Crowding out is a key concept in fiscal policy and government finance that occurs when increased government spending leads to a reduction in private sector investment. In AP Macroeconomics, understanding how government borrowing raises interest rates and limits private investment is essential for analyzing economic outcomes. This concept highlights the potential limitations of expansionary fiscal policies, especially when the government runs budget deficits. Crowding out can impact long-term growth, making it a critical topic for evaluating the effectiveness of government interventions.

Learning Objectives

In studying “Crowding Out” for AP Macroeconomics, you will learn to analyze how increased government spending affects private investment through the mechanism of rising interest rates. You will understand the difference between complete and partial crowding out and evaluate the impact of fiscal policy on economic growth. You will also explore how economic conditions, government borrowing, and monetary policy responses influence the severity of crowding out, helping you critically assess the effectiveness of fiscal policies in different macroeconomic environments.

Introduction of Crowding Out

Crowding out refers to a situation where increased government spending leads to a reduction in private sector spending or investment. Concept of Crowding Out Crowding out typically occurs in the context of fiscal policy, particularly when the government increases its spending to stimulate economic growth. When the government finances this spending through borrowing (issuing bonds), it increases the demand for loanable funds in the financial market. As the demand for funds increases, interest rates rise, making it more expensive for businesses and households to borrow money.

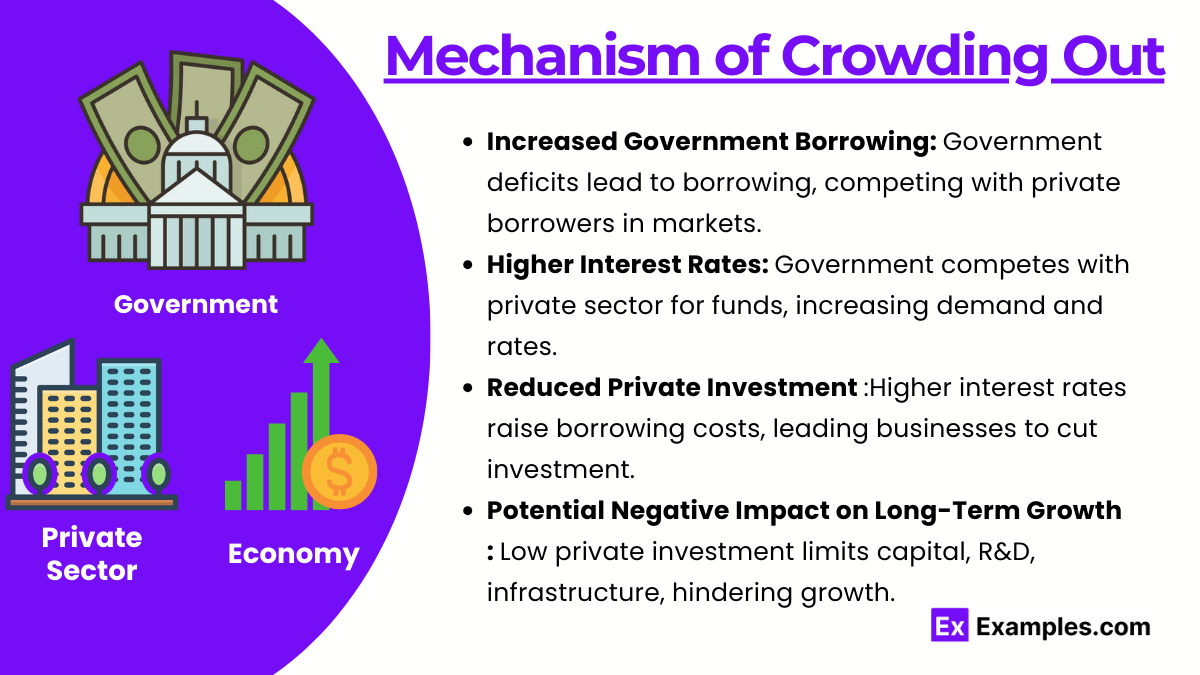

Mechanism of Crowding Out

- Increased Government Borrowing: When the government runs a budget deficit and borrows funds, it competes with private borrowers in the financial markets.

