Monetary policy is a critical aspect of economic management that involves the actions taken by a nation’s central bank to control the money supply and interest rates. In the context of AP Macroeconomics, understanding how monetary policy operates is essential for analyzing its effects on inflation, employment, and overall economic growth. By utilizing various tools such as open market operations, the discount rate, and reserve requirements, central banks aim to achieve their economic objectives, including stable prices and maximum employment.

Learning Objectives

In studying monetary policy for AP Macroeconomics, you should focus on understanding the definition and objectives of monetary policy, including how it aims to control inflation, unemployment, and economic growth. Learn to differentiate between expansionary and contractionary monetary policies, identify the tools used by central banks, such as open market operations and interest rate adjustments, and analyze the transmission mechanisms through which monetary policy affects the economy. Additionally, evaluate the effectiveness, goals, and limitations of monetary policy in real-world scenarios.

Introduction to Monetary Policy

Monetary policy refers to the actions undertaken by a nation’s central bank (in the U.S., the Federal Reserve) to control the money supply, interest rates, and overall economic activity. Its primary goals are to promote maximum employment, stabilize prices, and moderate long-term interest rates. Understanding monetary policy is crucial for analyzing how it impacts economic growth and inflation.

Types of Monetary Policy

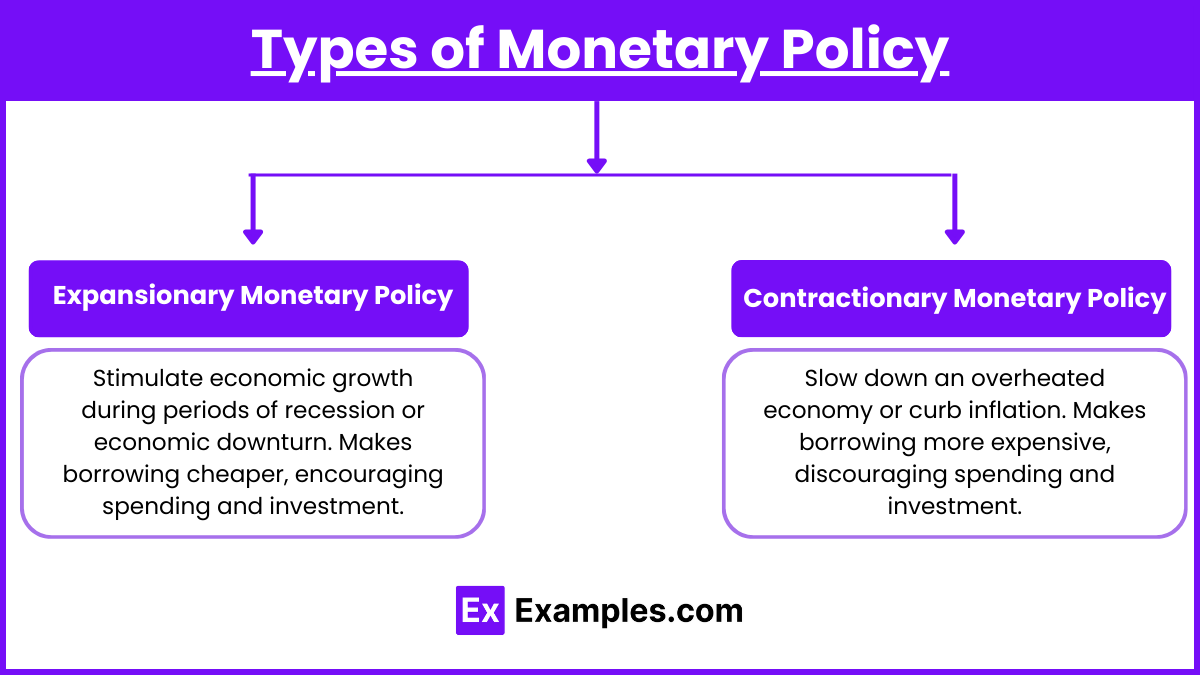

- Expansionary Monetary Policy:

- Objective: Stimulate economic growth during periods of recession or economic downturn.

