Fiscal policy refers to the government's use of spending and taxation to influence the economy. In AP Macroeconomics, understanding fiscal policy is crucial for analyzing how these tools can affect aggregate demand, stabilize economic fluctuations, and achieve macroeconomic objectives like full employment and controlled inflation. It encompasses both expansionary and contractionary approaches to manage economic performance.

Free AP Macroeconomics Practice Test

Learning Objectives

Understand the principles and tools of fiscal policy, including the differences between expansionary and contractionary policies. Analyze the impact of government spending and taxation on aggregate demand, recognize automatic stabilizers, evaluate the multiplier effect, and assess the limitations and implications of fiscal policy in real-world scenarios.

Fiscal Policy

Definition: Fiscal policy involves government spending and taxation decisions aimed at influencing economic activity.

Goals: To achieve full employment, control inflation, and stimulate economic growth.

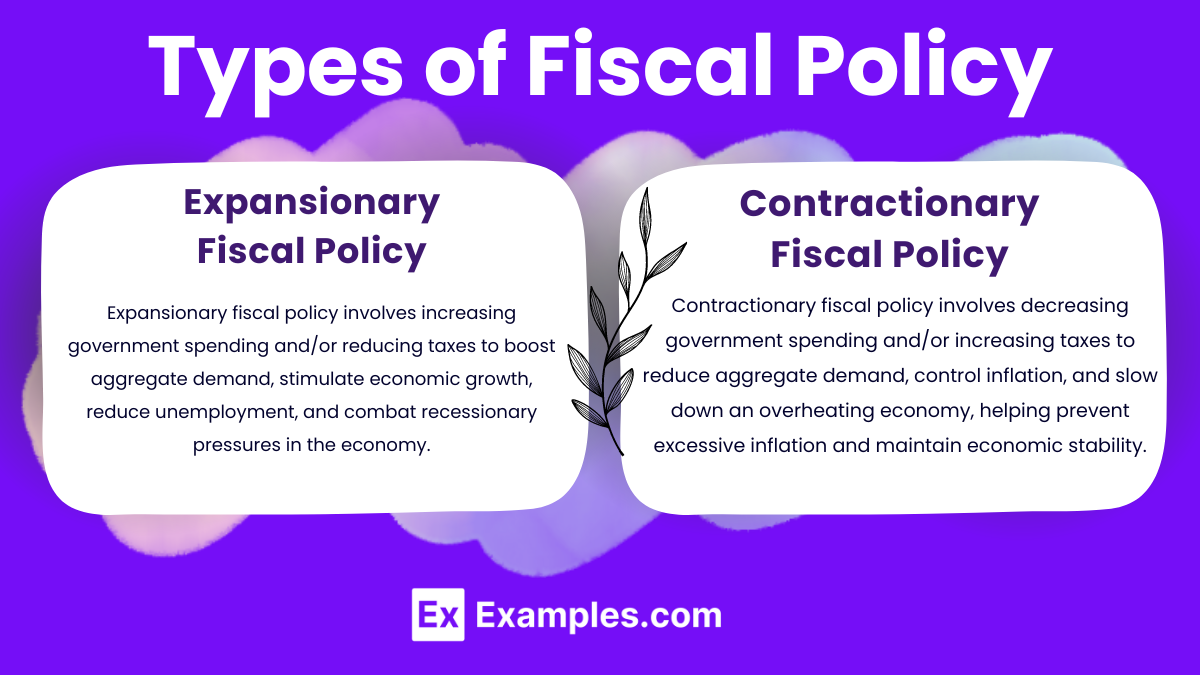

Types of Fiscal Policy

1. Expansionary Fiscal Policy:

Purpose: Used during recessions to increase aggregate demand.

Methods:

Increase government spending: Direct spending on infrastructure, education, etc.

Decrease taxes: Provides households and businesses with more disposable income.

2. Contractionary Fiscal Policy:

Purpose: Used to cool down an overheating economy and control inflation.

Methods:

Decrease government spending: Cutbacks in public services, programs, etc.

Increase taxes: Reduces disposable income, decreasing consumption and investment.

Components of Fiscal Policy

Government Spending: Direct impact on aggregate demand; includes spending on goods and services, social programs, and public projects.

Taxation: Affects disposable income and consumption levels; includes income tax, corporate tax, and sales tax.

Automatic Stabilizers

Definition: Economic policies and programs that automatically help stabilize an economy.

Examples:

Unemployment benefits: Increase during economic downturns.

Progressive tax systems: Higher taxes during economic booms, lower during recessions.

Multiplier Effect

Definition: The concept that an initial change in spending will lead to a larger change in overall economic activity.

Calculation: Multiplier = 1 / (1 - MPC), where MPC is the marginal propensity to consume.

Implication: Expansionary fiscal policy can lead to a greater than proportional increase in GDP.

Crowding Out

Definition: A situation where increased government spending leads to a reduction in private sector spending.

Mechanism: Higher government borrowing can lead to higher interest rates, discouraging private investment.

Limitations of Fiscal Policy

Time Lags: Recognition lag, implementation lag, and impact lag can delay the effects of fiscal policy.

Political Constraints: Political motivations may hinder timely and effective fiscal actions.

National Debt: Increased government spending can lead to higher national debt, raising concerns about long-term sustainability.

Examples

Example 1: Stimulus Package During a Recession

Governments increase spending on infrastructure projects to create jobs and boost consumer demand, helping the economy recover from a recession and reducing unemployment.

Example 2: Tax Cuts for Middle-Income Households

The government reduces income taxes for middle-income earners, increasing disposable income, encouraging consumer spending, and stimulating economic activity during periods of sluggish growth.

Example 3: Increased Defense Spending

During an economic downturn, governments allocate more funds to defense, creating jobs and contracts in the private sector, boosting demand, and spurring economic recovery.

Example 4: Raising Corporate Taxes to Control Inflation

To curb inflation, the government raises taxes on corporations, reducing their profit margins, discouraging investment, and slowing down an overheated economy.

Example 5: Unemployment Benefits Expansion

In a recession, governments expand unemployment benefits, providing financial support to individuals, maintaining consumer demand, and softening the economic impact of rising joblessness.

MCQs

Question 1

What happens when there is an increase in the price of a substitute good?

A) Demand for the original good increases

B) Demand for the original good decreases

C) Supply for the original good increases

D) Supply for the substitute good decreases

Answer: A) Demand for the original good increases

Explanation: When the price of a substitute good increases, consumers switch to the relatively cheaper original good, increasing its demand.

Question 2

What effect does a price ceiling below the equilibrium price have on a market?

A) It creates a surplus

B) It creates a shortage

C) It leads to an increase in supply

D) It has no impact

Answer: B) It creates a shortage

Explanation: A price ceiling below equilibrium prevents the price from rising, leading to higher demand than supply, thus creating a shortage.

Question 3

Which of the following will cause a movement along the demand curve?

A) A change in consumer preferences

B) A change in the price of the good

C) A change in income levels

D) A change in the price of a complementary good

Answer: B) A change in the price of the good

Explanation: A change in the price of the good itself leads to movement along the demand curve, whereas changes in other factors shift the curve.