Working Capital and Liquidity are critical aspects of financial management, focusing on a company’s short-term financial health and operational efficiency. This topic covers the components of working capital, including cash, inventory, and receivables, along with strategies for optimizing these assets. Liquidity management examines a firm’s ability to meet its short-term obligations, essential for maintaining smooth operations and avoiding cash flow issues. Mastery of these concepts enables a thorough understanding of how companies balance profitability with liquidity, providing a foundation for effective financial analysis and risk management.

Learning Objectives

In studying “Working Capital and Liquidity” for the CFA exam, you should learn to understand the components of working capital, including cash, accounts receivable, inventory, and accounts payable, and how they impact a company’s liquidity and operational efficiency. Analyze the working capital cycle and the management of short-term assets and liabilities to optimize cash flow. Evaluate liquidity ratios, such as the current and quick ratios, to assess a company’s ability to meet short-term obligations. Understand techniques for managing cash and marketable securities, as well as the trade-offs involved in inventory and credit policies. Additionally, assess how effective working capital management contributes to a company’s overall financial health and risk profile, particularly in fluctuating economic conditions.

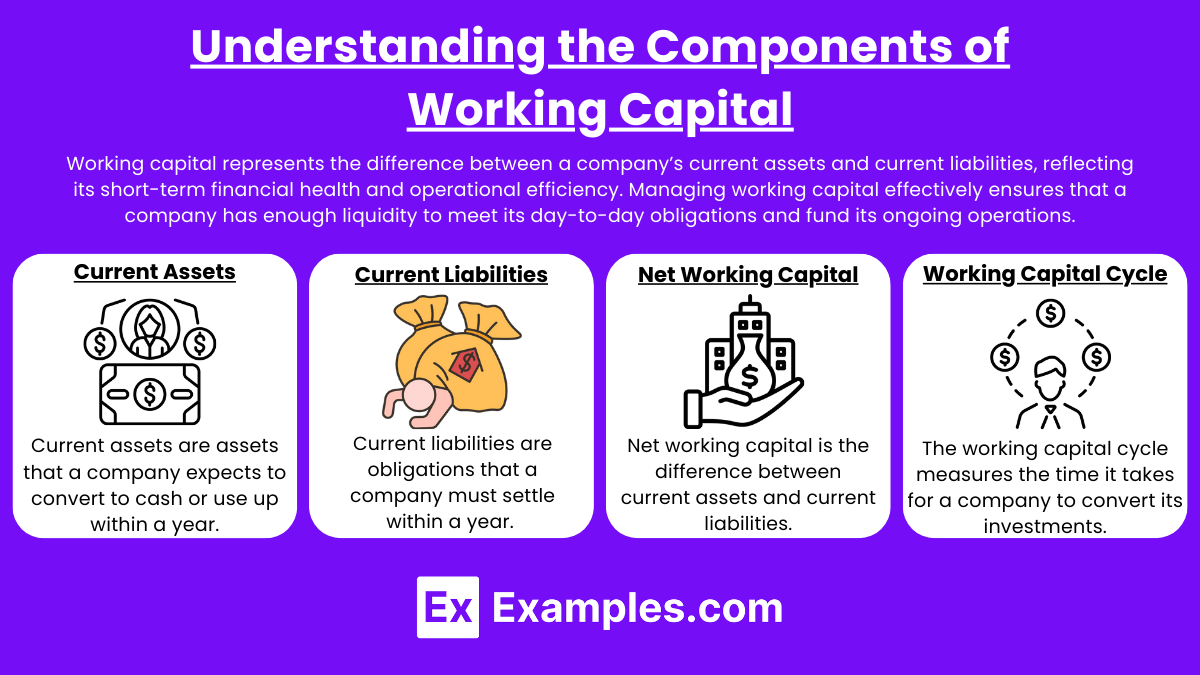

Understanding the Components of Working Capital

Working capital represents the difference between a company’s current assets and current liabilities, reflecting its short-term financial health and operational efficiency. Managing working capital effectively ensures that a company has enough liquidity to meet its day-to-day obligations and fund its ongoing operations. Here are the main components of working capital:

1. Current Assets

Current assets are assets that a company expects to convert to cash or use up within a year. These assets directly support business operations and are essential to working capital management.

Key Current Assets:

- Cash and Cash Equivalents: Readily available funds used to cover immediate expenses and obligations. This includes cash on hand, bank balances, and short-term investments.

