In AP Macroeconomics, understanding the relationship between money growth and inflation is essential for analyzing economic stability. Money supply influences inflation rates, which affects purchasing power and overall economic health. As central banks adjust the money supply through various tools, the resulting changes can lead to demand-pull or cost-push inflation. Grasping these concepts helps students comprehend the complexities of monetary policy and its critical role in managing economic fluctuations, making it a vital area of study for the AP Macroeconomics Exam.

Learning Objectives

In studying “Money Growth and Inflation” for AP Macroeconomics, you should focus on understanding the relationship between money supply and inflation, including the mechanisms of demand-pull and cost-push inflation. Learn to analyze the role of central banks in regulating the money supply and the implications of inflation expectations. Additionally, explore the effects of hyperinflation and the tools used in monetary policy, such as open market operations and reserve requirements, to assess their impact on economic stability and growth.

In AP Macroeconomics, understanding the relationship between money growth and inflation is crucial for grasping how monetary policy influences the economy. This topic explores how changes in the money supply impact inflation rates, affecting purchasing power, interest rates, and overall economic stability.

Key Concepts

Money Supply (M)

Refers to the total amount of money available in an economy, including cash, coins, and balances held in checking and savings accounts. The money supply can be categorized into:

- M1: Includes the most liquid forms of money (cash and checking deposits).

- M2: Includes M1 plus savings accounts, money market accounts, and other near-money assets.

Inflation

Defined as the increase in prices of goods and services over time. It is measured by various indices, including the Consumer Price Index (CPI) and the Producer Price Index (PPI). Inflation can be categorized into:

- Demand-Pull Inflation: Caused by an increase in aggregate demand (AD) exceeding aggregate supply (AS).

- Cost-Push Inflation: Resulting from increased costs of production leading to decreased supply.

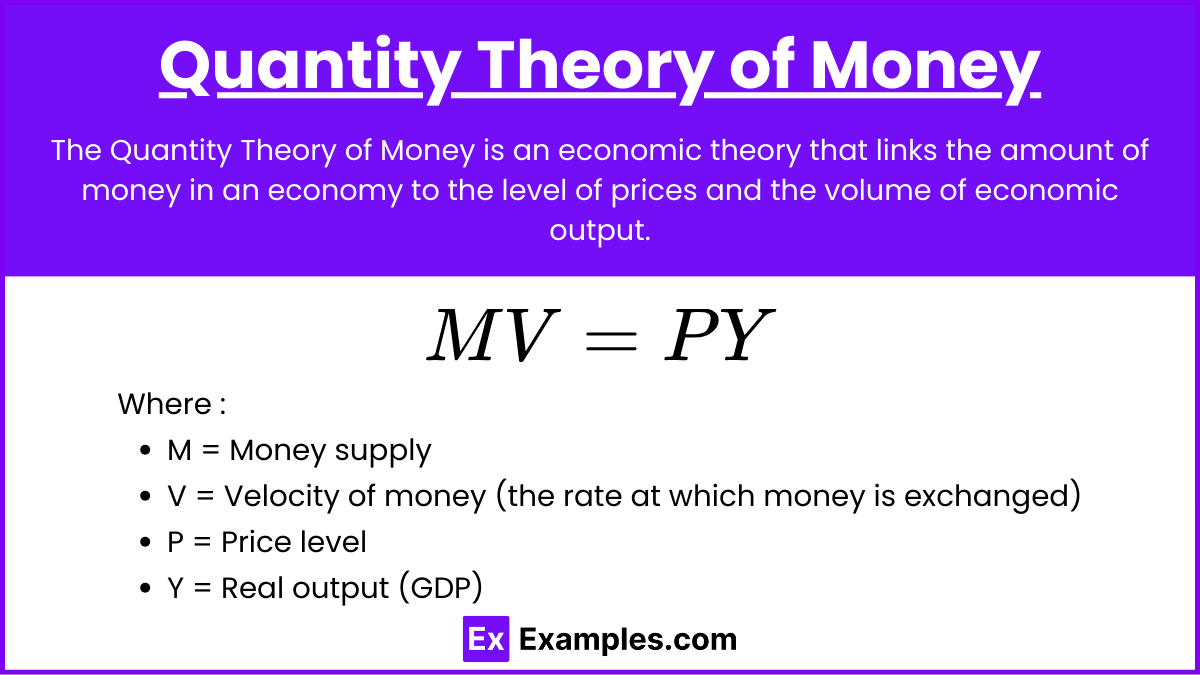

Quantity Theory of Money

The Quantity Theory of Money is an economic theory that links the amount of money in an economy to the level of prices and the volume of economic output. It is often summarized by the equation of exchange :

Expressed by the equation MV = PY, where:

- M = Money supply

- V = Velocity of money (the rate at which money is exchanged)

- P = Price level

- Y = Real output (GDP)

According to this theory, if the money supply increases (M) while velocity (V) and output (Y) remain constant, the price level (P) must rise, leading to inflation.

Monetary Policy

Central banks, like the Federal Reserve in the U.S., use monetary policy to control money supply and influence inflation. Key tools include:

- Open Market Operations: Buying and selling government securities to influence the money supply.

