A business model outlines how a company creates, delivers, and captures value, shaping its approach to generating revenue and achieving profitability. It encompasses the strategies, structures, and processes that drive a company’s operations and distinguish it from competitors. Understanding business models is essential in financial analysis, as it reveals key revenue sources, cost structures, and growth drivers. Analysts use business model insights to assess a company’s financial health, competitive advantage, and potential risks, enabling more informed investment and valuation decisions across different industries.

Learning Objectives

In studying ” Business Models ” for the CFA Exam, you should learn to understand how different business models impact financial performance, revenue generation, and profitability. Analyze key components like revenue models, cost structures, and capital requirements to assess a company’s financial stability and competitive positioning. Evaluate how various models, such as asset-intensive, subscription-based, or platform-based, influence financial statements, including the balance sheet, income statement, and cash flow statement. Additionally, explore how these models affect financial ratios, profitability metrics, and risk profiles, and apply this understanding to analyze companies across industries in practice exam scenarios.

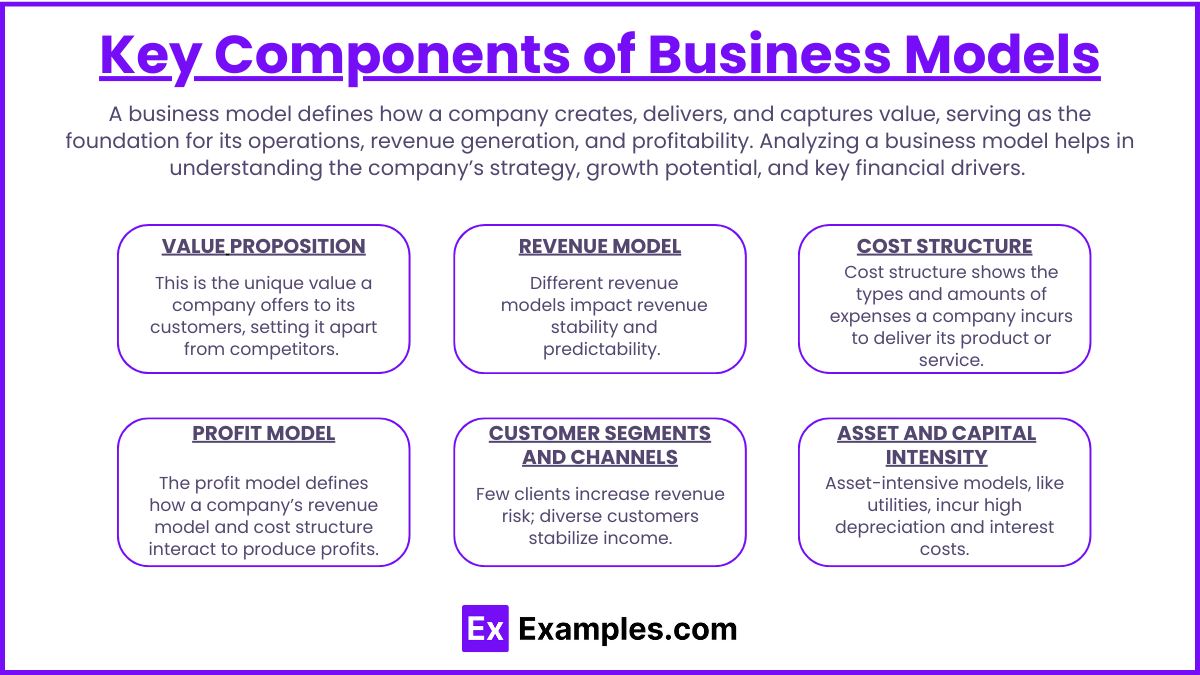

A business model defines how a company creates, delivers, and captures value, serving as the foundation for its operations, revenue generation, and profitability. Analyzing a business model helps in understanding the company’s strategy, growth potential, and key financial drivers. This context is crucial for evaluating a company’s financial performance within its industry and understanding the risk-return profile associated with its operations.

Key Components of Business Models

A business model defines how a company creates, delivers, and captures value, serving as the foundation for its operations, revenue generation, and profitability. Analyzing a business model helps in understanding the company’s strategy, growth potential, and key financial drivers.

- Value Proposition

- This is the unique value a company offers to its customers, setting it apart from competitors. The value proposition influences customer demand, pricing power, and ultimately, revenue.

- Example: A tech company may emphasize innovation, while a retail chain might focus on low prices.

