Preparing for the CFA Exam requires a comprehensive understanding of “Case Study in Portfolio Management: Institutional,” a crucial component of portfolio management. Mastery of managing institutional portfolios, including strategic asset allocation and adherence to investment policies, is essential. This knowledge provides insights into optimizing performance and managing risk, critical for achieving a high CFA score.

Learning Objective

In studying “Case Study in Portfolio Management: Institutional” for the CFA Exam, you should learn to understand the strategic approaches and challenges involved in managing institutional portfolios, such as those of pensions, endowments, and foundations. Analyze how asset allocation, risk tolerance, and investment horizons influence institutional investment strategies. Evaluate the principles behind policy formulation, performance measurement, and regulatory compliance. Additionally, explore how these investment strategies are implemented to meet specific institutional goals like funding liabilities and maximizing returns over long investment periods. Apply this knowledge to real-world case studies, enhancing your ability to manage large-scale portfolios effectively under varying market conditions and regulatory environments.

Introduction to Institutional Portfolio Management

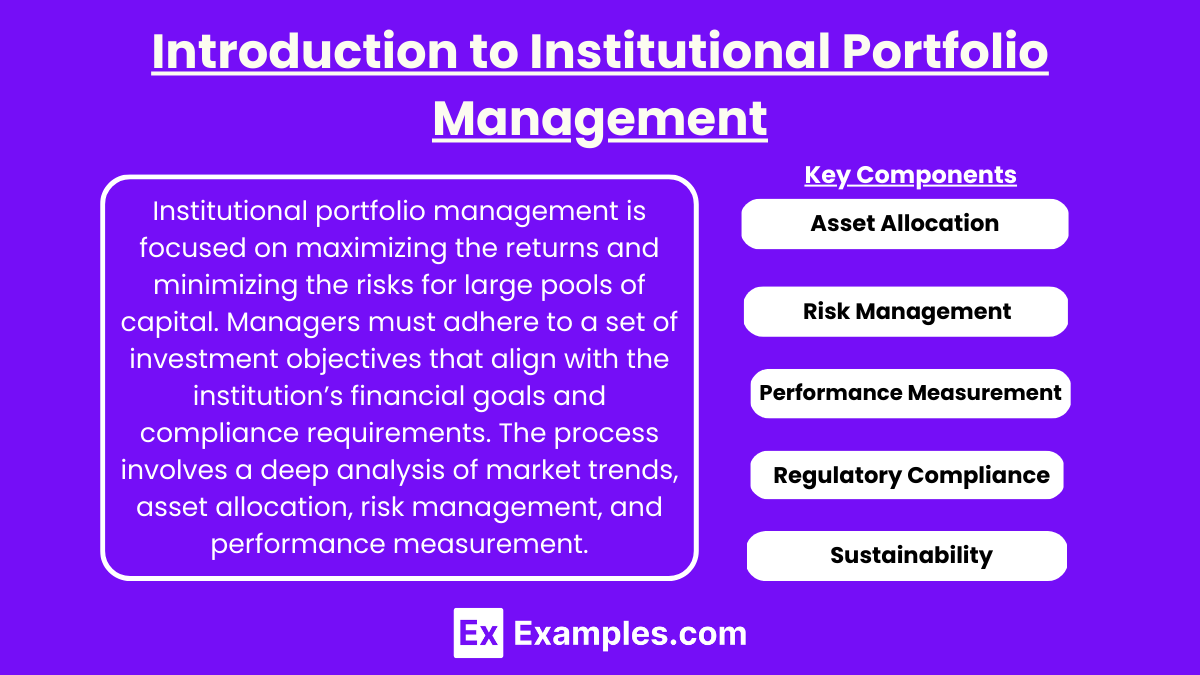

Institutional portfolio management is focused on maximizing the returns and minimizing the risks for large pools of capital. Managers must adhere to a set of investment objectives that align with the institution’s financial goals and compliance requirements. The process involves a deep analysis of market trends, asset allocation, risk management, and performance measurement.

Key Components of Institutional Portfolio Management:

- Asset Allocation: This is the process of dividing an investment portfolio among different asset categories, such as equities, fixed income, real estate, and alternatives. Effective asset allocation is crucial as it impacts the risk and return profile of the portfolio.

- Risk Management: Institutions must manage a variety of risks including market risk, credit risk, and liquidity risk. Strategies such as diversification, hedging, and the use of derivatives are common practices to mitigate these risks.

- Performance Measurement: Regular evaluation of investment performance against benchmarks and objectives is essential. This includes analyzing both the absolute performance and the performance relative to the risks taken.

- Regulatory Compliance and Governance: Adhering to regulatory requirements and maintaining robust governance structures are vital to ensure accountability and transparency in investment decisions.

