Preparing for the CFA Exam requires an understanding of “Swaps, Forwards, and Futures Strategies,” essential concepts in derivatives trading and risk management. These strategies involve entering contracts that stipulate future exchanges of cash flows or assets at predetermined prices, enabling investors to hedge against price fluctuations or speculate on market movements. Understanding these strategies equips candidates to assess various market scenarios, manage exposure to risk effectively, and make informed investment decisions in dynamic environments.

Learning Objectives

In studying “Swaps, Forwards, and Futures Strategies” for the CFA, you should aim to understand the fundamental concepts and applications of these derivatives in investment management. This includes utilizing swaps, forwards, and futures to manage risks, lock in prices, and enhance portfolio returns. Analyzing different instruments—such as interest rate swaps, currency forwards, and commodity futures—is essential for assessing their impacts on overall portfolio performance. Understanding the mechanics of these contracts, including factors like pricing, settlement, and market liquidity, is crucial for mastering this topic. Grasping these concepts enables you to implement derivatives across various market conditions and asset classes, ultimately improving your ability to manage risks and capitalize on market opportunities.

Swaps

Swaps are derivative contracts through which two parties exchange cash flows or liabilities from two different financial instruments. Commonly, swaps involve exchanging fixed-rate interest payments for floating-rate payments or exchanging currencies, enabling parties to manage financial risks or achieve cost savings.

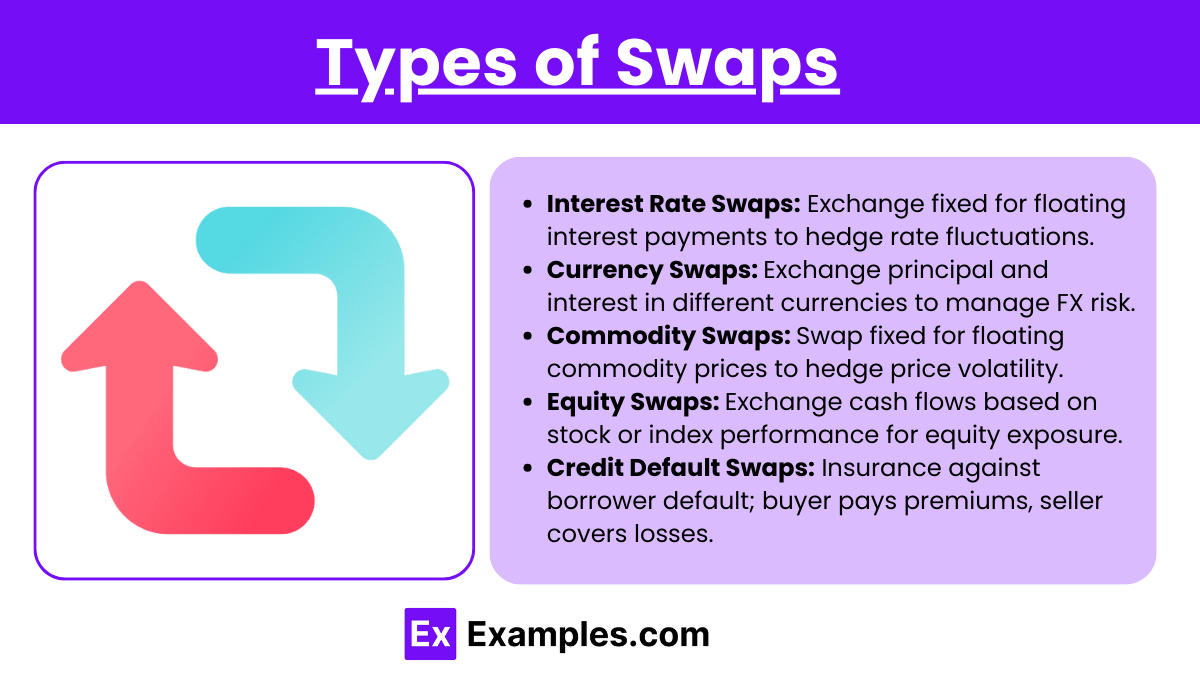

Types of Swaps

- Interest Rate Swaps

- Parties exchange fixed interest payments for floating interest payments or vice versa.