- Revenue Model

- A company’s revenue model determines how it earns money—whether through sales, subscriptions, licensing, or advertising.

- Different revenue models impact revenue stability and predictability. For instance, a subscription model can provide consistent income, while a sales model may fluctuate seasonally.

- Cost Structure

- The cost structure reflects the types and amounts of expenses a company incurs in delivering its product or service.

- High fixed costs, typical in manufacturing, can lead to higher operating leverage, meaning profit margins expand with sales volume but may drop sharply if demand declines.

- Profit Model

- The profit model defines how a company’s revenue model and cost structure interact to produce profits.

- Profitability analysis often focuses on gross margin, operating margin, and net margin, which provide insights into how efficiently a company converts revenue into profit.

- Customer Segments and Channels

- Business models vary based on customer target segments (e.g., B2B, B2C) and sales channels (e.g., direct, online, or through intermediaries).

- Customer concentration or reliance on a few large clients can create revenue risk, while diversified customer bases can stabilize income streams.

- Asset and Capital Intensity

- Business models differ in their need for physical or financial assets. Asset-intensive models (like utilities) often require significant capital investments and may have high depreciation and interest expenses.

- Less asset-intensive models (like software companies) typically have lower fixed costs but may have high R&D expenses.

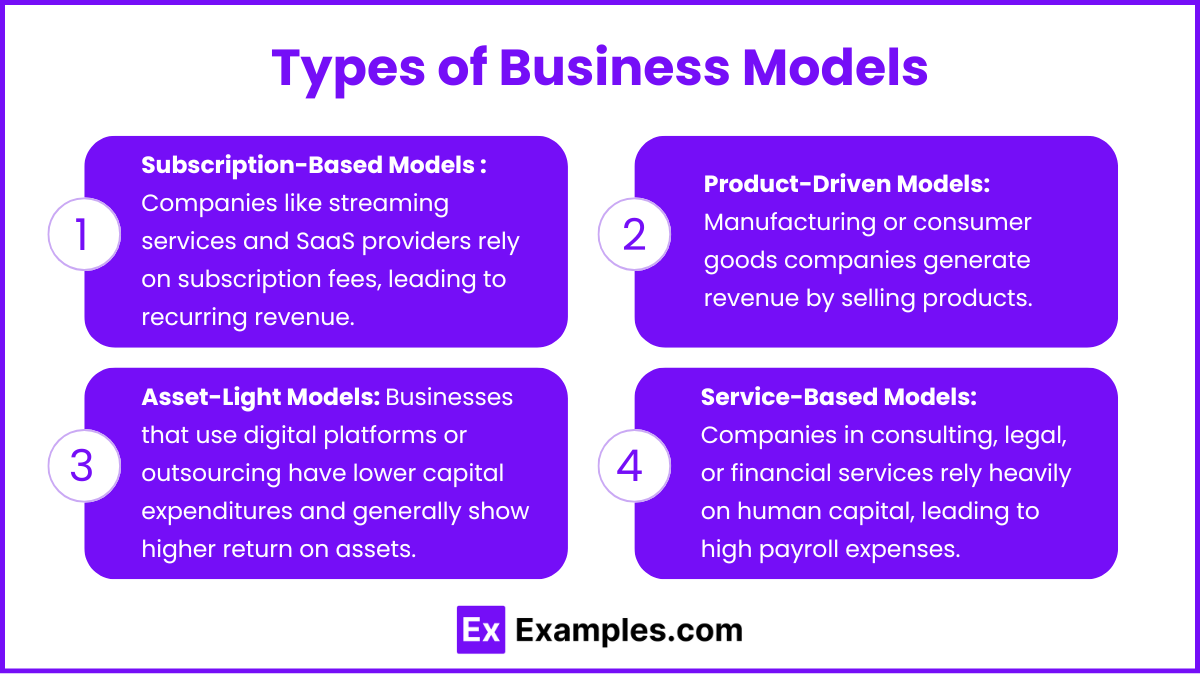

Types of Business Models

- Subscription-Based Models: Companies like streaming services and SaaS providers rely on subscription fees, leading to recurring revenue. Revenue may be recorded over time, which affects cash flow predictability and can increase deferred revenue on the balance sheet.

- Product-Driven Models: Manufacturing or consumer goods companies generate revenue by selling products. This model results in higher inventory levels and can introduce seasonal sales volatility, impacting working capital needs and inventory turnover ratios.

