Externalities in AP Microeconomics refer to the unintended side effects of economic activities that affect third parties who are not directly involved in the transaction. These effects can be either positive or negative and often lead to market inefficiencies. Understanding externalities is crucial for analyzing how governments address market failures through interventions such as taxes, subsidies, and regulation.

Free AP Microeconomics Practice Test

Learning Objectives

In studying "Externalities" for AP Microeconomics, you should learn to identify positive and negative externalities and how they occur when a third party is affected by an economic transaction. Analyze the impact of externalities on market efficiency, exploring concepts like social cost, social benefit, and market failure. Evaluate government interventions, such as taxes, subsidies, and regulations, designed to correct externalities and restore economic efficiency. Additionally, explore real-world examples of externalities in various markets and understand how addressing externalities contributes to societal welfare and policy decisions.

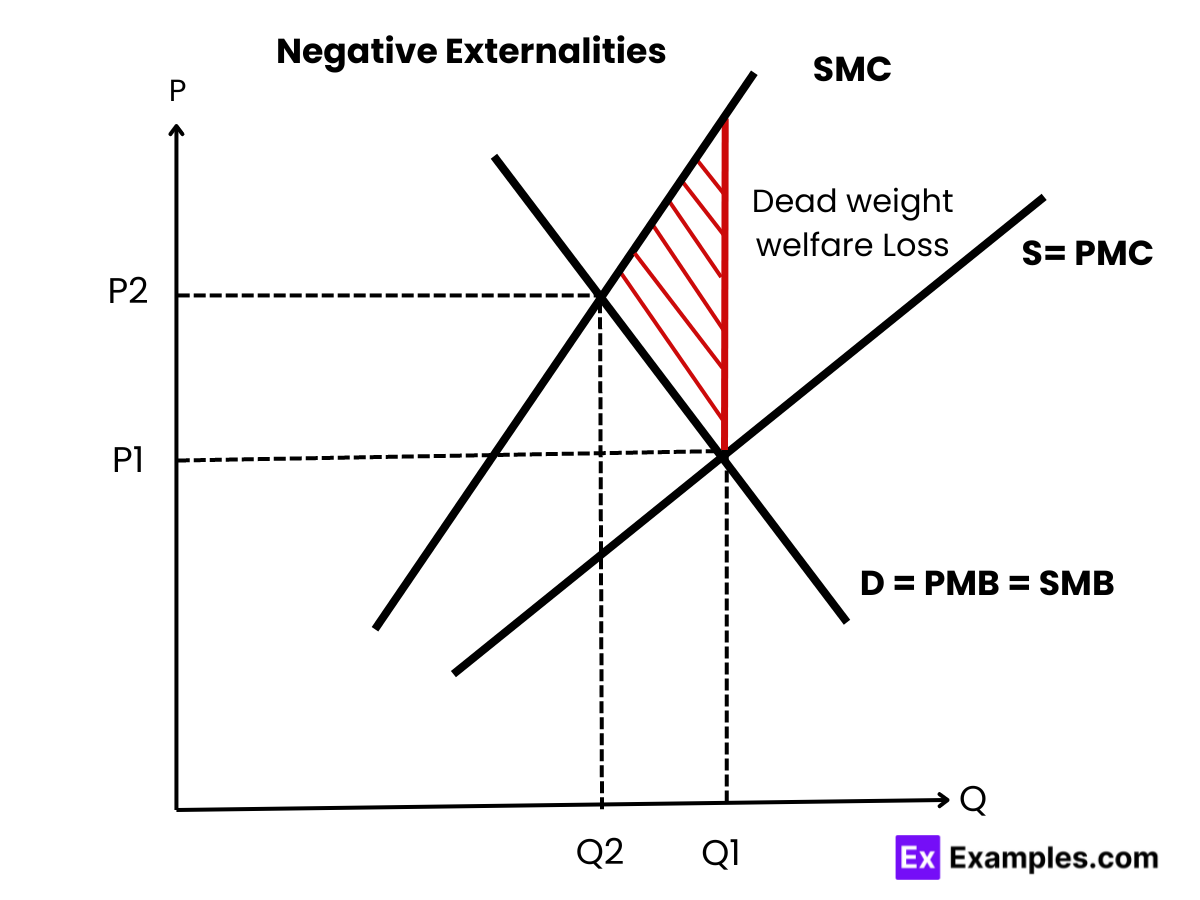

Negative Externalities

Air Pollution: Factories emitting pollutants into the air create negative externalities by harming public health and the environment. Residents and other businesses bear the cost through poor air quality, higher healthcare expenses, and environmental degradation.

Traffic Congestion: When individuals drive cars during rush hour, they contribute to traffic congestion, leading to increased travel times, stress, and additional fuel consumption for other drivers. This is a cost borne by society, not just the driver.

Water Pollution: Industrial waste dumped into water bodies negatively impacts aquatic life and public health. Communities reliant on clean water face increased treatment costs or health risks due to contaminated water.