- Higher Interest Rates: The increased demand for funds leads to higher interest rates, as the government competes with the private sector for available financial resources.

- Reduced Private Investment: Higher interest rates make borrowing more costly for businesses, which may result in lower levels of private investment. This reduction in investment can offset the initial increase in government spending, negating some of the intended positive effects of fiscal stimulus.

- Potential Negative Impact on Long-Term Growth: Lower levels of private investment can harm long-term economic growth, as investment in capital goods, research and development, and infrastructure is essential for productivity improvements.

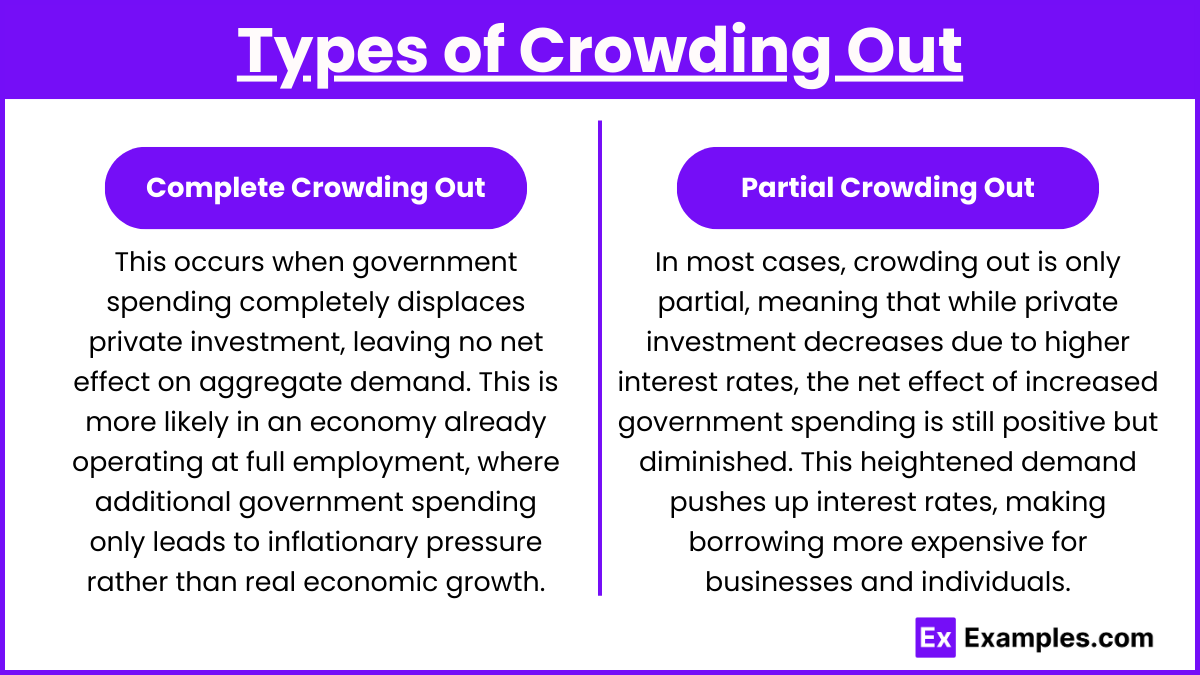

Types of Crowding Out

- Complete Crowding Out: This occurs when government spending completely displaces private investment, leaving no net effect on aggregate demand. This is more likely in an economy already operating at full employment, where additional government spending only leads to inflationary pressure rather than real economic growth.

- Partial Crowding Out: In most cases, crowding out is only partial, meaning that while private investment decreases due to higher interest rates, the net effect of increased government spending is still positive but diminished. This heightened demand pushes up interest rates, making borrowing more expensive for businesses and individuals.

