Preparing for the CFA Exam demands a thorough understanding of the Code of Ethics and Standards of Professional Conduct, foundational to ethical finance practices. Mastery of these principles ensures integrity, professionalism, and trust in the financial industry, crucial for building client relationships and achieving professional success.

Learning Objective

In studying the “Code of Ethics and Standards of Professional Conduct” for the CFA Exam, you should aim to deeply understand the ethical guidelines and professional standards that govern the conduct of finance professionals. Explore the principles of integrity, competence, diligence, and respect that underlie these standards. Analyze real-world scenarios to understand the application of these ethical principles in daily professional practice. Evaluate case studies to identify ethical dilemmas and appropriate responses. Apply this knowledge to solve practice exam questions effectively, ensuring ethical decision-making in complex financial situations.

Understanding the Core Principles

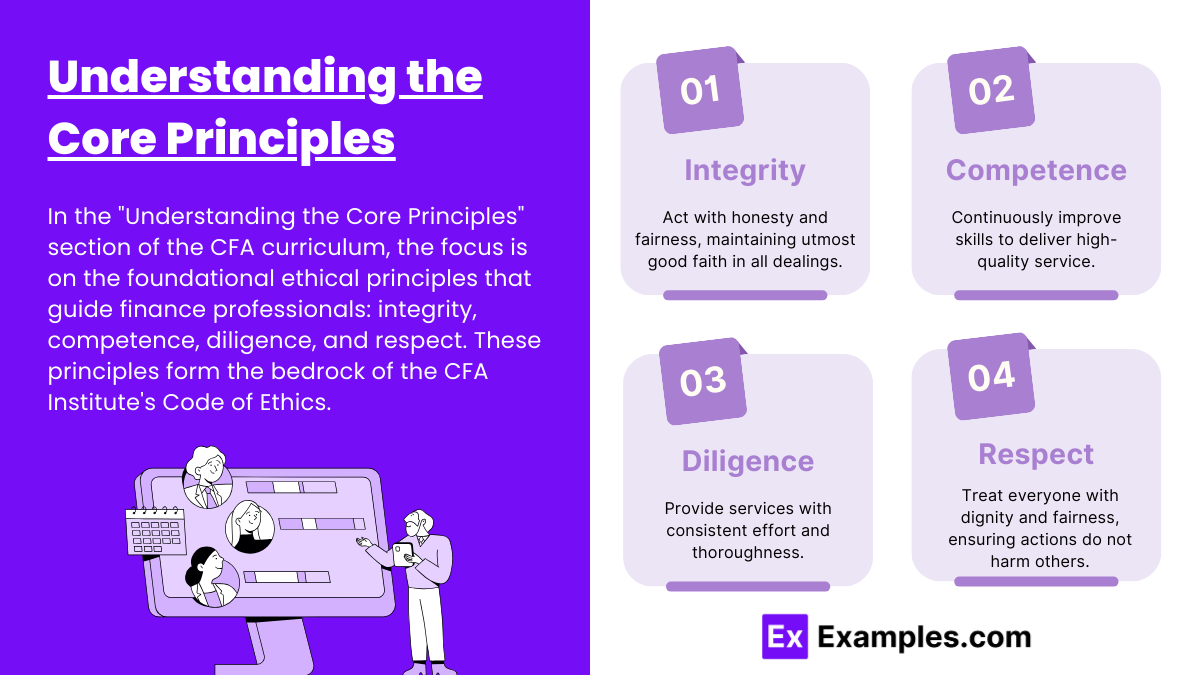

In the “Understanding the Core Principles” section of the CFA curriculum, the focus is on the foundational ethical principles that guide finance professionals: integrity, competence, diligence, and respect. These principles form the bedrock of the CFA Institute’s Code of Ethics.

- Integrity demands that professionals act with honesty and fairness in all professional dealings, upholding a standard of utmost good faith.

- Competence mandates continual personal improvement and professional development to provide high-quality service to clients and employers.

- Diligence emphasizes the importance of providing services with careful, consistent effort and thoroughness.

- Respect involves treating all individuals with dignity and fairness, ensuring that personal actions do not harm the rights and opportunities of others.

These principles ensure that financial professionals not only adhere to legal standards but also promote trust and ethical practices within the industry, essential for maintaining the public’s confidence in financial markets.

Application in Professional Scenarios

Applying ethical standards in real-world settings is crucial for CFA charter holders who frequently encounter complex situations requiring ethical decision-making. Here are some case study examples illustrating these applications:

- Conflict of Interest – Managing Bias: A CFA charter holder works as an investment advisor and learns that a close family member has a significant stake in a company under consideration for clients’ portfolios. To manage this conflict, the advisor discloses the relationship to both their employer and clients, recuses themselves from the recommendation process, and ensures that decisions are made solely in clients’ best interests. This action maintains integrity and upholds transparency, reinforcing client trust.

