Corporate Governance addresses the framework and practices by which companies are directed and controlled, focusing on balancing the interests of stakeholders. This topic explores common conflicts of interest, such as those between shareholders and management, and examines mechanisms like boards of directors, shareholder rights, and executive compensation to mitigate these conflicts. It also covers the risks associated with weak governance, including potential financial mismanagement and reputational damage, while highlighting the benefits of strong governance, such as enhanced company performance and investor trust. Understanding these elements is essential for evaluating company structure and decision-making processes.

Learning Objectives

In studying “Corporate Governance: Conflicts, Mechanisms, Risks, and Benefits” for the CFA, you should learn to identify the key conflicts of interest between various stakeholders, including shareholders, management, and the board of directors. Understand the mechanisms of corporate governance, such as the role of the board, executive compensation, and shareholder rights, in mitigating these conflicts. Analyze the risks associated with poor governance, including misalignment of interests, lack of accountability, and potential financial or reputational damage. Evaluate the benefits of strong corporate governance practices, such as enhanced firm performance, increased investor confidence, and reduced risk. Additionally, understand the regulatory frameworks and codes of conduct that guide corporate governance practices globally.

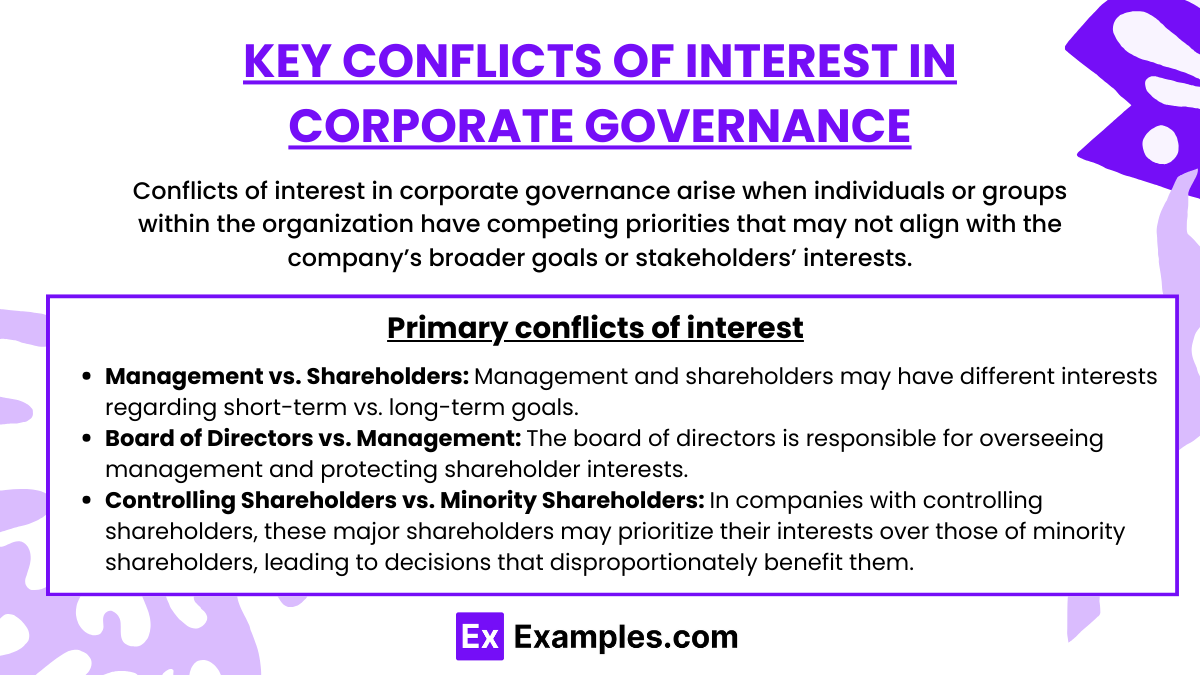

Key Conflicts of Interest in Corporate Governance

Conflicts of interest in corporate governance arise when individuals or groups within the organization have competing priorities that may not align with the company’s broader goals or stakeholders’ interests. Effective corporate governance requires identifying and mitigating these conflicts to ensure transparency, accountability, and ethical decision-making. Here are some of the primary conflicts of interest that can occur in corporate governance:

1. Management vs. Shareholders

- Conflict: Management and shareholders may have different interests regarding short-term vs. long-term goals. Executives might focus on initiatives that boost short-term earnings to maximize their bonuses, whereas shareholders typically seek sustainable long-term growth.

