A monopoly is a market structure in which a single firm dominates the entire market with no close substitutes for its product or service. In a monopoly, the firm acts as a price maker, determining the price and quantity of goods based on its own interests. For AP Microeconomics, understanding monopolies is crucial for analyzing how market power can lead to inefficiencies, such as deadweight loss, and how monopolists can influence prices, consumer surplus, and overall economic welfare through profit-maximizing strategies.

Learning Objectives

In studying the topic of monopoly for AP Microeconomics, you should learn how monopolies function as price makers, the effects of barriers to entry on competition, and how monopolists maximize profit by equating marginal revenue to marginal cost. You should understand the concept of deadweight loss, the inefficiencies created by monopolies, and how monopolies lead to a reduction in consumer surplus. Additionally, you should explore government regulations, such as price controls and antitrust laws, and how price elasticity affects a monopolist’s pricing strategy.

1. Definition of Monopoly

A monopoly is a market structure characterized by a single seller that controls the entire supply of a unique product or service with no close substitutes. This seller has significant market power to influence the price of the product.

Characteristics of a Monopoly

Monopolies possess several distinguishing features:

- Single Seller: Only one firm dominates the market.

- Unique Product: The product offered has no close substitutes.

- High Barriers to Entry: Significant obstacles prevent other firms from entering the market (e.g., patents, resource ownership, high startup costs).

- Price Maker: The monopolist can set the price above marginal cost due to lack of competition.

- Control Over Supply: The monopolist decides the quantity of goods to produce.

- Non-Price Competition: Often relies on advertising, product differentiation, and other strategies since price changes can significantly affect demand.

2. Sources of Monopoly Power

Several factors can lead to the establishment of a monopoly:

- Legal Barriers: Patents, licenses, and government regulations can restrict entry.

- Control of Essential Resources: Ownership of a critical resource necessary for production.

- Natural Monopoly: Occurs when a single firm can supply the entire market at a lower cost than multiple firms (e.g., utilities like water and electricity).

- Technological Superiority: Advanced technology that gives a firm a competitive edge.