- Insider Trading – Handling Confidential Information: Suppose a CFA charter holder, working with a firm involved in a major merger, overhears confidential details that could impact stock prices. Rather than using this information for personal gain, the charter holder refrains from trading on it, avoiding illegal insider trading. This action demonstrates integrity and compliance with market regulations, protecting both the client and the fairness of the market.

- Fiduciary Responsibility – Prioritizing Client Interests: In a scenario where a financial product offers high commission but doesn’t meet a client’s risk tolerance, a CFA professional opts instead to recommend a lower-commission product that aligns with the client’s needs. This decision reflects diligence and a commitment to fiduciary responsibility, putting the client’s well-being first rather than seeking personal gain.

- Pressure from Management – Maintaining Objectivity in Analysis: A charter holder is asked by their employer to produce favorable analysis on a company’s stock to attract new clients. Despite the pressure, the charterholder adheres to ethical standards by providing an objective, accurate assessment based on research and data. This decision showcases competence and integrity, ensuring that clients receive unbiased advice.

- Respect and Fair Treatment – Ethical Client Management: A CFA professional is asked to serve a new client but discovers potential conflicts with their current clients. To respect all clients equitably, they communicate transparently, disclose any conflicts, and if necessary, adjust their client roster or consult the employer to avoid partiality, prioritizing fair and respectful treatment.

In each scenario, adhering to ethical principles protects clients’ interests, maintains market integrity, and prevents potential consequences of ethical breaches, such as legal penalties, reputational damage, and loss of professional credentials. These cases illustrate how CFA charter holders use the Code of Ethics as a guide, helping them navigate professional challenges responsibly.

Analyzing Ethical Dilemmas

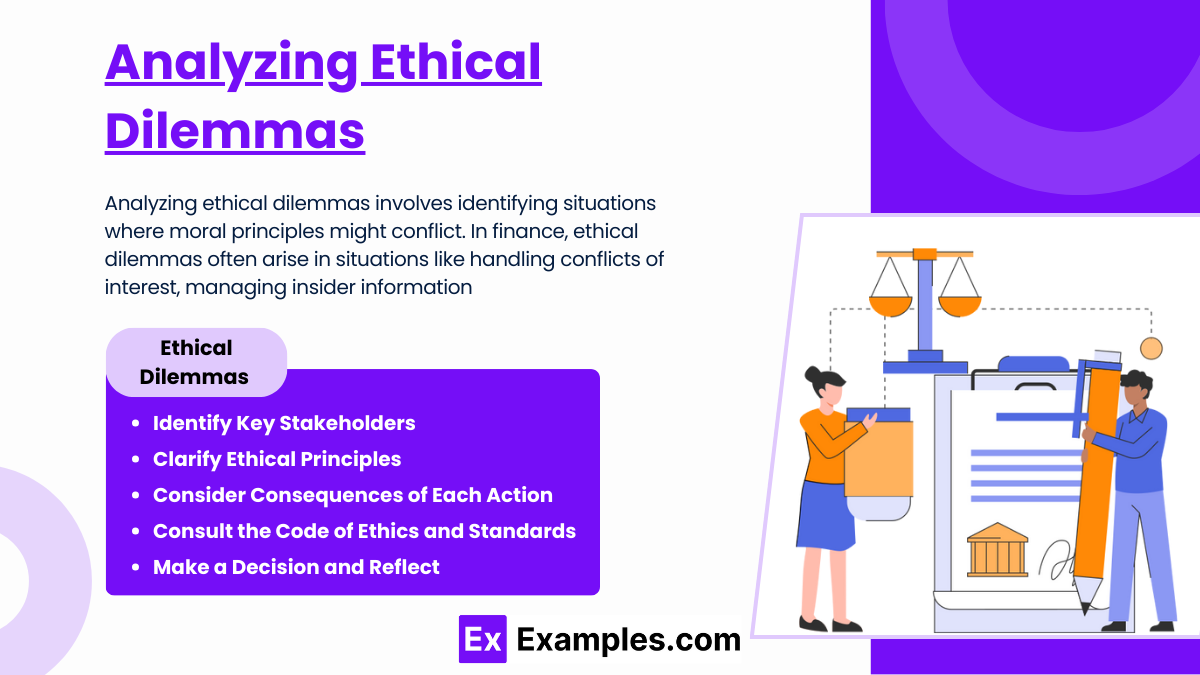

Analyzing ethical dilemmas involves identifying situations where moral principles might conflict, requiring careful consideration to reach a solution that upholds ethical standards. In finance, ethical dilemmas often arise in situations like handling conflicts of interest, managing insider information, or balancing fiduciary duties with personal or organizational pressures.

To effectively analyze these dilemmas, finance professionals:

- Identify Key Stakeholders: Recognize all parties impacted, such as clients, employers, and the public.

- Clarify Ethical Principles Involved: Assess which principles (e.g., integrity, fairness, diligence) are at risk.

