The foreign exchange market plays a crucial role in determining the value of currencies based on supply and demand. Changes in government policies, such as monetary and fiscal measures, and shifts in economic conditions can significantly impact exchange rates. For AP Macroeconomics, understanding how policies like interest rate adjustments, inflation control, and trade regulations affect the foreign exchange market is essential. These changes influence the balance of trade, investment flows, and overall economic health, making this a vital topic for comprehensive macroeconomic analysis.

Learning Objectives

When studying the Effects of Changes in Policies and Economic Conditions on the Foreign Exchange Market in AP Macroeconomics, you should focus on understanding how fiscal and monetary policies influence exchange rates. Learn how changes in interest rates, government spending, and taxation affect currency demand and supply. Explore the impact of economic indicators such as inflation, GDP growth, and employment on foreign investment and currency valuation. Additionally, examine how external factors like trade policies, political stability, and global economic conditions shape the dynamics of the foreign exchange market. Mastering these concepts will enable you to analyze and predict currency movements and their broader economic implications.

Effects of Changes in Policies and Economic Conditions on the Foreign Exchange Market

The foreign exchange (Forex) market is where currencies are traded, and the value of one currency in terms of another is determined by the forces of supply and demand. Economic conditions and government policies, such as monetary and fiscal policies, can significantly influence the exchange rates. These changes can lead to fluctuations in exchange rates, which in turn affect a country’s trade balance, investment flows, inflation rates, and overall economic performance. Understanding how these changes impact the Forex market is essential for analyzing the broader macroeconomic environment.

Monetary Policy and Exchange Rates

- Interest Rates and Capital Flows: A change in a country’s monetary policy, particularly changes in interest rates, affects the foreign exchange market. When a central bank increases interest rates, it often attracts foreign capital because investors seek higher returns. This inflow of capital increases demand for the domestic currency, causing it to appreciate. Conversely, a reduction in interest rates can lead to capital outflows and depreciation of the currency.

- Money Supply and Inflation: An expansionary monetary policy, which increases the money supply, typically results in lower interest rates and higher inflation. High inflation reduces a currency’s purchasing power, leading to depreciation. On the other hand, contractionary policies that reduce the money supply tend to increase interest rates and strengthen the currency due to lower inflation expectations.

Fiscal Policy and Exchange Rates

- Government Spending and Exchange Rates: An increase in government spending can lead to higher demand for domestic goods and services, which might attract foreign investment. This investment could increase the demand for the domestic currency, leading to appreciation. However, if the government’s spending leads to higher debt levels, investors may perceive increased risks, causing the currency to depreciate.

- Taxes and Currency Value: Changes in tax policies also impact exchange rates. Lower taxes can stimulate consumption and investment, possibly increasing economic growth. This can lead to higher demand for domestic currency as foreign investors seek opportunities. Higher taxes, on the other hand, may reduce the attractiveness of investment in the domestic economy, leading to depreciation.

Trade Policies and Exchange Rates

- Tariffs and Quotas: Protectionist trade policies, such as tariffs and import quotas, can influence exchange rates by altering the balance of trade. If a country reduces imports through tariffs, demand for foreign currencies decreases, potentially leading to an appreciation of the domestic currency. However, if other countries retaliate with their own tariffs, it can reduce exports and lead to depreciation.

- Free Trade Agreements: Liberalizing trade policies through free trade agreements tends to increase international trade and investment. This can increase the demand for foreign currency, depending on the country’s trade dynamics, affecting the exchange rate in complex ways.

Changes in Economic Conditions

- Recession and Currency Depreciation: In times of economic downturn or recession, investors often seek safer assets, leading to a decrease in demand for currencies of countries with struggling economies. This causes the domestic currency to depreciate.

- Boom and Currency Appreciation: During periods of economic growth, the domestic currency tends to appreciate as demand for domestic goods and services rises, attracting foreign investment. This increases demand for the domestic currency in the foreign exchange market.

- Inflation: Countries experiencing high inflation generally see their currency lose value, as the purchasing power of the currency declines relative to other currencies. In contrast, countries with low inflation typically see their currency appreciate.