3. Profit Maximization in Monopoly

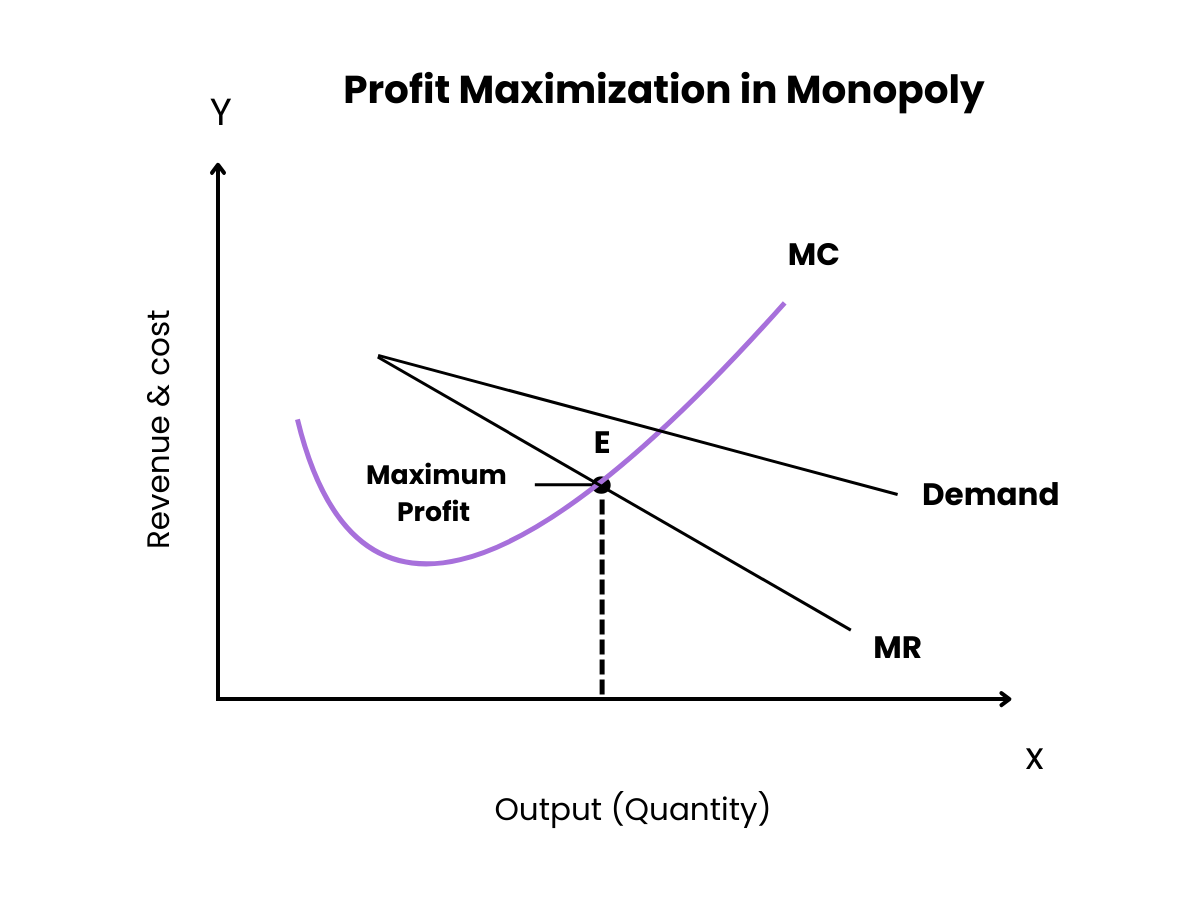

A monopolist maximizes profit where Marginal Revenue (MR) equals Marginal Cost (MC). Unlike firms in perfect competition, a monopolist’s MR curve lies below its demand curve due to the downward-sloping demand.

Key Steps:

- Determine the Demand Curve (D): Shows the relationship between price and quantity demanded.

- Calculate Total Revenue (TR): TR = P×Q

- Determine Marginal Revenue (MR): The additional revenue from selling one more unit. For linear demand curves, MR has the same y-intercept but twice the slope of D.

- Find Marginal Cost (MC): The cost of producing one additional unit.

- Set MR = MC: Identify the profit-maximizing quantity (Q∗).

- Determine the Price (P^*): Use the demand curve to find the price corresponding to Q∗.

Graphical Representation:

Diagram Description: The graph shows the downward-sloping Demand (D) and Marginal Revenue (MR) curves, and the upward-sloping Marginal Cost (MC) curve. The intersection of MR and MC determines Q∗, and the corresponding price P∗ is found on the demand curve.

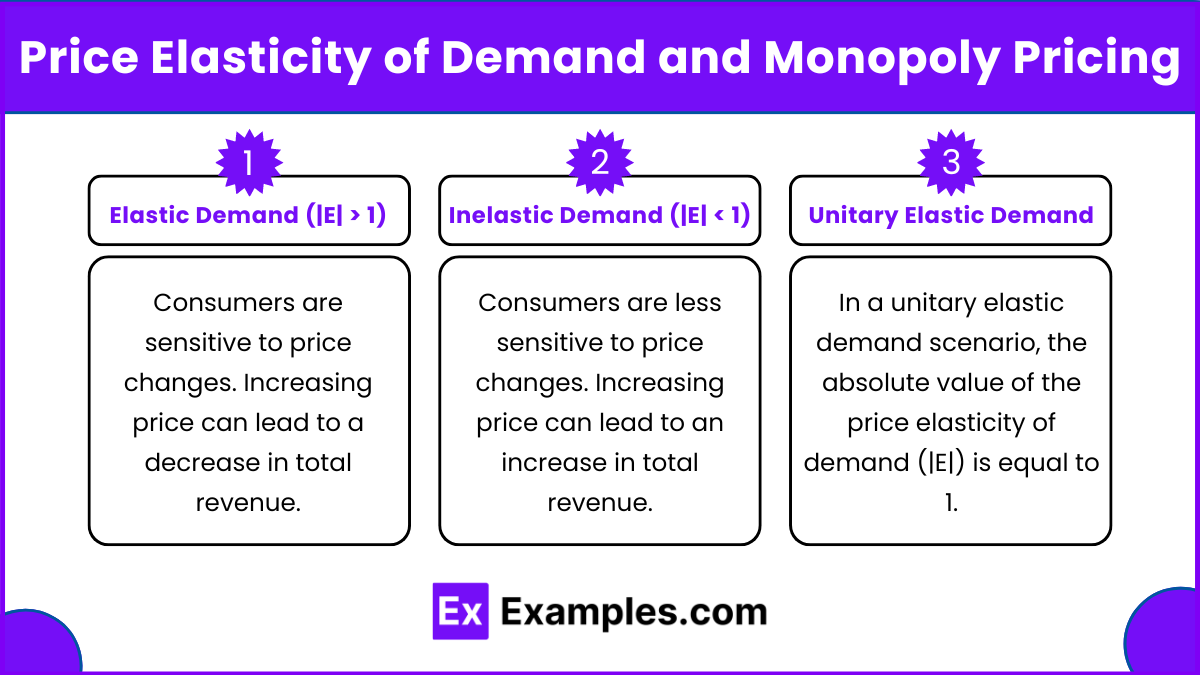

4. Price Elasticity of Demand and Monopoly Pricing

The ability of a monopolist to set prices is influenced by the price elasticity of demand:

- Elastic Demand (|E| > 1): Consumers are sensitive to price changes. Increasing price can lead to a decrease in total revenue.

- Inelastic Demand (|E| < 1): Consumers are less sensitive to price changes. Increasing price can lead to an increase in total revenue.

- Unitary Elastic Demand (|E| = 1): Total revenue remains unchanged when price changes.In a unitary elastic demand scenario, the absolute value of the price elasticity of demand (|E|) is equal to 1.

Formula:

Where E is the price elasticity of demand.