- Consider Consequences of Each Action: Evaluate the potential outcomes of different courses of action, including impacts on trust and market integrity.

- Consult the Code of Ethics and Standards: Use these guidelines to make decisions aligned with professional values.

- Make a Decision and Reflect: Choose an option that best upholds ethical standards and reflect on how similar situations could be handled in the future.

By following this structured approach, finance professionals can navigate complex situations while upholding trust, transparency, and ethical responsibility.

Preparation for Ethical Decision-Making in Examinations

Preparation for ethical decision-making in exams, like the CFA, involves understanding and applying the Code of Ethics and Standards of Professional Conduct to various scenarios. Here’s a brief approach:

- Master Key Principles: Familiarize yourself with core ethical principles, such as integrity, diligence, and client-first duty, as these are the foundation of ethical decisions.

- Practice Scenario-Based Questions: Engage with sample questions that present ethical dilemmas. Practice identifying the relevant ethical principles and analyzing potential actions.

- Use a Structured Approach: When faced with an ethical question, first identify the stakeholders, then evaluate which principles apply, and finally determine the best ethical action based on the Standards.

- Reflect on Case Studies: Reviewing real-world examples of ethical issues in finance can help you see how ethical standards are applied practically.

- Stay Calm and Objective: Ethical dilemmas can be nuanced, so it’s important to stay calm, avoid assumptions, and focus on the ethical guidelines.

This preparation ensures that candidates are ready to apply ethical reasoning effectively and confidently in exams, demonstrating both knowledge and practical understanding of professional ethics.

Examples

Example 1: Integrity in Financial Analysis

A financial analyst discovers a calculation error in a quarterly earnings report that, once corrected, significantly alters the company’s financial outlook. Instead of concealing the error to maintain stock prices, the analyst chooses to update the financial report and disclose the mistake to the public, adhering to the principle of integrity.

Example 2: Competence in Investment Advice

An investment advisor is asked by a client to recommend investments in complex derivatives. Recognizing that her understanding of derivatives is not comprehensive, she opts to undergo further training and education before advising her client, demonstrating the commitment to competence and ensuring informed, effective service to her client.

Example 3: Diligence in Client Management

A portfolio manager handles accounts for several family members. When a lucrative investment opportunity arises with limited spots available, instead of choosing one client over another, he systematically evaluates which client’s investment goals align best with the opportunity, ensuring diligence and fair treatment in managing client portfolios.

Example 4: Respect for Market Integrity

During a private meeting, a corporate CFO inadvertently reveals non-public, market-moving information to a fund manager. The manager decides not to act on or share this information, respecting market integrity and adhering to the standards of professional conduct by avoiding insider trading.

Example 5: Conflict of Interest Disclosure

A financial consultant working for a firm owns significant shares in a tech startup that her firm is considering for a major investment. Upon learning of the potential deal, she immediately discloses her holdings to her management and recuses herself from the decision-making process to avoid a conflict of interest, upholding ethical standards and transparency.

Practice Questions

Question 1

Which action best demonstrates a CFA charter holder’s adherence to the CFA Institute’s Code of Ethics?

A. Sharing material non-public information with a colleague to help improve their trading performance.

B. Reporting a coworker who is suspected of manipulating market prices to benefit personal investments.

C. Using client funds to explore high-risk investments without prior consent but intending to share profits.

D. Accepting gifts from clients in return for preferential treatment in investment opportunities.

Correct Answer: B

Explanation: Reporting unethical behavior, such as market manipulation, aligns with the CFA Code of Ethics, which emphasizes integrity and professionalism. It demonstrates a commitment to uphold the integrity of the capital markets and protect the interests of the public.

Question 2

What should a CFA charter holder do if they find themselves in a potential conflict of interest with a client?

A. Proceed with the action if it benefits both the charter holder and the client equally.

B. Avoid disclosure if the conflict of interest is minor and does not harm the client.

C. Disclose the conflict of interest to all affected parties and seek consent before proceeding.

D. Transfer the client to another advisor without disclosing the conflict.

Correct Answer: C

Explanation: Disclosing conflicts of interest and seeking informed consent from all affected parties is required under the CFA Institute’s Standards of Professional Conduct. This ensures transparency and maintains trust, allowing clients to make informed decisions based on the full disclosure of the charter holder’s position.

Question 3

How should a financial analyst who receives confidential information about an upcoming merger from an insider handle the situation?

A. Trade on the information before it becomes public to maximize returns for clients.

B. Share the information with only a select few clients to protect their interests.

C. Keep the information confidential and refrain from trading on or sharing the information.

D. Notify the authorities about the insider but continue trading to avoid suspicion.

Correct Answer: C

Explanation: The correct response is to keep the information confidential and abstain from trading or sharing it, as dictated by the CFA Institute’s Standards of Professional Conduct. This respects the integrity of capital markets and adheres to the standard regarding the misuse of material non-public information, thereby avoiding potential legal and ethical violations.