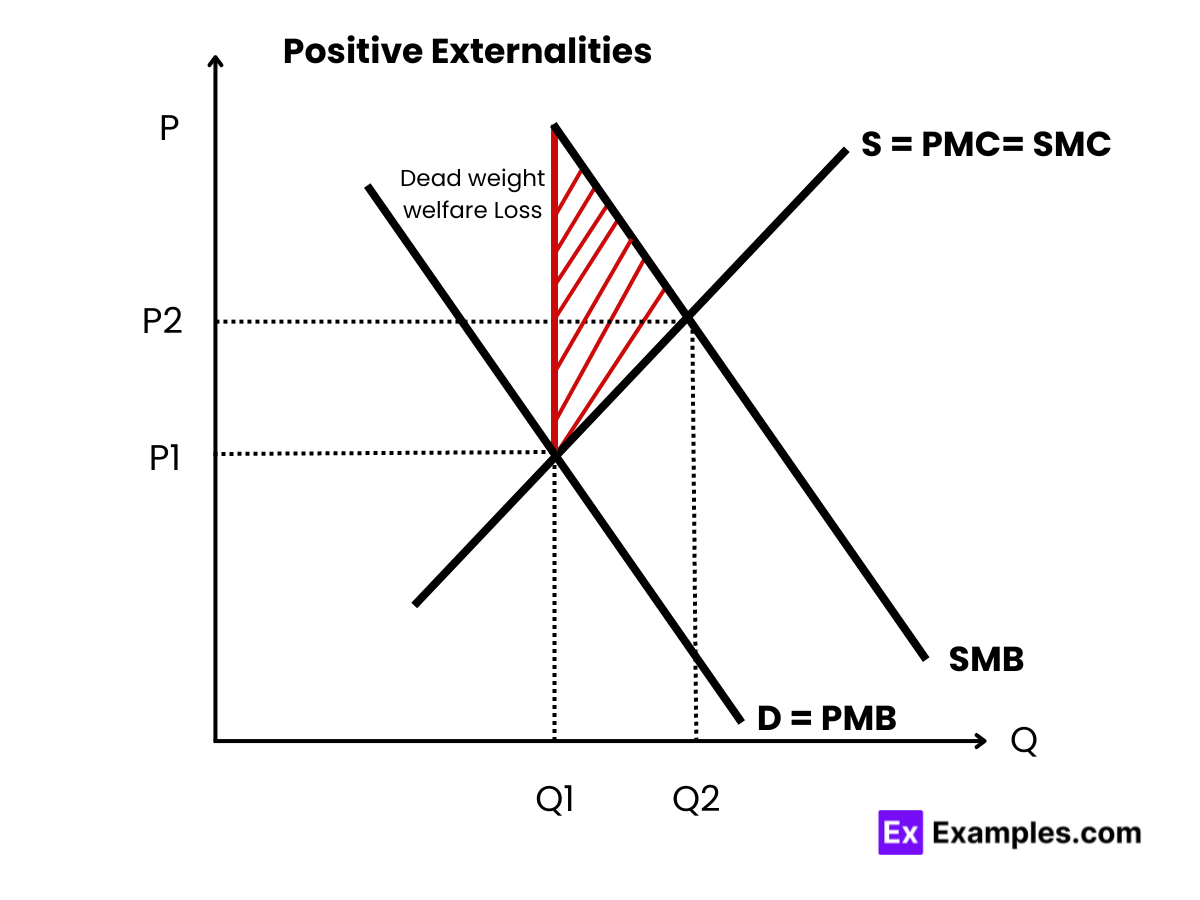

Positive Externalities

Education: When a person receives an education, society benefits from a more informed and productive workforce, leading to overall economic growth, lower crime rates, and better decision-making in civic life.

Vaccinations: When an individual gets vaccinated, it not only protects them but also contributes to herd immunity, reducing the likelihood of disease outbreaks and protecting those who cannot be vaccinated.

Public Parks: Well-maintained parks provide a space for recreation and relaxation, which contributes to the mental and physical health of community members, even those who may not directly contribute to the maintenance of the park.