- Accounts Receivable: Money owed to the company by its customers for products or services delivered. Efficiently managing receivables ensures timely cash inflows.

- Inventory: Goods available for sale or production. Managing inventory levels is crucial, as excess inventory ties up cash, while too little inventory can result in lost sales.

- Marketable Securities: Short-term investments that can be quickly converted to cash, providing an additional source of liquidity if needed.

Example: A retail store’s current assets may include cash in registers, customer receivables, and the inventory on its shelves, all of which contribute to its working capital.

2. Current Liabilities

Current liabilities are obligations that a company must settle within a year. Effective management of these liabilities ensures that the company maintains sufficient liquidity to meet its short-term obligations without financial strain.

Key Current Liabilities:

- Accounts Payable: Money owed to suppliers for goods and services received. Managing payables effectively allows a company to maintain good relationships with vendors and optimize cash outflows.

- Short-Term Debt: Loans or credit facilities due within a year. This includes bank loans, lines of credit, and portions of long-term debt that are payable in the near term.

- Accrued Expenses: Costs incurred but not yet paid, such as wages, utilities, and taxes. These are obligations that must be managed to ensure accurate budgeting and cash flow.

- Other Current Liabilities: Other payables due within a year, such as dividends payable or deferred revenue (when customers pay in advance for goods or services).

Example: A manufacturing firm’s current liabilities may include accounts payable for raw materials, accrued wages for employees, and short-term debt, all of which impact its working capital needs.

3. Net Working Capital

Net working capital is the difference between current assets and current liabilities. It represents the amount of liquidity available to finance day-to-day operations after covering short-term obligations.

Formula: Net Working Capital = Current Assets−Current Liabilities

- Positive Net Working Capital: Indicates that a company has more current assets than liabilities, suggesting good short-term liquidity and financial stability.

- Negative Net Working Capital: Indicates that a company’s current liabilities exceed its current assets, potentially signaling liquidity issues.

Example: If a company has current assets of $200,000 and current liabilities of $150,000, its net working capital is $50,000, meaning it has sufficient liquidity to cover its short-term obligations.

4. Working Capital Cycle

The working capital cycle (also known as the cash conversion cycle) measures the time it takes for a company to convert its investments in inventory and other resources into cash flows from sales. A shorter cycle indicates efficient working capital management, while a longer cycle may suggest inefficiencies.

Key Stages:

- Inventory Conversion Period: The time taken to convert inventory into sales.

- Receivables Collection Period: The time taken to collect payments from customers after sales.

- Payables Deferral Period: The time taken to pay suppliers after receiving inventory or services.

Formula: Working Capital Cycle = Inventory Conversion Period + Receivables Collection Period − Payables Deferral Period.

Example: If a company’s working capital cycle is 45 days, it means the company typically takes 45 days to convert its resources into cash. Shortening this cycle can improve liquidity and reduce the need for external financing.

