Preparing for the CFA Exam requires a deep understanding of “Portfolio Risk & Return: Part II,” focusing on advanced risk assessment and management strategies. Mastery of these concepts is crucial for optimizing portfolio construction and achieving targeted financial outcomes. This knowledge is essential for effective investment management and high performance on the CFA Exam.

Learning Objective

In studying “Portfolio Risk & Return: Part II” for the CFA Exam, you should aim to deepen your understanding of advanced portfolio risk management techniques and strategies for maximizing returns. Analyze concepts such as dynamic asset allocation, risk budgeting, and the use of derivatives for hedging. Evaluate how these strategies manage portfolio volatility and protect against downside risk. Additionally, explore the implications of behavioral finance on portfolio construction and investor decision-making. Apply this knowledge to construct portfolios that can adapt to varying market conditions and investor needs, effectively balancing risk with potential returns in the context of comprehensive financial planning.

Advanced Risk Management Techniques

Advanced risk management techniques are essential for investors and portfolio managers who aim to optimize their investment strategies while minimizing exposure to potential losses. These techniques incorporate sophisticated tools and methods to assess, mitigate, and monitor risks effectively. Here’s a breakdown of some advanced risk management strategies:

- Stress Testing: Simulates extreme market conditions to identify potential vulnerabilities in investment portfolios and prepare strategies to mitigate losses.

- Scenario Analysis: Creates hypothetical situations to assess the impact of significant changes in market conditions on portfolio performance, aiding in strategic adjustments.

- Value at Risk (VaR) and Conditional Value at Risk (CVaR): Measures the potential maximum losses in a portfolio over a defined period, helping manage risks in outlier events beyond standard expectations.

- Credit Risk Modeling: Predicts the likelihood of default among debt issuers and assesses its impact on portfolios, crucial for managing corporate bonds or loan portfolios.

- Liquidity Adjustment: Evaluates the liquidity profile of assets to understand conversion rates into cash, ensuring portfolios can meet obligations without substantial losses.

- Derivatives and Hedging: Utilizes options, futures, and swaps to hedge against price volatility, interest rate changes, and currency fluctuations, stabilizing portfolio performance.

- Risk Budgeting: Allocates risk rather than capital, optimizing the returns per unit of risk, commonly used by pensions and endowments to maximize returns relative to risk.

- Machine Learning in Risk Management: Employs algorithms to predict risks based on historical data, improving market downturn predictions, fraud detection, and credit assessments.

Strategies for Maximizing Returns

Maximizing returns on investments is a primary goal for most investors and requires a combination of strategic planning, market analysis, and risk management. Here are several strategies widely used to enhance portfolio returns:

- Asset Allocation: Diversify across asset classes (stocks, bonds, real estate) to balance risk and returns.

- Growth Investing: Invest in high-growth companies for potential stock price appreciation.

- Value Investing: Target undervalued stocks that are likely to appreciate as markets correct.

- Income Investing: Focus on dividend-paying stocks and bonds for steady income, offering stability in volatile markets.

- Small-Cap Investments: Invest in small-cap stocks with high growth potential, though riskier than large-caps.

- Sector Rotation: Shift investments across economic sectors to capitalize on cyclical trends.

- Use of Derivatives: Use options or futures to manage risk or magnify returns through leverage.

- Global Diversification: Expand internationally to benefit from growth in global markets.

- Tax Optimization: Minimize taxes through strategies like tax-advantaged accounts and loss harvesting.

- Active Trading: Engage in frequent trading to capture gains from short-term price movements, requiring skill and discipline.