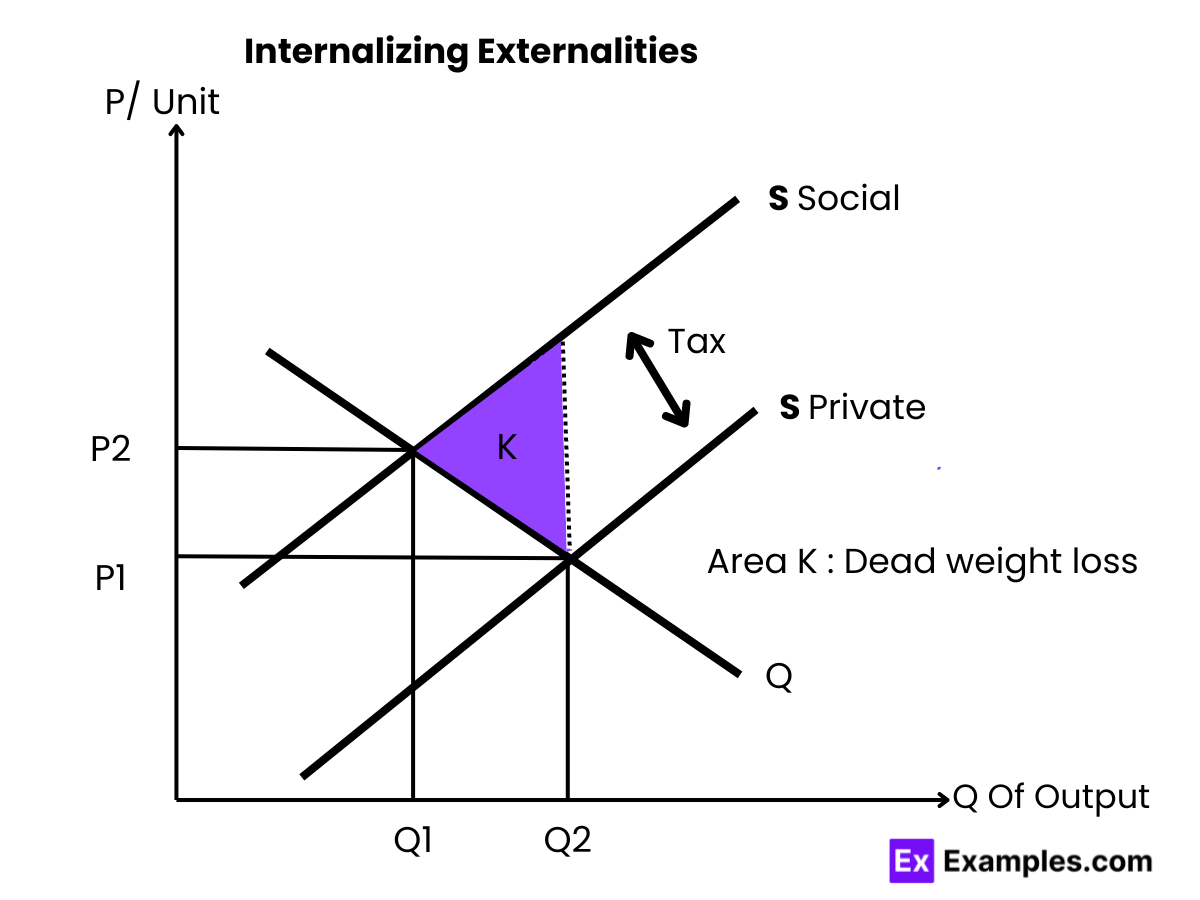

Internalizing Externalities

Governments or institutions often intervene to address externalities and bring market outcomes closer to the socially optimal level.

Taxes and Subsidies: Negative externalities can be corrected with taxes (e.g., a carbon tax to reduce pollution), while positive externalities can be encouraged through subsidies (e.g., subsidizing education or renewable energy).

Regulations: Governments may impose direct regulations, such as pollution limits or mandatory vaccination laws, to correct externalities.

