Preparing for the CMT Exam requires a comprehensive understanding of “Case Study of Rule Data Mining for the S&P 500,” a crucial component of technical analysis. Mastery of extracting patterns and rules from historical data helps identify predictive behaviors in market movements, critical for developing effective trading strategies and achieving a high CMT score.

Learning Objective

In studying the “Case Study of Rule Data Mining for the S&P 500” for the CMT Exam, you should learn to understand the methodologies used to analyze large datasets of stock market data, particularly for the S&P 500 index. Analyze how data mining techniques help identify recurring patterns and rules that can predict market movements. Evaluate the principles behind these techniques, such as association rule learning and clustering, and their effectiveness in extracting actionable insights. Additionally, explore how these tools are applied in real-world market scenarios to develop trading strategies based on historical data patterns, and apply this knowledge to enhance investment decision-making processes.

Introduction to Data Mining in Financial Markets

Data mining in financial markets involves the systematic application of statistical and computational techniques to discover patterns, trends, and relationships within large sets of financial data. This process is crucial for generating actionable insights, improving investment decisions, and developing predictive models for market behavior. Here’s an introduction to the role and application of data mining in financial markets:

Role of Data Mining in Financial Markets

- Predictive Analysis: Data mining helps in building predictive models for various market activities, such as stock price movements, currency fluctuations, and bond yield changes. By analyzing historical data, traders and analysts can forecast future market conditions.

- Risk Management: Advanced data mining techniques can identify potential risks and anomalies in real-time, enabling financial institutions to take preventive measures before significant losses occur.

- Algorithmic Trading: Many trading algorithms rely on patterns and predictions derived from data mining to execute trades at optimal times, improving profitability and efficiency.

- Customer Insights: In retail finance, data mining is used to understand customer behavior, optimize product offerings, and enhance customer service by identifying trends in customer data.

Data Mining Techniques

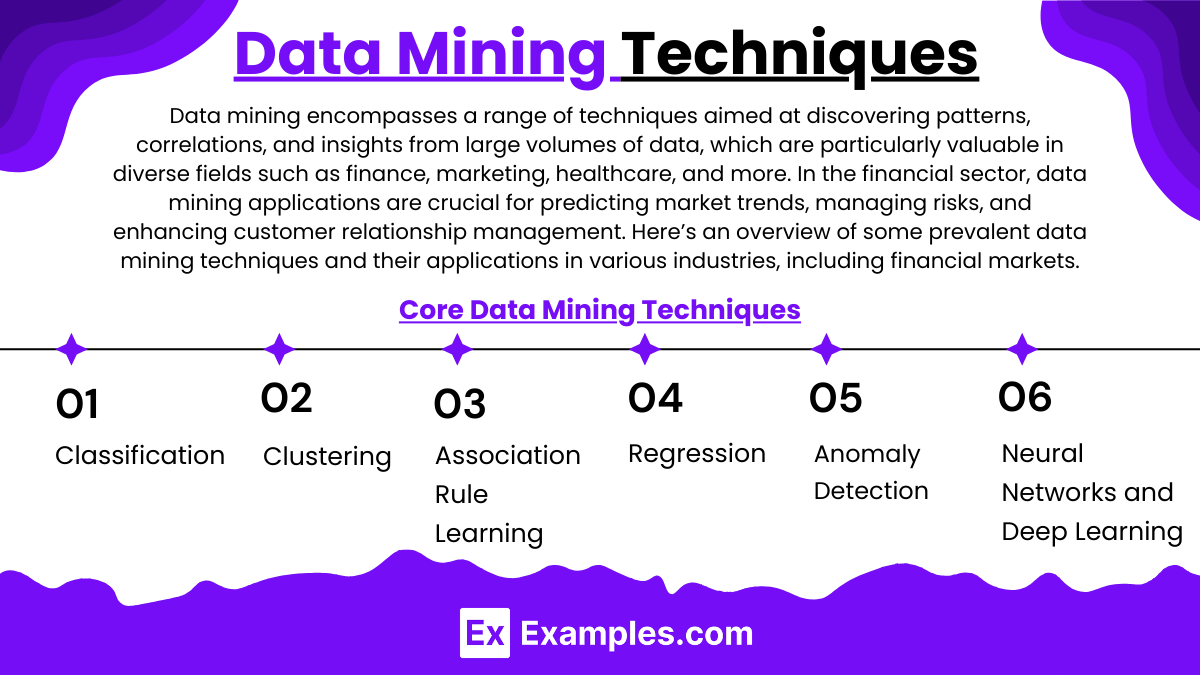

Data mining encompasses a range of techniques aimed at discovering patterns, correlations, and insights from large volumes of data, which are particularly valuable in diverse fields such as finance, marketing, healthcare, and more. In the financial sector, data mining applications are crucial for predicting market trends, managing risks, and enhancing customer relationship management. Here’s an overview of some prevalent data mining techniques and their applications in various industries, including financial markets.