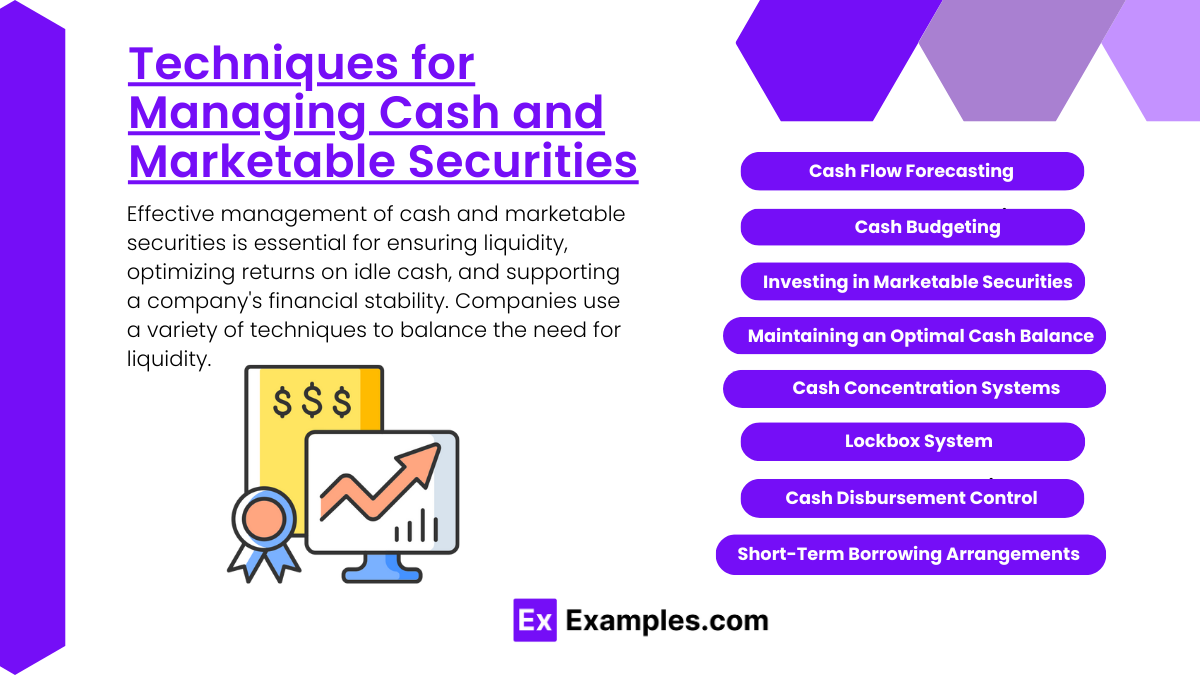

Techniques for Managing Cash and Marketable Securities

Effective management of cash and marketable securities is essential for ensuring liquidity, optimizing returns on idle cash, and supporting a company’s financial stability. Companies use a variety of techniques to balance the need for liquidity with the desire to earn returns on their short-term investments. Here are some key techniques:

1. Cash Flow Forecasting

Cash flow forecasting involves predicting the company’s future cash inflows and outflows to ensure that it has enough liquidity to meet its obligations.

- Short-Term Forecasting: Focuses on daily, weekly, or monthly cash requirements. This helps in managing day-to-day cash needs and avoids shortfalls.

- Long-Term Forecasting: Provides insight into cash needs over months or even years. This helps in planning for large expenditures and optimizing investment in marketable securities.

Example: A retailer might forecast cash flow to prepare for higher expenses during inventory stocking periods, ensuring sufficient liquidity for these peak times.

2. Cash Budgeting

A cash budget is a detailed plan that outlines expected cash inflows and outflows over a specific period. It helps in identifying surplus or deficit periods, guiding cash allocation decisions.

- Planning for Surpluses and Deficits: Cash budgets help identify periods of excess cash that can be invested or times when external financing may be required.

- Adjusting for Seasonal Needs: Companies with seasonal cash flows can plan for peak cash inflows and outflows, ensuring liquidity throughout the cycle.

Example: A construction company might use a cash budget to manage cash flows around major project expenses, such as equipment purchases or payroll during high activity periods.

3. Investing in Marketable Securities

Marketable securities are short-term, liquid investments that provide a return on idle cash. Companies can use these investments to earn income while maintaining easy access to funds.

Types of Marketable Securities:

- Treasury Bills: Short-term government securities with low risk, highly liquid and ideal for preserving capital.

- Commercial Paper: Unsecured, short-term debt issued by corporations. It offers higher returns than treasury bills but with slightly higher risk.

- Certificates of Deposit (CDs): Time deposits that offer a fixed interest rate. They provide higher returns than a traditional savings account but may have penalties for early withdrawal.

- Money Market Funds: Funds that invest in a mix of short-term, low-risk instruments, offering liquidity and diversification.

Example: A company with excess cash might invest in treasury bills, knowing they can convert them back into cash within a few days if needed.

4. Maintaining an Optimal Cash Balance

The optimal cash balance is the amount of cash a company needs to cover its immediate obligations without holding excessive idle cash. Maintaining this balance ensures liquidity without missing out on potential returns from marketable securities.

- Minimum Cash Balance: Ensures the company can meet unexpected expenses and maintain operations smoothly.

- Compensating Balances: Some banks require companies to maintain a minimum balance as part of loan agreements, affecting the optimal cash balance.

- Buffer for Uncertainties: Holding a small additional buffer above the minimum balance helps manage unexpected fluctuations in cash needs.

Example: A manufacturing firm may keep a minimum cash balance for payroll, routine expenses, and unexpected repairs, while investing any excess cash in marketable securities.

5. Cash Concentration Systems

Cash concentration systems centralize cash from various bank accounts into a single account, making it easier to manage and deploy funds as needed.

- Zero-Balance Accounts (ZBAs): Sub-accounts are maintained at a zero balance by automatically transferring funds from a master account to cover transactions.