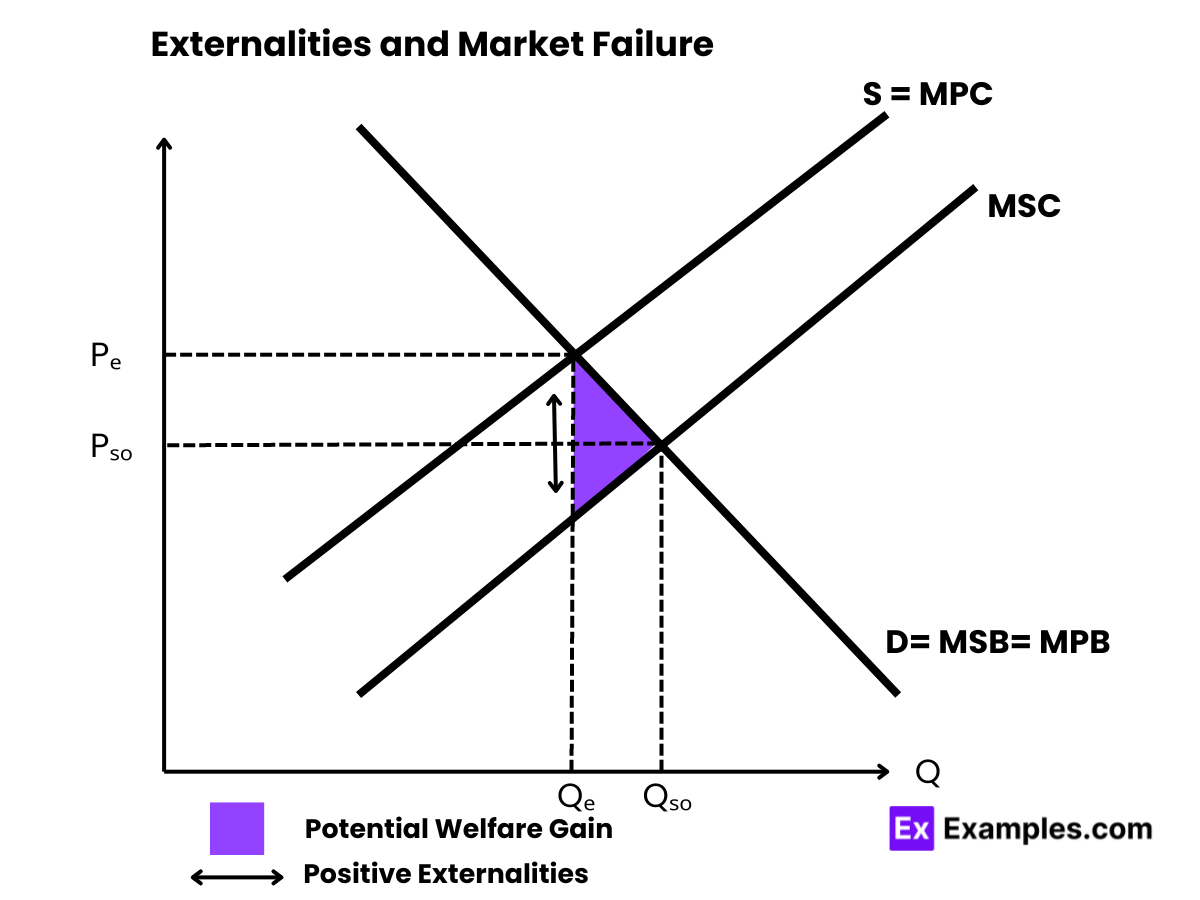

Externalities and Market Failure

Externalities are a key source of market failure, which occurs when the free market fails to allocate resources efficiently. In the absence of government intervention, externalities lead to overproduction of goods that create negative spillovers and underproduction of goods that generate positive spillovers. Corrective policies help to reduce deadweight loss and bring markets closer to the socially optimal outcome.

Externalities are costs or benefits arising from an economic activity that affect third parties who are not directly involved in the activity. These unintended side effects can be either positive or negative, depending on whether they provide benefits or impose costs on others. Externalities are one of the main reasons for market failure, where the allocation of resources by the free market is inefficient.

Examples

Example 1: Air Pollution from Factories

Factories emitting pollutants harm nearby residents and the environment, creating health problems and ecological damage. This negative externality results in social costs not borne by producers.

Example 2: Vaccination Programs

Vaccinations provide herd immunity, protecting individuals who aren’t vaccinated. This positive externality reduces the spread of disease, benefiting the entire community and lowering healthcare costs.

Example 3: Public Education

Education improves society by creating an informed, productive workforce. This positive externality leads to economic growth and lower crime rates, benefiting even those who aren’t directly involved in schooling.

Example 4: Traffic Congestion

Each additional vehicle on the road contributes to traffic jams, increasing travel times and fuel consumption for others. This negative externality results in societal inefficiencies and environmental harm.

