The Balance of Payments Accounts are a fundamental concept in AP Macroeconomics, providing a detailed record of a country’s economic transactions with the rest of the world over a specific period. These accounts encompass the current, capital, and financial accounts, tracking imports and exports, investments, and financial flows. Understanding the Balance of Payments is essential for analyzing a nation’s economic health, exchange rates, and international economic policies, making it a crucial topic for excelling in the AP Macroeconomics exam.

Learning Objectives

When studying Balance of Payments Accounts for AP Macroeconomics, you should understand the three main components: the Current Account, Capital Account, and Financial Account. Learn how to analyze trade balances, income flows, and transfers, as well as various types of investments and reserve assets. Grasp the principles of double-entry bookkeeping to ensure the BOP balances. Additionally, comprehend the economic implications of BOP surpluses and deficits, their impact on exchange rates, and the policy measures governments can implement to address imbalances. This comprehensive understanding will enable you to interpret international economic interactions effectively.

What is the Balance of Payments (BOP)?

The Balance of Payments is a systematic record of all economic transactions between residents of a country and the rest of the world within a specific time frame, typically a year or a quarter. It includes transactions in goods, services, financial capital, and financial transfers.

Key Characteristics:

- Double-Entry Accounting System: Every transaction is recorded twice—once as a credit and once as a debit—ensuring that the BOP always balances (i.e., the sum of all credits equals the sum of all debits).

- Comprehensive: It covers all economic transactions, including trade, investment, and financial transfers.

- Indicator of Economic Health: A balanced BOP reflects economic stability, while persistent deficits or surpluses can indicate underlying economic issues.

Main Components of the BOP

The BOP is divided into three primary accounts:

- Current Account

- Capital Account

- Financial Account

Additionally, there is a section for Errors and Omissions to account for discrepancies.

Current Account

The Current Account records the trade of goods and services, income flows, and current transfers between residents and non-residents.

Components of the Current Account:

- Trade Balance (Goods and Services):

- Exports of Goods and Services: Revenues from selling goods (like cars, electronics) and services (like tourism, consulting) to other countries.

- Imports of Goods and Services: Expenditures on purchasing goods and services from other countries.

- Trade Balance Calculation:Exports – Imports

- Surplus: Exports > Imports

- Deficit: Imports > Exports

- Primary Income (Factor Income):

- Wages and Salaries: Payments to workers abroad and payments to foreign workers domestically.

- Investment Income: Dividends, interest, and profits from investments held abroad and by foreigners domestically.

- Property Income: Earnings from ownership of assets like real estate or stocks in foreign countries.

- Secondary Income (Current Transfers):

- Unilateral Transfers: Transfers where no good or service is received in return, such as foreign aid, remittances, and gifts.

- Recurrent vs. Non-recurrent Transfers:

- Recurrent: Ongoing transfers like monthly remittances.

- Non-recurrent: One-time transfers like disaster relief funds.

Current Account Balance:

- Surplus: Indicates a country exports more than it imports, potentially leading to an accumulation of foreign reserves.

- Deficit: Indicates a country imports more than it exports, necessitating borrowing or selling assets to finance the deficit.