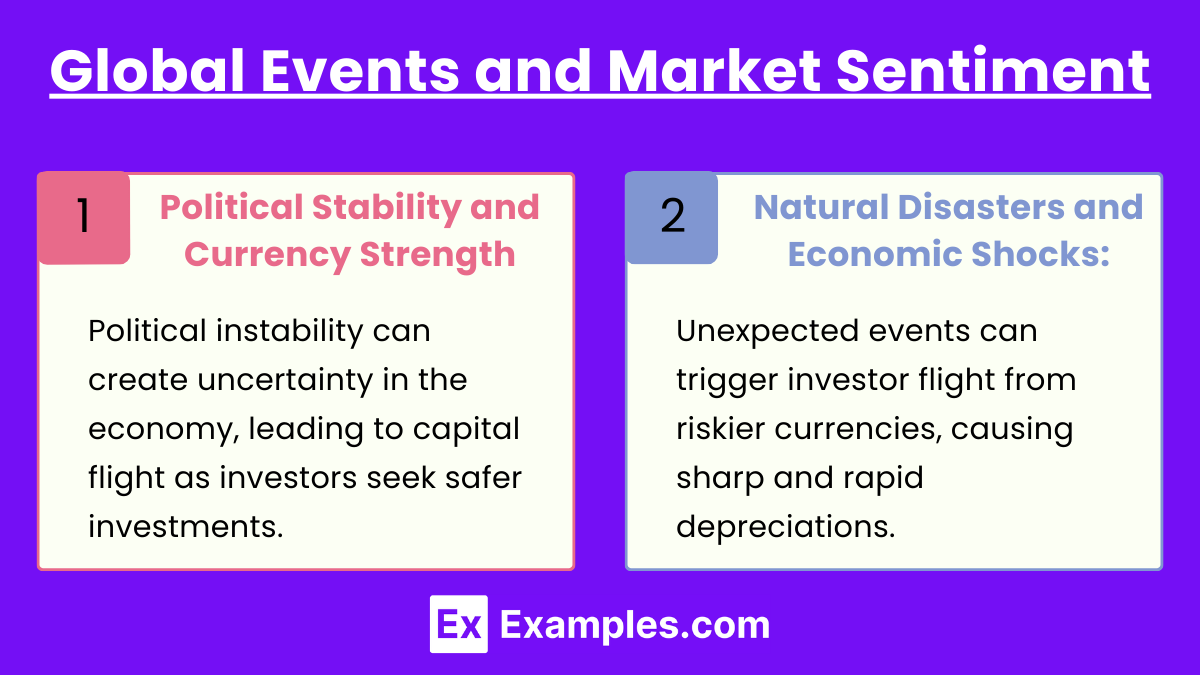

Global Events and Market Sentiment

- Political Stability and Currency Strength: Political instability can create uncertainty in the economy, leading to capital flight as investors seek safer investments. This results in the depreciation of the domestic currency. In contrast, political stability enhances investor confidence, leading to appreciation.

- Natural Disasters and Economic Shocks: Unexpected events such as natural disasters, pandemics, or economic crises can cause investors to flee from riskier currencies, leading to sharp depreciations. For instance, during the COVID-19 pandemic, many emerging market currencies experienced significant depreciation due to economic disruptions.

Examples

Example 1: The Effect of Interest Rate Increases by the U.S. Federal Reserve

When the U.S. Federal Reserve raises interest rates to combat inflation, it makes U.S. assets more attractive to foreign investors. This increases demand for the U.S. dollar, leading to an appreciation of the dollar against other currencies. As a result, American exports become more expensive for foreign consumers, and imports become cheaper for Americans, potentially impacting the trade balance.

Example 2: Impact of Expansionary Fiscal Policy in Japan

If the Japanese government decides to increase spending through expansionary fiscal policy, this can lead to higher economic growth but may also increase government debt. If investors become concerned about the rising debt levels, they might sell Japanese assets, leading to a depreciation of the yen. The weaker yen would make Japanese exports more competitive but could increase the cost of imports, affecting inflation in Japan.

