Preparing for the CFA Exam demands a solid understanding of fixed-income markets for government issuers, a key area within fixed-income investments. Mastery of sovereign debt structures, government bond pricing, and yield dynamics is essential. This knowledge provides insights into credit risk, fiscal policy impacts, and economic stability, crucial for excelling on the CFA.

Learning Objective

In studying “Fixed-Income Markets for Government Issuers” for the CFA Exam, you should learn to comprehend the structure, purpose, and characteristics of government-issued fixed-income securities. Analyze the different types of sovereign debt instruments, including treasury bonds, notes, and bills, and understand how interest rate fluctuations, inflation, and credit risk impact their value. Evaluate the role of central banks and fiscal policy on government bond yields and interest rates. Additionally, explore how these securities are used by investors for income and portfolio diversification, and apply this knowledge to assess market dynamics and potential investment opportunities in CFA practice scenarios.

Types of Government Fixed-Income Securities

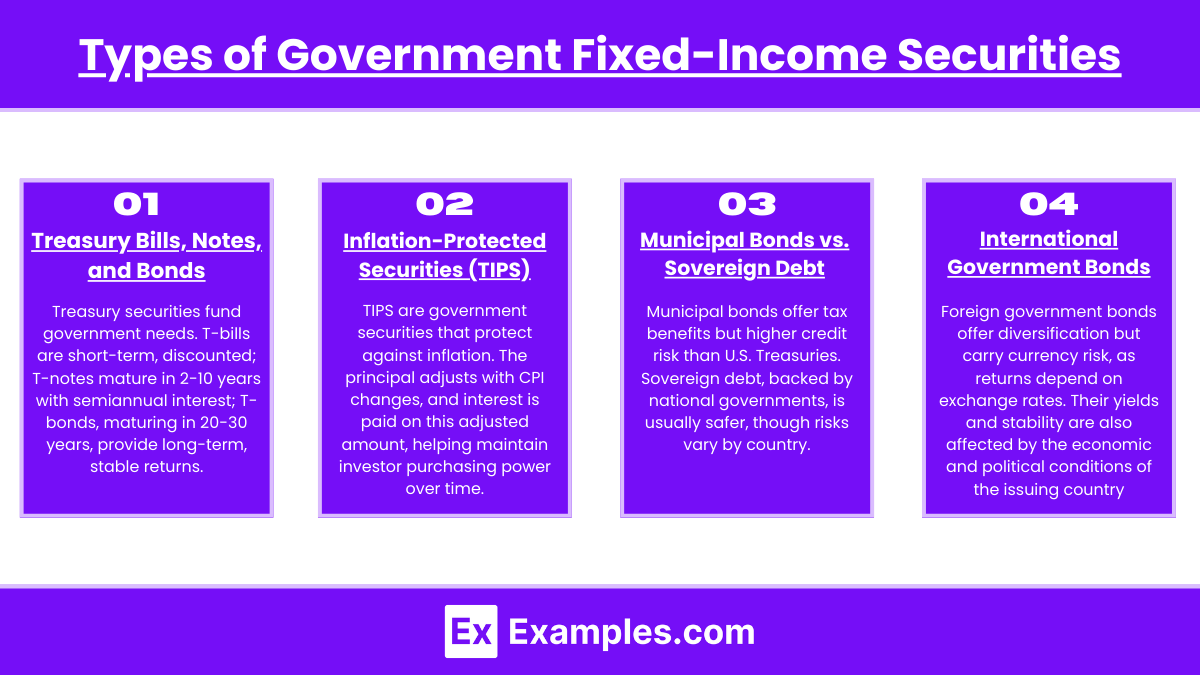

Treasury Bills, Notes, and Bonds

Treasury securities are issued by the government to fund operations and manage monetary policy. Treasury Bills (T-bills) are short-term securities with maturities of less than a year and do not pay interest but are issued at a discount. Treasury Notes (T-notes) have maturities ranging from 2 to 10 years and pay semiannual interest, providing a predictable income stream. Treasury Bonds (T-bonds) have the longest maturities, typically 20 to 30 years, and also pay semiannual interest, appealing to long-term investors seeking stable returns.