- Methods:

- Lowering Interest Rates: Makes borrowing cheaper, encouraging spending and investment.

- Increasing Money Supply: The central bank buys government securities, injecting liquidity into the economy.

- Effects: Increased consumer spending, higher business investment, and potential inflation.

- Contractionary Monetary Policy:

- Objective: Slow down an overheated economy or curb inflation.

- Methods:

- Raising Interest Rates: Makes borrowing more expensive, discouraging spending and investment.

- Decreasing Money Supply: The central bank sells government securities, pulling liquidity out of the economy.

- Effects: Reduced consumer spending, lower business investment, and potential recession if applied too aggressively.

Tools of Monetary Policy

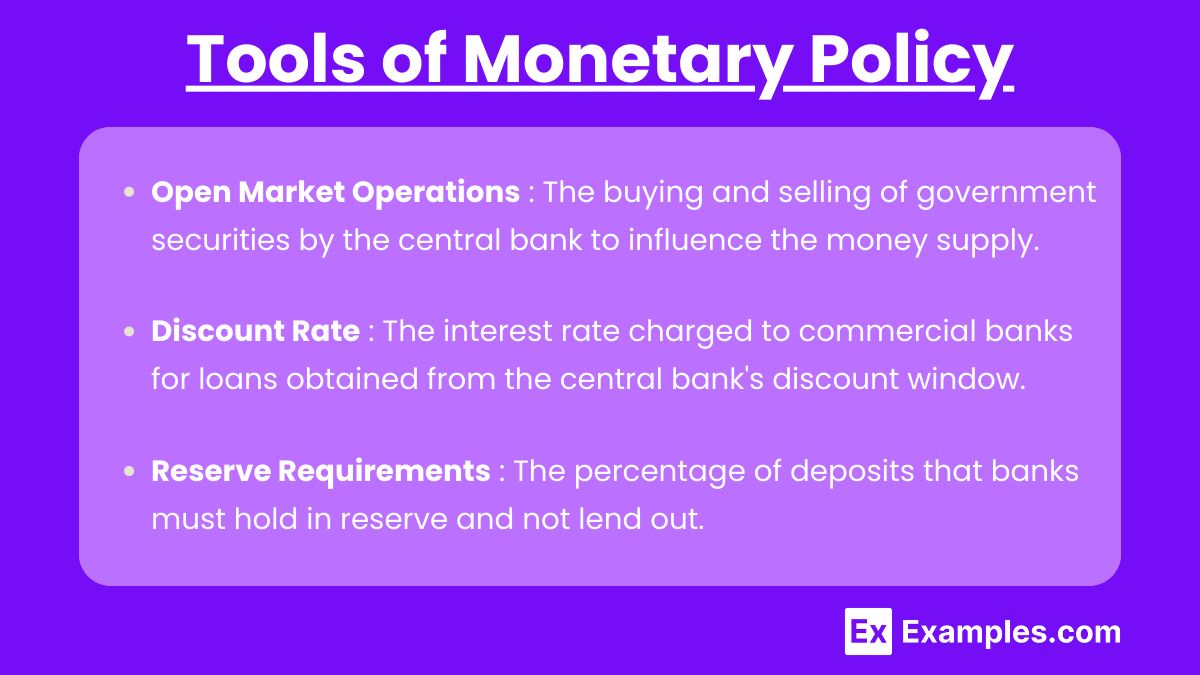

- Open Market Operations:

- The buying and selling of government securities by the central bank to influence the money supply.

- Buying Securities: Increases the money supply and lowers interest rates.

- Selling Securities: Decreases the money supply and raises interest rates.

- Discount Rate:

- The interest rate charged to commercial banks for loans obtained from the central bank’s discount window.

- A lower discount rate encourages banks to borrow more, increasing the money supply.

- A higher discount rate discourages borrowing, decreasing the money supply.

- Reserve Requirements:

- The percentage of deposits that banks must hold in reserve and not lend out.