Example 5: Smoking in Public

Smoking imposes secondhand smoke risks on bystanders, negatively affecting public health. This negative externality leads to increased healthcare costs for society, despite the smoker benefiting individually.

MCQs

Question 1

Which of the following is an example of a positive externality?

A) Air pollution from a factory

B) Traffic congestion

C) Vaccination programs

D) Noise from construction

Answer: C) Vaccination programs

Explanation: Vaccinations provide herd immunity, benefiting society by reducing disease spread, which is a positive externality. It creates social benefits beyond the individual receiving the vaccine.

Question 2

A negative externality occurs when:

A) Social benefits exceed private benefits

B) Social costs exceed private costs

C) Private costs equal social costs

D) Private benefits exceed social benefits

Answer: B) Social costs exceed private costs

Explanation: A negative externality happens when the external cost to society (social cost) exceeds the private cost, causing overproduction and market inefficiency.

Question 3

How can governments address negative externalities?

A) Subsidizing the harmful activity

B) Imposing taxes equal to the external cost

C) Encouraging underproduction

D) Allowing the market to self-correct

Answer: B) Imposing taxes equal to the external cost

Explanation:Governments address negative externalities by implementing Pigouvian taxes, which impose a cost on activities that generate external harm, such as pollution. By aligning private costs with social costs, these taxes incentivize firms to reduce harmful production, leading to a more efficient market outcome, minimizing overproduction, and reducing the overall societal damage caused by externalities.