- Used to hedge against interest rate fluctuations.

- Currency Swaps

- Involves exchanging principal and interest payments in one currency for another currency.

- Commonly used by multinational companies to manage foreign exchange risks.

- Commodity Swaps

- One party agrees to pay a fixed price for a commodity, while the other pays a floating market price.

- Useful for hedging price risks in commodities like oil or metals.

- Equity Swaps

- Parties exchange future cash flows based on an equity index or stock price.

- Used to gain exposure to equity markets without owning the asset.

- Credit Default Swaps (CDS)

- A form of insurance against the default of a borrower.

- The buyer of the swap makes payments, and the seller compensates if default occurs.

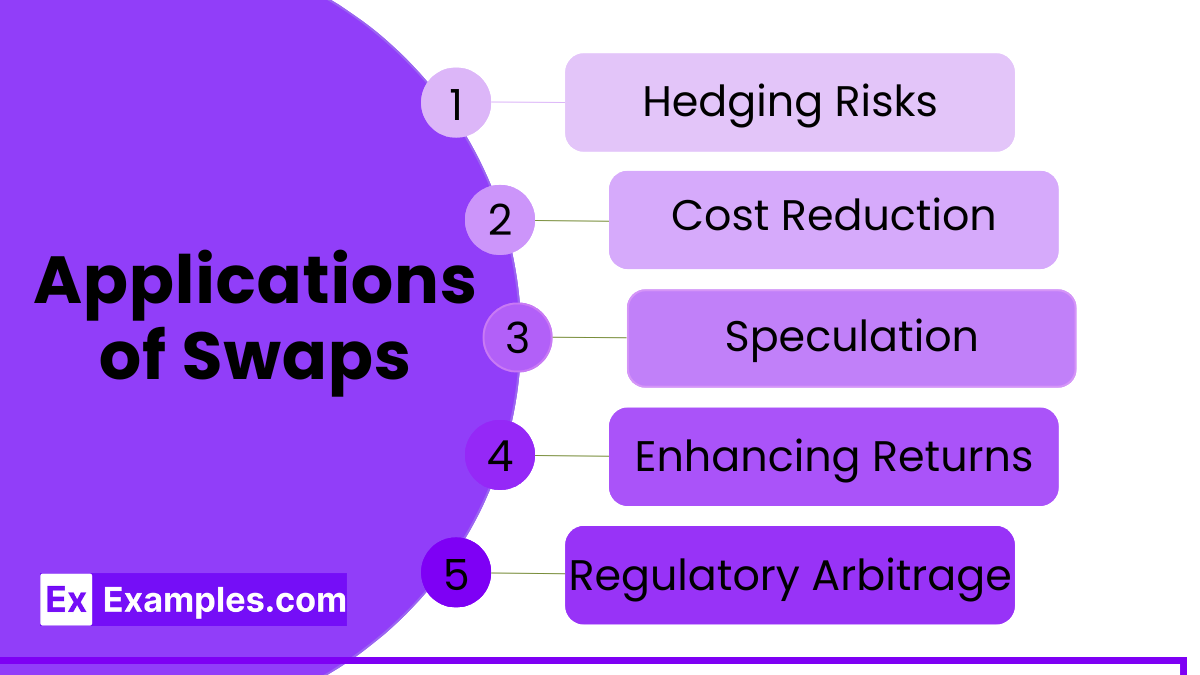

Applications of Swaps

- Hedging Risks

- Protects against uncertainties such as fluctuations in interest rates, currency values, or commodity prices.

- Cost Reduction

- Enables access to more favorable financial terms compared to existing obligations.

