In AP Microeconomics, perfect competition is a market structure characterized by many buyers and sellers, homogeneous products, and no barriers to entry or exit. Firms in a perfectly competitive market are price takers, meaning they cannot influence the market price. Instead, the market price is determined by overall supply and demand. This structure leads to both allocative and productive efficiency in the long run, as firms produce at the lowest possible cost and resources are allocated to their most valued uses.

Free AP Microeconomics Practice Test

Learning Objectives

In studying the topic of "Perfect Competition" for AP Microeconomics, you should learn how to identify the characteristics of a perfectly competitive market, including the concepts of price-taking firms and homogeneous products. You should understand how firms maximize profit by equating marginal cost to price, and why economic profits tend to zero in the long run due to market entry and exit. Additionally, grasp the importance of allocative and productive efficiency in perfect competition, and how long-run equilibrium ensures optimal resource allocation in the market.

Perfect Competition for AP Microeconomics

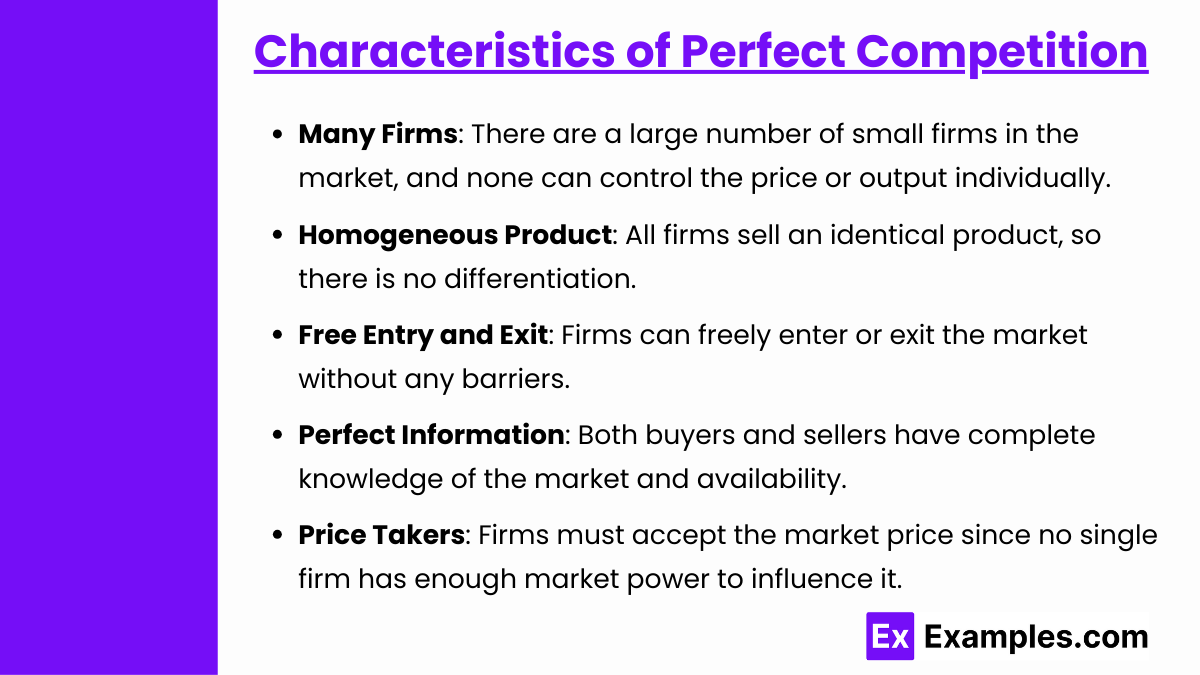

Perfect competition is a market structure where numerous small firms compete against each other. In this scenario, no single firm can influence the market price of a product. Firms are price takers, which means they must accept the market price set by supply and demand forces. Perfect competition is characterized by the following key features:

Characteristics of Perfect Competition

Many Firms: There are a large number of small firms in the market, and none can control the price or output individually.

Homogeneous Product: All firms sell an identical product, so there is no differentiation. Consumers see products from different firms as perfect substitutes.

Free Entry and Exit: Firms can freely enter or exit the market without any barriers. This keeps profits at normal levels in the long run.

Perfect Information: Both buyers and sellers have complete knowledge of the market, including prices, products, and availability.

