Preparing for the CFA Exam requires a comprehensive understanding of “Analysis of Income Taxes,” a core topic in financial reporting and analysis. Mastery of deferred tax assets and liabilities, temporary and permanent differences, tax rate changes, and valuation allowances is essential. This knowledge provides critical insights into assessing a company’s future tax liabilities and potential benefits, both of which are crucial for evaluating a company’s financial health and achieving a high CFA score.

Learning Objectives

In studying “Analysis of Income Taxes” for the CFA, you should learn to understand and apply various tax-related accounting concepts, including deferred tax assets, deferred tax liabilities, and the implications of temporary and permanent differences. Develop proficiency in calculating and interpreting changes in tax rates, valuation allowances, and the recognition of tax benefits on financial statements. Analyze and interpret the impact of income tax provisions and reserves on profitability and financial ratios. Evaluate tax planning strategies to understand their effect on a company’s financial stability and growth potential. Additionally, gain the ability to apply income tax analysis in real-world scenarios, such as assessing tax implications for investments, corporate restructuring, and financial forecasting within an organization.

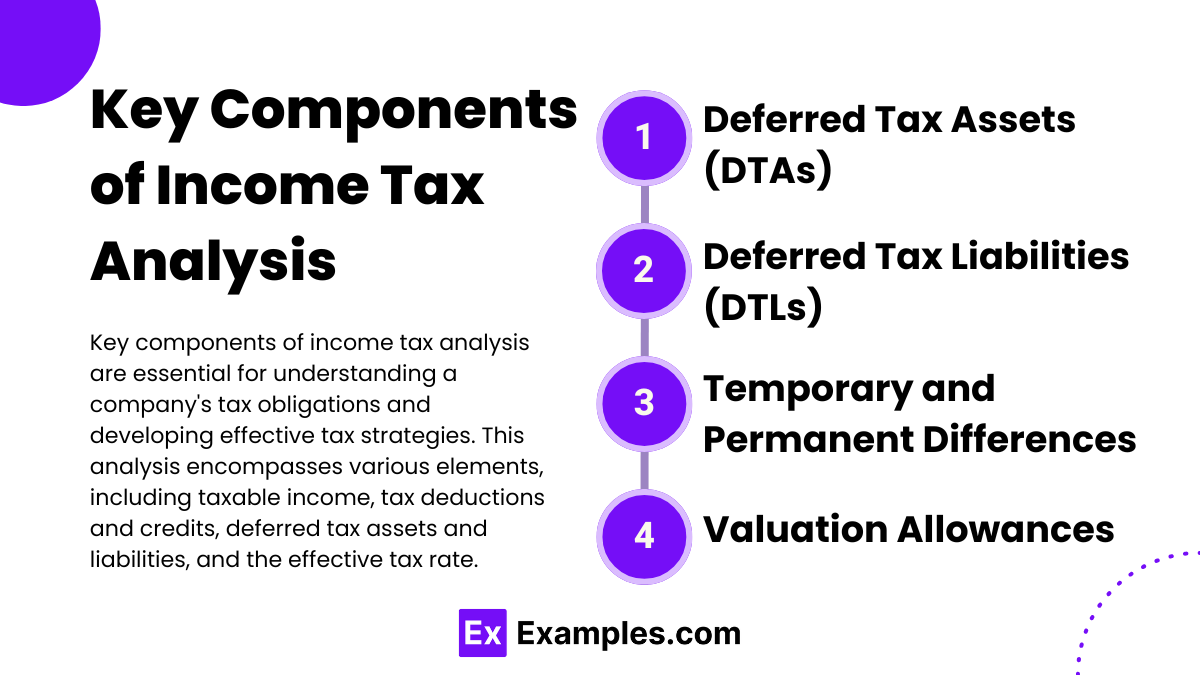

Key Components of Income Tax Analysis

- Deferred Tax Assets (DTAs)

- Definition: DTAs represent future tax benefits that arise when a company’s taxable income is higher than its accounting income, effectively resulting in a prepayment of taxes.

- Sources: Common sources include tax loss carryforwards and timing differences where expenses are recognized for tax purposes before accounting purposes.

- Realization: Assessing the likelihood of DTA realization is crucial; analysts examine future profitability to determine if the company can utilize these tax assets.

