“Fact, Fiction, and Momentum Investing” explores the principles and challenges of momentum investing, a strategy based on the idea that assets showing strong recent performance will continue in the same direction. By examining both behavioral biases and technical indicators, this topic sheds light on why trends persist and how momentum strategies are applied in portfolio management. This approach contrasts with other methods, like value investing, and raises questions around market efficiency. Understanding momentum’s advantages and limitations is crucial for effective analysis and risk management in technical investing.

Learning Objectives

In studying “Fact, Fiction, and Momentum Investing” for the CMT Exam, you should learn to analyze the foundations and controversies surrounding momentum investing, understanding its behavioral and technical underpinnings. Assess how momentum strategies are constructed using price trends, relative strength, and trading volume indicators. Critically evaluate empirical evidence supporting or challenging momentum’s effectiveness and explore its role within efficient market theory. Explore momentum anomalies and the behavioral biases that drive them, such as overconfidence and herding. Apply these concepts to backtesting and managing risk within portfolios, and interpret how momentum strategies interact with value and growth investing techniques.

Introduction to Momentum Investing

Momentum investing is a strategy that focuses on capitalizing on the continuation of existing trends in the market. It operates on the assumption that assets that have recently performed well are likely to continue performing well in the near future, while those that have performed poorly will likely continue to underperform. This concept contradicts the traditional efficient market hypothesis (EMH), which posits that asset prices reflect all available information and thus cannot be predicted systematically.

Key techniques :

- Trend-following indicators such as moving averages or the relative strength index (RSI).

- Price and volume analysis to gauge the strength of a trend.

- Sector rotation, where investors switch to trending sectors.

Historical Basis and Theoretical Foundation

- Academic Foundations: Momentum investing gained significant academic interest in the 1990s when researchers identified a “momentum effect” in stock markets across various timeframes, typically over 3 to 12 months. This effect implies that stocks that have outperformed or underperformed continue to do so in the near term. The work of scholars like Narasimhan Jegadeesh and Sheridan Titman is particularly foundational, with their studies showing that momentum strategies yield substantial abnormal returns.

- Behavioral Explanations: Momentum can also be explained through behavioral finance. Investors often overreact to positive news and underreact to negative news, leading to trends in price movements that persist over time. Psychological biases, such as the herding effect and the disposition effect (tendency to hold onto losers and sell winners too quickly), contribute to price trends that momentum investors can exploit.

- Market Inefficiencies: Momentum effects can persist due to market inefficiencies, such as delayed reactions to news or information asymmetry. This contrasts with EMH, suggesting that markets are not always perfectly efficient, thereby creating opportunities for momentum-based strategies.

Key Momentum Indicators and Their Application

Momentum investing employs various indicators to identify trends and assess the strength of price movements. Some of the most commonly used momentum indicators include:

- Relative Strength Index (RSI): RSI is used to measure the speed and change of price movements, providing insights into overbought or oversold conditions. A high RSI (typically above 70) might indicate overbought conditions, while a low RSI (below 30) could signal oversold conditions. Momentum investors use RSI to determine whether a trend might be reversing or continuing.

- Moving Averages: Momentum investors use simple and exponential moving averages to track price trends. The moving average crossover technique—when a short-term moving average crosses above or below a long-term moving average—can signal the start or end of a trend. Moving averages smooth out price data, making it easier to spot trends.

- Moving Average Convergence Divergence (MACD): MACD is a trend-following indicator that helps to identify momentum. When the MACD line crosses above the signal line, it’s generally a bullish indicator; when it crosses below, it’s bearish. Momentum investors often use this indicator to confirm trend direction and strength.

- Momentum Oscillators: These include various indicators like the Stochastic Oscillator, which helps identify potential trend reversals by measuring recent price movements relative to a specific range. High values indicate potential overbought conditions, while low values signal oversold conditions.

Practical Momentum Strategies

Momentum investing involves strategies that focus on capitalizing on continuing price trends, whether upward or downward. These strategies rely on indicators to gauge the strength and direction of trends, aiming to enter positions early in a trend and exit as momentum fades.

- Trend Following: This involves identifying and riding the trend, whether upward or downward. Trend-following strategies require disciplined entry and exit points based on momentum signals, often using technical indicators like moving averages or breakout points to confirm trend direction.

- Sector Rotation: Momentum investors may rotate between sectors based on performance trends. For example, if technology stocks have recently shown strong momentum, investors may shift their portfolios toward tech-focused assets.

- Relative Strength Investing: This strategy focuses on selecting assets with the highest relative performance compared to a benchmark or a peer group. Relative strength analysis identifies securities that are outperforming and likely to continue doing so in the near future.