Examples

Example 1. Utility Companies (e.g., Local Electricity Providers)

Utility companies, such as local electricity providers, often function as natural monopolies. This is primarily due to the high fixed costs associated with establishing and maintaining the infrastructure required to deliver electricity, such as power plants, transmission lines, and distribution networks. In most regions, it’s inefficient for multiple companies to build separate infrastructures for the same service, leading to a single provider dominating the market. As a result, these companies enjoy significant market power, allowing them to set prices with minimal competition. Governments typically regulate utility monopolies to prevent price gouging and ensure that consumers receive reliable and reasonably priced services.

Example 2. De Beers Group (Diamond Industry)

Historically, De Beers Group held a near-monopoly in the diamond industry. For much of the 20th century, De Beers controlled a significant portion of the world’s diamond mines and distribution channels. This dominance allowed De Beers to influence diamond prices and supply, maintaining high prices by limiting the availability of diamonds in the market. Their strategic control over diamond reserves and their ability to manage supply through stockpiling were key factors in sustaining their monopoly. Although their market share has decreased due to new competitors and regulatory pressures, De Beers remains a prominent example of how control over resources and distribution can establish and maintain monopoly power.

Example 3. Microsoft (Windows Operating System)

Microsoft achieved monopoly status in the personal computer operating system market with its Windows software. During the late 20th and early 21st centuries, Windows dominated the market, with a market share exceeding 90%. This dominance was facilitated by factors such as widespread compatibility with various hardware manufacturers, extensive software ecosystem, and aggressive business practices like bundling Microsoft Office with Windows. Microsoft’s monopoly allowed it to set prices and influence the development of software standards. However, antitrust lawsuits in the United States and Europe challenged some of Microsoft’s practices, leading to increased regulation and efforts to promote competition in the software industry.

Example 4. Google (Search Engine Market)

Google holds a dominant position in the search engine market, often regarded as a digital monopoly. With a market share exceeding 90% globally, Google effectively controls how information is accessed on the internet. This dominance is reinforced by network effects, where the more people use Google, the more data it collects, enhancing its search algorithms and maintaining its superior performance. Additionally, Google’s integration with various online services and advertising platforms creates high barriers for new entrants. While Google provides valuable services for free, its monopoly power has raised concerns regarding data privacy, market influence, and the potential stifling of innovation among competitors.

Example 5. Pharmaceutical Companies with Patent-Protected Drugs

Pharmaceutical companies that develop new drugs often hold monopolies on those drugs through patents. For example, when a company invents a new medication, it can obtain a patent that grants exclusive rights to produce and sell that drug for a certain period, typically 20 years. This exclusivity allows the company to set higher prices without competition, enabling them to recoup research and development costs and earn substantial profits. While patents incentivize innovation by providing temporary monopoly power, they also lead to higher drug prices and limited accessibility for consumers until generic alternatives enter the market after the patent expires. This example highlights the balance between encouraging innovation and ensuring affordable access to essential medications.

Multiple Choice Questions

Question 1

Which of the following is a key characteristic of a monopoly?

A) There are many sellers in the market.

B) The firm is a price taker.

C) There are no barriers to entry.

D) The firm is a price maker.

Answer: D) The firm is a price maker.

Explanation: A monopoly exists when a single firm dominates the entire market. Unlike firms in perfect competition, where firms are price takers and must accept the market price, a monopolist is a price maker. This means that the monopolist has significant control over the price of the product, as it is the only supplier of that good or service in the market. The other options describe characteristics of competitive markets rather than monopolies.

Question 2

A monopolist maximizes profit by producing the quantity of output where:

A) Marginal revenue equals marginal cost.

B) Price equals marginal cost.

C) Average total cost equals marginal revenue.

D) Marginal cost equals average variable cost.

Answer: A) Marginal revenue equals marginal cost.

Explanation: In a monopoly, the profit-maximizing condition is where marginal revenue (MR) equals marginal cost (MC). The monopolist produces at this level of output because producing more or less would reduce profit. When MR > MC, the firm can increase profit by producing more units. When MR < MC, the firm should reduce production to avoid losses. In contrast, in perfect competition, firms maximize profit where price equals marginal cost, but this does not apply to monopolies due to their downward-sloping demand curve.

Question 3

Which of the following best describes the deadweight loss in a monopoly?

A) The loss of consumer and producer surplus due to overproduction.

B) The loss of economic efficiency due to the monopolist producing less than the socially optimal quantity.

C) The transfer of surplus from producers to consumers due to price controls.

D) The elimination of consumer surplus as the monopolist captures it entirely.

Answer: B) The loss of economic efficiency due to the monopolist producing less than the socially optimal quantity.

Explanation: Deadweight loss in a monopoly refers to the loss of total economic welfare because the monopolist restricts output to a level lower than what would be produced in a competitive market, where price equals marginal cost. By producing less than the socially optimal quantity, the monopoly creates inefficiency, meaning that some potential transactions that would have benefited both consumers and producers are not occurring. This creates a deadweight loss, which is a measure of the inefficiency created by the monopolist’s pricing and production decisions.