Price Takers: Firms must accept the market price since no single firm has enough market power to influence it.

Short-Run vs. Long-Run Equilibrium

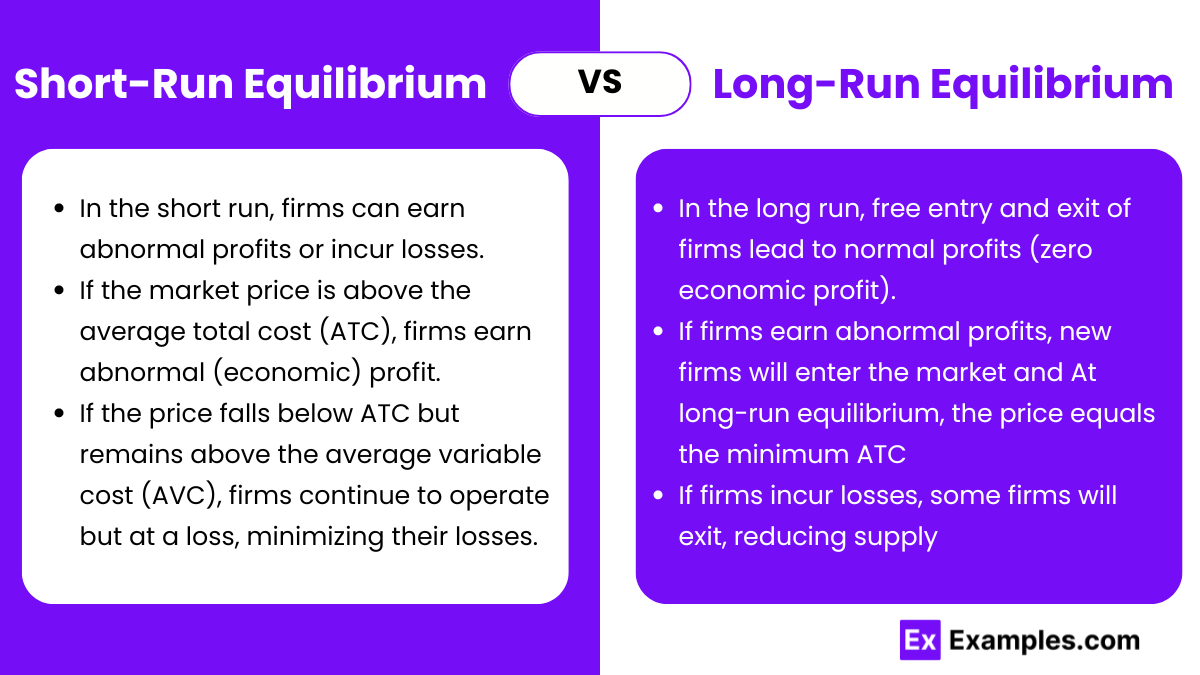

Short-Run Equilibrium:

In the short run, firms can earn abnormal profits or incur losses.

If the market price is above the average total cost (ATC), firms earn abnormal (economic) profit.

If the price falls below ATC but remains above the average variable cost (AVC), firms continue to operate but at a loss, minimizing their losses.

If the price drops below AVC, firms will shut down production as they cannot cover even the variable costs.

Long-Run Equilibrium:

In the long run, free entry and exit of firms lead to normal profits (zero economic profit).

If firms earn abnormal profits, new firms will enter the market, increasing supply and driving prices down until profits are eliminated.

If firms incur losses, some firms will exit, reducing supply and raising prices until losses are eliminated, and remaining firms earn normal profits.

At long-run equilibrium, the price equals the minimum ATC, and all firms operate efficiently.

