Price discrimination is a fundamental concept in AP Microeconomics that explores how firms maximize profits by charging different prices to different consumer groups for the same product or service. By understanding the various types of price discrimination—first, second, and third-degree—students can analyze how businesses leverage market power and consumer behavior to capture additional consumer surplus. Mastering this topic in AP Microeconomics enables learners to grasp the strategic pricing methods that influence market efficiency and welfare outcomes.

Free AP Microeconomics Practice Test

Learning Objectives

When studying Price Discrimination in AP Microeconomics, you should aim to understand its definition and the three types: first-degree, second-degree, and third-degree. Learn the necessary conditions for its successful implementation, including market power, market segmentation, and prevention of resale. Analyze how price discrimination affects consumer and producer surplus, and overall welfare. Master graphical representations to illustrate different scenarios and recognize real-world examples across various industries. Additionally, evaluate the legal and ethical implications associated with price discrimination practices.

1. What is Price Discrimination?

Price Discrimination occurs when a firm sells the same good or service to different consumers at different prices, not based on differences in cost. Essentially, the firm is capturing consumer surplus and converting it into additional profit.

Key Points:

Same Product: The product or service offered is identical across all consumers.

Different Prices: Prices vary based on certain criteria unrelated to production costs.

Profit Maximization: The primary goal is to increase total profits by capturing more consumer surplus.

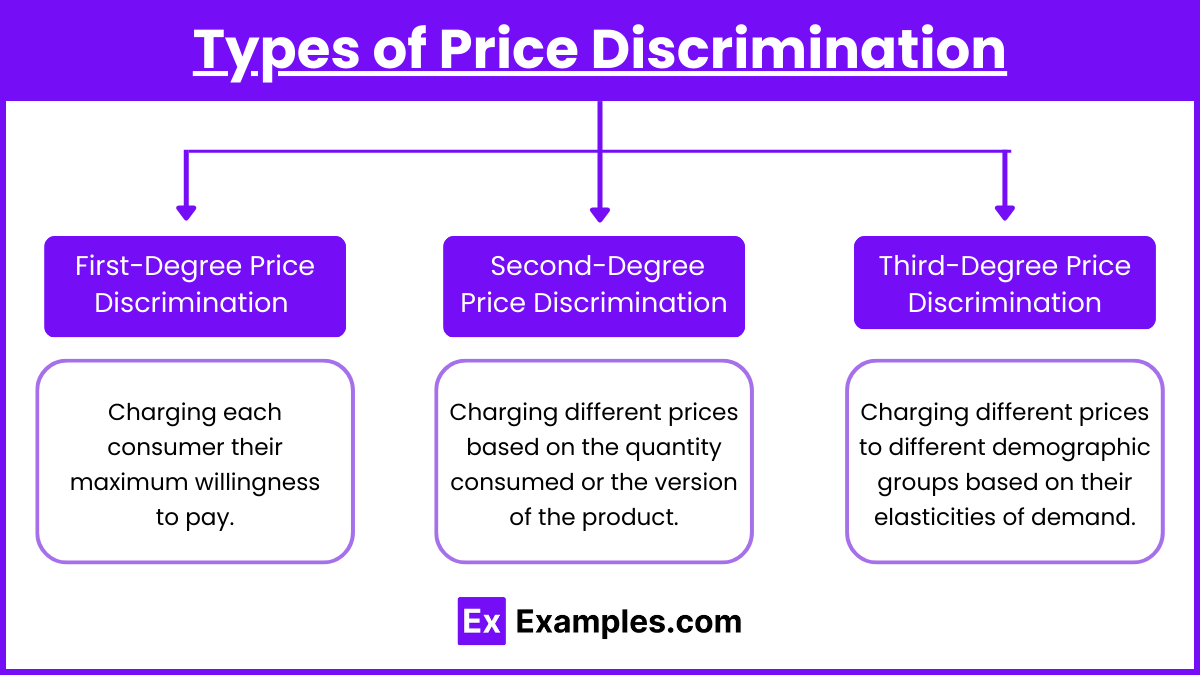

2. Types of Price Discrimination

Price discrimination is categorized into three main types based on the degree and method of price variation:

a. First-Degree Price Discrimination (Perfect Price Discrimination)

Definition: Charging each consumer their maximum willingness to pay.

Characteristics:

Personalized Pricing: Each consumer pays exactly what they are willing to pay.

Maximum Profit: The firm captures the entire consumer surplus.

Information Intensive: Requires detailed knowledge of each consumer’s preferences and willingness to pay.

Example:

Auctions: Where bidders pay their highest bid.