- Speculation

- Allows participants to take positions on expected market movements to achieve financial gains.

- Enhancing Returns

- Facilitates access to financial returns from diverse assets or markets without direct ownership.

- Regulatory Arbitrage

- Structures obligations to meet or benefit from differences in regulatory environments.

Forwards

Forwards are customized financial contracts between two parties to buy or sell an asset at a specified price on a future date. Unlike standardized futures contracts, forwards are traded over-the-counter (OTC), allowing for customization in terms, quantity, and settlement dates. They are commonly used for hedging or speculative purposes.

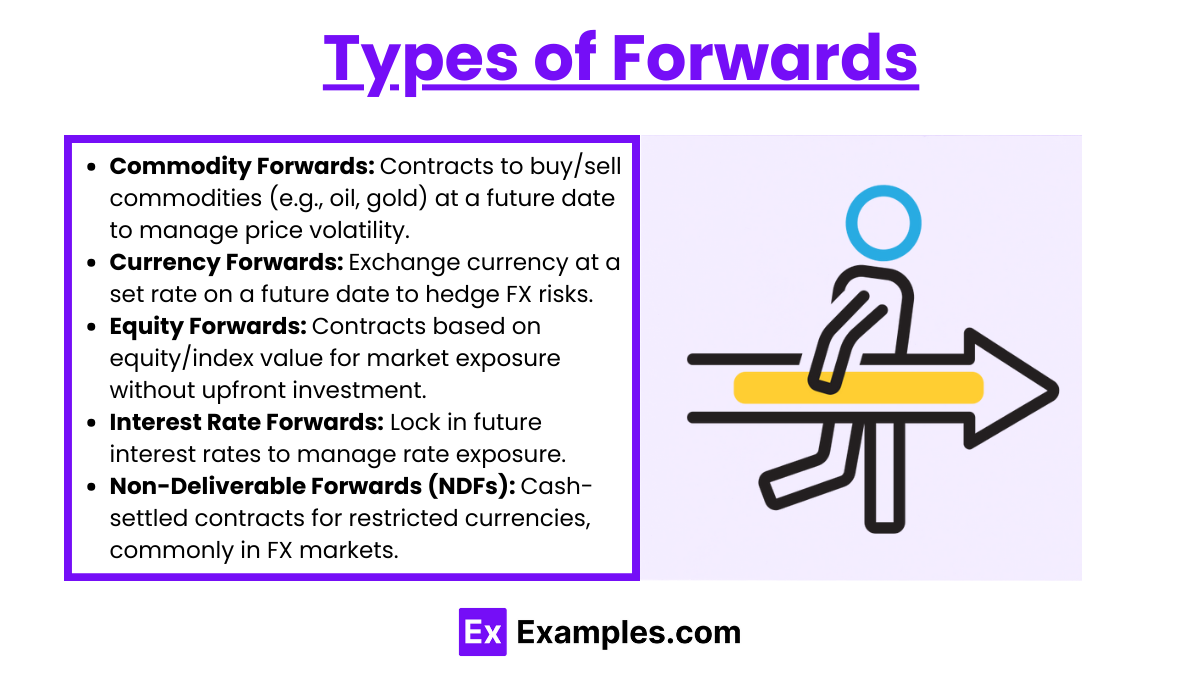

Types of Forwards

- Commodity Forwards

- Contracts to buy or sell physical commodities like oil, gold, or agricultural products at a future date.

- Used to manage price volatility in commodity markets.

- Currency Forwards

- Agreements to exchange a specified amount of currency at a predetermined rate on a set future date.

- Helps mitigate risks associated with foreign exchange rate fluctuations.

- Equity Forwards

- Contracts where the settlement price is based on the value of an underlying equity or equity index.

- Provides exposure to equity markets without requiring immediate investment.

- Interest Rate Forwards

- Agreements to lock in interest rates for a future period.

