The business cycle refers to the recurring phases of expansion and contraction in an economy’s activity, impacting key factors like GDP, employment, and inflation. In AP Macroeconomics, understanding these cycles is essential for analyzing how economies grow, shrink, and recover. The cycle’s four stages—expansion, peak, contraction, and trough—help explain economic fluctuations over time.

Learning Objectives

By studying the business cycle, students will understand the phases of economic expansion and contraction, the factors influencing these fluctuations, and how they impact GDP, employment, and inflation. They will also learn to interpret economic indicators and apply these concepts to real-world scenarios in AP Macroeconomics.

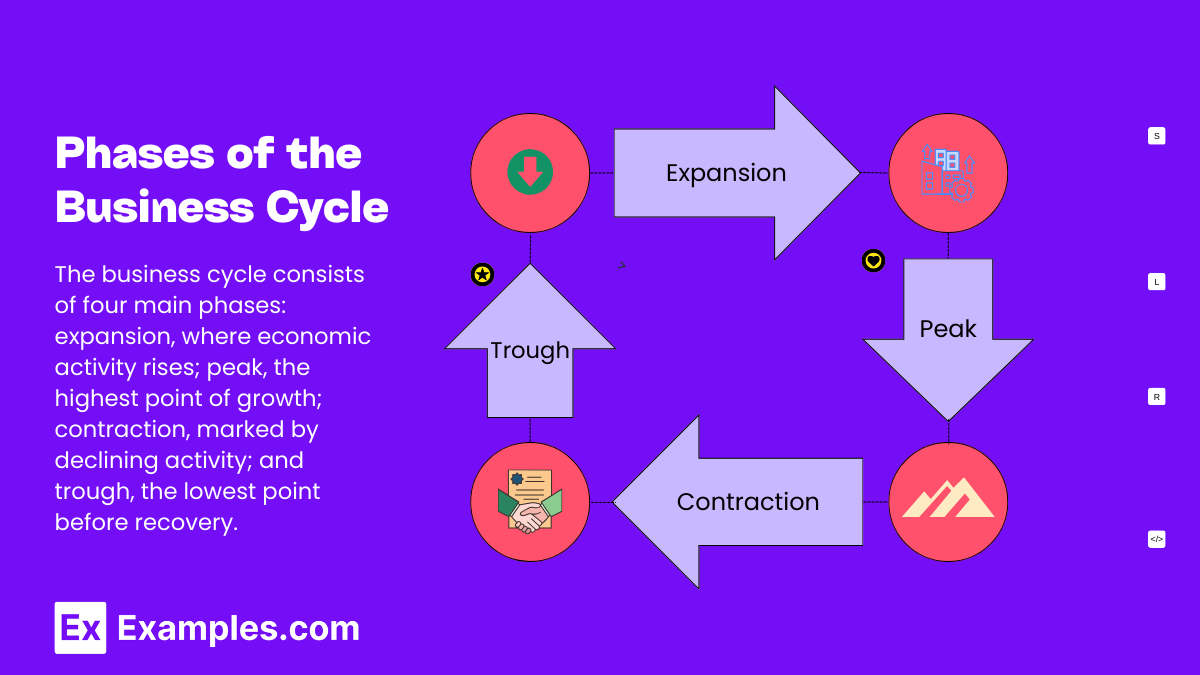

1. Phases of the Business Cycle

There are four main phases of the business cycle:

A. Expansion

Definition: This phase is marked by an increase in economic activity across various sectors.

Characteristics:

- Rising GDP: The gross domestic product (GDP) grows as consumer and business spending increases.

- High Employment: Unemployment rates decrease as businesses expand and hire more workers.

- Rising Investment: Investment in capital goods (machinery, infrastructure) increases.

- Inflation Pressure: With increased demand for goods and services, prices tend to rise.

B. Peak

Definition: The peak is the highest point of economic activity before a downturn.

Characteristics:

- Maximal Output: The economy is producing at its full capacity.

- High Inflation: Price levels are high as demand peaks.

- Overheating: Economic growth may outpace sustainable levels, leading to potential inflationary pressures.

C. Contraction (Recession)

Definition: A downturn in the economy characterized by declining output and economic activity.

Characteristics:

- Falling GDP: Economic output declines, and businesses reduce production.

- Rising Unemployment: Firms lay off workers due to decreased demand for goods and services.

- Lower Consumer Spending: With less disposable income, consumer spending decreases.

- Deflation Risk: In severe cases, prices may start to fall, leading to deflation.

D. Trough

Definition: The lowest point of the business cycle, where economic activity bottoms out.

Characteristics:

- Low GDP: Output is at its lowest, but the economy is starting to stabilize.

- High Unemployment: Unemployment is at its peak, but the rate of decline is slowing.

- Potential for Recovery: The economy begins to show early signs of recovery, with stabilizing prices and increased investment.

