The Circular Flow model illustrates the continuous movement of money, resources, and goods between households and firms in an economy, highlighting the interdependence of income and expenditure. In AP Macroeconomics, understanding this model is essential, as it underpins the calculation of GDP, which measures a nation’s total economic output and serves as a key indicator of economic health.

Learning Objectives

Learn how the circular flow model represents the flow of money, goods, and services in the economy, the role of households, firms, and the government, and the calculation of GDP using different approaches. Understand the differences between nominal and real GDP and GDP’s limitations.

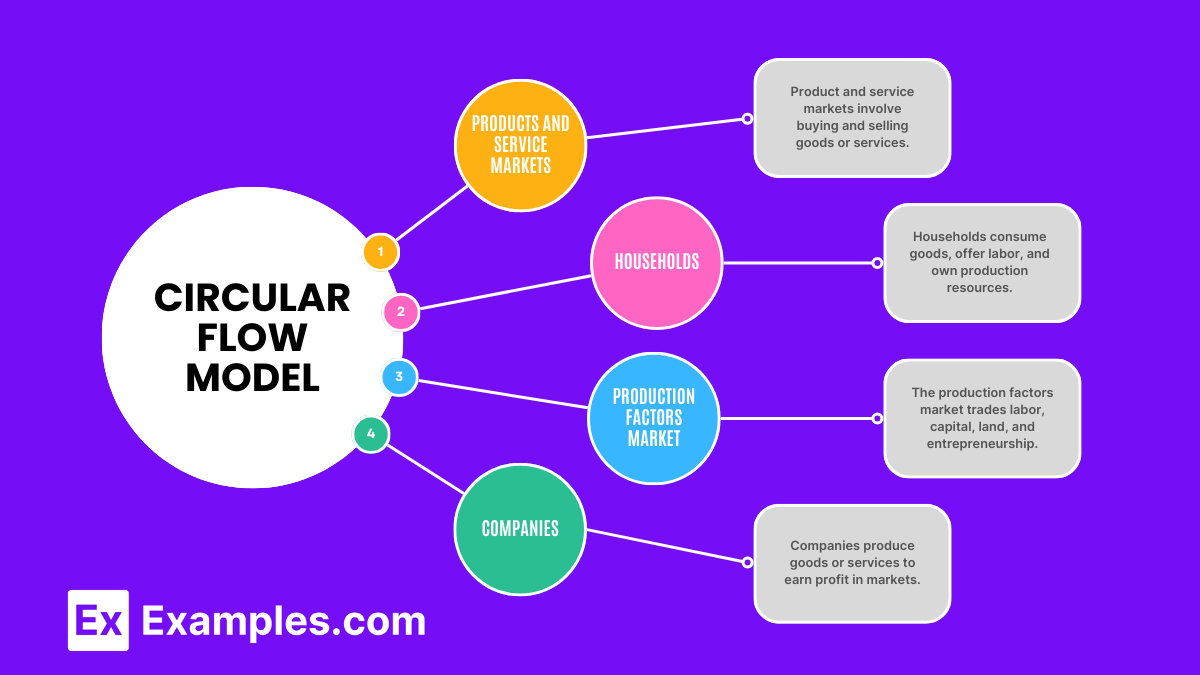

Circular Flow Model

The circular flow model represents the movement of goods, services, and money in an economy. It illustrates the interdependence between different economic agents—households, firms, the government, and the foreign sector. This model helps explain how income flows continuously between businesses and consumers in a functioning economy.

Key Players in the Circular Flow Model:

- Households: Own the factors of production (land, labor, capital, and entrepreneurship). They provide these resources to firms and receive wages, rent, interest, and profits in return.

- Firms: Use the factors of production to produce goods and services, which they sell to households and other sectors.

- Government: Collects taxes from households and firms and uses the revenue to provide public goods and services.

- Foreign Sector: Represents the international market, including exports (goods sold abroad) and imports (goods bought from abroad).

Markets in the Circular Flow Model:

- Factor Market: Where households sell labor and other factors of production to firms.

- Product Market: Where firms sell goods and services to households.

Flow of Money:

- Households → Firms: Payment for goods and services.

- Firms → Households: Wages, rent, interest, and profits.

Simplified Two-Sector Model:

In the basic two-sector circular flow, there are only households and firms. Here’s the flow:

- Households provide labor and other resources to firms through the factor market.

- Firms use these resources to produce goods and services and sell them back to households in the product market.

- The money spent by households becomes the revenue for firms, and the money paid by firms to households in wages becomes the income for households.

Leakages and Injections in the Circular Flow

- Leakages: These are factors that take money out of the circular flow. The main leakages are savings, taxes, and imports.

- Injections: These are factors that bring money into the economy. Key injections include investments, government spending, and exports.

Gross Domestic Product (GDP)

Gross Domestic Product (GDP) is the total market value of all final goods and services produced within a country’s borders during a specific period (usually a year).