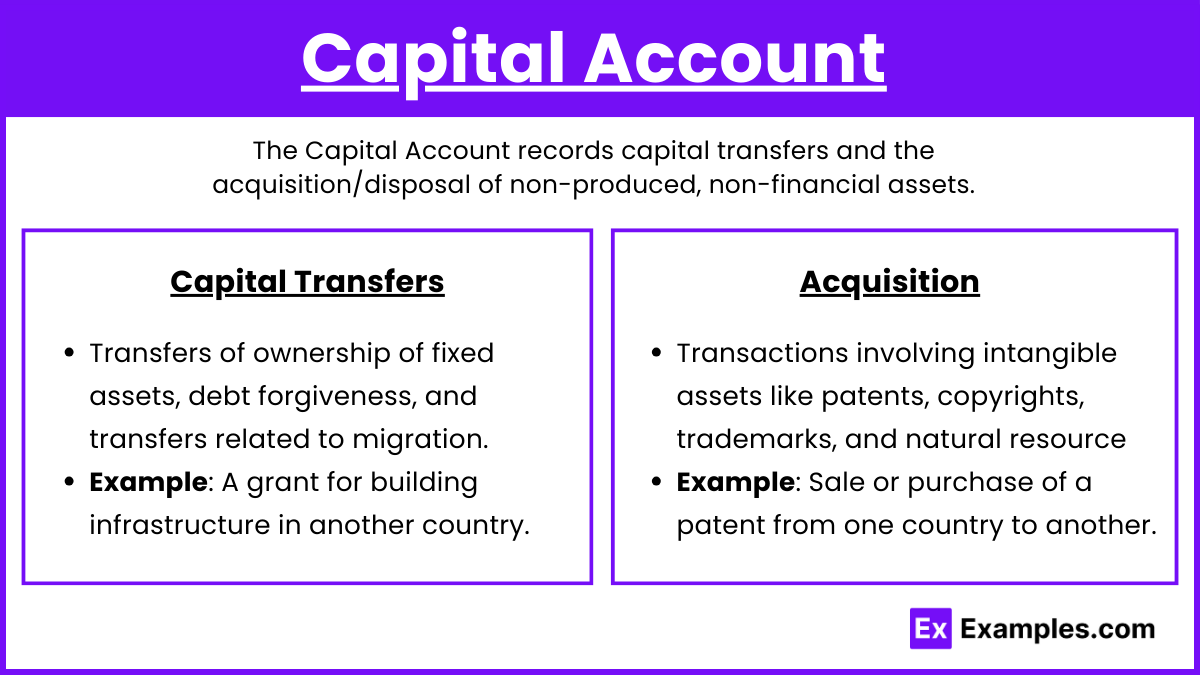

Capital Account

The Capital Account records capital transfers and the acquisition/disposal of non-produced, non-financial assets.Components of the Capital Account:

- Capital Transfers:

- Transfers of ownership of fixed assets, debt forgiveness, and transfers related to migration.

- Example: A grant for building infrastructure in another country.

- Acquisition/Disposal of Non-Produced, Non-Financial Assets:

- Transactions involving intangible assets like patents, copyrights, trademarks, and natural resource rights.

- Example: Sale or purchase of a patent from one country to another.

