Cost-Benefit Analysis (CBA) is a crucial tool in AP Microeconomics used to evaluate the relative strengths and weaknesses of different economic decisions. By systematically comparing the total expected costs against the total anticipated benefits, individuals and businesses can determine the most efficient and profitable choices. CBA encompasses both tangible factors, such as financial expenditures and revenues, and intangible elements like customer satisfaction and brand reputation. Mastering Cost-Benefit Analysis enables students to make informed decisions, optimize resource allocation, and understand the trade-offs inherent in economic activities.

Free AP Microeconomics Practice Test

Learning Objectives

By mastering Cost-Benefit Analysis (CBA) in AP Microeconomics, you will understand how to systematically evaluate the economic viability of decisions by identifying and quantifying explicit and implicit costs alongside monetary and non-monetary benefits. You will learn to apply marginal analysis to optimize resource allocation, assess opportunity costs, and utilize benefit-cost ratios and net benefits for informed decision-making. Additionally, you will develop the ability to critically analyze real-world scenarios, recognize the advantages and limitations of CBA, and effectively use relevant diagrams to illustrate economic concepts.

Cost-Benefit Analysis in Microeconomics

Cost-Benefit Analysis (CBA) is a fundamental tool in microeconomics used to evaluate the total anticipated costs versus the total expected benefits of one or more actions in order to choose the best or most profitable option. It is widely applied by individuals, businesses, and governments to make informed economic decisions.

Cost-Benefit Analysis (CBA) is a systematic process for calculating and comparing the benefits and costs of a decision, project, or policy. In microeconomics, CBA helps analyze choices at the individual or firm level by quantifying the advantages and disadvantages associated with different options.

Key Objectives of CBA:

Decision Making: Helps determine whether a particular action or investment is worthwhile.

Resource Allocation: Assists in allocating scarce resources efficiently to maximize benefits.

Policy Evaluation: Used by governments to assess the economic viability of policies or projects.

Components of Cost-Benefit Analysis

Costs in CBA are categorized into different types to provide a comprehensive view of the economic implications.

Explicit Costs:

Definition: Direct, out-of-pocket payments for resources or services.

Examples: Wages, rent, materials, utilities.

Illustration: If a company invests in new machinery, the purchase price and installation costs are explicit costs.

Implicit Costs:

Definition: Indirect costs representing the opportunity costs of using resources owned by the firm.

Examples: Foregone salary from not working elsewhere, using owner’s time.

Illustration: An entrepreneur investing their time into their business instead of earning a salary elsewhere.

Opportunity Costs:

Definition: The value of the next best alternative foregone when making a decision.

Examples: Choosing to produce one product over another, investing capital in one project instead of another.

Illustration: A farmer deciding to plant wheat instead of corn incurs the opportunity cost of the corn not produced.

Marginal Costs:

Definition: The additional cost incurred by producing one more unit of a good or service.

Examples: The cost of raw materials for one additional widget.

Illustration: If producing an extra unit of output requires additional labor or materials, those are the marginal costs.

Benefits of CBA

Benefits in CBA refer to the gains or advantages obtained from a decision or action.

Monetary Benefits:

Definition: Quantifiable financial gains.

Examples: Increased revenue, cost savings, higher profits.

Illustration: Implementing a new technology that reduces production costs increases monetary benefits.

Non-Monetary Benefits:

Definition: Benefits that are not directly quantifiable in monetary terms but still valuable.

Examples: Improved employee satisfaction, environmental benefits, enhanced reputation.

Illustration: Adopting environmentally friendly practices may improve a company's public image.