Inflation-Protected Securities (TIPS)

TIPS are government-issued securities designed to protect investors from inflation risk. The principal value of TIPS is adjusted based on changes in the Consumer Price Index (CPI), and they pay a fixed interest rate on the inflation-adjusted principal. As a result, both the principal and interest payments increase with inflation, ensuring that the investor’s purchasing power is preserved over time.

Municipal Bonds vs. Sovereign Debt

While municipal bonds are issued by state and local governments, sovereign debt represents bonds issued by a national government. Municipal bonds often offer tax advantages, making them attractive to certain investors, though they carry a higher credit risk compared to U.S. Treasury securities. Sovereign debt typically has lower risk due to the backing of a national government, but risk levels can vary significantly between countries based on political and economic stability.

International Government Bonds

These are bonds issued by foreign governments, and they can offer additional diversification benefits to investors. However, international government bonds carry currency risk, as their returns can be affected by fluctuations in foreign exchange rates. Additionally, foreign government bonds may be influenced by the specific economic and political conditions of the issuing country, impacting their yield and price stability

Interest Rate Dynamics and Government Bond Yields

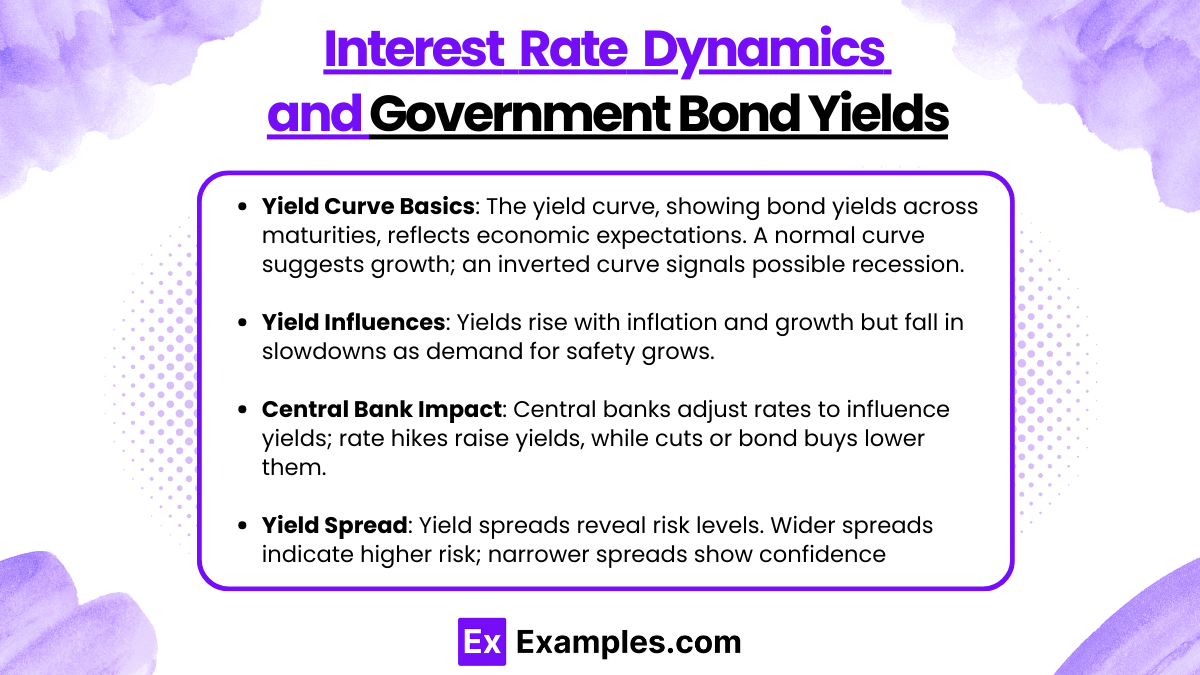

Yield Curve Basics

The yield curve is a graphical representation of bond yields across various maturities, often reflecting investor expectations for future interest rates and economic conditions. A normal yield curve, where longer-term bonds have higher yields than short-term bonds, suggests positive economic growth. An inverted yield curve, where short-term yields exceed long-term yields, can signal an economic downturn or recession. Understanding the yield curve is essential for assessing the risk and return profile of government bonds.

Factors Influencing Yield Changes

Government bond yields are affected by a combination of macroeconomic factors, including inflation, economic growth, and monetary policy. Rising inflation typically leads to higher yields, as investors demand greater returns to offset the erosion of purchasing power. Strong economic growth can push yields up, as higher demand for capital raises interest rates, while slow growth or recessionary pressures may lead to lower yields as demand for safe assets increases.

Central Bank Influence

Central banks play a significant role in determining government bond yields, particularly through their control of short-term interest rates and open-market operations. When central banks raise rates to combat inflation, short-term bond yields typically rise, often affecting longer-term yields as well. Conversely, during economic slowdowns, central banks may lower rates or purchase government bonds to stimulate growth, putting downward pressure on yields.

Yield Spread Analysis

The yield spread, or the difference between yields of different maturities or credit qualities, is a critical tool for evaluating risk and return in fixed-income investments. Widening spreads may indicate higher perceived risks in certain bond segments, while narrowing spreads suggest investor confidence. Yield spreads also reflect liquidity, credit risk, and other market factors, providing insights into broader economic trends and the relative attractiveness of different government bond maturities