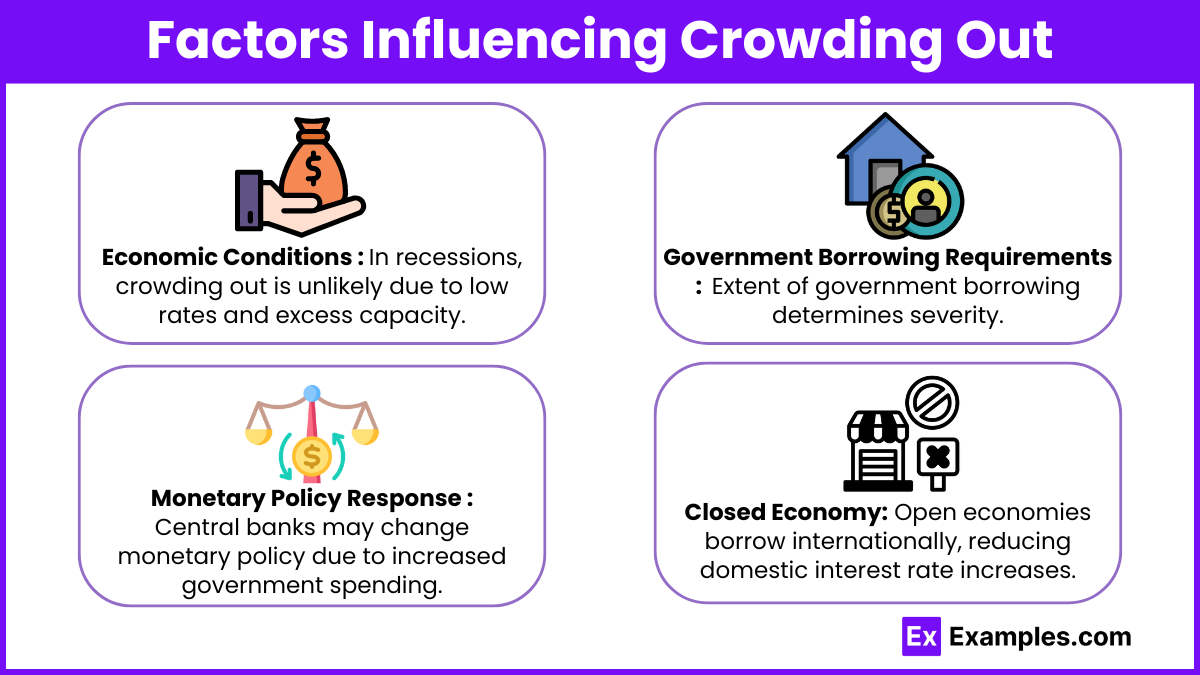

Factors Influencing Crowding Out

- Economic Conditions: In a recession, crowding out is less likely because interest rates are typically low, and there is excess capacity in the economy. Conversely, during periods of full employment, crowding out is more pronounced.

- Government Borrowing Requirements: The extent to which the government needs to borrow to finance spending plays a key role in determining how severe the crowding-out effect will be.

- Monetary Policy Response: Central banks may adjust their monetary policy in response to increased government spending. For example, if the central bank keeps interest rates low, the crowding-out effect may be mitigated.

- Open vs. Closed Economy: In an open economy with access to international financial markets, domestic interest rates may not rise as much because the government can borrow from abroad, reducing the crowding-out effect.

Crowding Out and Fiscal Policy

The crowding-out effect is a critical consideration when analyzing the effectiveness of fiscal policy. While expansionary fiscal policy can stimulate short-term growth, it may lead to higher interest rates and reduced private investment in the long run, thereby limiting its overall impact. Policymakers must balance the need for immediate economic stimulus with the potential long-term costs of higher public debt and reduced private sector growth.

Criticisms and Alternatives Some economists argue that crowding out is less of a concern in certain situations, such as during a liquidity trap, when interest rates are near zero and private sector investment is weak. In such cases, government spending can provide a much-needed boost to aggregate demand without significantly displacing private investment. Additionally, proponents of Modern Monetary Theory (MMT) argue that governments with sovereign currencies have more flexibility in borrowing and spending without triggering crowding out, especially when inflation is low.