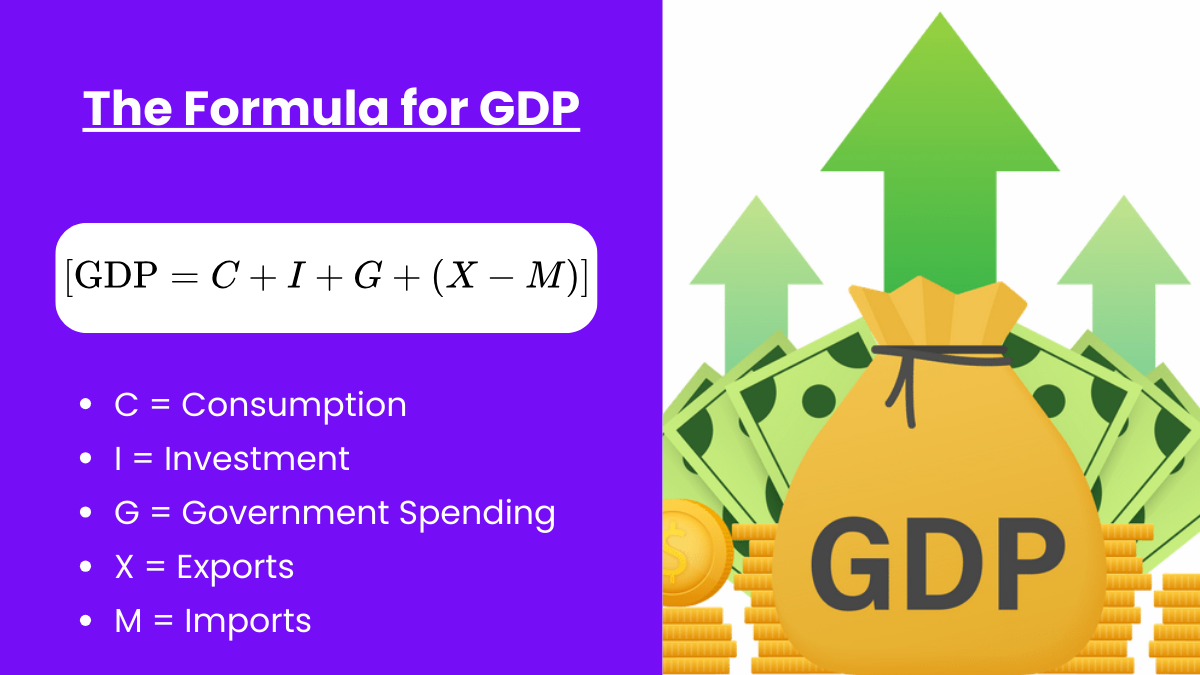

Four Components of GDP (Expenditure Approach):

- Consumption (C): Spending by households on goods and services.

- Investment (I): Spending on capital goods that will be used for future production (includes business investments, residential construction, and changes in inventories).

- Government Spending (G): Expenditure on goods and services by the government (excludes transfer payments like social security).

- Net Exports (NX): Exports minus imports (NX = Exports – Imports).

The Formula for GDP

![]()

- C = Consumption

- I = Investment

- G = Government Spending

- X = Exports

- M = Imports

Three Approaches to Calculating GDP:

- Expenditure Approach: Measures the total spending on final goods and services in the economy.

- Income Approach: Adds up all the incomes earned by households and firms in the production of goods and services.

- Production (or Value-Added) Approach: Measures the total value added at each stage of production for all goods and services.

Nominal vs. Real GDP:

- Nominal GDP: Measures the value of all final goods and services produced within a country at current market prices. It doesn’t account for inflation.

- Real GDP: Adjusted for inflation, giving a more accurate measure of the economy’s growth by using constant prices.

GDP Deflator:

The GDP deflator is a measure of the price level of all domestically produced goods and services in an economy. It is calculated as:

![]()

Examples

Example 1: Household Spending and Firm Revenue

Households purchase goods and services from firms, providing revenue that enables businesses to produce more, demonstrating the circular flow and boosting GDP.

Example 2: Wages Circulating Back into the Economy

Description: Firms pay wages to employees, who then spend their income on products, sustaining the circular flow of money and contributing to GDP.

Example 3: Government Taxation and Expenditure

The government collects taxes from households and firms, then injects funds back through public spending, affecting the circular flow and impacting GDP.

Example 4: Import and Export Activities

Through exports and imports, money flows in and out of an economy, altering the circular flow and influencing the net exports component of GDP.

Example 5: Investment via Financial Markets

Households save money in banks; these funds are lent to firms for investment, linking savings to production, affecting the circular flow and GDP growth.

MCQs

Question 1

In the circular flow model, households primarily:

- A) Supply goods and services to firms.

- B) Demand resources in the factor market.

- C) Supply resources and demand goods and services.

- D) Set fiscal policies to regulate the economy.

Answer: C) Supply resources and demand goods and services.

Explanation: Households provide factors of production (like labor) to firms in the factor market and receive income in return. They then use this income to purchase goods and services from firms in the product market.

Question 2

Which of the following is not included in the calculation of Gross Domestic Product (GDP) using the expenditure approach?

- A) Consumption

- B) Investment

- C) Government Spending

- D) Transfer Payments

Answer: D) Transfer Payments

Explanation: Transfer payments (such as social security benefits) are not included in GDP because they are not payments for goods or services but rather reallocations of income.

Question 3

In the circular flow model, firms receive revenue when:

- A) The government collects taxes.

- B) Households purchase goods and services.

- C) Firms pay wages to households.

- D) Banks provide loans to firms.

Answer: B) Households purchase goods and services.

Explanation: Firms earn revenue by selling goods and services to households in the product market, illustrating the flow of money in the economy.