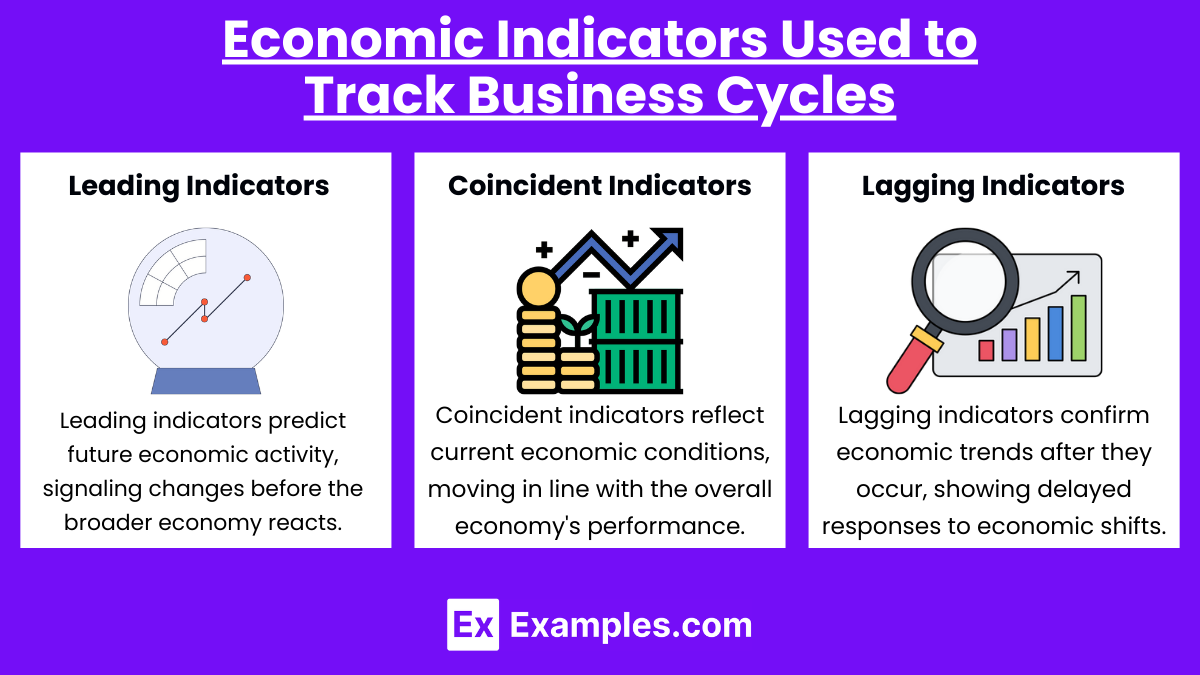

2. Economic Indicators Used to Track Business Cycles

Economic indicators help to gauge where the economy is within the business cycle. They are divided into three types:

A. Leading Indicators

These indicators signal future changes in the economy.

Examples:

- Stock market performance

- Consumer confidence index

- New orders for capital goods

- Building permits

B. Coincident Indicators

These indicators reflect the current state of the economy.

Examples:

- GDP

- Industrial production

- Employment levels

- Personal income

C. Lagging Indicators

These indicators show economic trends after they have already occurred.

Examples:

- Unemployment rate

- Inflation rate

- Consumer debt levels

3. Factors That Influence Business Cycles

Several factors can influence the movement of the business cycle. Understanding these helps explain why economies enter expansion or contraction.

A. Aggregate Demand and Supply

Fluctuations in aggregate demand and aggregate supply drive the phases of the business cycle. Increases in aggregate demand can lead to economic expansion, while decreases can result in contraction. Similarly, changes in aggregate supply, such as technological advancements or disruptions, can affect output and prices.

B. Government Policies

Fiscal and monetary policies can influence the business cycle. During a recession, governments may implement expansionary fiscal policy, such as increasing spending or cutting taxes, to stimulate the economy. Central banks may use monetary policy, such as lowering interest rates, to encourage borrowing and investment.

C. External Shocks

Unanticipated events like natural disasters, wars, or global pandemics can disrupt economic activity, leading to contractions or recessions. Conversely, positive external shocks, such as new technologies or discoveries of natural resources, can spur expansions.

D. The Role of the Business Cycle in Economic Policy

Understanding the business cycle helps policymakers and central banks make informed decisions to stabilize the economy. Counter-cyclical policies are designed to moderate the fluctuations of the business cycle.

- Expansionary Policy: Implemented during a contraction to stimulate economic growth by increasing government spending, cutting taxes, or lowering interest rates.

- Contractionary Policy: Used during an expansion to control inflation by reducing government spending, raising taxes, or increasing interest rates.

Examples

Example 1: The Great Depression (1929-1939)

A prolonged economic contraction marked by severe declines in GDP and employment. It lasted a decade and was followed by gradual recovery during the late 1930s.

Example 2: The Post-World War II Boom

Following World War II, the U.S. experienced rapid economic expansion driven by increased industrial output, consumer demand, and government spending, leading to sustained growth.

Example 3: The 2008 Financial Crisis

Caused by a housing market collapse, this recession saw declining GDP, rising unemployment, and widespread bank failures, with recovery spurred by government interventions and stimulus packages.

Example 4: The Dot-Com Bubble Burst (2001)

After rapid growth in tech investments, the economy contracted sharply when the bubble burst, leading to a recession that primarily affected the technology sector and related industries.

Example 5: The COVID-19 Recession (2020)

Global economic activity sharply contracted due to lockdowns, disrupted supply chains, and reduced consumer spending, followed by a swift recovery fueled by fiscal stimulus and vaccination efforts.

MCQs

Question 1

What happens when the price of a good decreases, assuming all other factors remain constant?

A) Demand decreases

B) Supply increases

C) Quantity demanded increases

D) Quantity supplied increases

Answer: C) Quantity demanded increases

Explanation: According to the law of demand, when the price of a good decreases, consumers will demand more of that good, increasing the quantity demanded.

Question 2

If the price of a substitute good rises, what happens to the demand for the original good?

A) Demand increases

B) Demand decreases

C) Supply increases

D) Quantity supplied decreases

Answer: A) Demand increases

Explanation: When the price of a substitute good rises, consumers will switch to the original good, leading to an increase in demand for the original product.

Question 3

What occurs when a price ceiling is set below the equilibrium price?

A) Surplus

B) Shortage

C) Equilibrium

D) Increased supply

Answer: B) Shortage

Explanation: A price ceiling set below equilibrium results in a shortage because the quantity demanded exceeds the quantity supplied at the lower price.