Core Data Mining Techniques

- Classification: This technique involves categorizing data into predefined classes. It is often used to determine whether a transaction is fraudulent or to predict if a borrower will default on a loan.

- Tools: Decision Trees, Naïve Bayes Classifier, Support Vector Machines (SVM).

- Clustering: Clustering groups a set of objects in such a way that objects in the same group are more similar to each other than to those in other groups. It’s frequently applied in market segmentation, image segmentation, and anomaly detection.

- Tools: k-Means, Hierarchical Clustering, DBSCAN.

- Association Rule Learning: This technique is used to find interesting associations and relationships between large sets of data items. This has applications in cross-selling strategies, market basket analysis, and catalog design.

- Tools: Apriori, Eclat, and FP-Growth algorithms.

- Regression: Regression analysis estimates the relationships among variables. It is used for forecasting and predicting numerical values such as sales amounts, customer lifetime value, and stock prices.

- Tools: Linear Regression, Logistic Regression, Polynomial Regression.

- Anomaly Detection (Outlier Detection): This technique identifies rare items, events, or observations which raise suspicions by differing significantly from the norm. Applied in fraud detection, network security, and fault detection.

- Tools: Isolation Forest, One-Class SVM, Elliptic Envelope.

- Neural Networks and Deep Learning: Advanced machine learning techniques that model high-level abstractions in data. They are used in applications requiring pattern recognition on large scales, such as speech recognition, image classification, and financial forecasting.

- Tools: TensorFlow, Keras, PyTorch.

Case Study: S&P 500

This case study explores the application of data mining techniques to predict trends and movements in the S&P 500, a key indicator of the U.S. stock market. Here’s a brief summary of the approach, methods, and considerations:

Objective:

- Use historical data on the S&P 500 to identify patterns and predict future market movements.

- Enhance investment decisions and risk management strategies.

Data Collection:

- Sources: Historical prices (Open, High, Low, Close, Volume) from services like Bloomberg or Yahoo Finance.

- Additional Data: Macroeconomic indicators (interest rates, GDP growth, etc.).

Ethical Considerations and Challenges

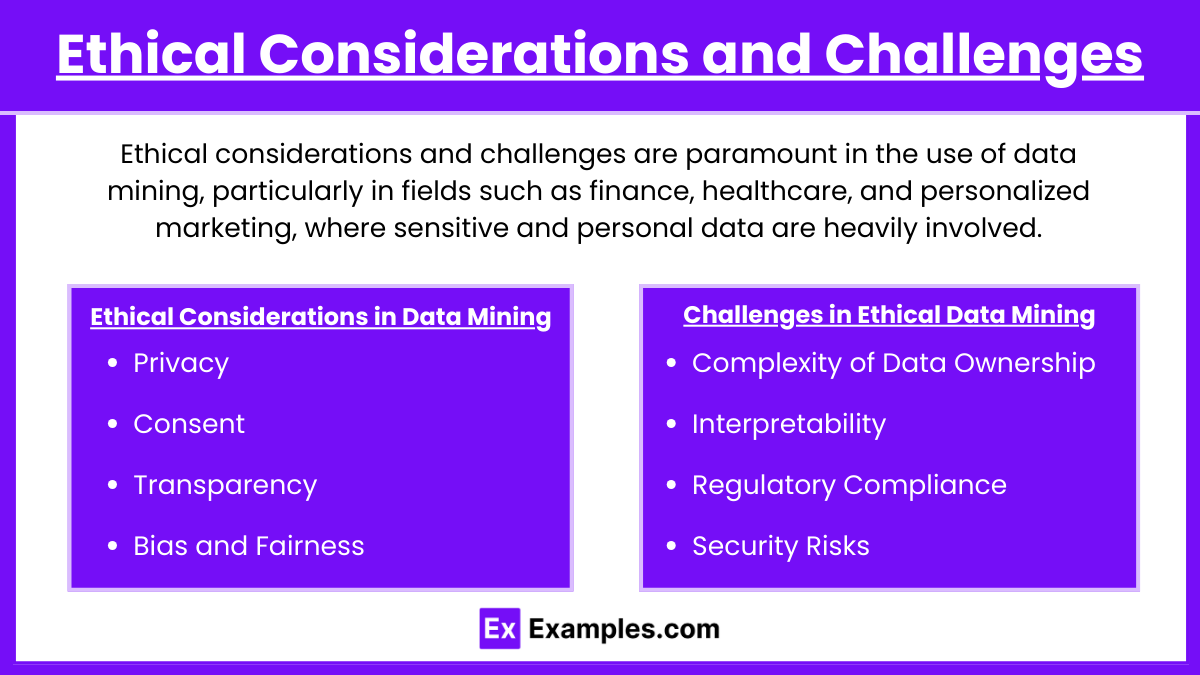

Ethical considerations and challenges are paramount in the use of data mining, particularly in fields such as finance, healthcare, and personalized marketing, where sensitive and personal data are heavily involved. Here’s a discussion on the ethical considerations, potential challenges, and best practices for navigating these issues:

Ethical Considerations in Data Mining

- Privacy: Data mining often involves the processing of vast amounts of personal data, raising significant privacy concerns. Ensuring that individuals’ data is used responsibly, without infringing on their privacy rights, is crucial.