- Lowering reserve requirements increases the money supply by allowing banks to lend more.

- Raising reserve requirements decreases the money supply by restricting lending.

Transmission Mechanism of Monetary Policy

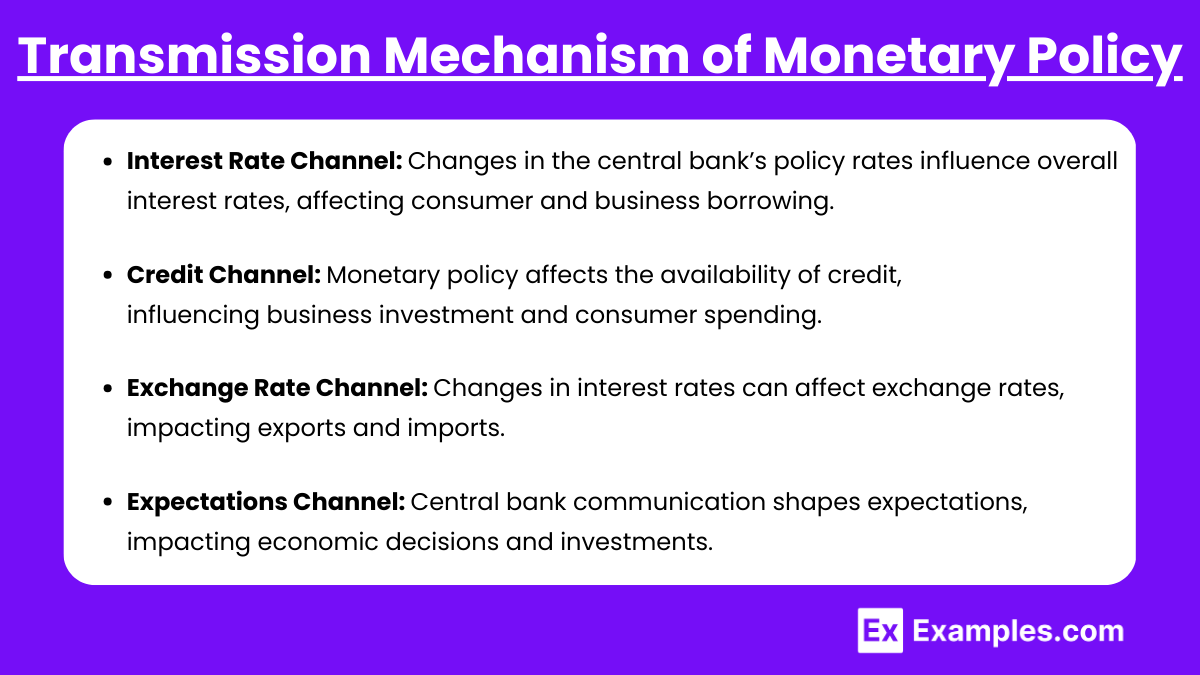

Monetary policy affects the economy through various channels:

- Interest Rate Channel: Changes in the central bank’s policy rates influence overall interest rates, affecting consumer and business borrowing.

- Credit Channel: Monetary policy affects the availability of credit, influencing business investment and consumer spending.

- Exchange Rate Channel: Changes in interest rates can affect exchange rates, impacting exports and imports.

- Expectations Channel: The central bank’s communication can shape public expectations about future economic conditions, influencing spending and investment decisions.

Recent Trends in Monetary Policy

- Quantitative Easing (QE): Post-2008 financial crisis, central banks adopted QE to inject liquidity directly into the economy through large-scale asset purchases. Quantitative Easing (QE) is an unconventional monetary policy tool used by central banks to stimulate the economy when traditional methods, like lowering interest rates, become ineffective.

- Negative Interest Rates: Some central banks have experimented with negative interest rates to encourage borrowing and spending. Negative interest rates represent an unconventional monetary policy tool where central banks set nominal interest rates below zero, effectively charging banks for holding excess reserves.