Credit Risk in Government Bonds

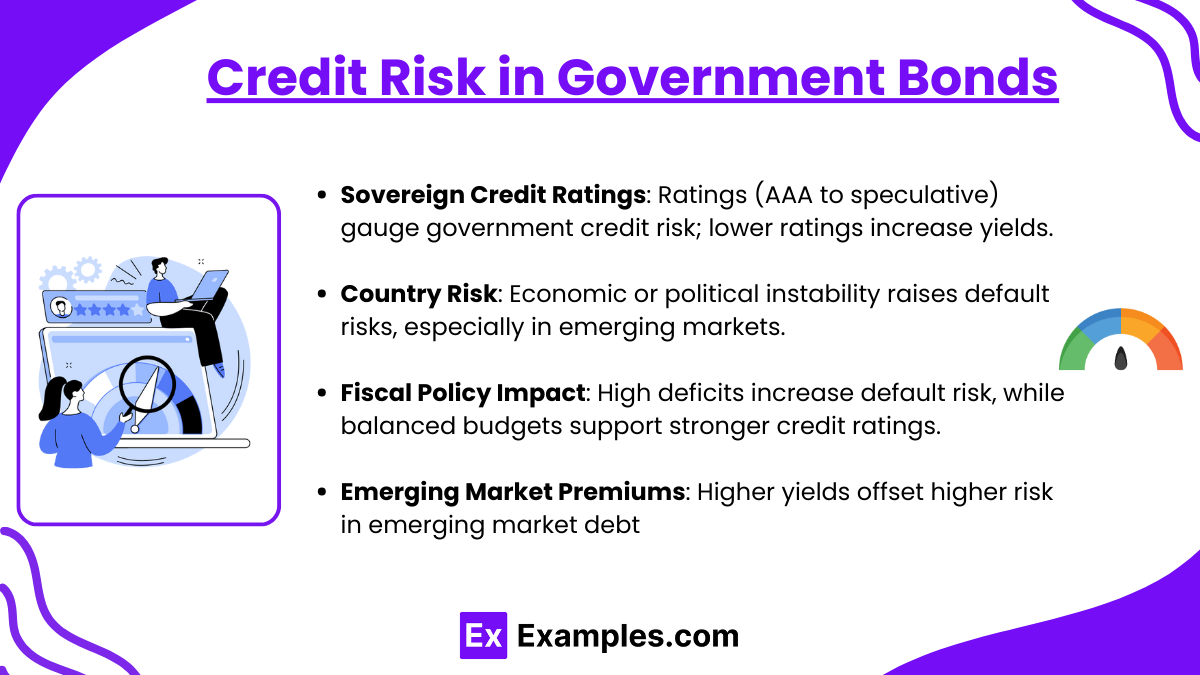

Sovereign Credit Ratings

Sovereign credit ratings, provided by agencies like Moody’s, S&P, and Fitch, assess a government’s ability to meet its debt obligations. Ratings range from high-grade (AAA or AA) to speculative grades, with higher ratings reflecting lower credit risk. Investors rely on these ratings to gauge the relative safety of government bonds, as they indicate the likelihood of default. Changes in a country’s credit rating can affect bond yields, with downgrades leading to higher yields due to increased risk perception.

Country Risk and Default Probability

Country risk refers to the potential for economic or political instability in a nation that could impact its ability to repay debt. Factors contributing to country risk include political upheaval, currency instability, and economic recession. A high default probability indicates a greater likelihood that a government may be unable to fulfill its debt obligations, especially in emerging markets where economic conditions can be volatile. Country risk assessments help investors understand potential threats to sovereign debt stability.

Fiscal Policy Impact on Credit Quality

A government’s fiscal policy, including its budgetary practices and debt levels, plays a crucial role in determining its credit quality. Persistent budget deficits and high debt-to-GDP ratios can strain a country’s finances, raising the risk of default. Conversely, sound fiscal policies that promote balanced budgets and sustainable debt levels contribute to stronger credit quality. Investors monitor fiscal policies closely, as fiscal mismanagement can lead to downgrades in credit ratings and increased bond yields.

Risk Premiums for Emerging Market Debt