- Potential Issues:

- Risk-Taking: Executives may take on excessive risks to achieve immediate gains, potentially endangering the company’s stability and shareholder value.

- Excessive Compensation: Executives may push for higher salaries, bonuses, and perks that may not reflect the company’s performance or shareholders’ interests.

- Mitigation Strategies:

- Performance-Based Incentives: Align executive compensation with long-term shareholder value through performance metrics like stock options or bonuses tied to sustainable performance.

- Active Oversight: Shareholders can vote on executive pay packages and other significant company decisions, creating a check on management.

Example: A CEO focuses on quarterly profit goals to boost stock prices in the short term, potentially neglecting long-term R&D investments that could drive sustainable growth.

2. Board of Directors vs. Management

- Conflict: The board of directors is responsible for overseeing management and protecting shareholder interests. However, close ties between board members and executives can lead to biases, compromising their ability to provide objective oversight.

- Potential Issues:

- Lack of Independence: Board members who are friends or former colleagues of executives may not provide impartial oversight.

- Rubber-Stamping Decisions: In cases of weak governance, the board may approve executive decisions without proper scrutiny, potentially harming shareholders.

- Mitigation Strategies:

- Independent Directors: Ensuring a majority of independent board members reduces potential biases and promotes objective decision-making.

- Board Evaluations: Regular evaluations of board performance, including independence and effectiveness, help maintain accountability.

Example: A board that primarily consists of close associates of the CEO may approve executive compensation packages that are overly generous, even if they don’t align with the company’s performance.

3. Controlling Shareholders vs. Minority Shareholders

- Conflict: In companies with controlling shareholders, these major shareholders may prioritize their interests over those of minority shareholders, leading to decisions that disproportionately benefit them.

- Potential Issues:

- Expropriation of Wealth: Controlling shareholders might pressure the company to engage in transactions that benefit them, such as favorable contracts with their other businesses.

- Influence Over Governance: Controlling shareholders can dominate board decisions, making it difficult for minority shareholders to have their voices heard.

- Mitigation Strategies:

- Minority Shareholder Protections: Legal protections, such as cumulative voting rights, empower minority shareholders to elect their representatives on the board.

- Independent Directors: Including independent directors on the board provides a counterbalance to the influence of controlling shareholders.

Example: A family-owned business with controlling shareholders might prioritize investments that benefit family interests, even if they don’t maximize value for all shareholders.

