Preparing for the CFA Exam requires a comprehensive understanding of “Portfolio Management: An Overview,” a foundational topic in investment management. Mastery of portfolio construction, asset allocation, and risk management strategies is essential. This knowledge provides insights into optimizing investment returns while managing risk, critical for achieving a high CFA score.

Learning Objective

In studying “Portfolio Management: An Overview” for the CFA Exam, you should aim to understand the fundamental principles of portfolio construction, asset allocation, and investment management. Analyze the objectives of portfolio management, including risk-return optimization, diversification, and alignment with investor goals. Evaluate core concepts such as the investment policy statement (IPS), the efficient frontier, and the importance of asset allocation in balancing risk and return. Additionally, explore how portfolio managers make strategic and tactical allocation decisions to adapt to market changes. Apply this knowledge to design and manage portfolios that meet varying investment objectives and risk tolerances for the CFA Exam.

Introduction to Portfolio Management

Portfolio management is the process of selecting, monitoring, and adjusting a combination of assets to achieve specific financial goals while managing risk. It combines art and science to balance returns with risk based on the investor’s objectives, time horizon, and risk tolerance. Key elements include:

- Asset Allocation: Diversifying investments across asset classes (stocks, bonds, real estate) to optimize returns relative to risk.

- Risk Management: Identifying and mitigating various types of risks, such as market, credit, and liquidity risks, to protect the portfolio’s value.

- Investment Strategy: Choosing an approach, like growth, income, or value investing, to guide the selection and timing of investments.

- Performance Monitoring: Regularly evaluating the portfolio against benchmarks to ensure alignment with goals and adjusting as needed.

- Rebalancing: Periodically adjusting the portfolio to maintain the desired asset mix, especially after market fluctuations.

Portfolio Management Objectives

Portfolio management objectives guide the investment process, helping align decisions with an investor’s financial goals, risk tolerance, and time horizon. Key objectives include:

- Capital Appreciation: Growing the portfolio’s value over time by investing in assets with high growth potential, suitable for long-term goals.

- Income Generation: Creating a steady income stream through dividends, interest, or rental income, which appeals to investors seeking regular cash flow.

- Capital Preservation: Protecting the portfolio’s value, particularly for risk-averse investors or those with short-term goals, by focusing on safer assets.

- Risk Management: Balancing returns with acceptable risk levels through diversification and asset allocation strategies to minimize potential losses.

- Liquidity: Ensuring the portfolio has sufficient liquid assets to meet short-term needs or unexpected expenses without impacting long-term goals.

- Tax Efficiency: Structuring investments to minimize tax liabilities, preserving more wealth for growth or income generation.