Emerging market government bonds often carry risk premiums, or additional yields, compared to bonds from more stable, developed economies. This premium compensates investors for the higher risk associated with economic volatility, political uncertainty, and currency fluctuations in emerging markets. The size of this premium can vary based on global economic conditions, with risk premiums generally increasing during periods of market instability. For investors, these risk premiums reflect both the potential for higher returns and the increased credit risk

Investment Applications and Portfolio Management

Income Generation and Capital Preservation

Government bonds are commonly used for income generation due to their regular interest payments, which provide a stable cash flow for investors. For risk-averse investors, government bonds offer a reliable means of preserving capital, as they are generally backed by the issuing government and considered low-risk. Treasury securities are especially popular among retirees and conservative investors who prioritize steady income and low volatility in their portfolios.

Portfolio Diversification

Government bonds are valuable for portfolio diversification because they typically exhibit low or negative correlations with riskier assets, like equities. During periods of economic uncertainty or market downturns, government bonds often retain or increase in value, offsetting losses in other asset classes. This counter-cyclical property helps to reduce overall portfolio volatility and can improve risk-adjusted returns.

Inflation and Interest Rate Hedging

Certain types of government bonds, such as Treasury Inflation-Protected Securities (TIPS), are designed to hedge against inflation by adjusting their principal based on inflation rates. Additionally, the value of traditional government bonds is sensitive to interest rate movements, making them a tool for managing interest rate risk in a portfolio. Investors with fixed-income allocations often consider duration management to protect against potential interest rate changes, aligning bond maturities with their interest rate expectations.

