA Exam.

Fundamentals of Fiscal Policy

Fiscal policy refers to the government’s use of spending and taxation to influence the economy. It’s a primary tool for managing economic stability, growth, and overall public welfare. Understanding fiscal policy fundamentals is essential for analyzing its impact on economic activity, inflation, and employment.

Key Components of Fiscal Policy

- Government Spending: The government allocates funds to various sectors, including infrastructure, education, healthcare, and defense. Increased spending can stimulate economic growth, while reduced spending can slow down an overheated economy.

- Taxation: Taxes collected from individuals and businesses fund government expenditures. Lower taxes can boost disposable income, encouraging spending and investment, while higher taxes can slow down consumer and business spending to control inflation.

- Budget Deficits and Surpluses:

- Deficit: When government spending exceeds tax revenue, resulting in borrowing. Deficit spending is often used to stimulate the economy during recessions.

- Surplus: When tax revenue exceeds spending, allowing the government to save or reduce debt. Surpluses are typically achieved in times of economic strength.

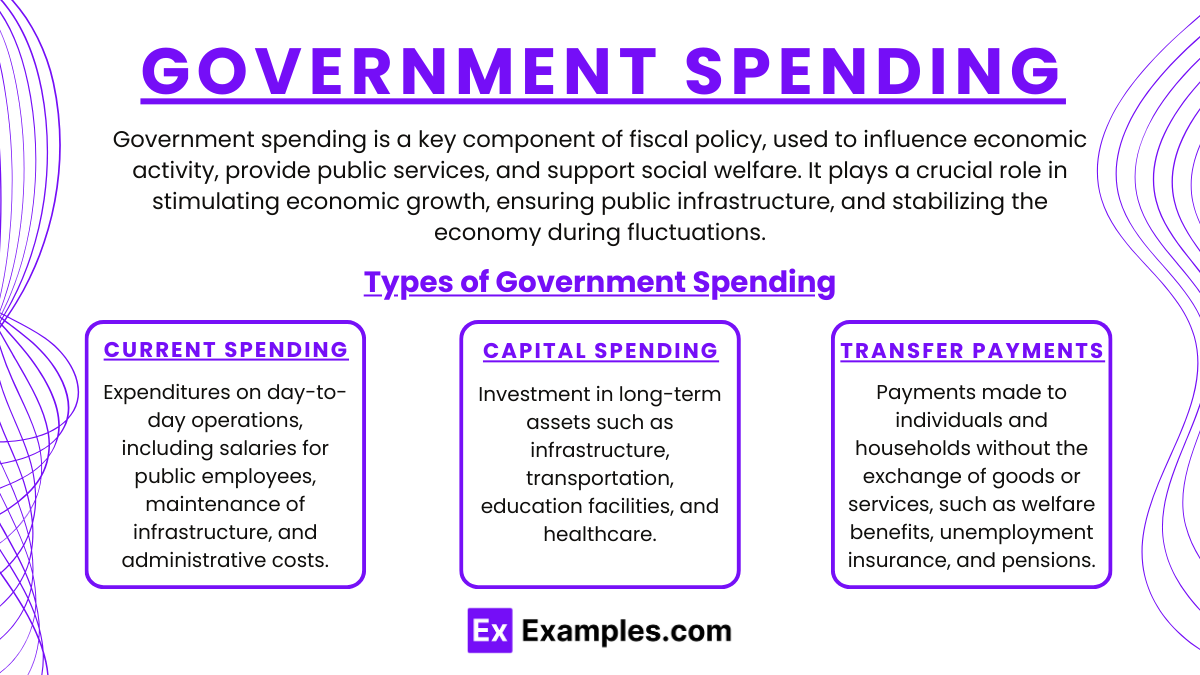

Government Spending

Government spending is a key component of fiscal policy, used to influence economic activity, provide public services, and support social welfare. It plays a crucial role in stimulating economic growth, ensuring public infrastructure, and stabilizing the economy during fluctuations.

Types of Government Spending

- Current Spending: Expenditures on day-to-day operations, including salaries for public employees, maintenance of infrastructure, and administrative costs.

- Capital Spending: Investment in long-term assets such as infrastructure, transportation, education facilities, and healthcare. Capital spending aims to boost productivity and long-term economic growth.

- Transfer Payments: Payments made to individuals and households without the exchange of goods or services, such as welfare benefits, unemployment insurance, and pensions. These aim to support lower-income households and reduce poverty.