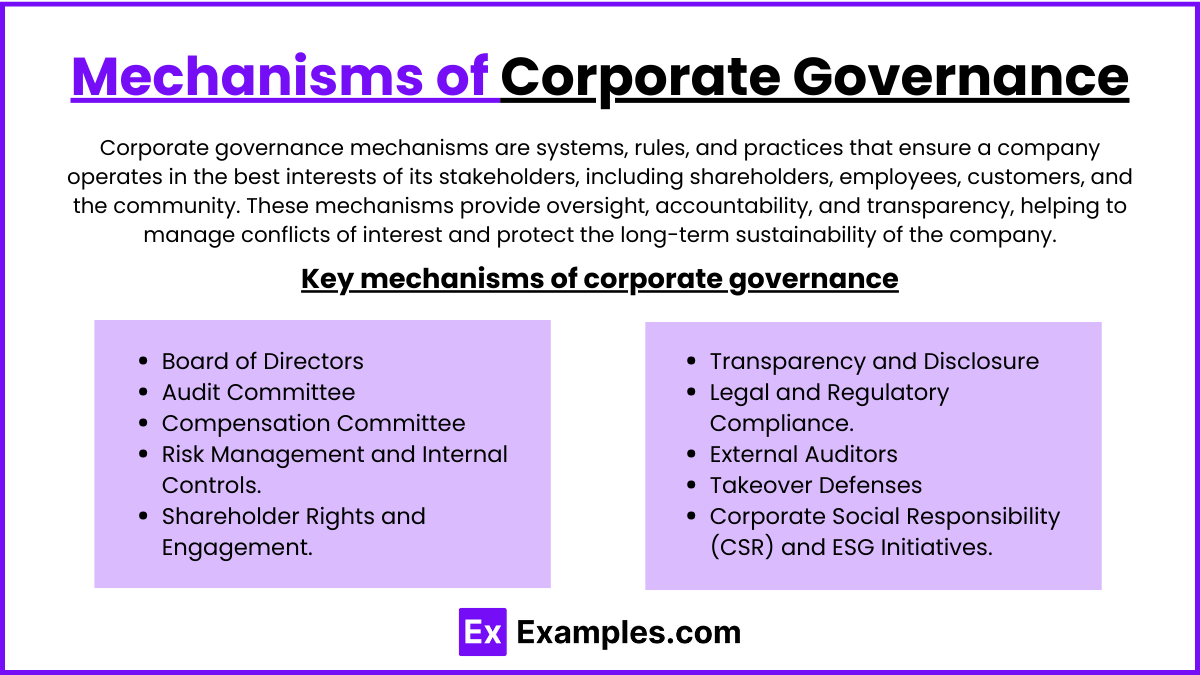

Mechanisms of Corporate Governance

Corporate governance mechanisms are systems, rules, and practices that ensure a company operates in the best interests of its stakeholders, including shareholders, employees, customers, and the community. These mechanisms provide oversight, accountability, and transparency, helping to manage conflicts of interest and protect the long-term sustainability of the company. Here are the key mechanisms of corporate governance:

- Board of Directors: The board of directors is the primary governance body, responsible for overseeing management and protecting shareholder interests.

- Audit Committee: The audit committee is a subset of the board responsible for overseeing financial reporting and internal controls.

- Compensation Committee: The compensation committee is responsible for setting and monitoring executive compensation, ensuring it aligns with performance and shareholder interests.

- Risk Management and Internal Controls: Effective corporate governance includes systems to identify, monitor, and manage risks that could impact the company’s objectives.

- Shareholder Rights and Engagement: Protecting and promoting shareholder rights is essential for effective governance, as shareholders are the company’s owners.

- Transparency and Disclosure: Transparency through regular, clear, and accurate disclosures builds trust among stakeholders and reduces the risk of financial misconduct.

- Legal and Regulatory Compliance: Compliance with laws and regulations is foundational to corporate governance, helping to ensure that a company operates within legal and ethical boundaries.

- External Auditors: External auditors provide an independent assessment of a company’s financial statements and internal controls, increasing reliability for investors and other stakeholders.

- Takeover Defenses: Some companies employ takeover defenses to protect against hostile takeovers, preserving the board’s ability to make strategic decisions without undue pressure.

- Corporate Social Responsibility (CSR) and ESG Initiatives: Focusing on Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) initiatives reflects a commitment to ethical practices and sustainability, which are increasingly valued by investors and consumers.

Risks Associated with Poor Corporate Governance

Poor corporate governance can have severe consequences for a company, impacting its reputation, financial performance, and long-term sustainability. When governance mechanisms fail or are ineffective, they expose the company to various risks that can lead to financial losses, legal issues, and loss of stakeholder trust. Here are some of the primary risks associated with poor corporate governance:

Financial Mismanagement and Fraud

Without strong governance, companies are vulnerable to mismanagement and fraudulent practices that can distort financial reporting and erode shareholder value.

- Risk: Lack of oversight from the board or audit committees increases the likelihood of accounting fraud, misappropriation of assets, and manipulation of financial statements.

- Potential Impact:

- Financial Losses: Fraudulent activities often result in significant financial losses, fines, and penalties.

- Stock Price Decline: Mismanagement and fraud, when revealed, can cause a sharp decline in stock prices, affecting shareholders and investors.

Example: The Enron scandal involved accounting fraud and off-balance-sheet transactions, leading to one of the largest bankruptcies in history and destroying shareholder wealth.

Legal and Regulatory Risks

Poor governance practices can result in non-compliance with laws and regulations, leading to legal action and regulatory penalties.

- Risk: Companies with inadequate compliance programs and poor internal controls are more likely to violate regulatory requirements, such as financial reporting standards or environmental laws.

- Potential Impact:

- Fines and Sanctions: Non-compliance often leads to heavy fines, penalties, and sanctions from regulatory bodies.

- Legal Liability: Legal actions may arise from stakeholders who suffer losses due to the company’s failure to comply with regulations.

Example: Volkswagen’s emissions scandal involved regulatory violations in which the company misrepresented emissions data, resulting in billions of dollars in fines and legal repercussions.

Loss of Shareholder Trust and Confidence

Shareholders expect transparency and accountability from management. Poor governance erodes trust, causing shareholders to lose confidence in the company’s leadership.

- Risk: Without transparency and ethical practices, shareholders may suspect management is acting in its own interest rather than protecting shareholder value.