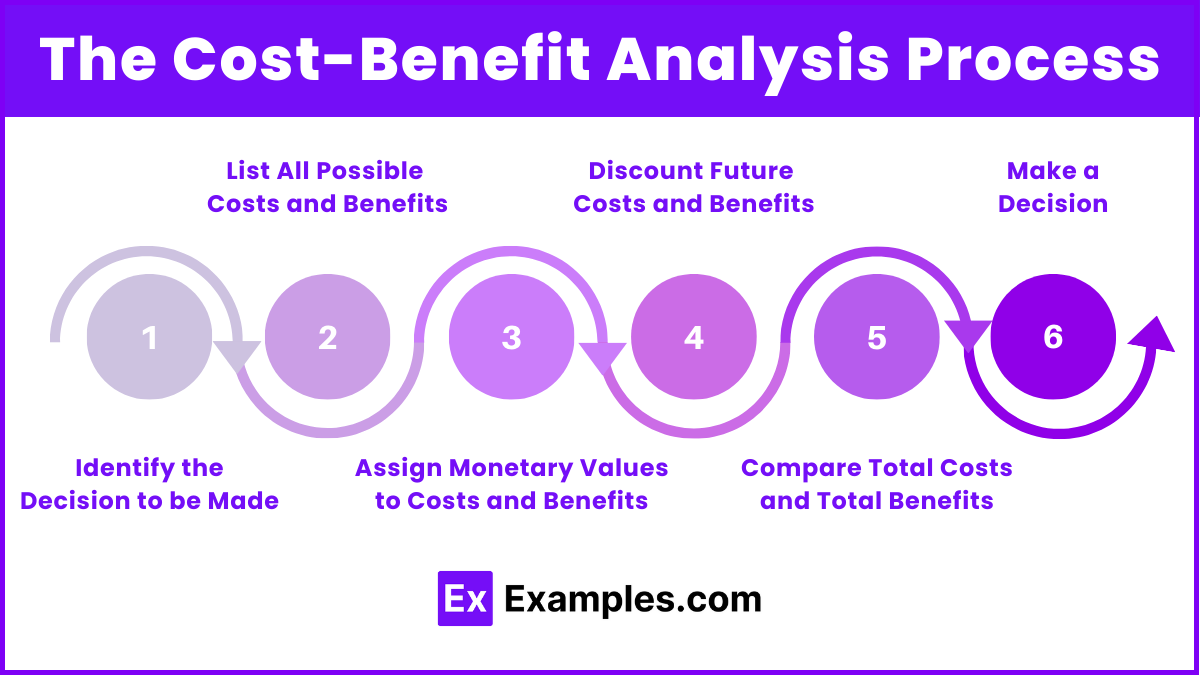

The Cost-Benefit Analysis Process

Conducting a CBA involves several systematic steps to ensure a thorough evaluation.

Step 1: Identify the Decision to be Made

Clearly define the problem or opportunity.

Determine the scope and boundaries of the analysis.

Step 2: List All Possible Costs and Benefits

Enumerate both explicit and implicit costs.

Identify all potential benefits, including non-monetary ones.

Step 3: Assign Monetary Values to Costs and Benefits

Quantify: Assign a dollar value to each cost and benefit where possible.

Valuation Methods: Use market prices, replacement costs, or willingness to pay methods for valuation.

Step 4: Discount Future Costs and Benefits

Time Value of Money: Future costs and benefits are often less valuable than present ones.

Discount Rate: Apply an appropriate discount rate to convert future values to present values.

Step 5: Compare Total Costs and Total Benefits

Net Benefit: Subtract total costs from total benefits.

Benefit-Cost Ratio (BCR): Divide total benefits by total costs.

Step 6: Make a Decision

Positive Net Benefit or BCR > 1: Proceed with the decision.

Negative Net Benefit or BCR < 1: Reconsider or reject the decision.

Opportunity Cost in CBA

Opportunity cost is a critical concept in CBA, representing the value of the next best alternative forgone.

Importance:

Ensures that all potential costs are considered.

Prevents overestimation of benefits by accounting for what is sacrificed.

Example:

If a student spends time studying for an economics exam, the opportunity cost might be the leisure time or time spent on another subject they forego.