Profit Maximization in Perfect Competition

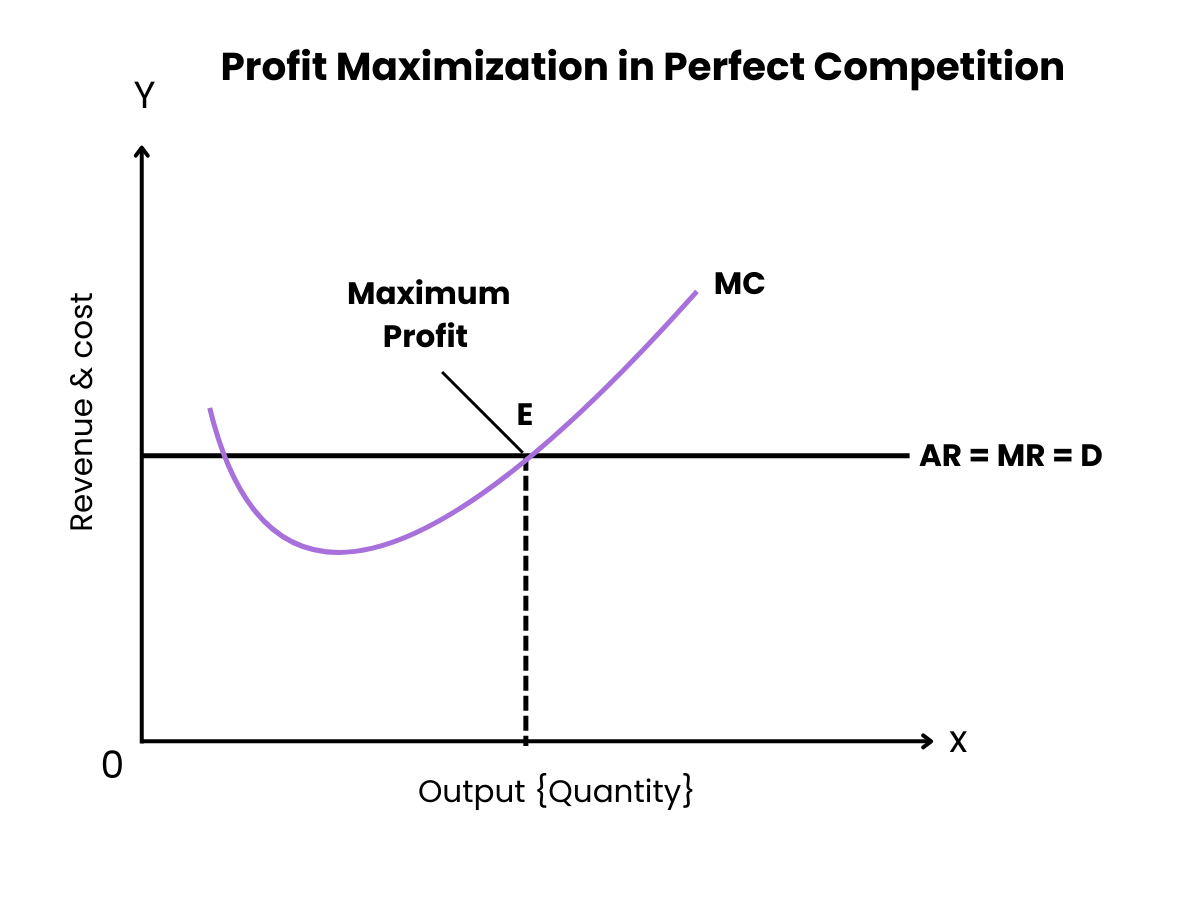

Graphical Representation:

In the short run, the firm can earn profits if the price is above ATC. In the long run, the entry of new firms causes supply to increase and price to fall, leading to a situation where price equals the minimum point on the ATC curve.

The firm's demand curve is perfectly elastic because it can sell any quantity at the prevailing market price but cannot charge a higher price due to perfect substitutes.

The graph shown illustrates the concept of Profit Maximization in Perfect Competition in microeconomics.

In a perfectly competitive market, profit maximization occurs where Marginal Cost (MC) equals Marginal Revenue (MR), which in perfect competition is also equal to Average Revenue (AR) and the market Demand (D). This point is labeled as E on the graph.

At this point, the firm's total revenue is maximized because the cost of producing one more unit (MC) is exactly balanced by the revenue gained from selling that unit (MR). Producing beyond this point would lead to higher costs than revenue, thus decreasing profit. This results in the maximum profit area between the firm's total cost and total revenue curves.

The upward-sloping portion of the MC curve reflects increasing marginal costs as output increases, while the horizontal line shows the constant MR/AR/D in perfect competition.