- Sweeping and Pooling: Surplus cash is automatically transferred (or “swept”) into a central account at the end of each day, where it can be invested.

- Efficiency in Cash Management: Centralized cash improves visibility, minimizes idle balances, and supports efficient allocation of funds across the organization.

Example: A retail chain with multiple stores uses cash concentration to pool funds daily from each location into a central account, improving cash control and investment opportunities.

6. Lockbox System

A lockbox system accelerates cash collection by directing customer payments to a designated post office box, where a bank processes the deposits on behalf of the company.

- Faster Cash Availability: Banks process checks immediately, reducing the time between payment receipt and cash availability.

- Reduced Collection Time: By centralizing payments, the company can speed up the collection process, improving cash flow.

- Security: Lockbox services also reduce the risk of check handling and improve the security of incoming cash.

Example: A utility company may use a lockbox system to ensure that customer payments are deposited quickly and securely, allowing faster access to funds.

7. Cash Disbursement Control

Controlling disbursements is essential to prevent cash outflow mismatches and manage liquidity effectively. Companies use timing strategies and controls to optimize cash outflows.

- Controlled Payment Timing: Delaying payments to suppliers until they are due can retain cash for as long as possible.

- Electronic Funds Transfer (EFT): Using EFTs for payments provides flexibility in timing and improves control over cash disbursements.

- Approval Process: Establishing a formal approval process for disbursements prevents unnecessary cash outflows and improves control.

Example: A company might implement EFTs with scheduled payment dates for suppliers, ensuring timely payments while retaining cash until the due date.

8. Short-Term Borrowing Arrangements

For companies facing seasonal or temporary cash shortages, having short-term borrowing options such as lines of credit can provide flexibility and maintain liquidity.

- Lines of Credit: An arrangement with a bank allowing the company to borrow up to a predetermined limit as needed.

- Commercial Paper: Issuing short-term unsecured debt for quick financing needs, often at lower interest rates than traditional loans.

- Revolving Credit: Provides access to funds that can be drawn, repaid, and redrawn as needed, supporting cash flow during tight periods.

Example: A retail business may use a line of credit to cover seasonal inventory purchases, knowing that cash inflows will repay the credit after peak sales periods.

Inventory and Credit Policy Trade-Offs

Managing inventory and credit policies involves trade-offs that can impact a company’s liquidity, profitability, and customer relationships. Balancing these factors is essential for optimizing cash flow and supporting business growth. Here’s a closer look at the trade-offs involved in inventory and credit policies:

1. Inventory Policy Trade-Offs

Inventory policies determine how much inventory a company holds, how frequently it restocks, and the methods for managing stock. Balancing inventory levels involves trade-offs between holding costs, stock-out risks, and operational efficiency.

a. Holding More Inventory

- Advantages:

- Reduced Stock-Out Risk: Having more inventory on hand prevents stock-outs, ensuring that customer demand is met promptly.

- Bulk Purchase Discounts: Ordering large quantities can result in cost savings from supplier discounts.

- Smooth Production Flow: Ample inventory supports production schedules, avoiding delays due to lack of materials.

- Disadvantages:

- Higher Holding Costs: Excess inventory increases storage, insurance, and maintenance costs, tying up cash that could be used elsewhere.

- Obsolescence Risk: Products in storage risk becoming outdated or spoiled, especially in industries with fast product cycles or perishable goods.

- Cash Flow Impact: Cash tied up in inventory reduces liquidity, potentially leading to cash shortages.

Example: A fashion retailer may benefit from holding more inventory to meet demand during peak seasons, but excess inventory afterward could lead to markdowns and holding costs.

b. Lean Inventory (Just-in-Time)

- Advantages:

- Lower Holding Costs: By minimizing stock, the company reduces storage and insurance expenses.

- Improved Cash Flow: Less cash tied up in inventory improves liquidity, allowing the company to invest in other areas.

- Reduced Obsolescence: Lean inventory minimizes the risk of products becoming obsolete or perishing.

- Disadvantages:

- Stock-Out Risks: Low inventory increases the risk of stock-outs, potentially resulting in missed sales and dissatisfied customers.

- Supply Chain Dependence: Just-in-time inventory relies heavily on timely deliveries from suppliers, making it vulnerable to disruptions.

- Reduced Flexibility: With minimal stock, the company may struggle to respond to sudden increases in demand.