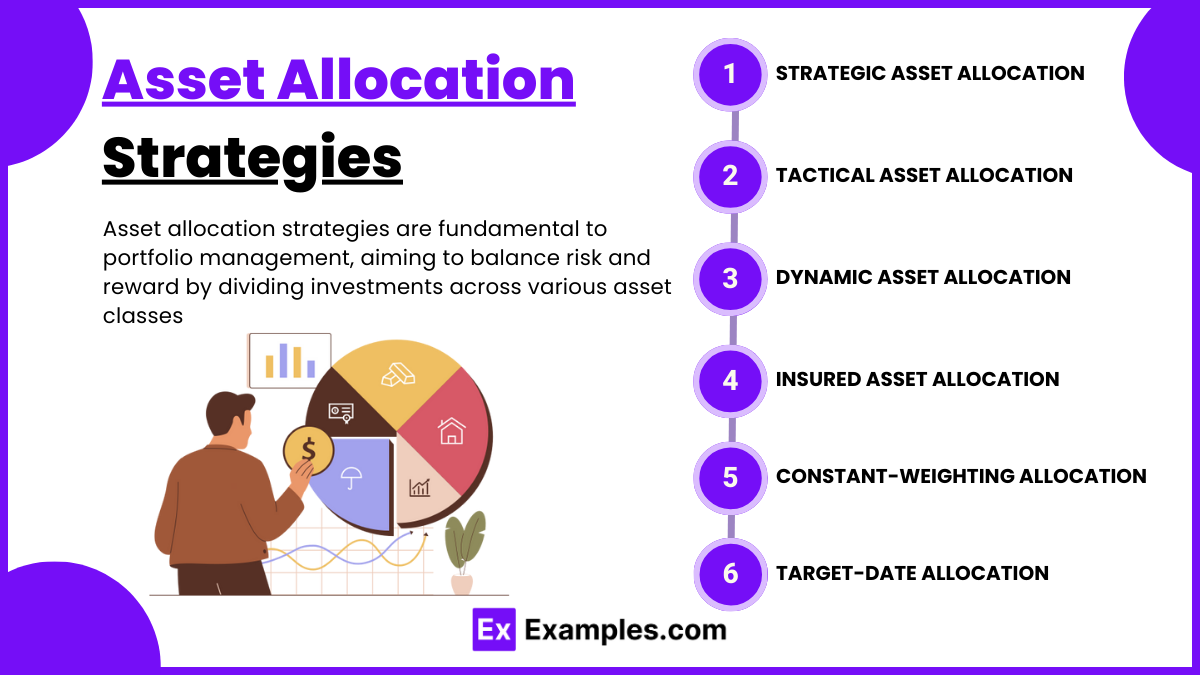

Asset Allocation Strategies

Asset allocation strategies are fundamental to portfolio management, aiming to balance risk and reward by dividing investments across various asset classes. Here are some common asset allocation strategies:

- Strategic Asset Allocation: Establishes long-term target allocations based on the investor’s risk tolerance and goals. Periodic rebalancing ensures the portfolio remains aligned with the original allocation despite market fluctuations.

- Tactical Asset Allocation: Allows for short-term deviations from the target allocations to capitalize on market opportunities. This flexible approach aims to enhance returns by adjusting asset weights based on economic or market conditions.

- Dynamic Asset Allocation: Continuously adjusts the portfolio mix in response to changing market conditions or economic cycles, shifting more into defensive assets during downturns and aggressive assets during growth phases.

- Insured Asset Allocation: Sets a minimum portfolio value threshold, investing more conservatively as the portfolio approaches this floor to protect against significant losses, especially for investors close to their financial goals.

- Constant-Weighting Allocation: Maintains fixed percentage allocations across asset classes by regularly rebalancing, regardless of market conditions, ensuring consistent exposure to each asset class.

- Life-Cycle or Target-Date Allocation: Tailors the asset mix to an investor’s age or target retirement date, starting with a higher allocation to growth assets and gradually shifting toward safer assets as the target date approaches.

Diversification and Risk Management

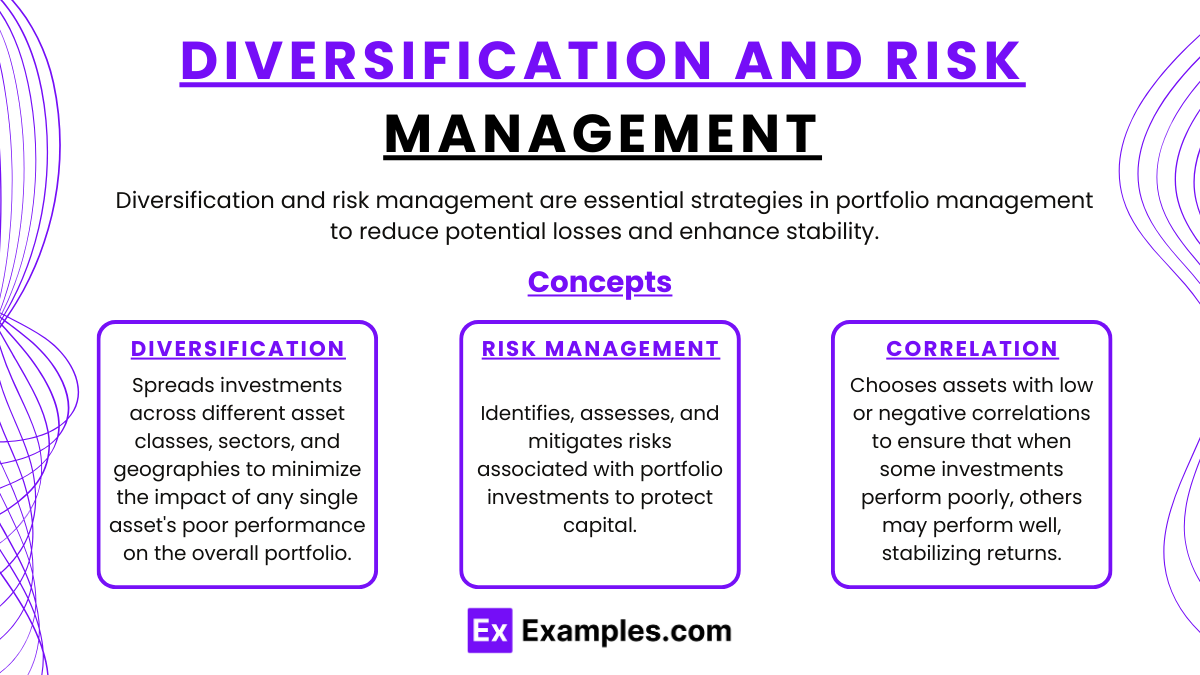

Diversification and risk management are essential strategies in portfolio management to reduce potential losses and enhance stability. Here’s a breakdown of these concepts:

- Diversification: Spreads investments across different asset classes, sectors, and geographies to minimize the impact of any single asset’s poor performance on the overall portfolio.