- Used to manage interest rate exposure.

- Non-Deliverable Forwards (NDFs)

- Forward contracts where physical delivery of the underlying asset does not occur; instead, settlement is made in cash based on price differences.

- Commonly used in currency markets for restricted currencies.

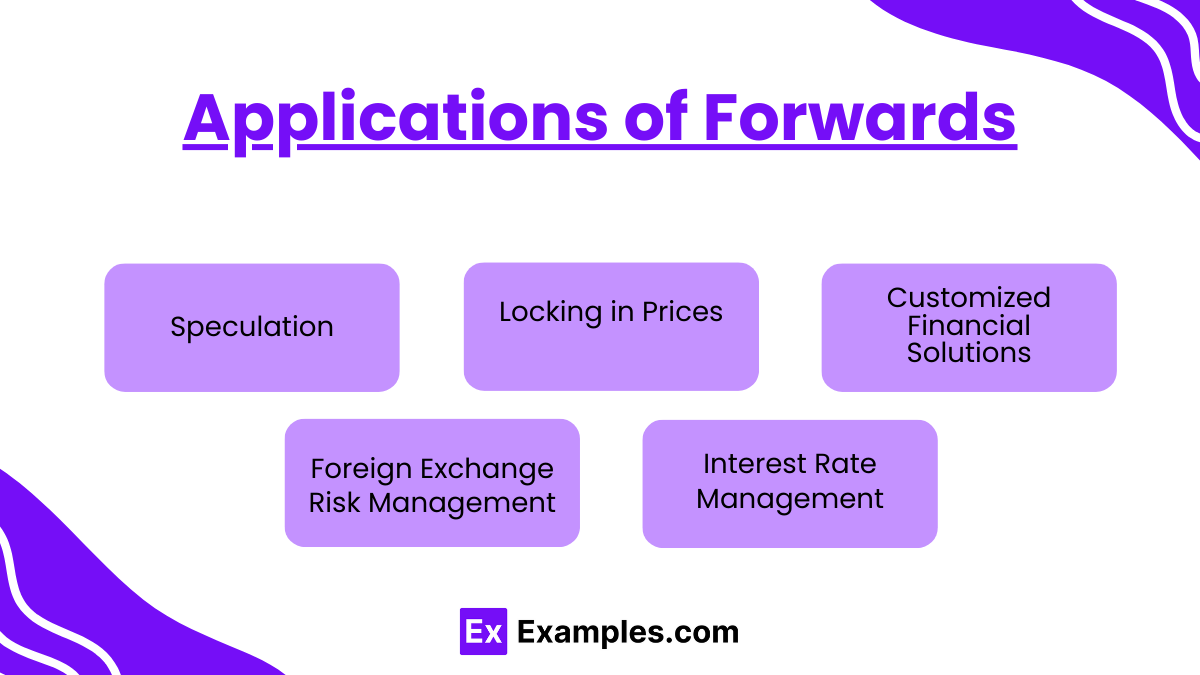

Applications of Forwards

- Speculation

- Allows participants to take advantage of expected price movements in the underlying asset to achieve financial gains.

- Locking in Prices

- Enables buyers or sellers to secure a fixed price for an asset, ensuring predictability in cash flows.

- Customized Financial Solutions

- Tailored contracts meet specific needs in terms of asset type, quantity, and settlement dates.

- Foreign Exchange Risk Management

- Mitigates risks for businesses or individuals engaged in cross-border transactions by fixing exchange rates in advance.

- Interest Rate Management

- Offers a tool to stabilize interest-related obligations by locking in future interest rates.

Futures Strategies

Futures strategies involve the use of futures contracts to achieve specific financial objectives, such as hedging against price risks, speculating on market movements, or arbitraging price differences. Futures are standardized contracts traded on exchanges, making them a versatile tool for various market participants.