Example: A technology manufacturer may use just-in-time inventory to avoid holding costs and obsolescence risks due to rapid innovation but faces challenges if supplier delays occur.

2. Credit Policy Trade-Offs

Credit policies govern the terms of payment offered to customers, impacting sales, cash flow, and customer relationships. Companies balance offering credit to boost sales with managing the risk of late payments or defaults.

a. Liberal Credit Policy (Extended Payment Terms)

- Advantages:

- Increased Sales: Offering credit attracts customers who may not have immediate funds, boosting sales and market share.

- Competitive Advantage: Flexible credit terms make a company’s offerings more attractive compared to competitors with stricter terms.

- Customer Loyalty: Extended credit builds goodwill and strengthens relationships with customers, encouraging repeat business.

- Disadvantages:

- Increased Risk of Bad Debt: Offering credit to customers with uncertain creditworthiness raises the likelihood of defaults.

- Delayed Cash Inflows: Longer payment terms delay cash inflows, potentially straining cash flow and liquidity.

- Higher Collection Costs: Managing overdue accounts, sending reminders, and handling collections can add administrative costs.

Example: An electronics wholesaler may extend credit to retailers to stimulate sales, but late payments from clients can affect cash flow and increase the risk of bad debt.

b. Strict Credit Policy (Short Payment Terms)

- Advantages:

- Improved Cash Flow: Short payment terms speed up cash collection, enhancing liquidity and reducing the need for external financing.

- Reduced Bad Debt Risk: By limiting credit to customers with strong credit histories and requiring faster payment, the company reduces its exposure to defaults.

- Lower Collection Costs: Faster payments reduce the need for extensive credit management, lowering administrative costs.

- Disadvantages:

- Potential Loss of Sales: Strict terms may discourage customers who prefer flexible credit, leading to missed sales opportunities.

- Customer Dissatisfaction: Customers may view tight credit policies as inflexible, affecting relationships and loyalty.

- Reduced Market Competitiveness: In competitive markets, a strict credit policy may make the company less attractive than competitors offering more lenient terms.

Example: A software provider that enforces strict payment terms improves cash flow but may lose potential customers to competitors with more flexible options.

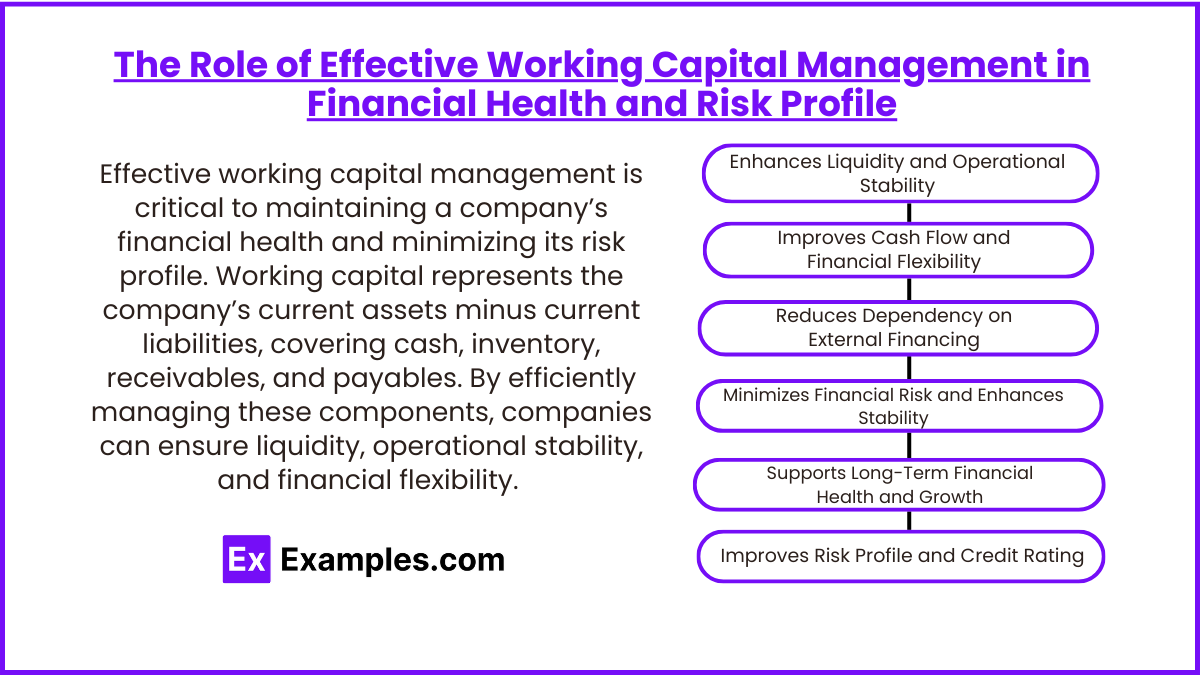

The Role of Effective Working Capital Management in Financial Health and Risk Profile