- Deferred Tax Liabilities (DTLs)

- Definition: DTLs represent future tax obligations resulting from timing differences where accounting income exceeds taxable income.

- Sources: Often arise from accelerated tax depreciation or the recognition of income in financial statements before it becomes taxable.

- Implications: Large DTLs can indicate future cash outflows, impacting a company’s long-term valuation.

- Temporary and Permanent Differences

- Temporary Differences: These are differences in timing between financial reporting and tax reporting that eventually reverse. They are the foundation for DTAs and DTLs, as they reflect when certain expenses or revenues are reported.

- Permanent Differences: These differences, such as non-deductible expenses, create a gap between accounting and taxable income that will not reverse, affecting effective tax rates but not future tax liabilities.

- Valuation Allowances

- Definition: A valuation allowance is an accounting reserve against DTAs, reflecting management’s expectation that some or all of the asset may not be realizable.

- Importance: Significant valuation allowances indicate potential profitability issues, as the company may not generate enough taxable income to benefit from the DTA.

- Analysis: Changes in valuation allowances are key indicators for analysts, as adjustments affect both income statements and balance sheets, impacting net income and equity.

Importance of Income Tax Analysis

- Impact on Earnings Quality

- The analysis of income taxes reveals the extent to which reported earnings reflect actual economic performance. Deferred tax adjustments can clarify if earnings are driven by sustainable operations or one-time tax benefits.

- By examining DTAs and DTLs, analysts can better assess if earnings growth is likely to continue or if tax-driven adjustments may reduce future income.

- Influence on Valuation and Cash Flows

- Taxes directly affect cash flows and, thus, the intrinsic valuation of a company. Analyzing DTAs and DTLs helps in adjusting cash flow projections and provides a clearer picture of actual cash available for investment or debt repayment.

- DTLs, in particular, indicate deferred cash outflows. A large DTL may suggest future tax payments that could reduce available capital for growth or dividend payments.

- Sustainability of Tax Strategies

- Reconciliation of effective and statutory tax rates reveals the sustainability of a company’s tax strategies. Significant deviations from the statutory rate may imply aggressive tax planning that may not be sustainable, especially in the face of potential regulatory changes.

- Consistent discrepancies in effective tax rates can indicate reliance on temporary tax strategies, impacting the stability of future cash flows and earnings.

Benefits of Income Tax Analysis

1. Enhanced Accuracy in Financial Modeling

- Analyzing income taxes allows CFA candidates to adjust financial models for deferred tax assets and liabilities, temporary differences, and tax credits.

- By understanding tax-related discrepancies, analysts can make more accurate adjustments to net income, cash flow, and valuation models, leading to a truer reflection of a company’s financial reality.

2. Improved Earnings Quality Assessment

- Income tax analysis sheds light on whether reported earnings are sustainable or inflated by temporary tax benefits. This enables analysts to identify earnings quality and determine if profits are derived from genuine operational performance.

- High-quality earnings are typically more sustainable, offering greater reliability in predicting a company’s future profitability.

3. Better Valuation Precision

- Adjusting for income taxes, such as deferred tax assets and liabilities, can reveal a clearer picture of a company’s intrinsic value by refining cash flow and income projections.

- By accurately accounting for future tax obligations and benefits, analysts can determine fairer valuations and make more informed investment decisions.

4. Insight into Cash Flow Sustainability

- Income tax analysis helps identify how future tax obligations (like deferred tax liabilities) or benefits (like tax loss carryforwards) might impact cash flows.

- With insights into potential tax-related cash outflows or inflows, analysts can better assess a company’s ability to sustain dividends, reinvest in the business, or pay down debt.

5. Increased Understanding of Tax Strategies

- Through tax reconciliation and disclosure analysis, CFA candidates gain insights into a company’s tax strategy, identifying potential reliance on aggressive tax tactics or one-time tax benefits.

- This understanding aids in assessing the stability of a company’s future tax rates, providing foresight into potential regulatory risks and earnings volatility.