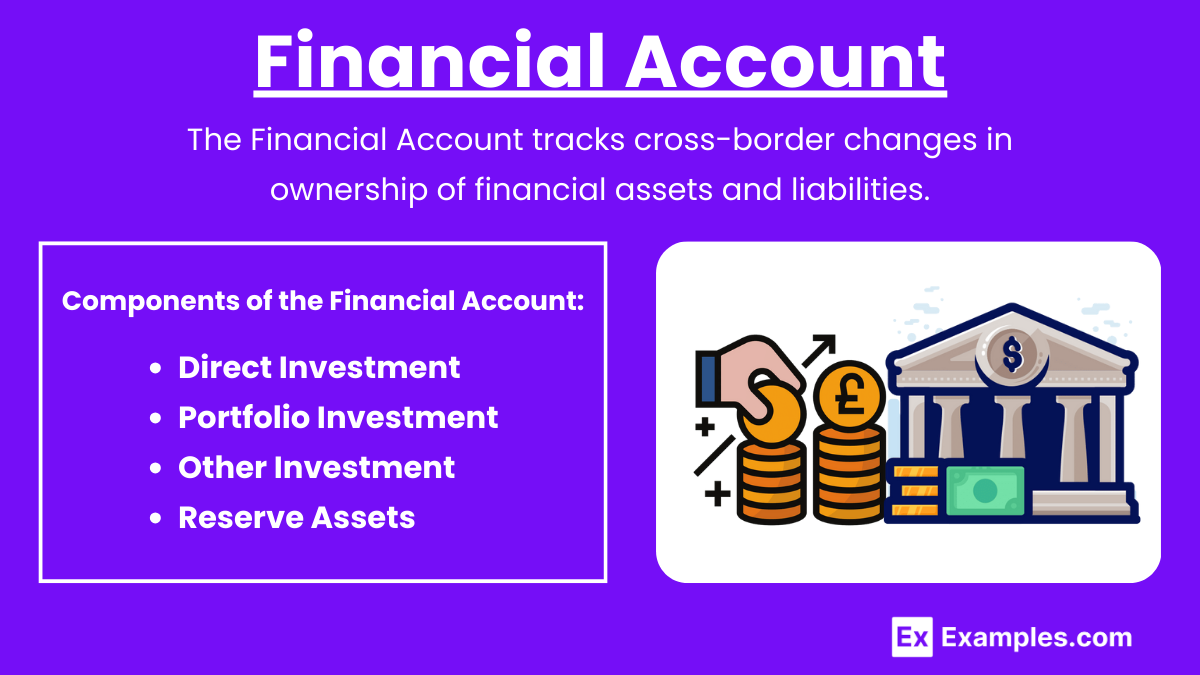

Financial Account

The Financial Account records transactions that involve financial assets and liabilities, reflecting changes in ownership of financial assets between residents and non-residents.

Components of the Financial Account:

- Direct Investment:

- Definition: Long-term investment where an investor acquires a lasting interest (typically 10% or more ownership) in a foreign company.

- Example: A U.S. company opening a factory in Germany.

- Portfolio Investment:

- Definition: Investment in securities and financial assets, such as stocks and bonds, without the intent of controlling the issuer.

- Example: Purchasing shares of a foreign corporation or government bonds.

- Other Investment:

- Includes: Short-term loans, bank deposits, trade credits, and other financial instruments not classified under direct or portfolio investment.

- Example: A foreign entity providing a short-term loan to a domestic company.

- Reserve Assets:

- Definition: Foreign currencies, gold reserves, and other assets held by a country’s central bank to back its own currency and manage exchange rates.

- Purpose: To intervene in foreign exchange markets to stabilize the national currency.

Financial Account Balance:

- Surplus: Indicates an inflow of financial capital into the country (foreigners are investing in the country).

- Deficit: Indicates an outflow of financial capital from the country (residents are investing abroad).

Double-Entry Bookkeeping in BOP

Every transaction in the BOP is recorded twice to maintain balance.

Example:

- Scenario: A U.S. company exports $1 million worth of goods to Europe.

- Current Account:

- Credit (Increase): Exports of goods +$1 million

- Financial Account:

- Debit (Increase): Receipts of financial capital +$1 million (could be a bank transfer or increase in foreign reserves)

- Current Account:

This ensures that the BOP remains balanced, as every credit has a corresponding debit.