- Discount Rate: The interest rate charged to commercial banks for borrowing funds from the central bank, influencing lending rates and money supply.

- Reserve Requirements: The amount of funds banks must hold in reserve, affecting how much money they can create through lending.

Hyperinflation and Deflation

- Hyperinflation: An extreme form of inflation where prices rise rapidly, often exceeding 50% per month. It can lead to the collapse of the currency.

- Deflation: A decrease in the general price level of goods and services, which can result in reduced consumer spending and increased unemployment.

Implications of Money Growth on Inflation

- Short-Term vs. Long-Term Effects: In the short term, an increase in money supply may stimulate economic growth. However, if it outpaces economic output, it can lead to inflation. In the long term, persistent money growth without corresponding output increases will likely result in sustained inflation.

- Impact on Purchasing Power: Inflation reduces the purchasing power of money, meaning consumers can buy less with the same amount of money over time. This can erode savings and impact fixed-income earners.

Examples

Example 1. The Weimar Republic (Germany, 1921-1923)

Following World War I, Germany experienced severe economic hardships, including war reparations that led to excessive money printing. The government printed money to pay debts, resulting in hyperinflation. By late 1923, prices soared to astronomical levels, with a loaf of bread costing billions of marks. This historical instance exemplifies how unchecked money supply growth can lead to hyperinflation, eroding savings and destabilizing the economy.

Example 2. Zimbabwe (Late 2000s)

Zimbabwe faced one of the most notorious cases of hyperinflation in history, primarily due to the government’s excessive money printing to finance deficit spending. By 2008, inflation rates reached an estimated 89.7 sextillion percent. Basic goods became unaffordable, and the Zimbabwean dollar became nearly worthless. This scenario illustrates the disastrous effects of monetary policy mismanagement and the loss of confidence in a currency.

Example 3. The United States (1970s Stagflation)

During the 1970s, the U.S. faced stagflation, characterized by high inflation and stagnant economic growth. The Federal Reserve’s policies to stimulate the economy through increased money supply contributed to rising prices, while oil shocks and supply chain disruptions exacerbated the situation. Inflation peaked at over 13% in 1980, highlighting the complexities of managing money growth and inflation amidst external shocks and internal policy decisions.

Example 4. Japan’s Asset Price Bubble (Late 1980s)

In the late 1980s, Japan experienced a significant economic boom fueled by low-interest rates and excessive credit expansion. As the Bank of Japan increased the money supply, asset prices, particularly in real estate and stocks, skyrocketed. However, this led to a painful deflationary period in the 1990s when the bubble burst, demonstrating how rapid money growth can lead to inflated asset prices and subsequent economic downturns.

Example 5. The Great Recession and Quantitative Easing (2008-Present)

In response to the Great Recession, the Federal Reserve implemented quantitative easing (QE) to increase the money supply and stimulate economic growth. While this policy aimed to lower unemployment and support recovery, concerns arose about potential inflation as the economy began to recover. Although inflation remained relatively low for several years, the discussion around the long-term effects of expanded money supply remains relevant for understanding current macroeconomic challenges.

Multiple Choice Questions

Question 1

What is the primary effect of an increase in the money supply, assuming velocity and output remain constant?

A) Decrease in inflation

B) Increase in unemployment

C) Increase in the price level

D) Decrease in interest rates

Correct Answer: C) Increase in the price level

Explanation: According to the Quantity Theory of Money (MV = PY), if the money supply (M) increases while the velocity of money (V) and real output (Y) remain unchanged, it leads to a proportional increase in the price level (P). This is because more money chasing the same amount of goods and services typically results in higher prices. Thus, an increase in the money supply directly contributes to inflation.

Question 2

Which of the following best describes demand-pull inflation?

A) Rising production costs lead to higher prices.

B) Increased consumer demand outpaces supply, causing prices to rise.

C) Central banks decrease the money supply to combat inflation.

D) Long-term contracts stabilize prices despite fluctuations in demand.

Correct Answer: B) Increased consumer demand outpaces supply, causing prices to rise.

Explanation: Demand-pull inflation occurs when aggregate demand in the economy exceeds aggregate supply, leading to an increase in overall prices. This can happen due to various factors such as increased consumer spending, government expenditure, or investment. As demand outstrips supply, producers raise prices to balance the market, resulting in inflation.

Question 3

If a central bank conducts an expansionary monetary policy by lowering interest rates, what is likely to happen to inflation in the short run?

A) Inflation will decrease due to higher savings.

B) Inflation will remain unchanged as rates do not affect demand.

C) Inflation will likely increase as borrowing becomes cheaper.

D) Inflation will fall as consumer confidence declines.

Correct Answer: C) Inflation will likely increase as borrowing becomes cheaper.

Explanation: When a central bank lowers interest rates, it makes borrowing cheaper for consumers and businesses. This encourages increased spending and investment, leading to higher aggregate demand. In the short run, as demand rises, it can lead to upward pressure on prices, resulting in higher inflation. The relationship between lower interest rates and increased inflation is a key concept in understanding monetary policy and its effects on the economy.