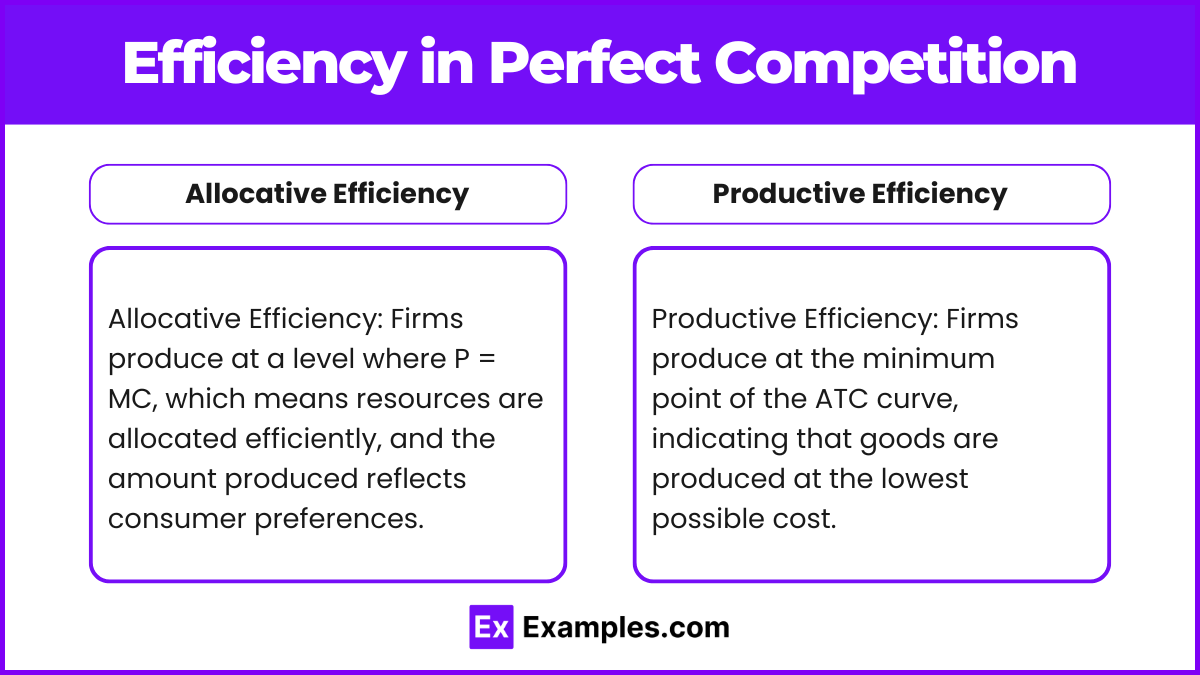

Efficiency in Perfect Competition

Allocative Efficiency: Firms produce at a level where P = MC, which means resources are allocated efficiently, and the amount produced reflects consumer preferences.

Productive Efficiency: Firms produce at the minimum point of the ATC curve, indicating that goods are produced at the lowest possible cost.

Examples

Example 1. Agricultural Markets (e.g., Wheat Farming)

Agricultural markets, particularly those dealing with staple crops like wheat, are often cited as prime examples of near-perfect competition. In these markets, there are numerous farmers producing a homogeneous product—wheat—ensuring that no single farmer can influence the market price. Each farmer acts as a price taker, accepting the prevailing market price determined by the overall supply and demand. Additionally, the barriers to entry and exit are relatively low, allowing new farmers to enter the market when profits are attractive and exit when they are not. The products are standardized, meaning that wheat from one farmer is virtually indistinguishable from that of another, eliminating any scope for product differentiation. These characteristics collectively contribute to a highly competitive environment where resources are efficiently allocated.

Example 2. Stock Markets

Stock markets exemplify perfect competition through their structure and the nature of the traded assets. In these markets, millions of buyers and sellers trade shares of publicly listed companies, ensuring that no single participant can influence the price of a stock. The shares themselves are homogeneous, meaning each share of a particular company is identical to another. Information in stock markets is highly transparent and disseminated rapidly, allowing all participants to make informed decisions based on current prices and available data. Moreover, the ease of entry and exit—anyone with sufficient capital and access to a trading platform can buy or sell shares—further aligns stock markets with the characteristics of perfect competition. These factors ensure that stock prices reflect the true equilibrium based on supply and demand dynamics.