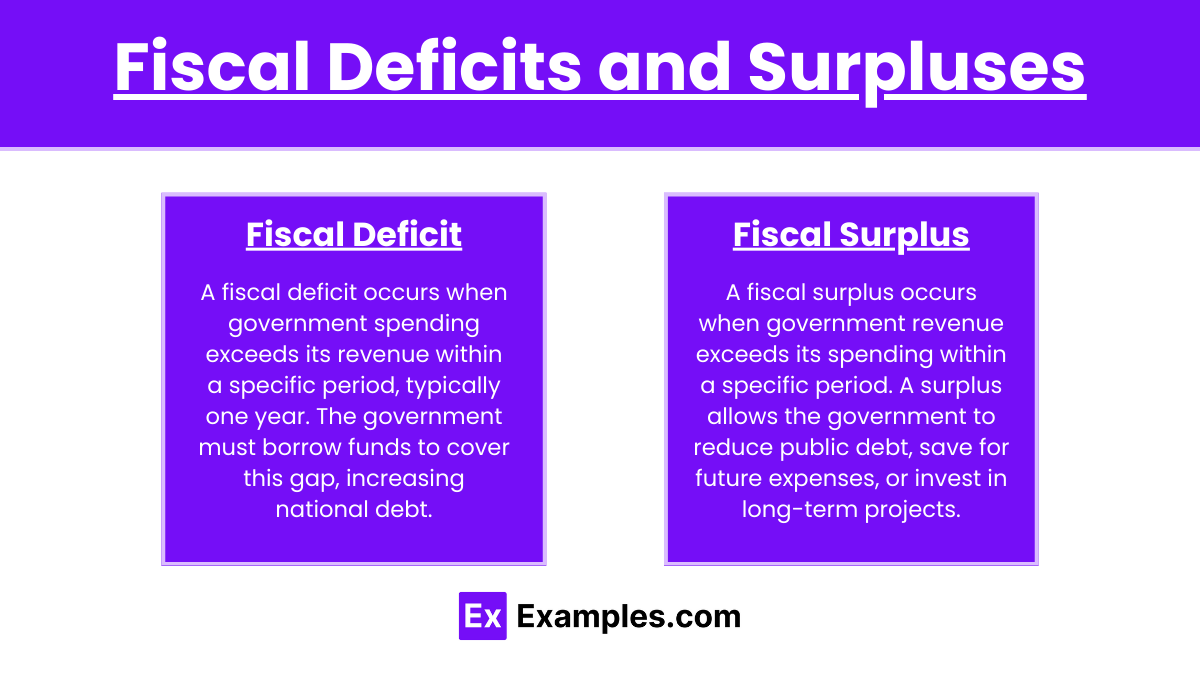

Fiscal Deficits and Surpluses

Fiscal deficits and surpluses are key concepts in government budgeting, reflecting the balance between government revenue and spending. They play a significant role in economic management and impact public debt, investment, and economic stability.

Fiscal Deficit

A fiscal deficit occurs when government spending exceeds its revenue within a specific period, typically one year. The government must borrow funds to cover this gap, increasing national debt.

Causes of Fiscal Deficit:

- Increased Spending: On social welfare, infrastructure, healthcare, and defense.

- Reduced Revenue: Due to tax cuts, economic downturns, or reduced corporate tax revenue.

- Counter-Cyclical Policy: Governments may run deficits intentionally during recessions to stimulate economic activity and reduce unemployment.

Implications of Fiscal Deficit:

- National Debt: Persistent deficits increase national debt, leading to higher interest payments and possible future tax increases.

- Crowding Out: Excessive government borrowing can raise interest rates, limiting private sector investment.

- Economic Growth: Deficit spending can stimulate economic growth in the short term, especially during downturns.

Fiscal Surplus

A fiscal surplus occurs when government revenue exceeds its spending within a specific period. A surplus allows the government to reduce public debt, save for future expenses, or invest in long-term projects.

Causes of Fiscal Surplus:

- Increased Revenue: Due to economic growth, higher tax collections, or increased tax rates.

- Reduced Spending: Cuts in government expenditures, often during periods of economic stability or growth.

- Boom Phase: Surpluses often occur during economic expansions when revenues are high, and social spending is relatively low.