Examples

Example 1: Federal Reserve’s Interest Rate Cuts (2008 Financial Crisis)

In response to the 2008 financial crisis, the Federal Reserve significantly lowered the federal funds rate to near zero. This expansionary monetary policy aimed to stimulate economic growth by making borrowing cheaper for consumers and businesses. The intent was to encourage spending and investment to mitigate the recession’s impacts. This policy helped stabilize the financial system and fostered a gradual recovery.

Example 2: Quantitative Easing (QE) Programs

Following the 2008 crisis, the Federal Reserve implemented several rounds of quantitative easing. This involved purchasing large quantities of government securities and mortgage-backed securities to increase the money supply directly. By injecting liquidity into the financial system, the Fed aimed to lower long-term interest rates, support asset prices, and encourage lending, thereby promoting economic recovery and growth.

Example 3: Federal Reserve’s Rate Hikes (2015-2018)

As the economy showed signs of recovery and inflation began to rise, the Federal Reserve gradually increased interest rates from late 2015 through 2018. This contractionary monetary policy aimed to prevent the economy from overheating and keep inflation in check. The gradual rate hikes reflected a balancing act between supporting continued economic growth and curbing potential inflationary pressures.

Example 4: European Central Bank’s Negative Interest Rate Policy (2014)

In an effort to stimulate the Eurozone economy and combat low inflation, the European Central Bank (ECB) introduced a negative interest rate policy in 2014. This meant that banks were charged for holding excess reserves, incentivizing them to lend more. The goal was to encourage borrowing and spending, thereby supporting economic growth in the region during a period of stagnation.

Example 5: Bank of Japan’s Quantitative and Qualitative Easing (QQE)

The Bank of Japan (BoJ) implemented a unique monetary policy known as Quantitative and Qualitative Easing (QQE) starting in 2013. This approach involved large-scale asset purchases and commitments to keep interest rates low. The BoJ aimed to overcome deflationary pressures and achieve stable inflation, thereby revitalizing Japan’s stagnant economy. This policy has been a critical component of Japan’s economic strategy for years.

Multiple Choice Questions

Question 1

Which of the following actions would the Federal Reserve most likely take during a recession?

A) Raise the discount rate

B) Sell government securities

C) Lower the federal funds rate

D) Increase reserve requirements

Recommended Answer: C) Lower the federal funds rate

Explanation: During a recession, the Federal Reserve aims to stimulate economic activity. Lowering the federal funds rate decreases the cost of borrowing, encouraging consumers and businesses to spend and invest more. In contrast, raising the discount rate or selling government securities would tighten the money supply, which is not desirable in a recession. Increasing reserve requirements would also restrict lending, further contracting the economy.

Question 2

What is the primary goal of expansionary monetary policy?

A) Decrease the money supply

B) Control inflation

C) Increase employment and economic growth

D) Strengthen the currency

Recommended Answer: C) Increase employment and economic growth

Explanation: The primary goal of expansionary monetary policy is to stimulate the economy, which often includes increasing employment and promoting economic growth. This is achieved by lowering interest rates and increasing the money supply, which encourages borrowing and spending. Options A and B are associated with contractionary monetary policy, which aims to control inflation and decrease the money supply. Strengthening the currency (option D) is not a direct goal of expansionary policy.

Question 3

Which of the following best describes the term “quantitative easing”?

A) A method to decrease the federal funds rate

B) A form of contractionary monetary policy

C) Large-scale purchases of financial assets by a central bank

D) A strategy to raise reserve requirements

Recommended Answer: C) Large-scale purchases of financial assets by a central bank

Explanation: Quantitative easing (QE) is a non-traditional monetary policy tool used by central banks to stimulate the economy when standard monetary policy (like lowering interest rates) becomes ineffective, particularly in a liquidity trap. Through QE, the central bank purchases large quantities of financial assets, such as government bonds or mortgage-backed securities, to increase the money supply and lower interest rates. Options A and B do not accurately describe QE, and option D refers to tightening monetary policy rather than easing it.