A monopsonistic market is a type of market structure in which there is only one dominant buyer, giving that buyer significant control over the prices of goods or services it purchases, particularly in labor markets. In AP Microeconomics, this concept contrasts with competitive markets, where many buyers and sellers interact. Monopsonists often pay lower wages and employ fewer workers than would occur in competitive conditions, leading to inefficiencies and wage suppression. Understanding monopsony is essential for analyzing labor market dynamics and price-setting behavior in AP Microeconomics.

Free AP Microeconomics Practice Test

Learning Objectives

For the topic "Monopsonistic Markets" in AP Microeconomics, you should focus on understanding how a single buyer, or monopsonist, exerts market power in hiring labor or purchasing inputs, leading to wage suppression and underemployment. Learn to analyze how marginal factor cost (MFC) differs from labor supply, causing inefficiencies and deadweight loss. Study the impact of government interventions like minimum wage laws or labor unions on reducing monopsony power and improving market outcomes. Graphical representation and comparisons with competitive markets are also key learning objectives.

Monopsonistic Markets in AP Microeconomics

A monopsony is a market structure where there is only one buyer, often referred to as a "single buyer" market. Unlike a monopoly, where one firm dominates as the sole seller, in a monopsony, the buyer has significant control over the market. This occurs primarily in labor markets but can apply to other markets as well, where a single firm (the buyer) has the power to influence the prices it pays for goods or services.

Key Characteristics of Monopsonistic Markets:

Single Buyer: In a monopsonistic market, there is only one buyer, which gives that buyer substantial market power. This power allows the firm to influence the price it pays for the factors of production, especially labor.

Price Maker for Inputs: The monopsonist can set the price of inputs (such as wages for labor) rather than taking the market price as given. This differs from a competitive market, where firms are price takers.

Limited Choices for Suppliers: Suppliers (like workers or producers of raw materials) in a monopsony have few, if any, alternative buyers for their product or labor. This lack of competition forces them to accept lower prices for their inputs.

Marginal Factor Cost (MFC): In a monopsonistic market, the marginal factor cost (the additional cost of hiring one more unit of a factor of production) exceeds the wage rate paid to the workers. This occurs because hiring more workers requires offering a higher wage to all workers, increasing the total cost.