- Sustainability and Ethical Investing: Increasingly, institutions are also focusing on sustainable investing, considering environmental, social, and governance (ESG) factors, which can significantly influence long-term investment outcomes.

Developing Investment Policy Statements

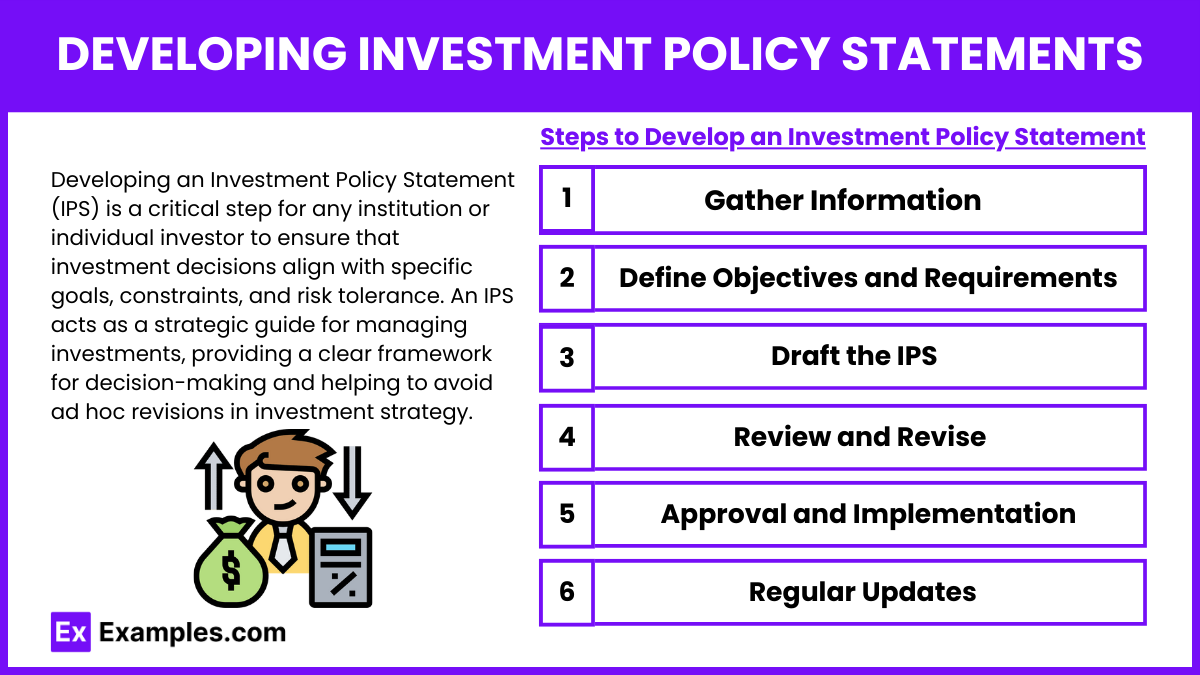

Developing an Investment Policy Statement (IPS) is a critical step for any institution or individual investor to ensure that investment decisions align with specific goals, constraints, and risk tolerance. An IPS acts as a strategic guide for managing investments, providing a clear framework for decision-making and helping to avoid ad hoc revisions in investment strategy. Here’s a comprehensive guide to developing effective Investment Policy Statements:

Steps to Develop an Investment Policy Statement

- Gather Information: Collect detailed information on the financial situation, investment goals, and risk tolerance of the institution or individual.

- Define Objectives and Requirements: Clarify what the investment program is intended to achieve and any specific requirements or constraints.

- Draft the IPS: Begin with a draft that includes all necessary components based on gathered information and strategic discussions.

- Review and Revise: The draft should be reviewed and potentially revised by all stakeholders to ensure accuracy and completeness.

- Approval and Implementation: Once finalized and approved, the IPS should be formally adopted and used as the basis for managing the investments.

- Regular Updates: The IPS should be reviewed periodically and updated as necessary to reflect any changes in financial circumstances, investment goals, or market conditions.

Strategic Asset Allocation

Strategic Asset Allocation is designed to establish a primary framework for an investor’s portfolio that aligns with their overarching financial goals and risk preferences. It is typically implemented with the intention to hold these allocations steady over a long period, only making adjustments in response to significant changes in financial circumstances, investment outlook, or life events.

Key Elements of Strategic Asset Allocation:

- Long-term Focus: SAA focuses on long-term investment horizons, often stretching over multiple years or even decades.

- Diversification: The approach seeks to diversify investments across multiple asset classes (e.g., stocks, bonds, real estate, commodities) to reduce risk and enhance returns through exposure to different sectors and geographic regions.