Examples

Example 1: Government Infrastructure Projects

When a government decides to invest in large-scale infrastructure projects, such as building roads or bridges, it may finance this through borrowing. This increases the demand for loanable funds, causing interest rates to rise. As a result, businesses that rely on borrowing to fund their own construction or development projects may find it too expensive to secure loans, leading to a decrease in private sector investment in infrastructure.

Example 2: Military Spending During Wartime

During periods of conflict, governments often increase military spending to fund operations. This increased demand for funds can drive up interest rates. For example, during World War II, many countries significantly ramped up their borrowing to finance military expenditures, which in turn made it more costly for businesses to borrow money for investment. This led to a reduction in private sector activity, such as factory expansions or technological research.

Example 3: Expansionary Fiscal Policy in a Full-Employment Economy

When an economy is operating at or near full employment, increased government spending, such as through social programs or public works, may require borrowing that pushes up interest rates. In such a scenario, firms looking to invest in capital goods or new technologies face higher borrowing costs, which can lead them to scale back or delay their investments, resulting in crowding out of private sector growth.

Example 4: Public Debt and Rising Interest Rates

In a country with high levels of public debt, the government may need to borrow large sums of money to meet its fiscal obligations. This heavy borrowing increases competition for funds, leading to higher interest rates. As these rates rise, consumers may reduce borrowing for purchases such as homes or cars, and businesses may cut back on borrowing for expansion. This leads to a crowding out of private consumption and investment.

Example 5: Economic Stimulus Packages

In times of economic downturn, governments often introduce stimulus packages that include significant spending on unemployment benefits, healthcare, or direct payments to citizens. To finance these measures, the government may issue bonds, leading to increased demand for loanable funds. While the intention is to boost the economy, the higher interest rates that result from increased borrowing can make it more difficult for businesses to take out loans, thus crowding out private investment that could otherwise stimulate growth.

Multiple Choice Questions

Question 1

When the government increases its spending by borrowing, which of the following is a likely result in the economy?

A) Private investment will increase.

B) Interest rates will decrease.

C) Private sector investment will decrease.

D) Government bonds will become less attractive to investors.

Correct Answer: C) Private sector investment will decrease.

Explanation: When the government borrows to finance increased spending, it competes for available funds in the financial markets. This competition for loanable funds typically pushes up interest rates, making borrowing more expensive for the private sector. As a result, businesses may reduce their investment in new projects because the higher cost of borrowing lowers the expected profitability of their investments. This effect is referred to as “crowding out.” The other options are incorrect because higher government borrowing does not lead to increased private investment (A), lower interest rates (B), or make government bonds less attractive (D) — in fact, higher interest rates usually make bonds more attractive to investors.

Question 2

In which economic condition is crowding out most likely to be significant?

A) During a recession.

B) When the economy is at full employment.

C) When interest rates are low.

D) In a liquidity trap.

Correct Answer: B) When the economy is at full employment.

Explanation: Crowding out is most significant when the economy is operating at full employment. In such conditions, all available resources are already being used, so an increase in government spending does not lead to additional productive output. Instead, it raises demand for loanable funds, which leads to higher interest rates. These higher rates reduce private investment, as businesses are discouraged from borrowing due to increased costs. During a recession (A) or in a liquidity trap (D), interest rates tend to be low, and there is excess capacity in the economy, making crowding out less likely. In these scenarios, government spending is less likely to displace private sector investment.

Question 3

Which of the following could mitigate the crowding out effect when the government increases borrowing?

A) An increase in the central bank’s interest rates.

B) A rise in private sector demand for credit.

C) A reduction in private savings.

D) An accommodative monetary policy by the central bank.

Correct Answer: D) An accommodative monetary policy by the central bank.

Explanation: An accommodative monetary policy refers to actions taken by the central bank to keep interest rates low, such as increasing the money supply or purchasing government bonds. When the central bank pursues such a policy, it can offset the rise in interest rates caused by increased government borrowing. This helps reduce the crowding out effect by keeping borrowing costs for businesses and households lower, thus supporting private sector investment. The other options would not mitigate crowding out: an increase in interest rates (A) would worsen it, rising private demand for credit (B) would further push up interest rates, and a reduction in private savings (C) would limit the funds available for both public and private borrowing.