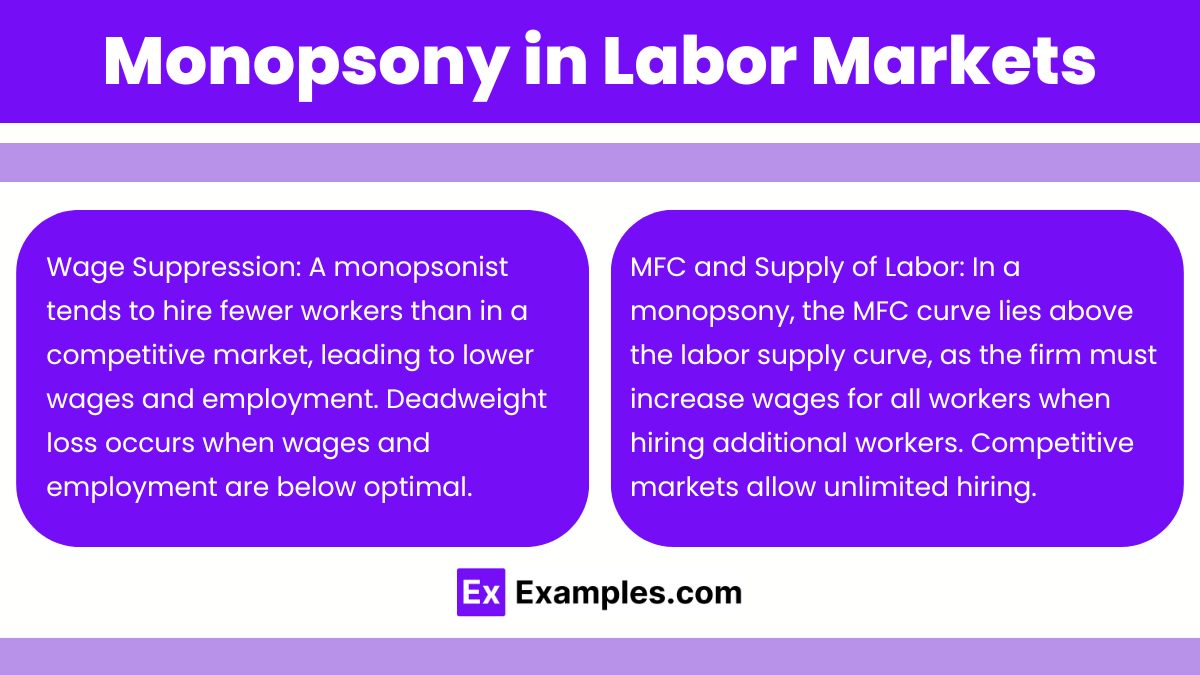

Monopsony in Labor Markets

In labor markets, a monopsonistic firm is the dominant or only employer. Examples can include large corporations in small towns or industries where only one company provides employment opportunities. The firm’s buying power allows it to push wages below the competitive equilibrium, leading to inefficiencies in the allocation of labor.

Wage Suppression: A monopsonist tends to hire fewer workers than in a competitive market, leading to lower wages and employment. This creates a deadweight loss because the wage and employment levels are below what would be socially optimal.

MFC and Supply of Labor: In a monopsony, the MFC curve lies above the labor supply curve, as the firm must increase wages for all workers when hiring additional workers. This contrasts with competitive markets, where firms can hire more workers at the going wage rate.

Monopsony and Efficiency

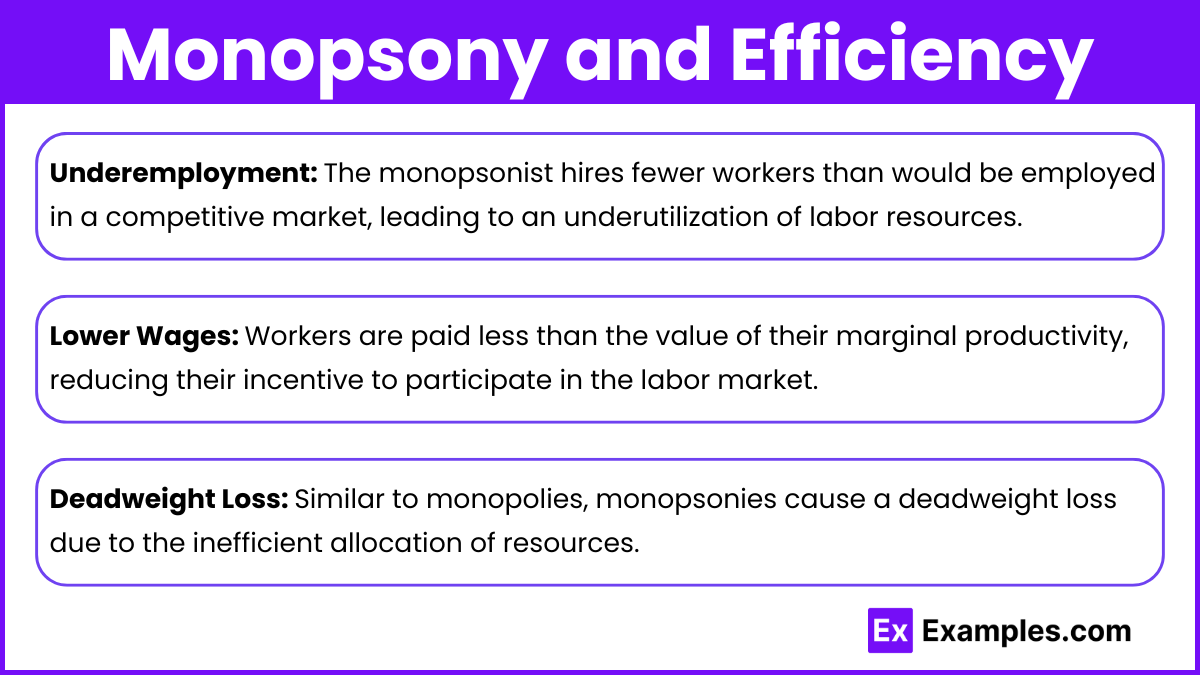

Monopsony markets are considered inefficient due to the following reasons:

Underemployment: The monopsonist hires fewer workers than would be employed in a competitive market, leading to an underutilization of labor resources.

Lower Wages: Workers are paid less than the value of their marginal productivity, reducing their incentive to participate in the labor market.