- Potential Impact:

- Shareholder Activism: Discontented shareholders may engage in activist efforts, pushing for changes in the board, management, or company strategy.

- Decline in Stock Value: Loss of confidence can lead to a sell-off of shares, decreasing the company’s stock value and market reputation.

Example: Wells Fargo faced significant backlash from shareholders after it was revealed that employees had opened

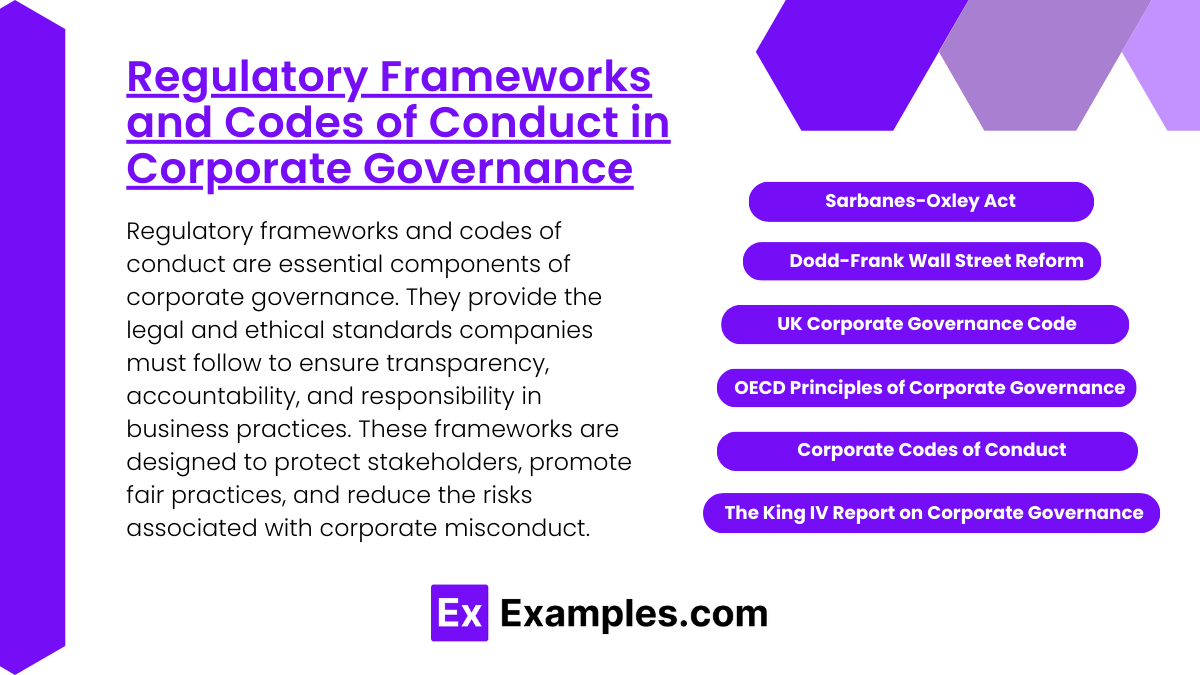

Regulatory Frameworks and Codes of Conduct in Corporate Governance

Regulatory frameworks and codes of conduct are essential components of corporate governance. They provide the legal and ethical standards companies must follow to ensure transparency, accountability, and responsibility in business practices. These frameworks are designed to protect stakeholders, promote fair practices, and reduce the risks associated with corporate misconduct. Here are some of the most significant regulatory frameworks and codes of conduct in corporate governance:

- Sarbanes-Oxley Act (SOX): The Sarbanes-Oxley Act (SOX) was enacted in the United States in 2002 in response to major corporate scandals such as Enron and WorldCom. SOX focuses on improving the accuracy and reliability of corporate disclosures.

- Dodd-Frank Wall Street Reform and Consumer Protection Act: The Dodd-Frank Act was passed in the United States in 2010 following the 2008 financial crisis, aiming to increase transparency and reduce systemic risks in the financial sector.

- UK Corporate Governance Code: The UK Corporate Governance Code provides principles of good corporate governance for companies listed on the London Stock Exchange. It is based on a “comply or explain” approach, meaning companies must either follow the code or explain deviations.

- OECD Principles of Corporate Governance: The Organisation for Economic Co-operation and Development (OECD) Principles of Corporate Governance are widely recognized standards that provide guidance on improving governance practices globally.