Examples

Example 1. Strategic Financial Planning

Income tax analysis plays a critical role in financial planning for businesses. By evaluating tax liabilities and potential deductions, companies can better forecast their after-tax profits. This strategic insight allows businesses to allocate resources more effectively, invest in growth areas, and make informed decisions about financing and operational strategies. Through rigorous income tax analysis, businesses can plan for tax obligations, optimize cash flow, and align financial practices with their long-term objectives.

Example 2. Identifying Tax Savings Opportunities

Through an analysis of income taxes, companies can uncover various tax-saving opportunities. These could include taking advantage of deductions, credits, and other incentives available at both state and federal levels. For instance, identifying eligible research and development tax credits or capital investments can significantly reduce tax burdens. This process requires a detailed examination of all applicable tax laws and is essential for maximizing a company’s financial efficiency while complying with regulatory requirements.

Example 3. Impact Assessment of Tax Law Changes

The income tax landscape is dynamic, with frequent changes to tax laws and regulations. A robust income tax analysis enables businesses to assess the financial impact of these changes on their operations. For example, recent modifications to corporate tax rates or the introduction of new deductions could alter a company’s tax strategy. By keeping up with these developments, businesses can adjust their tax planning to mitigate risks associated with non-compliance and capitalize on new opportunities.

Example 4. Optimizing Investment Decisions

Income tax analysis is crucial when evaluating the tax implications of potential investments. By assessing the tax benefits or liabilities associated with various investment options, companies can make more informed choices. For instance, choosing between different forms of business financing, such as equity or debt, can impact taxable income. A careful income tax analysis helps companies weigh these options in light of tax efficiency, contributing to better investment decisions and financial growth.

Example 5. Enhancing Compliance and Transparency

Effective income tax analysis ensures that a company meets all its tax obligations while maintaining transparency in its financial reporting. By regularly reviewing income tax calculations and reconciling discrepancies, businesses can avoid penalties associated with underpayment or late payment of taxes. This commitment to compliance supports positive relationships with tax authorities and enhances stakeholders’ trust by demonstrating sound financial practices and integrity in reporting.

Practice Questions

Question 1

Which of the following is a primary goal of conducting an analysis of income taxes for a business?

A) To identify potential areas for revenue generation

B) To estimate and plan for tax liabilities

C) To reduce payroll costs

D) To increase inventory turnover

Answer: B) To estimate and plan for tax liabilities

Explanation: A key objective in analyzing income taxes is to estimate and plan for tax liabilities accurately. This analysis helps businesses forecast their tax obligations, ensuring they have the necessary funds set aside to meet these requirements. Proper tax planning helps prevent cash flow issues and allows companies to avoid penalties for underpayment. While revenue generation (Option A), reducing payroll costs (Option C), and increasing inventory turnover (Option D) may contribute to overall financial health, they are not the primary goals of income tax analysis.

Question 2

How can changes in tax laws most directly impact a company’s financial statements?

A) By altering the reported revenue on the income statement

B) By influencing the amount of net income after tax

C) By adjusting the company’s asset valuation

D) By changing the employee compensation expense

Answer: B) By influencing the amount of net income after tax

Explanation: Changes in tax laws primarily impact a company’s financial statements by influencing the amount of net income after taxes. New tax rates, deductions, or credits directly alter the income tax expense line on the income statement, thus affecting the net income. For example, a reduction in corporate tax rates would lower tax expenses, leading to higher after-tax income. This differs from revenue reporting (Option A), asset valuation (Option C), or employee compensation expense (Option D), which are not directly affected by changes in income tax laws.

Question 3

Which of the following methods is commonly used in the analysis of income taxes to optimize a company’s tax strategy?

A) FIFO (First-In, First-Out) inventory method

B) Accelerated depreciation of assets

C) Percentage-of-completion accounting method

D) LIFO (Last-In, First-Out) inventory method

Answer: B) Accelerated depreciation of assets

Explanation: Accelerated depreciation is a common tax optimization method that companies use to reduce taxable income. By using accelerated depreciation, companies can increase the depreciation expense recorded on their income statement in the early years of an asset’s life, thereby lowering taxable income and tax liability in those years. This is a proactive tax strategy, as it reduces the company’s immediate tax burden. FIFO (Option A), LIFO (Option D), and percentage-of-completion (Option C) are specific accounting methods that influence revenue or inventory valuation but are not primarily used to optimize tax strategies directly.