- Consent: Obtaining informed consent from individuals whose data is being collected and used is a fundamental ethical requirement. Users should be fully aware of how their data will be used and must have the option to opt out.

- Transparency: There should be transparency regarding the data mining processes and algorithms used. Stakeholders should have a clear understanding of how decisions are derived from the data.

- Bias and Fairness: Data mining models can perpetuate or even exacerbate existing biases if the data used are biased. Ensuring fairness involves careful design, implementation, and continuous monitoring to identify and mitigate any discriminatory biases in the models.

Challenges in Ethical Data Mining

- Complexity of Data Ownership: In today’s digital age, data often flows across borders and through multiple entities, making it difficult to establish clear data ownership and accountability.

- Interpretability: Advanced data mining techniques, such as deep learning, can result in “black box” models that are difficult to interpret. This lack of interpretability can make it challenging to explain how decisions are made, complicating issues of consent and bias.

- Regulatory Compliance: Compliance with data protection regulations (like GDPR or HIPAA) can be complex, especially for organizations that operate across multiple jurisdictions with varying laws.

- Security Risks: Data breaches can expose sensitive personal data. Ensuring the security of data used in mining operations is a persistent challenge.

Examples

Example 1: Detecting Bullish Engulfing Patterns

Using historical price data of the S&P 500 to mine for occurrences of the bullish engulfing candlestick pattern and assessing subsequent market performance. This involves determining the frequency and reliability of this pattern as a predictor of short-term price increases.

Example 2: Volume and Price Anomaly Detection

Analyzing trading volume spikes coinciding with significant price movements in the S&P 500. Data mining is used to identify and verify patterns where volume increases typically precede bullish trends, providing a basis for a momentum trading strategy.

Example 3: Earnings Announcements and Market Reaction

Mining S&P 500 company earnings announcement data to identify patterns of price movement post-earnings release. This could involve clustering companies based on similarities in price volatility post-earnings and creating predictive models for future earnings seasons.

Example 4: Seasonal Trends Identification

Applying data mining techniques to identify and verify seasonal trends within the S&P 500, such as the “Sell in May and go away” phenomenon. Historical data is analyzed to test the validity and profitability of reducing exposure to the stock market from May through October.

Example 5: Correlation Mining for Asset Allocation

Using data mining to uncover hidden correlations between S&P 500 stock movements and various macroeconomic indicators like interest rates and GDP growth rates. These insights are used to optimize asset allocation decisions in real-time, enhancing portfolio diversification and risk management.

Practice Question

Question 1

What is a primary goal of applying data mining techniques to the S&P 500 historical data?

A. To ensure that all S&P 500 companies outperform market expectations.

B. To predict future S&P 500 movements based on past performance patterns.

C. To increase the transaction costs associated with trading S&P 500 stocks.

D. To eliminate all forms of market risk in S&P 500 investments.

Answer:

B. To predict future S&P 500 movements based on past performance patterns.

Explanation:

The primary goal of using data mining on historical data of the S&P 500 is to identify patterns that can predict future movements of the index. This method leverages statistical models to extract insights from past data, helping investors make informed decisions based on likely future trends and anomalies.

Question 2

Which technique is commonly used in data mining for detecting patterns in stock market data?

A. Fundamental analysis of company earnings

B. Technical analysis using moving averages

C. Association rule learning

D. Random sampling of stock prices

Answer:

C. Association rule learning

Explanation:

Association rule learning is a data mining technique used to find interesting correlations and frequent patterns, relationships, or associations among a set of items in transactional databases like stock market data. This method is particularly useful in rule data mining to uncover relationships between different market conditions and stock movements.

Question 3

What is an ethical consideration when conducting rule data mining on financial data such as the S&P 500?

A. Maximizing profit for a select group of investors

B. Sharing proprietary trading strategies publicly

C. Ensuring the transparency and reproducibility of the analysis

D. Guaranteeing financial returns on investments

Answer:

C. Ensuring the transparency and reproducibility of the analysis

Explanation:

An ethical consideration in financial data mining, including studies like those performed on the S&P 500, is ensuring that the methods and findings are transparent and reproducible. This practice supports the integrity of the analysis, allows for verification by peers or regulators, and helps maintain trust in the financial markets by showing that results are not manipulated or biased.