- Corporate Codes of Conduct: A company’s code of conduct outlines its values, ethical standards, and business practices, guiding employees and management in making ethical decisions.

- The King IV Report on Corporate Governance (South Africa): The King IV Report, developed in South Africa, emphasizes the role of corporate governance in achieving sustainable development. It is principles-based rather than rules-based, offering flexibility.

Examples

Example 1: Board Diversity and Decision-Making

A company’s board of directors may face conflicts of interest if its members have similar backgrounds or interests. For instance, a lack of diversity can lead to groupthink, where board members favor consensus over critical analysis. Implementing mechanisms to ensure diverse perspectives—such as gender, experience, and expertise—can enhance decision-making processes and reduce risks associated with narrow viewpoints, ultimately leading to better governance and improved company performance.

Example 2: Executive Compensation Structures

Conflicts can arise when executive compensation is tied to short-term performance metrics, leading executives to prioritize immediate profits over long-term sustainability. For example, if a CEO’s bonus is based on quarterly earnings, they may engage in practices that boost short-term results but jeopardize the company’s future. Mechanisms such as linking compensation to long-term goals and performance, like stock options or vesting periods, can align executive interests with those of shareholders, mitigating risks and enhancing accountability.

Example 3: Shareholder Rights and Activism

Shareholder activism occurs when investors use their rights to influence corporate governance and decision-making. For example, institutional investors may challenge management decisions that they believe are not in the best interests of shareholders, such as excessive spending on projects with low returns. This mechanism of shareholder engagement can lead to conflicts but also serves as a check on management, ensuring that the voices of investors are heard and potentially leading to more prudent corporate strategies.

Example 4: Risk Management Frameworks

Effective corporate governance requires robust risk management mechanisms to identify and mitigate potential risks. For instance, a company may establish an independent risk committee that regularly reviews and assesses operational, financial, and reputational risks. By proactively managing risks through well-defined policies and practices, companies can reduce the likelihood of conflicts arising from unforeseen challenges, thereby enhancing stability and shareholder confidence.

Example 5: Transparency and Reporting Practices

Transparency in corporate governance involves clear and honest reporting of a company’s financial performance, operations, and governance practices. For example, companies that adhere to rigorous reporting standards, such as those outlined by the International Financial Reporting Standards (IFRS), help mitigate conflicts related to information asymmetry. By ensuring that all stakeholders have access to accurate and timely information, organizations can foster trust and accountability, minimizing risks associated with misinformation or lack of clarity in corporate activities.

Practice Questions

Question 1

What is a primary goal of corporate governance?

A) To maximize shareholder profits at any cost

B) To ensure that the company operates ethically and transparently

C) To minimize regulatory compliance

D) To enhance market competition

Correct Answer: B) To ensure that the company operates ethically and transparently.

Explanation: The primary goal of corporate governance is to establish a framework that ensures a company operates ethically, transparently, and in the best interest of all stakeholders, including shareholders, employees, customers, and the community. Good corporate governance helps mitigate risks, prevents conflicts of interest, and promotes accountability, ultimately fostering long-term sustainability and trust in the organization.

Question 2

Which of the following best describes a conflict of interest in corporate governance?

A) A situation where company profits are low.

B) A scenario where a board member makes decisions that benefit personal interests over the company’s welfare.

C) A disagreement between shareholders and management over dividend distribution.

D) A lack of regulations governing corporate practices.

Correct Answer: B) A scenario where a board member makes decisions that benefit personal interests over the company’s welfare.

Explanation: A conflict of interest arises when an individual in a position of authority (such as a board member) has personal interests that could improperly influence their decisions regarding the company. This situation can undermine the trust of stakeholders and lead to decisions that do not align with the best interests of the company and its shareholders. Options A, C, and D do not accurately capture the essence of a conflict of interest.

Question 3

What is a benefit of having a strong corporate governance framework?

A) Increased executive compensation

B) Enhanced risk management and accountability

C) Reduced regulatory oversight

D) Higher barriers to shareholder engagement

Correct Answer: B) Enhanced risk management and accountability.

Explanation: A strong corporate governance framework enhances risk management by establishing clear policies, procedures, and accountability mechanisms that help organizations identify, assess, and mitigate potential risks. This framework fosters a culture of transparency and responsibility, ensuring that decisions are made with due diligence and in the best interests of all stakeholders. Options A, C, and D do not represent the benefits of strong governance; instead, they could lead to negative outcomes or inefficiencies.