Deadweight Loss: Similar to monopolies, monopsonies cause a deadweight loss due to the inefficient allocation of resources. The reduced output and lower wages mean that the overall welfare of the economy is lower than it could be in a competitive market.

Government Intervention

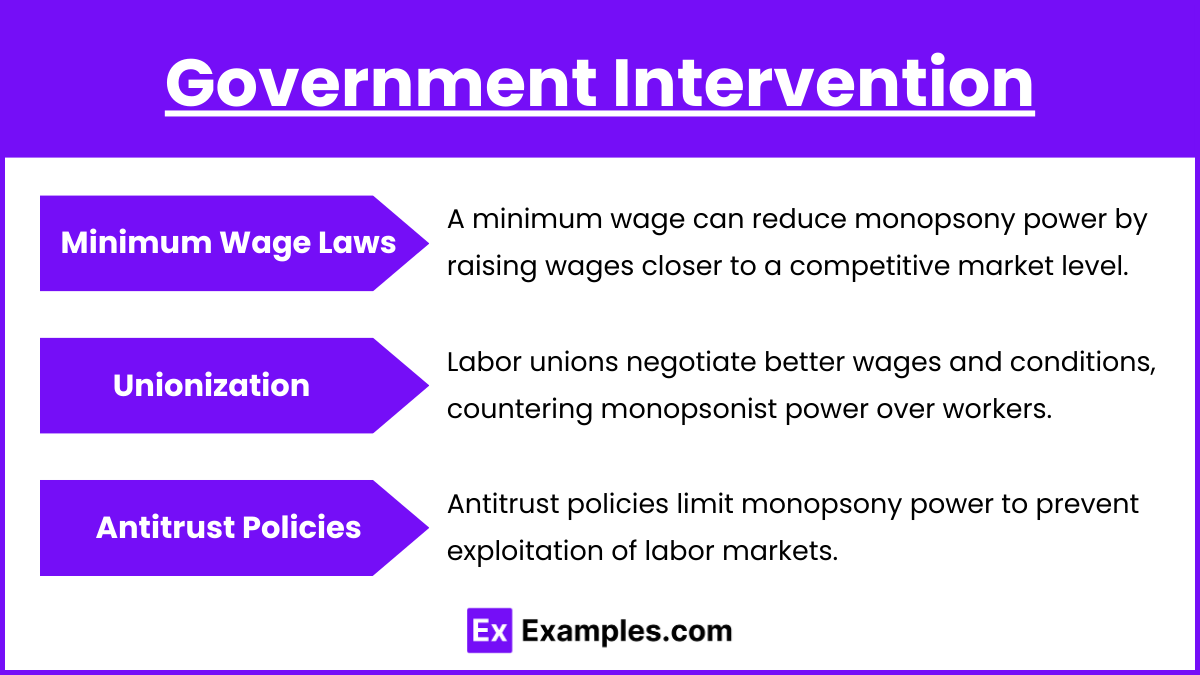

To correct the inefficiencies of monopsonistic markets, governments may intervene in the following ways:

Minimum Wage Laws: By imposing a minimum wage, the government can raise wages closer to the competitive level, reducing the monopsonist’s power to suppress wages.

Unionization: Labor unions can help negotiate better wages and conditions for workers, counterbalancing the monopsonist’s power.

Antitrust Policies: If a monopsonist gains too much power, antitrust policies may be implemented to prevent the firm from further exploiting its position.

Examples

Example 1: Single Employer in a Small Town

In many small towns, a single large employer such as a manufacturing plant, mining operation, or textile factory can dominate the local labor market. For instance, if a steel mill is the only significant employer in a town, it holds substantial power over wage rates and employment conditions. Workers have limited alternative employment opportunities within the vicinity, allowing the steel mill to set lower wages than would be possible in a more competitive labor market. This concentration of employment creates a monopsonistic environment where the employer can influence the labor supply and exert control over the workforce.

Example 2: Government as the Sole Purchaser of Certain Services

Governments often act as the only buyer for specific types of services or labor. For example, the military is the primary employer for defense-related engineers and technicians. Similarly, public education systems may be the sole purchaser of teachers' services within a region. In these cases, the government’s exclusive demand for these services grants it monopsony power, enabling it to influence wages and employment terms. This monopolistic purchasing power can impact the overall compensation and working conditions offered to professionals in these fields.