- Factor-Based Momentum: This involves using multiple factors (e.g., value, growth, size) alongside momentum signals to construct a diversified portfolio that captures the performance of different market segments.

Risks and Limitations of Momentum Investing

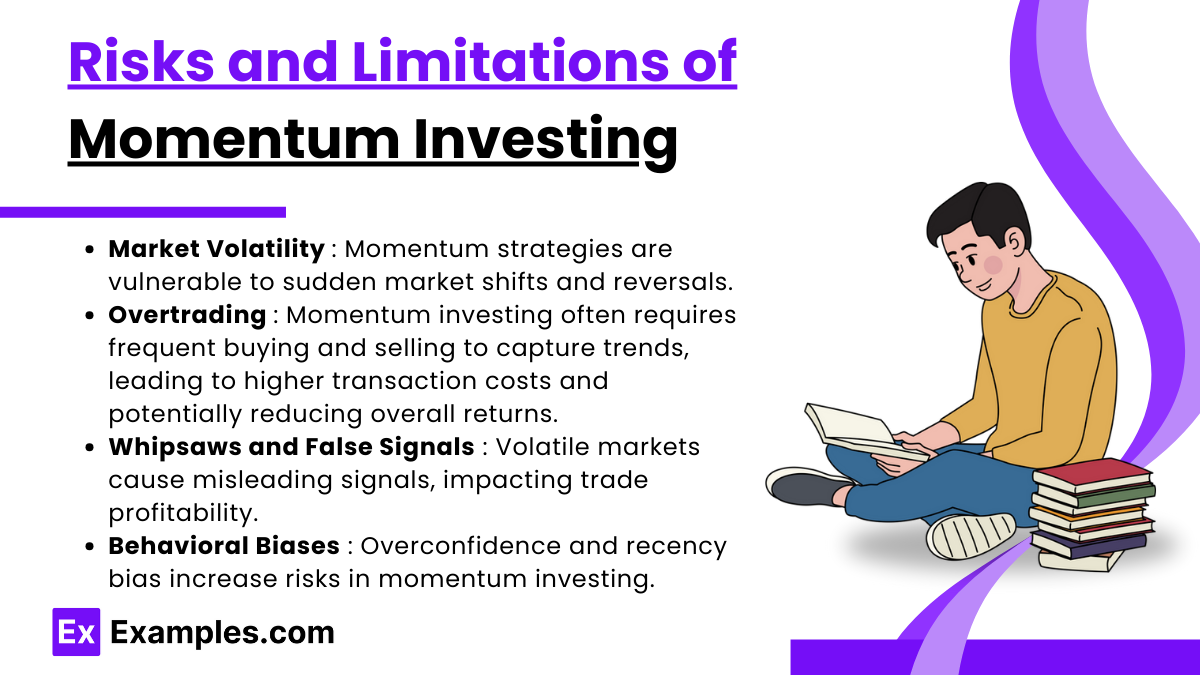

While momentum investing can offer high returns, it also comes with distinct risks and limitations:

- Market Volatility: Momentum strategies are vulnerable to sudden market shifts and reversals. A rapid change in market sentiment can lead to sharp declines, causing substantial losses for momentum-driven portfolios.

- Overtrading: Momentum investing often requires frequent buying and selling to capture trends, leading to higher transaction costs and potentially reducing overall returns. Overtrading can also erode gains due to slippage and bid-ask spreads.

- Whipsaws and False Signals: In volatile or sideways markets, momentum indicators may give false signals, leading investors to enter or exit trades prematurely. False breakouts and whipsaw effects can significantly impact profitability.

- Behavioral Biases: Overconfidence in a momentum strategy can lead to excessive risk-taking. Similarly, recency bias may cause investors to favor assets that have recently performed well without considering broader market or economic conditions.

Examples

Example 1. Fact: Momentum Strategies Can Outperform in the Short Term

Momentum investing has been shown to outperform in specific market conditions, especially in shorter-term horizons. Empirical studies reveal that assets with strong recent performance often continue to generate returns over the next few months. Portfolio managers using momentum strategies typically focus on assets with positive price trends, capitalizing on upward or downward momentum. The effectiveness of momentum is particularly evident during strong bull or bear markets when trends are well-defined. However, these gains are often fleeting and may not be sustainable over the long term, making it critical for managers to reassess positions frequently.

Example2. Fiction: Momentum Investing Always Outperforms Value Investing

A common misconception is that momentum investing always outperforms other strategies, such as value investing. In reality, the relative performance of momentum and value investing depends on the market cycle. Momentum tends to excel in trending markets but can struggle during periods of economic instability or rapid reversals. Value investing, on the other hand, often outperforms during market corrections or recoveries, when undervalued assets gain investor interest. Portfolio managers should consider integrating momentum with value factors to smooth returns over time and balance risk, particularly in mixed market environments.