Example 3: Effect of Brexit on the British Pound

The United Kingdom’s decision to leave the European Union (Brexit) in 2016 created political and economic uncertainty. Investors feared the potential economic consequences, leading to a sell-off of the British pound. As a result, the pound depreciated significantly against other major currencies, such as the U.S. dollar and the euro. The weaker pound made U.K. exports cheaper but raised the cost of imports, contributing to inflation.

Example 4: Trade Tariffs Between the U.S. and China

During the U.S.-China trade war, both countries imposed tariffs on each other’s goods. These tariffs disrupted trade flows and increased uncertainty in global markets. In response, the Chinese yuan depreciated against the U.S. dollar, partly as a result of reduced demand for Chinese exports and economic uncertainty. A weaker yuan helped cushion the impact of tariffs on Chinese exports by making them cheaper, but it increased import costs for China.

Example 5: Economic Recession in Argentina and Currency Depreciation

In the early 2000s, Argentina experienced a severe economic recession, leading to widespread capital flight as investors lost confidence in the country’s ability to repay its debt. The Argentine peso rapidly depreciated in the foreign exchange market, as demand for the currency plummeted. This depreciation further worsened inflation in Argentina, as the cost of importing goods rose dramatically, leading to an economic crisis.

Multiple Choice Questions

Question 1

Which of the following factors is most likely to cause the domestic currency to appreciate in a floating exchange rate system?

A) An increase in domestic interest rates relative to foreign interest rates.

B) A decrease in domestic productivity compared to other countries.

C) An increase in government spending without corresponding tax increases.

D) A decrease in foreign demand for domestic exports.

Answer: A) An increase in domestic interest rates relative to foreign interest rates.

Explanation: In a floating exchange rate system, the value of the domestic currency is determined by supply and demand in the foreign exchange market. An increase in domestic interest rates relative to foreign interest rates attracts foreign capital as investors seek higher returns. This inflow of capital increases the demand for the domestic currency, leading to its appreciation.

- Option B: A decrease in domestic productivity would likely reduce foreign demand for domestic goods, decreasing demand for the domestic currency and causing depreciation.

- Option C: An increase in government spending without tax increases can lead to higher deficits, potentially weakening the currency due to concerns over fiscal sustainability.

- Option D: A decrease in foreign demand for exports reduces demand for the domestic currency, leading to depreciation.

Question 2

Under a fixed exchange rate system, which of the following actions can a country’s central bank take to prevent its currency from depreciating?

A) Increase domestic interest rates.

B) Sell foreign reserves and buy domestic currency.

C) Reduce government spending to lower the budget deficit.

D) Implement capital controls to restrict foreign investment.

Answer: B) Sell foreign reserves and buy domestic currency.

Explanation: In a fixed exchange rate system, the central bank intervenes in the foreign exchange market to maintain the currency’s value at a predetermined level. If there is downward pressure on the currency (i.e., depreciation), the central bank can sell its foreign reserves (like US dollars) and buy its own domestic currency. This action reduces the supply of the domestic currency in the market, supporting its value and preventing depreciation.

- Option A: While increasing domestic interest rates can attract foreign capital, it is a less direct method compared to directly buying the currency.

- Option C: Reducing government spending may improve the fiscal situation, but it does not directly address immediate pressures on the currency’s value.

- Option D: Implementing capital controls can limit the outflow of capital, but selling foreign reserves is a more conventional and direct method for supporting the currency.

Question 3

If the U.S. dollar appreciates against the euro, what is the most likely immediate effect on the U.S. trade balance?

A) The trade balance will improve because exports become cheaper.

B) The trade balance will worsen because imports become more expensive.

C) The trade balance will worsen because exports become more expensive and imports become cheaper.

D) The trade balance will remain unchanged as exchange rates do not affect trade.

Answer: C) The trade balance will worsen because exports become more expensive and imports become cheaper.

Explanation: When the U.S. dollar appreciates against the euro, it means that the dollar has strengthened relative to the euro. As a result:

Option A: Incorrect because exports become more expensive, not cheaper.

Option B: Incorrect because while imports become cheaper, the trade balance worsens not because imports are more expensive.

Option D: Incorrect because exchange rates directly impact the relative prices of imports and exports, thereby affecting the trade balance.