Implications of Fiscal Surplus:

- Debt Reduction: Surpluses can help reduce national debt, lowering future interest expenses.

- Public Investment: Allows for increased investment in infrastructure, education, or other areas without needing to borrow.

- Economic Stability: A surplus can provide a buffer for economic downturns, allowing flexibility in fiscal policy.

Case Studies and Real-World Applications

Case studies and real-world applications provide valuable insights into how economic principles, including fiscal policy, interest rates, and exchange rates, function in practice. Here are a few illustrative examples:

1. U.S. 2008 Financial Crisis

- Policy: $787 billion stimulus via tax cuts and infrastructure spending.

- Outcome: Stimulus aided recovery but increased national debt.

2. Japan’s Low Interest Rates

- Policy: Near-zero interest rates to combat stagnation.

- Outcome: Weaker yen boosted exports, but low rates limited future monetary policy options.

3. EU Sovereign Debt Crisis

- Policy: Austerity measures in exchange for bailouts.

- Outcome: Reduced deficits but deepened recessions and social unrest.

4. China’s Managed Exchange Rate

- Policy: Kept yuan weak to support exports.

- Outcome: Enabled rapid growth but led to trade tensions with global partners.

5. Brazil’s Inflation Control

- Policy: High interest rates to curb inflation.

- Outcome: Controlled inflation but slowed economic growth.

Examples

Example 1: The New Deal (1930s)

- Study the fiscal policy measures implemented during the Great Depression under Franklin D. Roosevelt’s New Deal. Analyze how increased government spending on public works and social welfare programs aimed to reduce unemployment and stimulate economic growth, illustrating the application of Keynesian economic theories.

Example 2: Reaganomics (1980s)

- Examine the fiscal policies under President Ronald Reagan, which focused on tax cuts, reduced government spending on certain social programs, and increased military spending. Discuss the long-term effects on economic growth, income inequality, and federal debt.

Example 3: Japanese Fiscal Policies in the 1990s

- Analyze Japan’s use of fiscal policy to combat prolonged economic stagnation during the 1990s, including multiple fiscal stimulus packages. Evaluate the effectiveness of these measures in ending deflation and reviving economic growth, and the resulting implications for public debt.

Example 4: Post-2008 Financial Crisis Stimulus Measures

- Discuss the fiscal policies implemented by various governments following the 2008 global financial crisis, including stimulus spending and tax relief measures aimed at boosting economic activity. Consider the impact on recovery rates in different economies and the debate over fiscal multipliers.

Example 5: COVID-19 Pandemic Response (2020-Present)

- Investigate the fiscal responses to the COVID-19 pandemic, including massive increases in government spending, subsidies to businesses and individuals, and tax deferrals. Explore the intended effects on cushioning the economic impact of the pandemic, stabilizing employment, and facilitating recovery, alongside the potential long-term consequences on public finance.

Practice Questions

Question 1

What is the primary effect of a government implementing a fiscal stimulus during a recession?

A. It decreases public debt.

B. It increases unemployment.

C. It stimulates economic growth.

D. It reduces consumer spending.

Answer:

C. It stimulates economic growth.

Explanation:

The primary goal of fiscal stimulus—such as increasing government spending or cutting taxes during a recession—is to boost economic activity. By injecting money into the economy, the government aims to increase consumer spending and investment, thereby stimulating economic growth and potentially reducing unemployment.

Question 2

Which type of fiscal policy is automatically triggered without new government action during an economic downturn?

A. Discretionary fiscal policy

B. Expansionary fiscal policy

C. Contractionary fiscal policy

D. Automatic stabilizers

Answer:

D. Automatic stabilizers

Explanation:

Automatic stabilizers are fiscal mechanisms that automatically adjust government spending and taxes without the need for explicit new government action. Examples include unemployment benefits and progressive tax systems, which naturally increase spending or reduce tax revenue during economic downturns, helping to stabilize the economy.

Question 3

Which fiscal policy measure is most likely to lead to an increase in a country’s public debt?

A. Cutting corporate taxes

B. Reducing government subsidies

C. Increasing interest rates

D. Selling government bonds

Answer:

A. Cutting corporate taxes

Explanation:

Reducing corporate tax rates typically leads to a decrease in government revenue, assuming no compensating reduction in government spending. This shortfall in revenue can lead to higher deficits and, consequently, an increase in public debt if not offset by other fiscal measures or economic growth.