Example 3: Large Corporations in Specialized Industries

In specialized industries, a dominant corporation may act as the sole or primary purchaser of specialized labor or materials. For example, a leading tech company that requires highly specialized software engineers might be the only major employer in a specific geographic area or niche market. This dominance allows the company to set wage levels and employment terms that are less favorable to workers compared to a competitive market scenario. The limited number of alternative employers for these specialized skills reinforces the monopsonistic power of the dominant corporation.

Example 4: Professional Sports Teams Purchasing Athletes

Professional sports leagues, such as the National Basketball Association (NBA) or Major League Baseball (MLB), can exhibit monopsonistic characteristics. Teams within a league are often the sole buyers of athletes' talents within that sport. The league's structure, salary caps, and collective bargaining agreements can limit the negotiating power of individual players, effectively creating a monopsony. Athletes may have limited opportunities to negotiate higher wages or better contract terms due to the collective influence of the teams and the league's regulations.

Example 5: Healthcare Providers in Rural Areas

In rural or underserved regions, a single hospital or healthcare provider may be the only significant employer of medical professionals such as doctors, nurses, and technicians. This situation grants the healthcare provider monopsony power, allowing it to influence wages and employment conditions. Medical professionals in these areas may have limited alternative employment options, making them more reliant on the sole healthcare provider. Consequently, the provider can set compensation levels and working conditions that might be less competitive compared to urban areas with multiple healthcare employers.

Multiple Choice Questions

Question 1

Which of the following best describes the hiring behavior of a monopsonistic employer in a labor market?

A) The employer hires the same number of workers as a perfectly competitive firm.

B) The employer hires fewer workers and pays higher wages compared to a perfectly competitive firm.

C) The employer hires fewer workers and pays lower wages compared to a perfectly competitive firm.

D) The employer hires more workers and pays lower wages compared to a perfectly competitive firm.

Answer: C) The employer hires fewer workers and pays lower wages compared to a perfectly competitive firm.

Explanation: A monopsonist has significant market power because it is the sole or dominant buyer in the labor market. As a result, the monopsonist can influence both the wage rate and the level of employment. Unlike in a competitive market, where firms are price takers, a monopsonist pays lower wages because it can dictate the terms of employment. It also hires fewer workers than in a competitive market because the marginal factor cost (MFC) of hiring additional workers is higher than the wage rate, leading to underemployment. Thus, the correct answer is that the monopsonist hires fewer workers and pays lower wages compared to a perfectly competitive market.

Question 2

In a monopsonistic labor market, why does the marginal factor cost (MFC) exceed the wage paid to workers?

A) Because the firm needs to pay workers above the market wage to attract more labor.

B) Because the firm must increase the wage for all workers when it hires an additional worker.

C) Because the firm can charge higher prices to consumers.

D) Because the firm needs to lower wages to minimize costs.

Answer: B) Because the firm must increase the wage for all workers when it hires an additional worker.

Explanation: In a monopsony, the marginal factor cost (MFC) is greater than the wage because when the firm hires more workers, it must raise the wage for all workers, not just the additional ones. This happens because the firm is the dominant or only buyer of labor in the market, and in order to attract more workers, it must raise the wage rate. However, this increase in wage applies to all existing workers, not just the newly hired ones, which results in the MFC exceeding the wage. This concept is different from competitive markets, where firms can hire additional workers at the going wage without affecting other workers’ pay.

Question 3

Which of the following is a potential government intervention in a monopsonistic labor market to improve efficiency?

A) Implementing a maximum wage.

B) Enforcing antitrust laws to reduce the monopsonist's market power.

C) Reducing taxes on the monopsonist to encourage more hiring.

D) Allowing the monopsonist to hire more workers at lower wages.

Answer: B) Enforcing antitrust laws to reduce the monopsonist's market power.

Explanation: Monopsonistic markets are inefficient because they result in lower wages and employment levels than what would occur in a competitive market. To correct this inefficiency, governments can intervene by enforcing antitrust laws to reduce the monopsonist’s market power. These laws can promote competition by either breaking up the monopsony or regulating it to ensure fair labor practices. Other common interventions include setting a minimum wage to ensure workers are paid fairly, or encouraging unionization to give workers more bargaining power. Reducing taxes or allowing the firm to hire at lower wages would not address the fundamental issue of underemployment and wage suppression.