Preparing for the CFA Exam requires a thorough understanding of “Analyzing Statements of Cash Flows II,” an advanced component of financial analysis. This section builds on cash flow classification, emphasizing deeper analysis of operating, investing, and financing activities. It highlights the implications of cash flow variations and their impact on financial stability and investment decisions. This knowledge enhances insight into a company’s long-term solvency, growth prospects, and risk management, which are essential for a high CFA score.

Learning Objectives

In studying “Analyzing Statements of Cash Flows II” for the CFA, you should aim to deepen your understanding of complex cash flow components, particularly the nuances of interrelationships between operating, investing, and financing activities. Gain insights into how advanced cash flow adjustments, including deferred taxes and changes in contingent liabilities, impact financial analysis. Examine the role of strategic cash allocations and the influence of foreign currency translations on consolidated cash flow. Analyze trends in cash flow ratios to assess long-term solvency and resilience. Additionally, evaluate how sophisticated cash flow metrics inform corporate governance decisions, performance benchmarking, and the company’s positioning within its industry.

Key Concepts in Cash Flow II Analysis

- Advanced Cash Flow Components

- Deferred Taxes: Deferred tax liabilities and assets impact cash flows and provide insights into future tax obligations or benefits. Understanding these components can help assess a company’s potential tax liabilities and the timing of future cash flows.

- Contingent Liabilities and Provisions: These are critical for understanding cash reserves set aside for potential future obligations. Analyzing how companies allocate funds to contingencies shows how they manage risk and financial stability.

- Foreign Currency Translations

- Companies operating internationally may report cash flows in multiple currencies. Foreign currency translations can impact consolidated cash flows and reveal insights into currency risk. Understanding translation effects is vital for accurately assessing cash flow stability and exposure to currency fluctuations.

- Working Capital Management and Operational Cash Flow Efficiency

- Analyzing working capital changes is essential for understanding a company’s operational cash flow efficiency. Changes in accounts receivable, inventory, and accounts payable reveal how well a company manages its cash for day-to-day operations. Efficient working capital management leads to positive cash flows and improved liquidity.

- Non-Recurring Cash Flow Items

- One-time items such as large asset sales or acquisitions can distort cash flow figures. Identifying and adjusting for these non-recurring items enables you to analyze core cash flow trends without the influence of irregular events, providing a clearer picture of sustainable cash flow.

- Cash Flow Ratios for Financial Health Assessment

- Operating Cash Flow to Total Liabilities: This ratio measures a company’s ability to cover its liabilities with cash from core operations, indicating solvency.

- Free Cash Flow to Equity (FCFE): FCFE is a crucial metric for shareholders, as it represents the cash available for distribution after all expenses, including debt repayment and capital expenditures.

- Cash Flow Coverage Ratios: Coverage ratios, such as cash flow interest coverage, reveal how well a company can meet interest obligations from its operating cash flow, which is a critical measure of financial resilience.

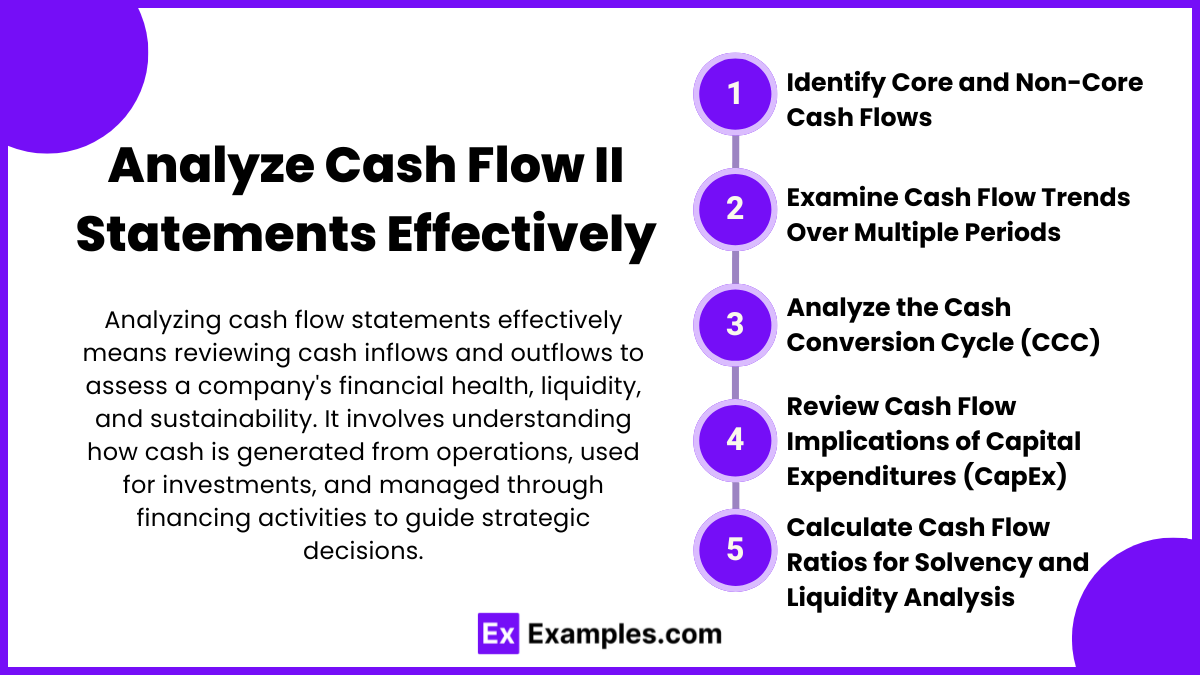

Analyze Cash Flow II Statements Effectively

- Identify Core and Non-Core Cash Flows

- Separate regular, recurring cash flows from non-core activities (like asset sales) to understand the company’s core operational cash performance. This helps isolate the sustainable cash flow level, essential for long-term financial projections.