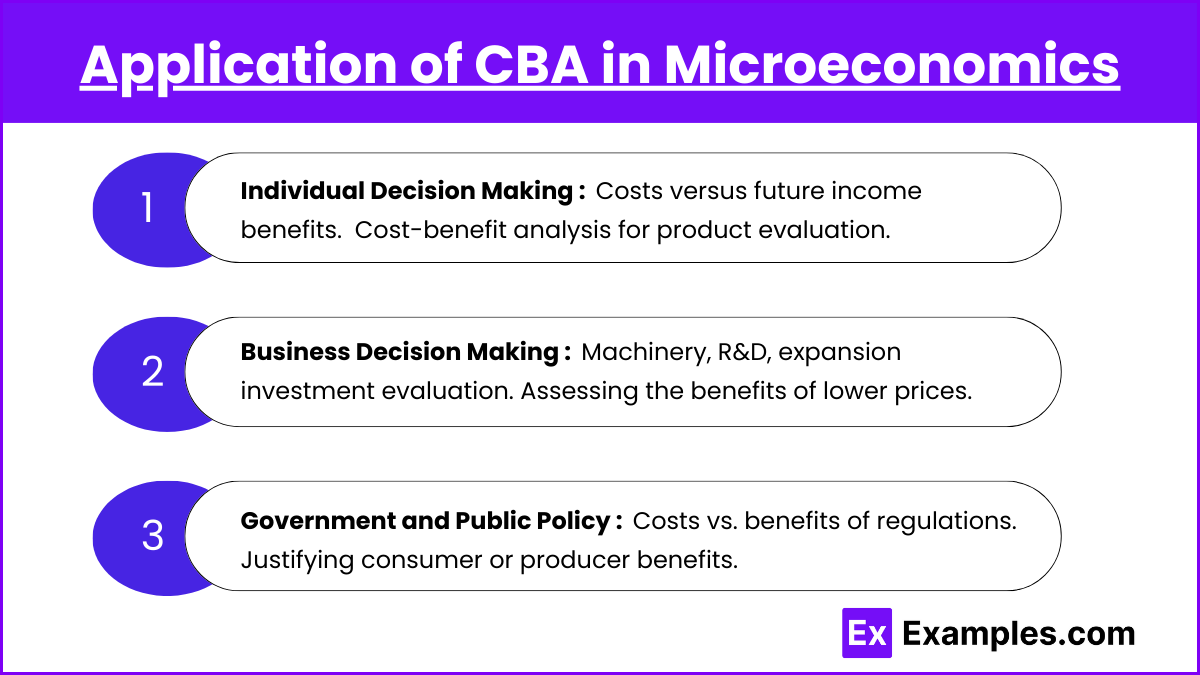

Application of CBA in Microeconomics

Individual Decision Making : Individuals use CBA to make personal choices, such as:

Education Investment: Weighing the costs of tuition and foregone earnings against the future benefits of higher income.

Purchasing Decisions: Comparing the costs of a product against the benefits it provides.

Business Decision Making :

Investment Decisions: Evaluating whether to invest in new machinery, research and development, or expansion projects.

Pricing Strategies: Assessing the benefits of lower prices (e.g., increased sales) against the costs (e.g., reduced profit margins).

Government and Public Policy : While more aligned with macroeconomics, some microeconomic policies involve CBA, such as:

Regulation: Evaluating the costs of implementing regulations against the benefits of improved safety or environmental outcomes.

Subsidies: Assessing whether the benefits to consumers or producers justify the cost to taxpayers.

Examples

Example 1. Individual Deciding to Pursue Higher Education

Jane is considering whether to enroll in a four-year college program. To make an informed decision, she conducts a cost-benefit analysis.

Costs:

Explicit Costs: Tuition fees of 2,000, and living expenses totaling 224,000.

Implicit Costs: Opportunity cost of not working full-time during these four years. If Jane could earn 120,000.

Benefits:

Monetary Benefits: Upon graduation, Jane expects to secure a job that pays 30,000 she could earn without a degree. Over her career, this higher income significantly outweighs the initial costs.

Non-Monetary Benefits: Enhanced knowledge, personal development, and increased job satisfaction.

Analysis:

Jane compares the total costs (120,000 = $344,000) against the projected benefits (higher lifetime earnings and personal growth). If the present value of her increased earnings exceeds the total costs, pursuing higher education is deemed beneficial.

Example 2. A Small Business Evaluating Expansion

Sarah owns a local bakery and is contemplating expanding her business by opening a second location

Costs:

Explicit Costs: Leasing a new storefront for 15,000, and hiring two new employees at 21,000, with ongoing monthly costs of $8,000.

Implicit Costs: Sarah’s time and effort diverted from managing the current bakery, potentially leading to reduced efficiency or personal time.

Benefits:

Monetary Benefits: Projected increase in monthly revenue by 180,000.

Non-Monetary Benefits: Enhanced brand presence, increased market share, and potential economies of scale.

Analysis: Sarah assesses whether the increased revenue (21,000 + ongoing $96,000 annually). If the net benefit is positive after accounting for all costs, expansion is a favorable decision.

Example 3. An Individual Choosing Between Leisure and Overtime Work

Mark works as a graphic designer and is offered the opportunity to work overtime, earning an additional $500 for the month. However, this requires sacrificing his leisure time.

Costs:

Explicit Costs: Minimal, as overtime work does not require additional financial expenditure.

Implicit Costs: Value of leisure time lost, which Mark estimates at $400 based on what he would enjoy doing during that time.

Benefits:

Monetary Benefits: Extra income of $500 for the month.

Non-Monetary Benefits: Potential for career advancement, increased job satisfaction, or future job security.

Analysis: Mark compares the additional income (400). The net benefit is $100, suggesting that taking the overtime opportunity is beneficial. Additionally, he considers non-monetary factors that might further influence his decision.