- Asset-Light Models: Businesses that use digital platforms or outsourcing have lower capital expenditures and generally show higher return on assets (ROA). These companies may require less debt financing, leading to a more flexible balance sheet.

- Service-Based Models: Companies in consulting, legal, or financial services rely heavily on human capital, leading to high payroll expenses. Revenue recognition may be project-based or on a billable hours basis, which can introduce variability in cash flows and profit margins.

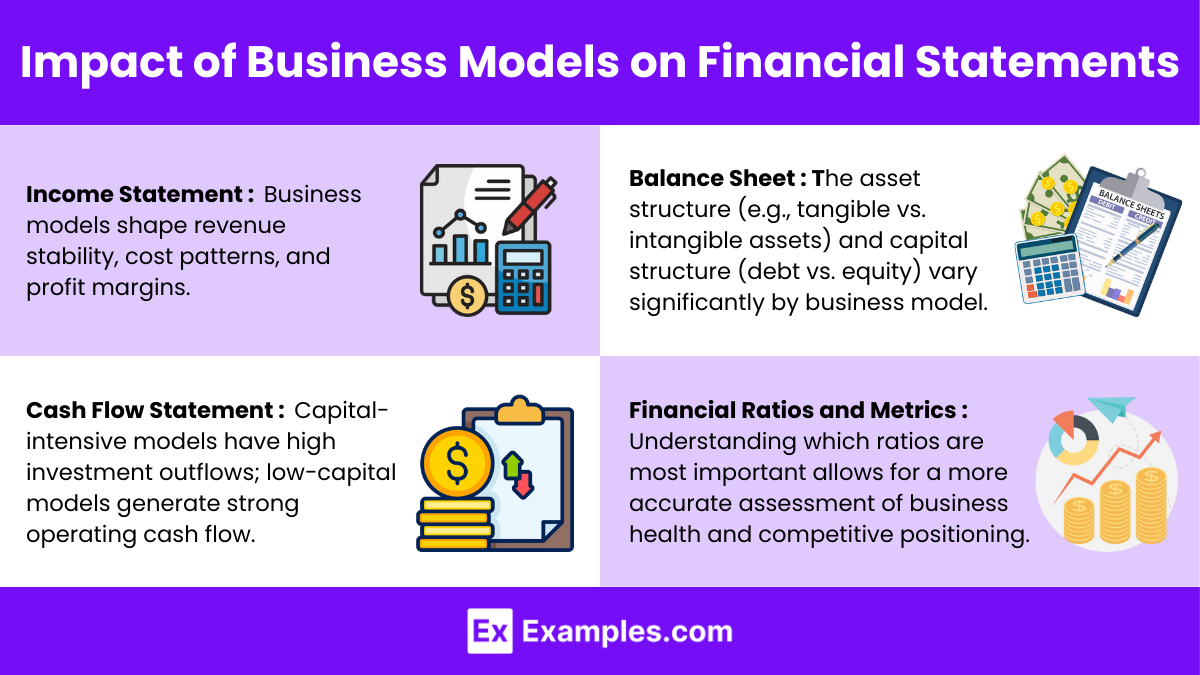

Impact of Business Models on Financial Statements

- Income Statement

- Business models shape revenue stability, cost patterns, and profit margins. For instance, subscription-based businesses may have smoother revenue flows compared to cyclical industries.

- Margin analysis—such as comparing gross, operating, and net margins across companies—provides insight into business model efficiency and resilience.

- Balance Sheet

- The asset structure (e.g., tangible vs. intangible assets) and capital structure (debt vs. equity) vary significantly by business model.

- For asset-heavy models, debt ratios, depreciation, and asset turnover are critical for assessing efficiency and financial leverage.

- Cash Flow Statement

- Business models influence cash flow patterns; capital-intensive companies may have significant cash outflows for investments, while low-capital models might generate strong operating cash flow.

- Analyzing cash flow stability and capital expenditure needs helps assess liquidity and financial flexibility.

- Financial Ratios and Metrics

- Key ratios differ in relevance based on business models. Asset turnover is vital for asset-intensive models, while metrics like retention rates and average revenue per user (ARPU) matter more in subscription or platform models.

- Understanding which ratios are most important allows for a more accurate assessment of business health and competitive positioning.

Examples

Example 1: Subscription-Based Model (e.g., Streaming Services, SaaS)

Companies with a subscription model generate recurring revenue through customer subscriptions. This model provides predictable revenue streams and is typically less volatile than transaction-based models. Analysts often examine metrics like customer retention rates, churn rates, and average revenue per user (ARPU) to gauge revenue stability and growth potential. Operating expenses might include substantial R&D or customer acquisition costs. The cash flow statement may reflect steady operating cash flows but limited capital expenditure needs, enhancing liquidity and financial flexibility.