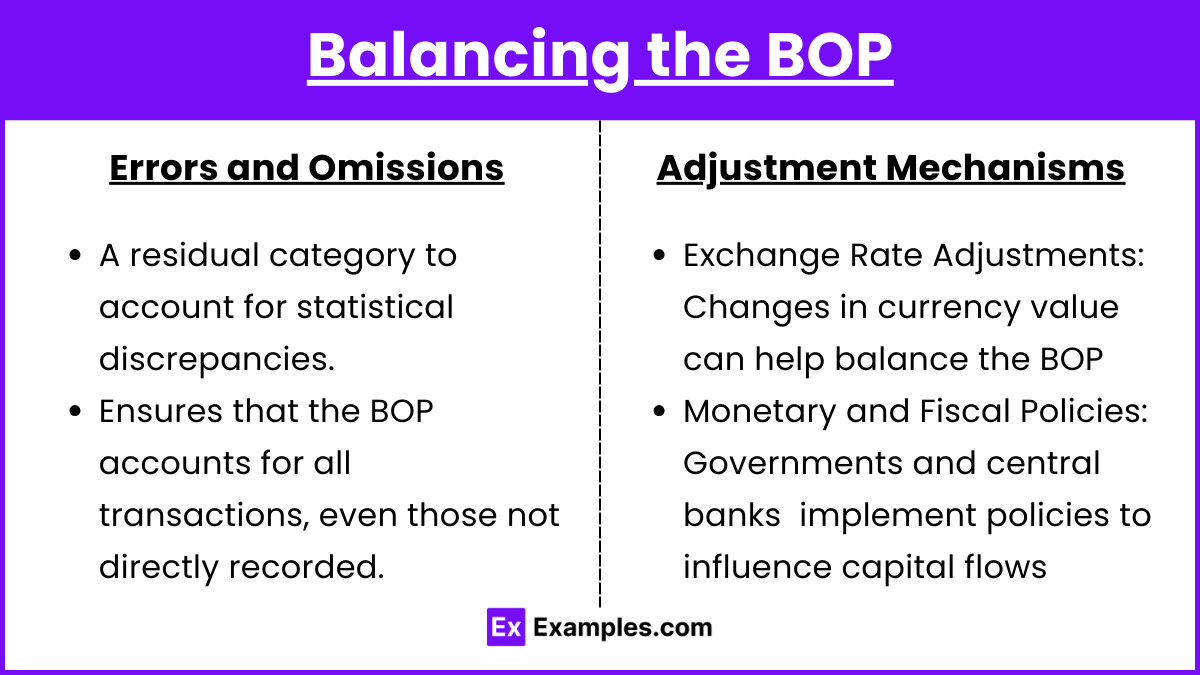

Balancing the BOP

While theoretically, the BOP should always balance (credits = debits), in practice, discrepancies can occur due to measurement errors or timing differences.

Errors and Omissions:

- A residual category to account for statistical discrepancies.

- Ensures that the BOP accounts for all transactions, even those not directly recorded.

Adjustment Mechanisms:

- Exchange Rate Adjustments: Changes in currency value can help balance the BOP by affecting exports and imports.

- Monetary and Fiscal Policies: Governments and central banks may implement policies to influence capital flows and economic activities to correct imbalances.

Examples

Example 1. Export of Manufactured Goods (Current Account)

Scenario: A German automobile manufacturer sells 10,000 cars to customers in the United States for $500 million.

Explanation: This transaction is recorded in the Current Account under the Trade Balance as an export of goods. Exports generate a credit in the Current Account because they represent an inflow of foreign currency into Germany. A positive trade balance (exports exceeding imports) can contribute to a Current Account surplus, indicating strong demand for German cars abroad. This surplus can lead to an accumulation of foreign reserves or increased investment abroad, depending on how Germany chooses to utilize the excess funds.

Example 2. Import of Services – Tourism (Current Account)

Scenario: Thousands of American tourists visit France, spending a total of €200 million on hotels, restaurants, and other services during the summer season.

Explanation: The expenditure by American tourists in France is recorded in the Current Account under the Trade Balance as an import of services for France. For the United States, this would be an import of services, represented as a debit in the Current Account. A high level of service imports can contribute to a Current Account deficit if not offset by sufficient exports of goods and services. This example highlights how tourism, a significant service sector, impacts a country’s BOP by affecting the flow of money across borders.

Example 3. Foreign Direct Investment (Financial Account)

Scenario: A Japanese electronics company establishes a manufacturing plant in Mexico, investing $300 million in infrastructure, equipment, and training.

Explanation: This investment is recorded in the Financial Account under Direct Investment. Direct investment involves a long-term interest (typically 10% or more ownership) in a foreign enterprise. The $300 million investment represents a credit in Mexico’s Financial Account, indicating an inflow of capital. For Japan, this would be a debit, showing an outflow of capital to establish the plant abroad. Direct investments can have significant implications for the host country’s economy, including job creation, technology transfer, and increased production capacity.

Example 4. Portfolio Investment – Purchase of Foreign Stocks (Financial Account)

Scenario: An American investment firm purchases $50 million worth of shares in a Canadian technology company.

Explanation: This transaction is recorded in the Financial Account under Portfolio Investment. Portfolio investments involve the purchase of financial assets like stocks and bonds without seeking control over the issuing entity. The $50 million purchase represents a credit in Canada’s Financial Account, indicating an inflow of foreign capital. Conversely, for the United States, it is a debit, reflecting an outflow of capital to acquire foreign securities. Portfolio investments are generally more liquid and shorter-term compared to direct investments, making them a key component of financial market activities influencing the BOP.

Example 5. Remittances Sent by Workers Abroad (Current Account)

Scenario: Overseas Filipino workers send $1 billion in remittances back to their families in the Philippines over the course of a year.