- Examine Cash Flow Trends Over Multiple Periods

- Look at trends in operating, investing, and financing cash flows over several reporting periods. Consistent positive operating cash flows indicate operational strength, while significant outflows in investing activities may reflect growth investments.

- Analyze the Cash Conversion Cycle (CCC)

- The CCC measures how long it takes for a company to convert resource investments into cash flows. A shorter cycle indicates efficient cash use, while a longer cycle may signal issues with inventory or receivables management.

- Review Cash Flow Implications of Capital Expenditures (CapEx)

- Evaluate CapEx spending in relation to cash flow from operations. High CapEx may be necessary for growth but can strain liquidity. A balanced CapEx approach shows prudent growth investment while maintaining operational cash flow stability.

- Calculate Cash Flow Ratios for Solvency and Liquidity Analysis

- Utilize ratios like operating cash flow to liabilities and cash flow margin to gauge liquidity and financial health. These ratios help identify whether a company generates enough cash from operations to meet its short-term obligations.

Purpose of Analyzing Statements of Cash Flows II

- Assessing Financial Stability: Determines if a company can meet its obligations with consistent cash flow, indicating long-term solvency.

- Evaluating Cash Flow Quality: Distinguishes sustainable cash flows from one-time items, highlighting operational reliability.

- Supporting Investment Decisions: Provides insights for strategic investments, capital allocations, and growth funding.

- Understanding External Impacts: Analyzes effects of foreign currency and economic factors on cash flow stability.

- Enhancing Transparency: Improves clarity in financial reporting, building trust with stakeholders.

Examples

Example 1. Comparative Analysis of Cash Flow Trends

In “Analyzing Statements of Cash Flows II,” a comparative approach is crucial for understanding cash flow trends over multiple periods. By examining changes in operating, investing, and financing activities, you can gain insights into how cash is generated and used within the company. This comparative analysis helps identify patterns in cash flow that indicate stability or areas where the organization may need to make adjustments.

Example 2. Assessing Liquidity and Financial Health

“Analyzing Statements of Cash Flows II” allows for a deep dive into liquidity metrics, which can reveal the company’s ability to meet short-term obligations. By assessing cash flows from operations, you can determine if the business generates enough cash to cover its day-to-day expenses without relying heavily on external financing. This analysis is essential for stakeholders who are concerned with the company’s immediate financial health.

Example 3. Evaluating Investment Decisions

Cash flows related to investing activities provide insights into the company’s strategic direction and capital allocation. In “Analyzing Statements of Cash Flows II,” you evaluate these investment cash flows to understand whether funds are being used for expansion, asset acquisition, or technological upgrades. This section of the cash flow statement reveals the company’s commitment to long-term growth and sustainability.

Example 4. Understanding Debt and Equity Financing Impact

In “Analyzing Statements of Cash Flows II,” the financing activities section is essential for understanding how the company manages its debt and equity. This analysis focuses on cash inflows from issuing debt or equity and outflows from dividends or debt repayments. A thorough examination can reveal the organization’s reliance on external funding and its approach to capital structure, which is key for assessing financial leverage and shareholder returns.

Example 5. Forecasting Future Cash Flows

Utilizing historical data from the cash flow statement in “Analyzing Statements of Cash Flows II” helps forecast future cash flows. By analyzing trends in each section of the statement, you can project potential cash inflows and outflows, giving a clearer picture of future liquidity. This forecasting is beneficial for budgeting, financial planning, and ensuring the company has adequate cash reserves to support growth or handle economic downturns.

Practice Questions

Question 1

Which of the following is not included in the operating activities section of the cash flow statement?

A) Cash received from customers

B) Cash paid to suppliers

C) Interest paid on loans

D) Cash paid for the acquisition of equipment

Answer: D) Cash paid for the acquisition of equipment

Explanation:

The operating activities section of the cash flow statement reflects the cash flows from the core business operations, including cash received from customers, cash paid to suppliers, and cash paid for expenses (like interest on loans). Cash paid for acquiring equipment is classified as an investing activity, as it represents a long-term investment in the company’s assets. Therefore, the correct answer is D.

Question 2

If a company’s net income is significantly higher than its net cash provided by operating activities, which of the following might be a plausible reason?

A) The company recorded high depreciation expense

B) The company made substantial sales on credit

C) The company issued new shares of stock

D) The company sold a major fixed asset

Answer: B) The company made substantial sales on credit

Explanation:

When a company makes substantial sales on credit, it increases net income but does not bring in cash immediately, causing net income to be higher than net cash from operating activities. Depreciation expense (A) would reduce net income but does not impact cash, while issuing shares (C) and selling assets (D) would affect financing and investing cash flows, not operating cash flows. Hence, the correct answer is B.

Question 3

Which of the following changes in the cash flow statement would likely indicate that a company is experiencing liquidity issues?

A) Increasing cash flows from financing activities

B) Negative cash flows from investing activities

C) Declining cash flows from operating activities

D) Positive net income

Answer: C) Declining cash flows from operating activities

Explanation:

Operating cash flows are essential for a company’s daily expenses and sustaining business operations. Declining cash flows from operating activities indicate that a company might not be generating enough cash from its core business, signaling potential liquidity issues. Increasing cash flows from financing activities (A) or negative cash flows from investing activities (B) can occur for various strategic reasons, and positive net income (D) alone doesn’t guarantee liquidity. Thus, C is the correct answer.