- Risk Tolerance: Asset allocations are heavily influenced by the investor’s risk tolerance, balancing potential returns with acceptable levels of risk.

- Rebalancing: Regular rebalancing is employed to maintain the original or desired asset allocation, adjusting the portfolio to align with target allocations as market values fluctuate.

Performance Measurement and Analysis

Performance measurement and analysis are critical aspects of portfolio management, enabling investors and managers to assess how well their investments are performing relative to expectations and benchmarks. This process is essential for making informed decisions about portfolio adjustments, strategy alignment, and overall financial planning. Here’s a detailed look at the key elements and methodologies involved in performance measurement and analysis:

Key Objectives of Performance Measurement:

- Evaluate Success: Assess how well the investment strategy meets predefined objectives.

- Identify Strengths and Weaknesses: Pinpoint which investments or strategies are performing well and which are underperforming.

- Inform Decision Making: Provide data that can guide future investment decisions and strategic adjustments.

- Transparency and Accountability: Ensure stakeholders understand the performance dynamics and that managers are held accountable.

Examples

Example 1: Pension Fund Liability Matching

A pension fund uses duration matching to align the maturities of its bond investments with the expected payout obligations. This strategy helps to minimize the interest rate risk and ensure that the fund has sufficient liquidity to meet its liabilities as they become due.

Example 2: Endowment Spending Policy Implementation

An endowment at a university implements a spending policy that allows for annual spending of 5% of the average market value of the fund over the past three years. This policy is designed to smooth spending over time, protecting the endowment’s principal while providing a stable flow of funds to support university programs.

Example 3: Insurance Company Asset-Liability Management (ALM)

An insurance company uses ALM techniques to manage the risks associated with discrepancies between its assets and insurance liabilities. This involves investing in assets that closely match the characteristics of the liabilities in terms of duration, cash flow patterns, and sensitivity to economic variables.

Example 4: Sovereign Wealth Fund Strategic Asset Allocation

A sovereign wealth fund diversifies its investments across a broad range of asset classes, including global equities, fixed income, real estate, and alternative investments. The fund’s strategic asset allocation is periodically reviewed and adjusted based on long-term economic forecasts and the fund’s risk tolerance.

Example 5: Foundation’s Responsible Investment

A charitable foundation integrates Environmental, Social, and Governance (ESG) criteria into its investment process. This involves screening potential investments to exclude companies with poor ESG performance and actively engaging with companies in the portfolio to encourage more sustainable and ethical practices.

Practice Questions

Question 1

An investment manager of a pension fund is considering adding a new asset class to the fund’s portfolio. Which of the following should be the primary consideration according to the CFA Institute’s ethical standards?

A. The potential for high returns from the new asset class.

B. The compatibility of the new asset class with the fund’s investment policy statement (IPS).

C. The popularity of the new asset class among peer funds.

D. The manager’s personal interest in the asset class.

Answer:

B. The compatibility of the new asset class with the fund’s investment policy statement (IPS).

Explanation:

According to the CFA Institute’s ethical standards, the primary consideration when making investment decisions should be alignment with the client’s investment objectives and constraints, which are outlined in the IPS. Adding an asset class that aligns with the IPS ensures that the manager acts in the best interest of the beneficiaries and adheres to the duty of loyalty, care, and prudence.

Question 2

A portfolio manager receives an offer from a brokerage firm to attend an all-expenses-paid seminar in a luxury resort. According to the CFA Institute’s Standards of Professional Conduct, the manager should:

A. Accept the offer, as attending could provide educational benefits.

B. Decline the offer to avoid potential conflicts of interest.

C. Accept the offer but disclose the trip to the employer.

D. Request that the seminar be conducted online instead.

Answer:

B. Decline the offer to avoid potential conflicts of interest.

Explanation:

Accepting significant gifts from a brokerage can impair the manager’s ability to remain objective and act in the best interest of clients, potentially leading to conflicts of interest. Declining such offers aligns with the CFA Institute’s guidance on independence and objectivity.

Question 3

When conducting due diligence on external managers, an institutional investor discovers that one potential manager does not provide detailed disclosures on fee structures. Ethically, the investor should:

A. Proceed with hiring the manager as other aspects such as past performance are satisfactory.

B. Request the necessary fee structure information to perform a complete assessment.

C. Hire the manager but monitor the fees closely.

D. Ignore the fee details if the manager comes highly recommended.

Answer:

B. Request the necessary fee structure information to perform a complete assessment.

Explanation:

Ethically and in accordance with the CFA Institute’s Standards of Professional Conduct, an investor should have a full understanding of all aspects of an investment decision, including transparent and detailed disclosures on fees. Requesting comprehensive fee information is crucial for assessing the suitability and integrity of the manager, ensuring that all decisions are made with sufficient due diligence and transparency.