Example 3. Foreign Exchange (Forex) Markets

The foreign exchange market, where currencies are traded globally, closely mirrors the conditions of perfect competition. It is the largest and most liquid financial market in the world, with countless participants including banks, corporations, governments, and individual traders. The sheer number of buyers and sellers ensures that no single entity can manipulate exchange rates. Currencies traded in the forex market are homogeneous, as each unit of a currency is identical to another unit of the same currency. Information about exchange rates is readily available and updated in real-time, providing all participants with equal access to market data. Additionally, the low barriers to entry allow anyone with the necessary resources to participate in currency trading. These attributes contribute to highly efficient pricing and resource allocation in the forex market.

Example 4. Online Commodity Markets (e.g., Digital Goods Platforms)

Certain online marketplaces that deal with standardized digital goods, such as e-books, software, or digital art, can exhibit characteristics of perfect competition. Platforms like Amazon Kindle for e-books or standardized software distribution sites often feature numerous sellers offering identical or highly similar products. The digital nature of these goods means there is no differentiation between products from different sellers, leading to a homogeneous product offering. Prices are typically driven by market forces, with sellers acting as price takers since they have little to no influence over the prevailing market price. Information about prices and product availability is transparent and accessible to all buyers and sellers, facilitating informed decision-making. Moreover, the low marginal cost of distributing digital goods allows for easy entry and exit from the market, reinforcing competitive pressures.

Example 5. Basic Commodity Markets (e.g., Salt and Sugar)

Markets for basic commodities like salt and sugar often display traits of perfect competition. These goods are standardized and lack differentiation, meaning that salt from one supplier is identical to that from another. The presence of numerous small suppliers ensures that no single producer can influence the market price, compelling all to accept the prevailing equilibrium price. Information about prices is widely available, and consumers can easily switch between suppliers based on price alone. Additionally, the barriers to entry and exit in these markets are minimal, allowing new producers to enter when prices are favorable and exit when they are not. This fluidity maintains a balance where supply meets demand efficiently, and resources are allocated optimally within the market.

Multiple Choice Questions

Question 1

In a perfectly competitive market, a firm maximizes its profit by producing where:

A) Marginal Revenue (MR) = Average Total Cost (ATC)

B) Price (P) = Marginal Cost (MC)

C) Price (P) > Marginal Cost (MC)

D) Marginal Cost (MC) > Marginal Revenue (MR)

Answer: B) Price (P) = Marginal Cost (MC)

Explanation: In perfect competition, the firm is a price taker, meaning that the price it receives for its product is determined by the market. Profit maximization occurs where the marginal revenue equals marginal cost (MR = MC). Since in perfect competition, the marginal revenue is equal to the price (MR = P), the firm maximizes profit by producing where P = MC. This is the condition for profit maximization because producing beyond this point would increase costs more than revenues, reducing profit.

Question 2

In the long run, perfectly competitive firms will:

A) Earn positive economic profits

B) Earn zero economic profits

C) Earn negative economic profits

D) Shut down because they cannot cover their fixed costs

Answer: B) Earn zero economic profits

Explanation: In the long run, economic profits in perfect competition attract new firms to enter the market, which increases supply and drives prices down. Conversely, if firms are making losses, some will exit the market, reducing supply and raising prices. This entry and exit process continues until all firms earn zero economic profit, which means they only cover their opportunity costs and make normal profits. Zero economic profit does not mean the firm is not profitable in the conventional sense; it means that the firm is making a normal profit, enough to keep it in the industry but not more than that.

Question 3

Which of the following statements about perfect competition is true?

A) Firms can influence the price of their product by increasing production

B) Firms sell differentiated products

C) Firms earn economic profits in the long run

D) Firms produce at the minimum point of their average total cost (ATC) curve in the long run

Answer: D) Firms produce at the minimum point of their average total cost (ATC) curve in the long run

Explanation: In the long run, perfectly competitive firms produce at the minimum point of the average total cost (ATC) curve, ensuring productive efficiency. This happens because any firm that does not minimize costs will either reduce its output or leave the market, as it would not be able to compete with more efficient firms. At the minimum ATC, firms earn zero economic profit (normal profit), and all firms in the industry operate at maximum efficiency, using resources in the best possible way. The other options are incorrect because firms in perfect competition are price takers, they sell homogeneous products, and they do not earn economic profits in the long run.