Tactical and Strategic Allocations

In portfolio management, government bonds can be used for both tactical and strategic asset allocations. A tactical approach involves adjusting bond holdings in response to short-term market conditions, such as anticipated rate hikes or recessions, to capitalize on changing yields. Strategic allocation, on the other hand, is more long-term, with government bonds serving as a stable core component of a diversified portfolio, providing a foundation for income and capital preservation across different market cycles

Examples

Example 1: U.S. Treasury Bonds

U.S. Treasury bonds are long-term securities issued by the U.S. Department of the Treasury with maturities typically ranging from 10 to 30 years. They pay semiannual interest and are considered one of the safest investments globally due to the U.S. government’s high credit rating. These bonds are used by investors seeking stable returns and capital preservation and serve as a benchmark for other debt securities in the financial markets.

Example 2: Japanese Government Bonds (JGBs)

Japanese Government Bonds (JGBs) are debt instruments issued by the Japanese government to finance its spending. JGBs come in various maturities, from short-term bills to long-term bonds. They are popular among domestic investors and are known for their low yields, influenced by Japan’s low interest rates and monetary policies. These bonds are a key component of Japan’s fixed-income market, providing funding for government operations while offering stable returns to investors.

Example 3: United Kingdom Gilts

Gilts are bonds issued by the United Kingdom government and are a major segment of the U.K. fixed-income market. Gilts are typically categorized by their maturity dates: short (less than 7 years), medium (7-15 years), and long (over 15 years). They pay fixed interest and are seen as a safe investment due to the U.K. government’s creditworthiness. Gilts are attractive to both domestic and international investors seeking steady income with low default risk.

Example 4: Emerging Market Government Bonds

Emerging market government bonds are issued by developing countries to raise capital for economic development and other public expenses. These bonds often carry higher yields than those of developed countries to compensate for greater risks, such as political instability, currency fluctuations, and economic volatility. Examples include bonds issued by governments of Brazil, India, and South Africa. Investors in emerging market bonds seek diversification and potentially higher returns but face increased credit and market risk.

Example 5: European Union Bonds (EU Bonds)

The European Union issues bonds collectively backed by member states to fund initiatives and support member economies. EU bonds have gained prominence as the EU has increased issuance to finance pandemic recovery efforts. These bonds benefit from the strong credit ratings of EU member countries and offer relatively low yields compared to individual sovereign bonds from less stable economies within the EU. They provide a way for investors to gain exposure to European economic stability while supporting EU-wide projects

Practice Questions

Question 1

Which of the following government bonds is specifically designed to protect investors against inflation?

A. Treasury Bills (T-Bills)

B. Treasury Inflation-Protected Securities (TIPS)

C. Municipal Bonds

D. Foreign Government Bonds

Answer: B. Treasury Inflation-Protected Securities (TIPS)

Explanation: Treasury Inflation-Protected Securities (TIPS) are U.S. government bonds that adjust their principal value based on changes in the Consumer Price Index (CPI), providing investors with protection against inflation. Treasury Bills, Municipal Bonds, and Foreign Government Bonds do not offer this specific inflation-adjustment feature.

Question 2

Which factor is most likely to cause an increase in the yield of a government bond?

A. Rising interest rates

B. Declining economic growth

C. Increase in central bank bond purchases

D. Stable inflation

Answer: A. Rising interest rates

Explanation: Rising interest rates generally lead to an increase in bond yields, as new bonds issued offer higher interest rates to match the prevailing market. This makes existing bonds with lower yields less attractive, causing their prices to fall and yields to rise. Declining growth, central bank purchases, and stable inflation typically have an opposite or neutral effect on bond yields.

Question 3

Which of the following best describes a key advantage of investing in government bonds from emerging markets?

A. They offer tax-free income.

B. They carry no credit risk.

C. They generally offer higher yields to compensate for additional risks.

D. They are not affected by currency fluctuations.

Answer: C. They generally offer higher yields to compensate for additional risks.

Explanation: Government bonds from emerging markets often offer higher yields compared to bonds from developed markets to compensate for the additional risks, such as economic volatility, political instability, and currency risk. These bonds do not carry tax-free income universally, they have credit risk, and are indeed affected by currency fluctuations, especially for international investors