Effective working capital management is critical to maintaining a company’s financial health and minimizing its risk profile. Working capital represents the company’s current assets minus current liabilities, covering cash, inventory, receivables, and payables. By efficiently managing these components, companies can ensure liquidity, operational stability, and financial flexibility. Here’s how effective working capital management positively influences financial health and reduces risk:

1. Enhances Liquidity and Operational Stability

Efficient working capital management ensures that a company has enough liquidity to meet short-term obligations, which is essential for day-to-day operations.

- Sustaining Daily Operations: Companies need adequate cash to pay for operational expenses such as salaries, utilities, and rent. Effective working capital management ensures these costs are met without delays.

- Avoiding Liquidity Crunches: By monitoring cash flow and managing receivables and payables, companies can reduce the risk of cash shortages. This minimizes the need for emergency borrowing and reduces associated interest costs.

Example: A retail company that manages its inventory and receivables efficiently can generate steady cash inflows, enabling it to cover costs even during seasonal sales fluctuations.

2. Improves Cash Flow and Financial Flexibility

Effective management of cash flow components like receivables, payables, and inventory directly impacts a company’s cash position, enabling it to maintain financial flexibility.

- Optimizing Receivables and Payables: Faster collection of receivables and strategic timing of payables help improve cash flow. This reduces the need for short-term financing and lowers interest expenses.

- Investment Opportunities: With better cash flow management, companies have more funds available for reinvestment in growth opportunities, such as R&D, acquisitions, or expansion.

- Flexibility in Financial Planning: Companies with strong cash flow from working capital can respond quickly to market changes, unexpected expenses, or investment opportunities, which strengthens their competitive position.

Example: A manufacturing firm with efficient cash flow management can seize opportunities to expand production capacity without resorting to high-interest debt.

3. Reduces Dependency on External Financing

When working capital is managed effectively, companies rely less on external financing for short-term needs, reducing their cost of capital and exposure to interest rate risk.

- Decreasing Short-Term Borrowing: By maintaining optimal levels of working capital, companies avoid relying on costly short-term loans to cover gaps in cash flow.

- Lower Cost of Capital: Reduced dependency on external financing lowers interest expenses and improves the company’s bottom line, enhancing overall profitability.

- Mitigating Credit Risk: Lower reliance on financing strengthens a company’s creditworthiness, which can lead to better loan terms when borrowing is necessary.

Example: A business with efficient inventory turnover and timely receivable collections can maintain liquidity without frequent use of lines of credit, which lowers interest expenses.

4. Minimizes Financial Risk and Enhances Stability

Effective working capital management reduces financial risk by improving a company’s ability to handle economic downturns, supply chain disruptions, and operational challenges.

- Managing Inventory Risks: Optimizing inventory levels reduces risks associated with obsolescence, spoilage, or theft. This minimizes write-offs, reduces storage costs, and protects profit margins.

- Reducing Credit Risk: By setting clear credit policies and monitoring receivables, companies can reduce the risk of bad debt, which stabilizes cash inflows and enhances financial predictability.

- Mitigating Operational Risks: Maintaining a stable cash position through effective working capital management enables a company to respond to unexpected operational expenses without financial strain.

Example: During an economic downturn, a company with strong working capital management can avoid cash flow issues and continue operating smoothly without having to liquidate assets or incur emergency loans.

5. Supports Long-Term Financial Health and Growth

Working capital management impacts not only short-term liquidity but also the long-term financial health of a company, positioning it for sustainable growth.

- Funding for Growth Initiatives: Effective working capital management frees up resources that can be reinvested in expansion, new products, or market entry, contributing to long-term growth.

- Enhancing Profitability: Reduced holding costs, lower borrowing expenses, and optimized cash flows all contribute to improved profit margins, strengthening the company’s financial position.

- Increasing Shareholder Value: Improved liquidity and profitability through effective working capital management often lead to higher dividends and stock price appreciation, benefiting shareholders.