Behavioral Finance in Portfolio Management

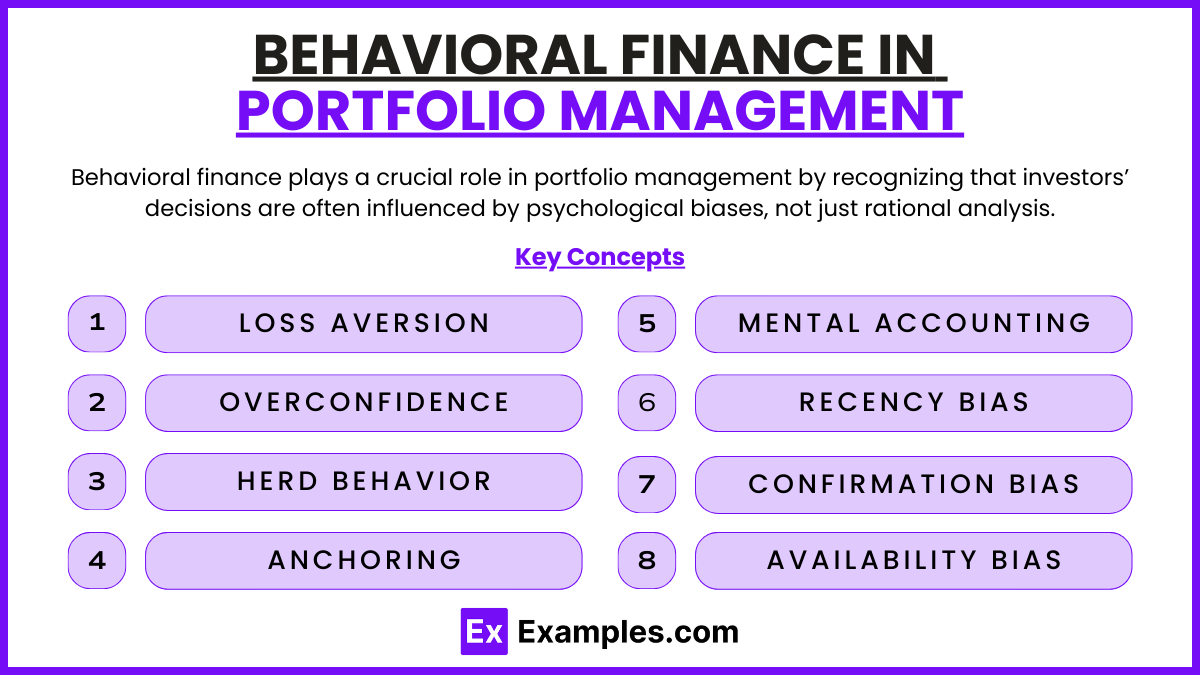

Behavioral finance plays a crucial role in portfolio management by recognizing that investors’ decisions are often influenced by psychological biases, not just rational analysis. Understanding these biases can help portfolio managers make more informed decisions and avoid common pitfalls. Here are some key concepts:

- Loss Aversion: Investors often hold losing investments too long or sell winners too early, potentially reducing returns.

- Overconfidence: Excessive trading or risk-taking due to overestimating one’s predictive ability can increase costs and risk.

- Herd Behavior: Following the crowd rather than independent analysis can lead to overpaying for assets or selling undervalued ones.

- Anchoring: Relying on initial information or past prices may prevent reassessment based on current value.

- Mental Accounting: Treating money differently based on subjective criteria can lead to inefficient asset allocation.

- Recency Bias: Prioritizing recent events can cause short-term decision-making and increase volatility.

- Confirmation Bias: Seeking data that supports existing beliefs can lead to unbalanced portfolios.

- Availability Bias: Relying on readily available information without thorough research may result in uninformed choices.

Performance Measurement and Attribution

Performance measurement and attribution are essential tools in portfolio management to evaluate and understand the sources of returns and assess how effectively a portfolio manager’s decisions align with investment goals. Here are the core components:

- Performance Measurement:

- Total Return: Tracks overall returns, including gains and income.

- Benchmark Comparison: Compares returns to relevant benchmarks for context.

- Risk-Adjusted Returns: Metrics like the Sharpe Ratio show returns per unit of risk.

- Performance Attribution:

- Asset Allocation Effect: Measures impact of asset allocation on returns.

- Security Selection Effect: Evaluates returns from choosing specific securities.

- Timing Effect: Assesses results of market timing decisions.