Example 4. A Manufacturing Firm Considering Automation

Scenario:

TechParts Inc., a manufacturing firm, is evaluating whether to automate one of its production lines to increase efficiency.

Costs:

Explicit Costs: Investment in automated machinery costing 20,000.

Implicit Costs: Potential job displacement for workers, which could lead to reduced morale or the need for retraining programs.

Benefits:

Monetary Benefits: Increased production capacity leading to higher sales revenue of 50,000 per year.

Non-Monetary Benefits: Enhanced production quality, consistency, and the ability to meet higher demand.

Analysis: TechParts Inc. calculates the total initial costs (150,000 + 200,000). The payback period is less than a year, and ongoing benefits surpass the costs, making automation a favorable investment.

Example 5. A Homeowner Deciding to Install Solar Panels

Emily is considering installing solar panels on her home to reduce electricity bills and contribute to environmental sustainability.

Costs:

Explicit Costs: Purchase and installation of solar panels amounting to $25,000.

Implicit Costs: Potential decrease in home resale value due to the modification or the time and effort required for installation coordination.

Benefits:

Monetary Benefits: Reduction in monthly electricity bills by 1,800 annually. Potential tax incentives and rebates totaling $5,000.

Non-Monetary Benefits: Environmental benefits from using renewable energy, increased energy independence, and enhanced property value in eco-conscious markets.

Analysis: Emily assesses the total costs (1,800 + 6,800) and the long-term savings and environmental impact. If the present value of future savings and benefits exceeds the initial investment, installing solar panels is a worthwhile decision.

Multiple Choice Questions

Question 1

Which of the following best exemplifies an implicit cost in a firm's cost-benefit analysis?

A) Payment for raw materials used in production.

B) Wages paid to hourly workers.

C) The salary the owner forgoes by not working elsewhere.

D) Rent paid for factory space.

Answer:

C) The salary the owner forgoes by not working elsewhere.

Explanation: Implicit costs represent the opportunity costs of using resources owned by the firm for which no direct payment is made. These are non-monetary costs reflecting the value of the next best alternative that is foregone.

Option A (Payment for raw materials) and Option D (Rent paid for factory space) are explicit costs because they involve direct, out-of-pocket payments.

Option B (Wages paid to hourly workers) is also an explicit cost since it involves actual cash payments to employees.

Option C correctly identifies an implicit cost: the opportunity cost of the owner's time. If the owner could earn a salary elsewhere but chooses to invest time in their own business instead, the forgone salary represents an implicit cost.

Question 2

A government is evaluating a new public transportation project. The total expected benefits are estimated at 4 million. What is the Benefit-Cost Ratio (BCR), and should the project be approved based on this ratio?

A) BCR = 0.8; Reject the project.

B) BCR = 1.25; Approve the project.

C) BCR = 1.25; Reject the project.

D) BCR = 0.8; Approve the project.

Answer: B) BCR = 1.25; Approve the project.

Explanation: The Benefit-Cost Ratio (BCR) is calculated by dividing the total benefits by the total costs.

Interpretation of BCR:

BCR > 1: Benefits exceed costs. The project is economically viable and should be approved.

BCR < 1: Costs exceed benefits. The project is not economically viable and should be rejected.

In this case, BCR = 1.25, which is greater than 1, indicating that the benefits outweigh the costs. Therefore, the project should be approved.

Question 3

During a cost-benefit analysis, a company is deciding whether to invest in new machinery. The Marginal Benefit (MB) of producing an additional unit with the new machinery is 40. According to marginal analysis, what should the company do?

A) Do not invest in the new machinery because MB > MC.

B) Invest in the new machinery because MB > MC.

C) Do not invest in the new machinery because MB < MC.

D) Invest in the new machinery only if MB equals MC.

Answer: B) Invest in the new machinery because MB > MC.

Explanation: Marginal Analysis involves comparing the additional benefits (Marginal Benefit, MB) to the additional costs (Marginal Cost, MC) of a decision.

If MB > MC: The additional benefit of the decision exceeds the additional cost, indicating that the decision is profitable and should be undertaken to maximize profit.

If MB < MC: The additional cost exceeds the additional benefit, suggesting that the decision is not profitable and should be avoided.

If MB = MC: The company is indifferent as the additional benefit equals the additional cost; no gain or loss occurs from the decision.

In this scenario:

50 > \text{MC} = \

Since the Marginal Benefit of producing an additional unit is greater than the Marginal Cost, the company should invest in the new machinery to increase production and maximize profits.