Example 3. Fact: Momentum Investing Relies on Behavioral Biases

Momentum investing capitalizes on behavioral biases such as overconfidence, herd behavior, and anchoring. Investors frequently chase performance, driving prices higher and creating trends. For a portfolio manager, understanding these biases allows for a more strategic approach to momentum, as they can identify when a trend is likely to persist or fade. By monitoring sentiment indicators or trading volumes, managers can assess whether a trend has robust support or is nearing exhaustion. Behavioral finance insights help managers refine entry and exit points, enhancing the effectiveness of momentum strategies.

Example 4. Fiction: Momentum Investing Is a Low-Risk Strategy

Momentum investing may appear low-risk due to its trend-following nature, but it carries substantial risk, particularly in volatile markets. Trends can reverse suddenly, leading to sharp losses, especially if a portfolio is overexposed to one sector or asset class. Portfolio managers must use risk management tools, such as stop-loss orders and position sizing, to mitigate potential downturns. Additionally, incorporating diverse asset classes in a momentum portfolio can help balance risk. Without these measures, momentum investing can result in significant drawdowns, particularly during market corrections or unpredictable news events.

Example 5. Fact: Momentum Strategies Require High Liquidity and Low Transaction Costs

Momentum investing often involves frequent buying and selling, making high liquidity and low transaction costs essential for effective portfolio management. Stocks with lower trading volumes or wide bid-ask spreads can erode profits from momentum trades. Portfolio managers should focus on liquid assets and consider transaction costs carefully, as excessive costs can diminish returns, especially in high-frequency trading environments. Additionally, high-frequency momentum strategies require efficient execution systems to manage orders swiftly, helping to capture gains while minimizing market impact.

Practice Questions

Question 1

Which of the following best describes the primary rationale behind momentum investing?

A) Momentum investing relies on identifying undervalued securities that have high intrinsic value.

B) Momentum investing is based on the belief that securities exhibiting recent strong performance will continue to perform well in the near future.

C) Momentum investing is focused on securities with low volatility and stable earnings.

D) Momentum investing is only effective in efficient markets where all information is reflected immediately in prices.

Answer: B

Explanation: Momentum investing is a strategy that capitalizes on the continuation of existing trends. The central idea is that stocks or assets that have recently shown strong price performance are likely to continue performing well in the short term. This trend-following approach contrasts with value investing, where investors look for undervalued assets regardless of current price trends. Momentum investing relies on investor behavior and market inefficiencies, where prices continue to move in a particular direction due to factors like investor sentiment, overreaction, and underreaction, rather than intrinsic valuation alone. Choices A and C describe value-based investing and low-risk investing, while D contradicts the concept, as momentum investing often exploits inefficiencies and behavioral biases in the market.

Question 2

Which of the following behavioral biases best explains the persistence of price trends in momentum investing?

A) Anchoring

B) Loss aversion

C) Confirmation bias

D) Overconfidence

Answer: D

Explanation: Overconfidence is a common behavioral bias associated with momentum investing. Overconfident investors believe that their interpretation of information is correct and, as a result, tend to hold onto winners or add to positions, pushing prices even higher. This overconfidence can lead to a feedback loop, where initial gains create further buying interest, propelling prices upward. Anchoring (A) and confirmation bias (C) are also related to momentum investing, as they can lead investors to focus on prior price levels or seek out information supporting their view, but overconfidence most directly drives the continuation of trends. Loss aversion (B) typically explains why investors might hold onto losing positions, rather than contributing to momentum.

Question 3

Why might momentum investing experience significant losses during market reversals?

A) Momentum investing strategies rely on high-dividend stocks, which are sensitive to interest rate changes.

B) Momentum strategies often involve crowded trades that can lead to rapid price changes when trends reverse.

C) Momentum strategies are based on fundamental analysis, which is reliable only in stable markets.

D) Market reversals do not affect momentum investing, as it relies solely on technical indicators.

Answer: B

Explanation: Momentum investing can be vulnerable during market reversals, as these strategies often involve crowded trades, where many investors are following the same trends. When the market shifts, these crowded positions can lead to quick and substantial losses as investors rush to exit. This phenomenon is particularly risky in momentum investing, where trends can reverse sharply, causing downward spirals as traders sell off positions in unison. Choices A and C are incorrect because momentum investing does not primarily focus on high-dividend stocks or fundamental analysis. Choice D is also incorrect, as market reversals can significantly disrupt momentum strategies, despite the reliance on technical indicators.