- Interaction Effect: Examines combined effects of allocation and selection.

- Attribution Models:

- Brinson Model: Separates returns into allocation and selection contributions.

- Factor-Based Attribution: Attributes returns to systematic factors, such as value or momentum.

Ethical and Regulatory Considerations

Ethical and regulatory considerations are crucial in portfolio management, ensuring that investment practices align with legal standards and ethical principles. Here are the main points:

- Fiduciary Duty: Managers must act in clients’ best interests, maintaining integrity and transparency.

- Transparency and Disclosure: Clear disclosure of fees, risks, and strategies helps clients make informed choices.

- Conflicts of Interest: Avoiding or disclosing conflicts protects client interests and maintains trust.

- Insider Trading: Using non-public information is illegal and leads to severe penalties.

- Regulatory Compliance: Adhering to regulations from bodies like the SEC ensures fair practices and market integrity.

- Socially Responsible Investing (SRI): Incorporating ESG factors aligns investments with clients’ ethical values.

- Anti-Money Laundering (AML): Detecting and preventing money laundering maintains portfolio integrity.

Examples

Example 1: Use of Futures in Portfolio Hedging

- Analyze how portfolio managers use futures contracts to hedge against potential losses in equity positions. Explore the mechanics of hedging with index futures, including calculation of the hedge ratio and alignment with portfolio beta.

Example 2: Real Estate Portfolio Diversification

- Discuss the benefits of including real estate investments in a portfolio to enhance diversification. Examine the different types of real estate investments (e.g., REITs, direct property investment) and how they can mitigate risks associated with traditional stock and bond investments.

Example 3: Implementing Covered Calls to Generate Income

- Explore how writing covered calls on stock positions can generate additional income for a portfolio. Study the trade-offs between income generation and the limitation on potential upside for the stock positions.

Example 4: Currency Risks in International Portfolios

- Examine the impact of currency fluctuations on international investments. Discuss strategies for managing currency risk, including the use of currency futures and options, and natural hedging through asset location.

Example 5: Behavioral Biases and Portfolio Rebalancing

- Investigate the role of behavioral biases such as status quo bias and loss aversion in portfolio rebalancing decisions. Discuss techniques that can help investors overcome these biases to adhere to systematic rebalancing strategies, thereby maintaining alignment with targeted risk levels.

Practice Questions

Question 1

What is the primary purpose of using derivatives in a portfolio?

A. To eliminate risk completely

B. To increase the portfolio’s beta

C. To hedge against specific risks

D. To diversify the portfolio’s asset base

Answer:

C. To hedge against specific risks

Explanation:

Derivatives are financial instruments that derive their value from an underlying asset. They are primarily used in portfolio management to hedge against risks such as price fluctuations, interest rate changes, and currency exchange risks, rather than eliminating risk completely or primarily increasing portfolio beta.

Question 2

Which strategy involves adjusting the asset allocation of a portfolio based on short-term market forecasts?

A. Strategic asset allocation

B. Constant-weighting asset allocation

C. Tactical asset allocation

D. Insurance asset allocation

Answer:

C. Tactical asset allocation

Explanation:

Tactical asset allocation is a dynamic investment strategy that adjusts the asset mix in a portfolio based on short-term market forecasts and economic conditions. This approach aims to take advantage of pricing anomalies or strong market sectors to enhance returns temporarily, differentiating it from the more static strategic asset allocation.

Question 3

In the context of portfolio management, what does “risk budgeting” primarily focus on?

A. Minimizing costs associated with investment management

B. Allocating capital based on expected returns

C. Distributing risk across various assets to align with risk tolerance

D. Investing a fixed amount regularly regardless of market conditions

Answer:

C. Distributing risk across various assets to align with risk tolerance

Explanation:

Risk budgeting is a portfolio management strategy that involves distributing and managing the amount of risk across various assets or strategies to align with the investor’s overall risk tolerance and investment objectives. It focuses on optimizing the risk-reward ratio within the portfolio, rather than merely focusing on returns or cost minimization.