Example 2 : Asset-Intensive Model (e.g., Utilities, Telecommunications)

Asset-intensive companies require significant investments in infrastructure, such as power plants or network equipment, leading to high fixed costs and depreciation expenses. This model typically results in high operating leverage, where small changes in revenue significantly impact profitability. Analysts pay close attention to debt ratios due to the substantial capital financing often used in these industries. The balance sheet is critical for assessing long-term assets and liabilities, while the cash flow statement reveals ongoing capital expenditures that impact free cash flow.

Example 3 :Retail Model (e.g., Department Stores, E-Commerce)

Retail businesses rely on direct sales to consumers, with revenue fluctuating based on consumer demand and seasonal trends. Key performance metrics include same-store sales growth, inventory turnover, and gross margin. High inventory levels on the balance sheet and significant accounts payable indicate a need for effective working capital management. Cash flow statements may show fluctuating operating cash flows due to seasonal sales cycles, and profitability often hinges on efficient cost management and competitive pricing.

Example 4 : Manufacturing Model (e.g., Automobiles, Electronics)

Manufacturing companies convert raw materials into finished goods, incurring direct costs such as labor and raw materials. Analysts focus on metrics like gross margin, operating margin, and inventory turnover to assess cost efficiency and production effectiveness. The balance sheet reflects substantial inventory and fixed assets, and the cash flow statement shows significant cash outflows related to capital expenditures for machinery and facilities. Financial performance is sensitive to changes in production costs, economies of scale, and supply chain efficiency.

Example 5 : Platform-Based Model (e.g., Social Media, Online Marketplaces)

Platform-based companies connect users, often relying on network effects to drive growth. Revenue is typically generated from advertisements, transaction fees, or subscriptions. Analysts examine metrics such as active users, engagement rates, and revenue per user. The income statement might show high margins due to low variable costs, while the balance sheet highlights intangible assets, such as patents or proprietary technology. Cash flow statements often show strong operating cash flows with minimal capital expenditures, which can support rapid growth and scalability.

Practice Questions

Question 1

A company operates a subscription-based business model, where customers pay a monthly fee for access to its services. Which of the following would most likely appear on its balance sheet due to this business model?

A) High levels of inventory

B) Significant deferred revenue

C) Large accounts payable balance

D) Low accounts receivable turnover

Answer: B) Significant deferred revenue

Explanation : In a subscription-based business model, customers pay for services in advance or on a regular schedule, creating a situation where revenue is received before the service is fully provided. This unearned income is recorded as deferred revenue on the balance sheet, a liability that represents the obligation to provide the service in the future. Unlike product-driven models, which may show high levels of inventory, subscription models have limited inventory needs, making option B the most accurate answer.

Question 2

A company using a product-driven business model is likely to have which of the following financial characteristics?

A) High inventory turnover ratio

B) High fixed assets and low capital expenditures

C) Low inventory turnover ratio and significant seasonal cash flow variations

D) High deferred revenue from advance customer payments

Answer: C) Low inventory turnover ratio and significant seasonal cash flow variations

Explanation : A product-driven business model, typical of manufacturing and retail companies, often faces seasonal sales cycles, resulting in seasonal cash flow variations. These companies may also hold substantial amounts of inventory, especially if they deal in physical products, and may have low inventory turnover if their products are not sold or restocked quickly. High deferred revenue (option D) is more common in subscription models, while high inventory turnover is more typical of fast-moving consumer goods, making option C the best answer for a typical product-driven model.

Question 3

Which of the following would best describe the financial structure of an asset-light business model?

A) High capital expenditures and significant long-term debt

B) Low return on assets (ROA) and high fixed costs

C) Minimal capital expenditures and higher return on assets (ROA)

D) High inventory levels and extensive accounts receivable

Answer : C) Minimal capital expenditures and higher return on assets (ROA)

Explanation : An asset-light business model relies less on physical assets, which means it typically incurs minimal capital expenditures and has a leaner balance sheet. This model often shows a higher return on assets (ROA) because it uses fewer assets to generate revenue, resulting in efficient asset utilization. High capital expenditures (option A) and high inventory levels (option D) are more common in capital-intensive and product-driven models, respectively. Option C accurately describes the financial structure of an asset-light model, making it the correct answer.