- Asset Class Diversification: Allocates funds across stocks, bonds, real estate, and commodities, each responding differently to economic changes.

- Sector Diversification: Invests across industries (e.g., technology, healthcare, finance) to avoid concentration risk within any one sector.

- Geographic Diversification: Expands investments globally to reduce region-specific risks like political instability or economic downturns.

- Risk Management: Identifies, assesses, and mitigates risks associated with portfolio investments to protect capital.

- Volatility Management: Balances high-risk, high-return assets with more stable ones to reduce fluctuations.

- Hedging: Uses derivatives (e.g., options, futures) to offset potential losses in other investments.

- Regular Rebalancing: Periodically adjusts asset allocations to maintain the desired risk level as market conditions change.

- Correlation: Chooses assets with low or negative correlations to ensure that when some investments perform poorly, others may perform well, stabilizing returns.

Examples

Example 1: Creating an Investment Policy Statement (IPS) for a Retiree

- Develop an IPS for a retiree whose primary goals are capital preservation and income generation. Discuss how to set clear objectives, risk tolerance, time horizon, and constraints in alignment with retirement goals, using examples of appropriate asset allocations.

Example 2: Strategic vs. Tactical Asset Allocation in an Equity Portfolio

- Compare long-term strategic asset allocation to short-term tactical adjustments within an equity portfolio. Illustrate how strategic allocation focuses on stability while tactical allocation seeks to capitalize on temporary market conditions, using examples of sector rotation during economic cycles.

Example 3: Applying Modern Portfolio Theory (MPT) to Achieve Diversification

- Explore how MPT principles can be applied to create a diversified portfolio on the efficient frontier. Analyze the selection of different asset classes and their correlations to achieve an optimal balance between risk and return, showcasing portfolios with various risk levels.

Example 4: Risk Management through Derivatives

- Study how derivatives like options and futures can be used to hedge a portfolio. For example, using put options to protect against downside risk in a volatile market or employing futures contracts to lock in gains, helping manage risk effectively while preserving returns.

Example 5: Evaluating Portfolio Performance with Benchmarking

- Analyze the performance of an equity portfolio using a benchmark, such as the S&P 500. Discuss how attribution analysis breaks down sources of returns, comparing asset allocation, sector performance, and individual security selection to evaluate a manager’s effectiveness.

Practice Questions

Question 1

What is the primary purpose of creating an Investment Policy Statement (IPS) in portfolio management?

A. To outline the portfolio’s target asset allocation and trading strategy

B. To document the expected returns for each asset class in the portfolio

C. To establish the client’s investment objectives, risk tolerance, and constraints

D. To predict future market movements and provide recommendations accordingly

Answer:

C. To establish the client’s investment objectives, risk tolerance, and constraints

Explanation:

An Investment Policy Statement (IPS) is a formal document that outlines a client’s investment objectives, risk tolerance, and constraints. It serves as a guide for the portfolio manager to make decisions aligned with the client’s goals and preferences, ensuring consistency and suitability in investment choices.

Question 2

Which of the following best describes tactical asset allocation?

A. A long-term strategy that maintains a fixed proportion of assets

B. Adjusting asset allocation based on short-term market opportunities

C. Diversifying a portfolio to minimize unsystematic risk

D. Allocating funds equally across all asset classes to reduce risk

Answer:

B. Adjusting asset allocation based on short-term market opportunities

Explanation:

Tactical asset allocation involves short-term adjustments to a portfolio’s asset allocation to take advantage of market opportunities or temporary mispricings. This is distinct from strategic asset allocation, which focuses on a long-term balance between asset classes.

Question 3

Which performance measure specifically indicates how much excess return a portfolio has generated relative to its risk?

A. Beta

B. Alpha

C. Standard deviation

D. R-squared

Answer:

B. Alpha

Explanation:

Alpha is a measure of the excess return a portfolio generates relative to a benchmark, adjusted for risk. A positive alpha indicates the portfolio has outperformed the market after accounting for risk, while a negative alpha suggests underperformance. It helps investors understand the value added by the portfolio manager’s active management.