Example: A tech firm that efficiently manages its cash and working capital can reinvest in R&D, leading to innovation and competitive advantage, which fuels sustainable growth and boosts shareholder value.

6. Improves Risk Profile and Credit Rating

A company with strong working capital management typically enjoys a healthier risk profile, which improves its credit rating and overall financial reputation.

- Stronger Credit Profile: Companies that consistently manage working capital efficiently tend to have better credit ratings, which provides access to more favorable financing terms when needed.

- Lower Default Risk: Improved cash flow and liquidity reduce the risk of default, enhancing relationships with creditors and lenders.

- Attractive to Investors: Investors view companies with sound working capital management as lower risk, often leading to greater investor interest and potentially lower cost of equity.

Example: A large corporation that maintains a solid working capital position may enjoy a higher credit rating, resulting in lower interest rates on corporate bonds.

Examples

Example 1: Seasonal Business Operations

A retail company that sells holiday decorations typically experiences fluctuations in sales throughout the year. During peak seasons, such as the holidays, the company needs sufficient working capital to purchase inventory in advance. This liquidity ensures that the company can meet demand without delays, covering expenses like payroll and rent while managing stock levels efficiently.

Example 2: Manufacturing Inventory Management

A manufacturing company needs to maintain a certain level of working capital to manage its raw materials and finished goods. For instance, a car manufacturer must ensure that it has enough working capital to purchase parts and materials required for production. Adequate liquidity allows the company to operate without interruptions, ensuring timely production schedules and fulfilling customer orders.

Example 3: Service-Based Businesses

A consulting firm may require working capital to manage its cash flow, especially if it operates on a retainer or project basis. Delays in receiving payment from clients can impact liquidity, so the firm may need to maintain sufficient working capital to cover ongoing expenses like salaries and office rent while waiting for client invoices to be paid.

Example 4: Construction Projects

In the construction industry, companies often require significant working capital to finance projects before receiving payments from clients. For instance, a construction firm might need to buy materials, pay subcontractors, and cover labor costs upfront. Maintaining adequate liquidity is essential to keep the project moving forward without delays due to cash flow issues.

Example 5: Crisis Management

During economic downturns or unexpected events (such as a pandemic), companies may face liquidity challenges due to decreased sales and cash flow. For example, a restaurant that suddenly experiences a drop in customers needs sufficient working capital to cover fixed expenses like rent and utilities. Adequate liquidity during such times allows the business to navigate through tough periods, providing a buffer against financial distress while seeking recovery strategies.

Practice Questions

Question 1

What does working capital primarily represent in a company’s financial analysis?

A) The company’s total assets

B) The difference between current assets and current liabilities

C) The total amount of cash available

D) The long-term financial obligations of a company

Correct Answer: B) The difference between current assets and current liabilities.

Explanation: Working capital is defined as the difference between a company’s current assets (such as cash, inventory, and accounts receivable) and its current liabilities (such as accounts payable and short-term debt). This measure indicates the short-term financial health of the company and its ability to cover its short-term obligations. A positive working capital suggests that the company can effectively manage its short-term liabilities with its short-term assets.

Question 2

Which of the following is a common measure of liquidity for a company?

A) Debt-to-equity ratio

B) Current ratio

C) Price-to-earnings ratio

D) Return on equity

Correct Answer: B) Current ratio.

Explanation: The current ratio is a widely used measure of liquidity that assesses a company’s ability to pay its short-term obligations. It is calculated by dividing current assets by current liabilities. A current ratio greater than 1 indicates that the company has more current assets than current liabilities, suggesting a strong liquidity position. In contrast, the other options are more focused on leverage, valuation, or profitability rather than liquidity.

Question 3

Why is maintaining adequate working capital important for a business?

A) It ensures long-term growth opportunities.

B) It allows the company to invest in fixed assets.

C) It helps to meet day-to-day operational expenses.

D) It reduces the company’s debt levels.

Correct Answer: C) It helps to meet day-to-day operational expenses.

Explanation: Maintaining adequate working capital is crucial for covering a company’s daily operational expenses, such as payroll, inventory purchases, and other short-term liabilities. Without sufficient working capital, a company may struggle to meet its financial obligations, potentially leading to operational disruptions or even bankruptcy. While options A, B, and D may reflect broader financial strategies, the primary purpose of working capital is to ensure liquidity for daily operations.