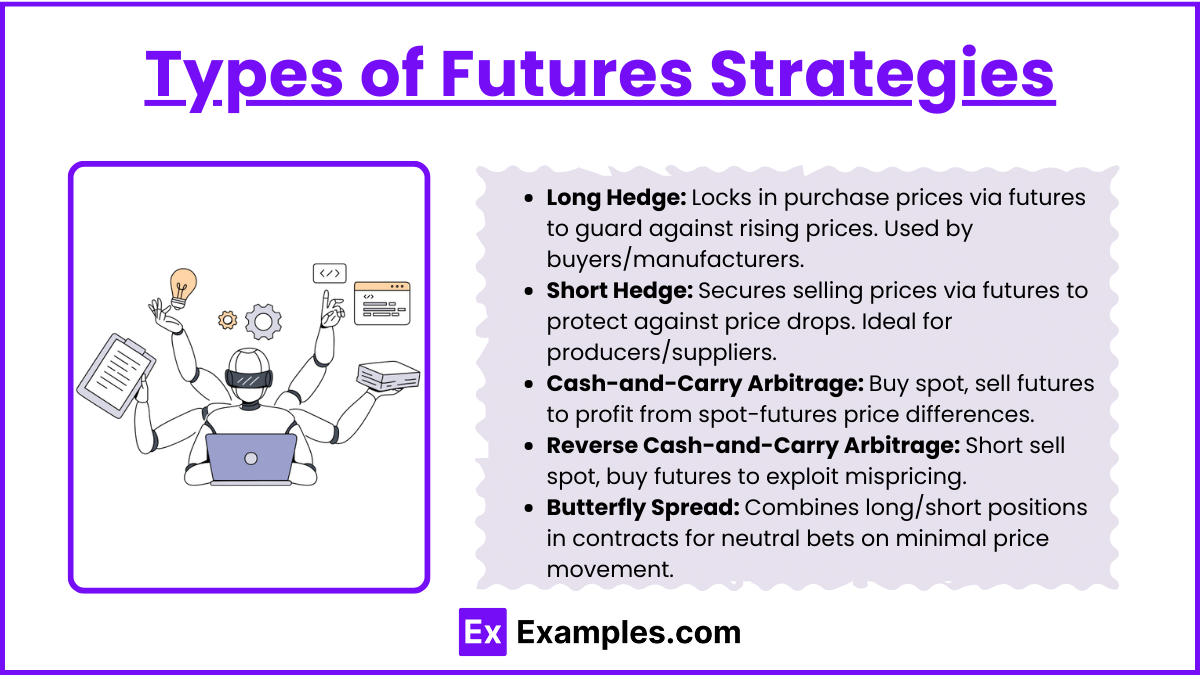

Types of Futures Strategies

- Long Hedge Strategy

- Used to protect against rising prices by locking in purchase prices through futures.

- Common for buyers or manufacturers needing raw materials.

- Short Hedge Strategy

- Protects sellers from declining prices by locking in selling prices via futures.

- Ideal for producers or suppliers securing future sales.

- Cash-and-Carry Arbitrage

- Combines buying an asset in the spot market with selling its futures.

- Profits from price differentials between spot and futures markets.

- Reverse Cash-and-Carry Arbitrage

- Involves short-selling an asset and buying its futures.

- Exploits mispricing for risk-free returns.

- Butterfly Spread

- A neutral strategy combining long and short positions in multiple contracts.

- Suitable for traders expecting minimal market movement.

Applications of Futures Strategies

- Commodity Hedging: Farmers and producers use futures to secure predictable revenues.

- Forex Management: Businesses hedge currency exposure in international markets.

- Interest Rate Protection: Futures help manage risks associated with fluctuating interest rates.

- Speculative Trades: Active traders predict and bet on market directions for short-term gains.

- Asset Allocation: Institutions use futures to adjust exposure in diverse portfolios without liquidating holdings.

