Money plays a crucial role in the economy, serving as a medium of exchange, a unit of account, and a store of value. In AP Macroeconomics, understanding the definition, measurement, and functions of money is essential for analyzing economic activities. Money can be classified into various types, including commodity and fiat money, and its supply is measured using categories like M1 and M2, reflecting its significance in facilitating transactions and economic stability.

Learning Objectives

For the topic of Definition, Measurement, and Functions of Money in AP Macroeconomics, you should aim to understand the different types of money, such as commodity and fiat money, and how they function within the economy. Additionally, focus on the various measures of money supply, like M1 and M2, and comprehend the critical roles money plays in facilitating transactions and maintaining economic stability.

Money

Money is any asset that can be used in the economy as a medium of exchange, a unit of account, and a store of value. It facilitates transactions and helps in pricing goods and services.

Types of Money

- Commodity Money: Has intrinsic value (e.g., gold, silver).

- Fiat Money: Has no intrinsic value but is established as money by government regulation (e.g., US dollars).

- Representative Money: Represents a claim on a commodity (e.g., gold certificates).

Measurement of Money

Money supply is typically measured in several ways:

1. M1: Includes the most liquid forms of money:

- Currency in circulation (coins and paper money)

- Demand deposits (checking accounts)

- Other liquid assets (traveler’s checks)

2. M2: Broader measure includes:

- M1 components

- Savings accounts

- Time deposits under $100,000

- Retail money market mutual funds

3. M3: Even broader measure includes:

- M2 components

- Large time deposits, institutional money market funds, and other larger liquid assets (though M3 is no longer reported by the Fed).

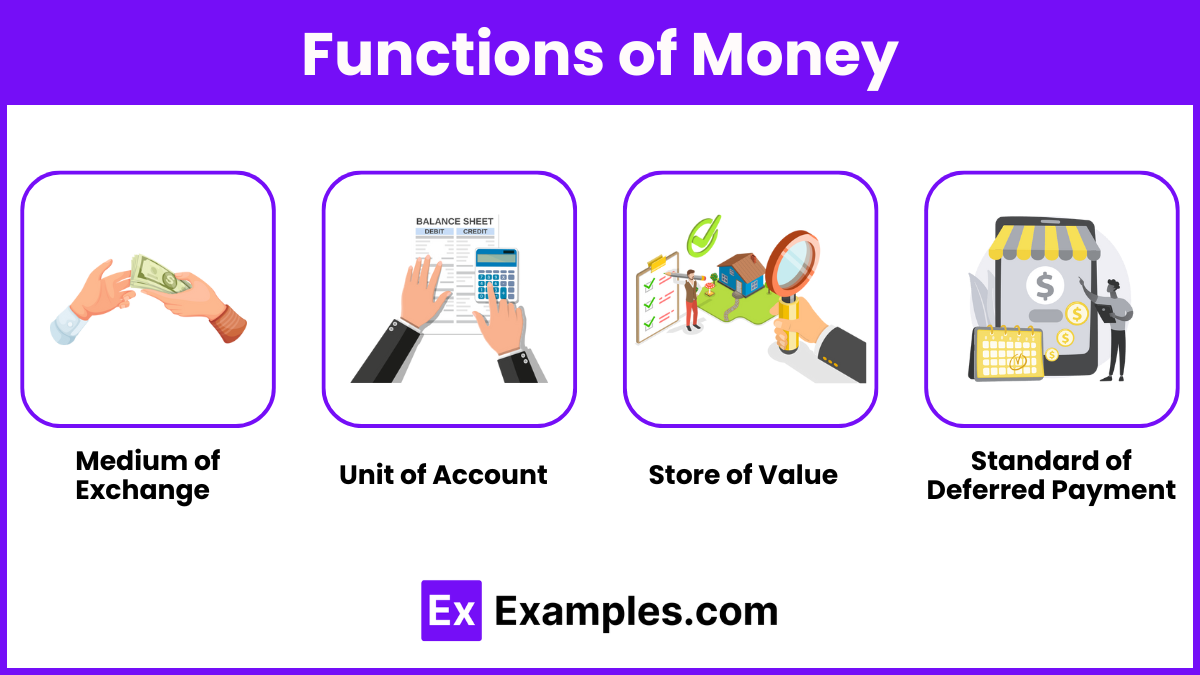

Functions of Money

- Medium of Exchange: Money facilitates transactions by eliminating the inefficiencies of barter. It is universally accepted for the purchase of goods and services.

- Unit of Account: Money provides a standard measure of value, which allows individuals and businesses to compare the worth of goods and services. This simplifies pricing and record-keeping.

- Store of Value: Money can retain its value over time, allowing individuals to save and defer consumption until later. It should maintain its purchasing power, though inflation can erode this function.

- Standard of Deferred Payment: Money can be used to settle debts over time, making it easier for individuals and businesses to engage in credit transactions.

Examples

Example 1: Commodity Money

Gold and silver coins are considered commodity money, as they have intrinsic value and can be used in trade for goods and services.

Example 2: Fiat Money

The US dollar is an example of fiat money, which has no intrinsic value but is accepted as legal tender by government decree.

Example 3: M1 Measurement

M1 includes the most liquid forms of money, such as currency in circulation and demand deposits, facilitating immediate transactions in the economy.

Example 4: M2 Measurement

M2 encompasses M1 plus savings accounts and time deposits under $100,000, providing a broader view of money available for spending and saving.

Example 5: Medium of Exchange

Money serves as a medium of exchange by allowing individuals to trade goods and services efficiently, eliminating the complexities of bartering.

MCQs

Question 1

Question: What happens to the demand for a good when its price decreases, ceteris paribus?

A) Demand decreases

B) Demand increases

C) Demand remains the same

D) Demand becomes perfectly inelastic

Answer: B) Demand increases

Explanation: According to the law of demand, when the price of a good falls, the quantity demanded typically increases, as consumers are more willing to purchase at lower prices.

Question 2

Question: If there is a surplus of a product in the market, what is likely to happen to its price?

A) The price will increase

B) The price will decrease

C) The price will remain constant

D) The price will fluctuate wildly

Answer: B) The price will decrease

Explanation: A surplus indicates that supply exceeds demand, leading sellers to lower prices to encourage sales and eliminate excess inventory.

Question 3

Question: Which of the following would likely cause a shift to the left in the demand curve for a product?

A) An increase in consumer income

B) A decrease in the price of a substitute good

C) A change in consumer preferences in favor of the product

D) An increase in the price of a complementary good

Answer: B) A decrease in the price of a substitute good

Explanation: If the price of a substitute good decreases, consumers may choose to buy the substitute instead, leading to a decrease in demand for the original product.