Explanation: Remittances are recorded in the Current Account under Secondary Income (Current Transfers). These unilateral transfers represent money sent by individuals working abroad to their home country without any exchange of goods or services. For the Philippines, remittances are a credit in the Current Account, contributing to a surplus by increasing foreign currency inflows. For the workers’ host countries (e.g., the United States), remittances are considered a debit, reflecting an outflow of funds. Remittances play a vital role in supporting household incomes, reducing poverty, and contributing to the overall economic stability of recipient countries.

Multiple Choice Questions

Question 1

Which of the following transactions would be recorded as a credit in the Current Account of a country’s Balance of Payments?

A) A U.S. company invests in building a factory in Germany.

B) A German tourist spends money on hotels and restaurants while visiting the United States.

C) The U.S. government grants foreign aid to a developing country.

D) A Japanese investor purchases U.S. Treasury bonds.

Answer: B) A German tourist spends money on hotels and restaurants while visiting the United States.

Explanation: The Current Account of the Balance of Payments (BOP) records transactions involving the trade of goods and services, income flows, and current transfers between residents and non-residents. A credit in the Current Account signifies an inflow of funds, which typically occurs when a country exports goods or services.

- Option A: This is a financial account transaction, specifically Direct Investment, not a Current Account transaction.

- Option B: When a German tourist spends money in the United States, the U.S. is providing services (hospitality) to a foreign resident. This is recorded as an export of services, which is a credit in the Current Account.

- Option C: Foreign aid is considered a current transfer. Since it’s an outflow from the U.S. to another country, it would be a debit in the Current Account.

- Option D: Purchasing U.S. Treasury bonds by a Japanese investor is a Financial Account transaction, specifically Portfolio Investment, not a Current Account transaction.

Question 2

If Country X has a persistent Current Account deficit, which of the following is most likely to occur in the Financial Account?

A) An increase in exports of goods and services.

B) A decrease in foreign direct investment.

C) An inflow of foreign capital to finance the deficit.

D) A reduction in reserve assets held by the central bank.

Answer: C) An inflow of foreign capital to finance the deficit.

Explanation: In the Balance of Payments, the Current Account and the Financial Account must balance each other out (excluding Errors and Omissions). If a country has a Current Account deficit (meaning it is importing more goods, services, and capital than it is exporting), it needs to finance this deficit somehow.

- Option A: An increase in exports would reduce the Current Account deficit, not directly relate to the Financial Account.

- Option B: A decrease in foreign direct investment would exacerbate the Current Account deficit, not compensate for it.

- Option C: To finance a Current Account deficit, Country X would need an inflow of foreign capital. This could come from Foreign Direct Investment (FDI), Portfolio Investment, or other financial inflows. Essentially, the Financial Account would show a surplus to offset the Current Account deficit.

- Option D: A reduction in reserve assets could be a way to finance the deficit, but it is typically a less common and less sustainable method compared to attracting foreign capital. Moreover, reserve asset transactions are just a part of the Financial Account and not the most direct way to address a persistent Current Account deficit.

Question 3

Which of the following best describes a situation where a country is experiencing a surplus in its Financial Account?

A) The country is exporting more goods and services than it is importing.

B) The country is receiving more investment from abroad than it is investing in other countries.

C) The government is running a budget surplus.

D) The central bank is increasing its holdings of foreign exchange reserves.

Answer: B) The country is receiving more investment from abroad than it is investing in other countries.

Explanation: A Financial Account surplus occurs when there is an inflow of financial capital into the country, meaning that foreign investors are investing more in the country than domestic investors are investing abroad.

- Option A: Exporting more goods and services than importing would result in a Current Account surplus, not directly related to the Financial Account.

- Option B: If the country is receiving more investment from abroad (e.g., foreign companies investing in domestic businesses, foreign portfolio investments) than it is investing abroad, this results in a Financial Account surplus. Essentially, more capital is flowing into the country than flowing out.

- Option C: A government budget surplus pertains to the government’s fiscal balance and does not directly affect the Financial Account. However, it could indirectly influence it through other channels, but it is not the best description of a Financial Account surplus.

- Option D: When the central bank increases its holdings of foreign exchange reserves, it is making transactions in the Financial Account (specifically reserve assets). However, this action alone doesn’t necessarily indicate a surplus; it depends on whether the central bank is buying or selling reserves. Increasing reserves could be a response to other imbalances but does not inherently describe a Financial Account surplus.