Examples

Example 1: Hedging Against Interest Rate Fluctuations with Swaps

A corporation with a variable-rate loan can use an interest rate swap to convert its exposure to a fixed rate. For instance, a company might enter into a swap agreement to pay a fixed interest rate to a counterparty while receiving a variable rate. This strategy stabilizes the company’s interest expenses and protects it from rising rates, ensuring predictable financial planning.

Example 2 : Locking in Exchange Rates with Forward Contracts

An exporter anticipating payment in a foreign currency in three months can use a forward contract to lock in the current exchange rate. This eliminates the risk of unfavorable currency fluctuations. For example, if a U.S. company is expecting €1 million in revenue, it can agree to sell euros and buy dollars at a predetermined rate, safeguarding its dollar-denominated revenue.

Example 3 :Managing Commodity Price Volatility with Futures Contracts

A farmer planning to harvest wheat in six months can use futures contracts to lock in the current wheat price. By selling wheat futures, the farmer secures a guaranteed price, protecting against a potential drop in market prices. Conversely, a bread manufacturer might buy wheat futures to secure stable raw material costs.

Example 4 :Enhancing Portfolio Returns Using Futures for Speculation

Investors can use equity index futures to speculate on market movements without directly purchasing the underlying stocks. For instance, if an investor expects the S&P 500 to rise, they can buy S&P 500 futures contracts. If the market performs as anticipated, the investor benefits from the price increase in the futures contracts, leveraging their position with minimal upfront capital.

Example 5: Mitigating Cross-Border Investment Risks with Currency Swaps

A multinational corporation investing in a foreign market can use a currency swap to reduce exchange rate exposure. For example, if a U.S.-based company is building a facility in Japan, it can swap U.S. dollars for Japanese yen at an agreed rate. This allows the company to access local currency for operations while repaying the swap counterparty in dollars, minimizing currency risk.

Practice Questions

Question 1

Which of the following best describes the primary difference between forwards and futures contracts?

A. Forwards are standardized, while futures are customized.

B. Forwards trade on exchanges, while futures are traded over-the-counter (OTC).

C. Futures are standardized and exchange-traded, while forwards are customized and traded OTC.

D. Both forwards and futures are identical in structure and trading.

Correct Answer: C. Futures are standardized and exchange-traded, while forwards are customized and traded OTC.

Explanation:

Futures contracts are standardized agreements to buy or sell an asset at a future date, traded on organized exchanges like the Chicago Mercantile Exchange (CME). This standardization ensures liquidity and reduces counterparty risk. In contrast, forwards are customized agreements between two parties traded OTC, meaning they are not standardized and carry higher counterparty risk.

Question 2

What is the main benefit of using an interest rate swap in corporate finance?

A. To lock in a fixed exchange rate for future transactions.

B. To hedge against interest rate fluctuations.

C. To speculate on future price changes of an asset.

D. To ensure delivery of an underlying commodity.

Correct Answer: B. To hedge against interest rate fluctuations.

Explanation:

An interest rate swap allows two parties to exchange cash flows based on different interest rate structures (fixed and floating). This is often used to hedge against fluctuations in interest rates. For instance, a company with a floating-rate loan might enter a swap to convert its obligation into a fixed rate, reducing uncertainty in future payments. This strategy enhances risk management in volatile interest rate environments.

Question 3

A company wants to hedge against a potential rise in commodity prices using futures. Which of the following positions should the company take?

A. Buy a futures contract on the commodity.

B. Sell a futures contract on the commodity.

C. Enter into a currency swap.

D. Enter into an interest rate forward contract.

Correct Answer: A. Buy a futures contract on the commodity.

Explanation:

If a company is concerned about rising commodity prices, it should buy a futures contract to lock in the current price for future delivery. This strategy ensures the company can purchase the commodity at a known cost, mitigating the risk of price increases. Selling a futures contract would be appropriate for hedging against price decreases, not increases. Currency swaps and interest rate forwards are unrelated to commodity price risk.