Personalized Negotiations: Such as car sales where prices may vary based on negotiation.

b. Second-Degree Price Discrimination

Definition: Charging different prices based on the quantity consumed or the version of the product.

Characteristics:

Self-Selection: Consumers choose among different pricing options based on their preferences.

Nonlinear Pricing: Prices change with the quantity or type purchased.

No Need for Consumer Identification: Firms do not need to know individual consumers’ willingness to pay.

Subtypes:

Quantity Discounts: Lower prices per unit when more are purchased.

Example: Bulk purchasing discounts in wholesale markets.

Versioning: Offering different versions of a product at different prices.

Example: Software companies offering basic, standard, and premium versions.

Example:

Utilities: Charging lower rates per unit for higher consumption levels.

Telecommunications: Offering various data packages at different price points.

c. Third-Degree Price Discrimination

Definition: Charging different prices to different demographic groups based on their elasticities of demand.

Characteristics:

Market Segmentation: Dividing consumers into distinct groups with different demand elasticities.

Group Pricing: Each group is charged a different price based on their willingness to pay.

Requires Identification: Firms must be able to identify and segregate different consumer groups.

Example:

Student and Senior Discounts: Reduced prices for students and seniors.

Geographical Pricing: Different prices in different regions or countries.

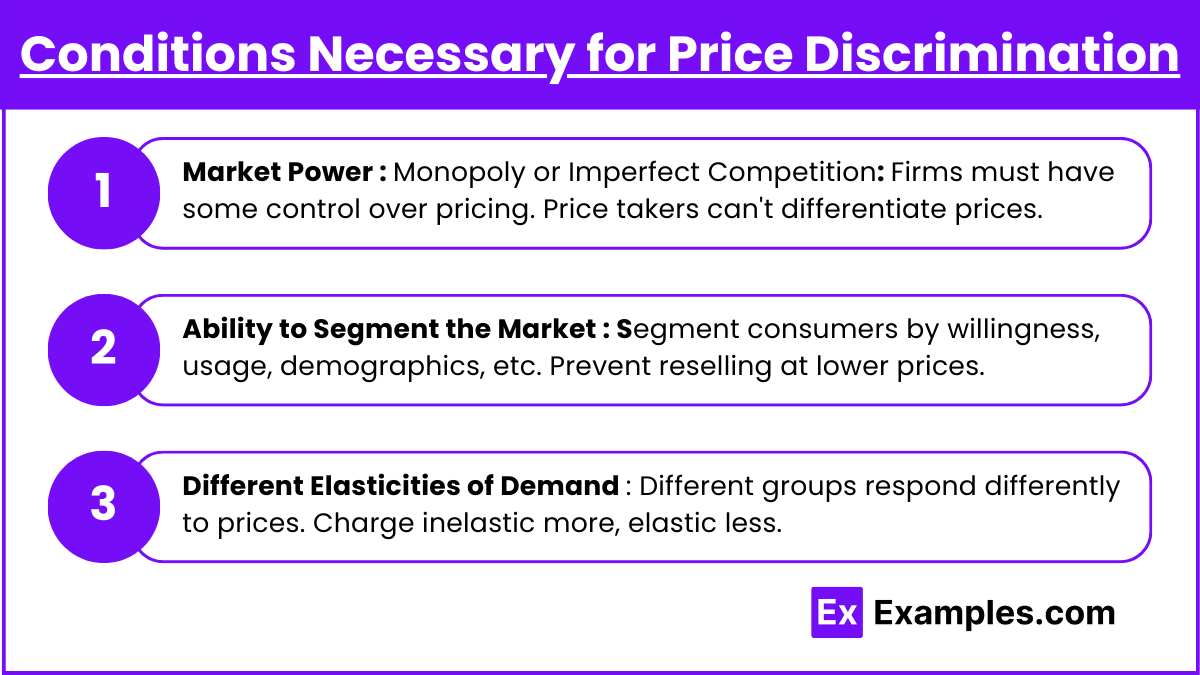

3. Conditions Necessary for Price Discrimination

For a firm to successfully implement price discrimination, several conditions must be met:

a. Market Power

Monopoly or Imperfect Competition: Firms must have some control over pricing.

Not Possible in Perfect Competition: Firms are price takers and cannot set different prices.

b. Ability to Segment the Market

Identify Distinct Consumer Groups: Based on willingness to pay, usage, demographics, etc.

Prevent Arbitrage: Ensure consumers cannot resell the product to others at a lower price.

c. Different Elasticities of Demand

Variation in Price Sensitivity: Different groups have varying responsiveness to price changes.

Target Groups Accordingly: Charge higher prices to inelastic groups and lower prices to elastic groups.

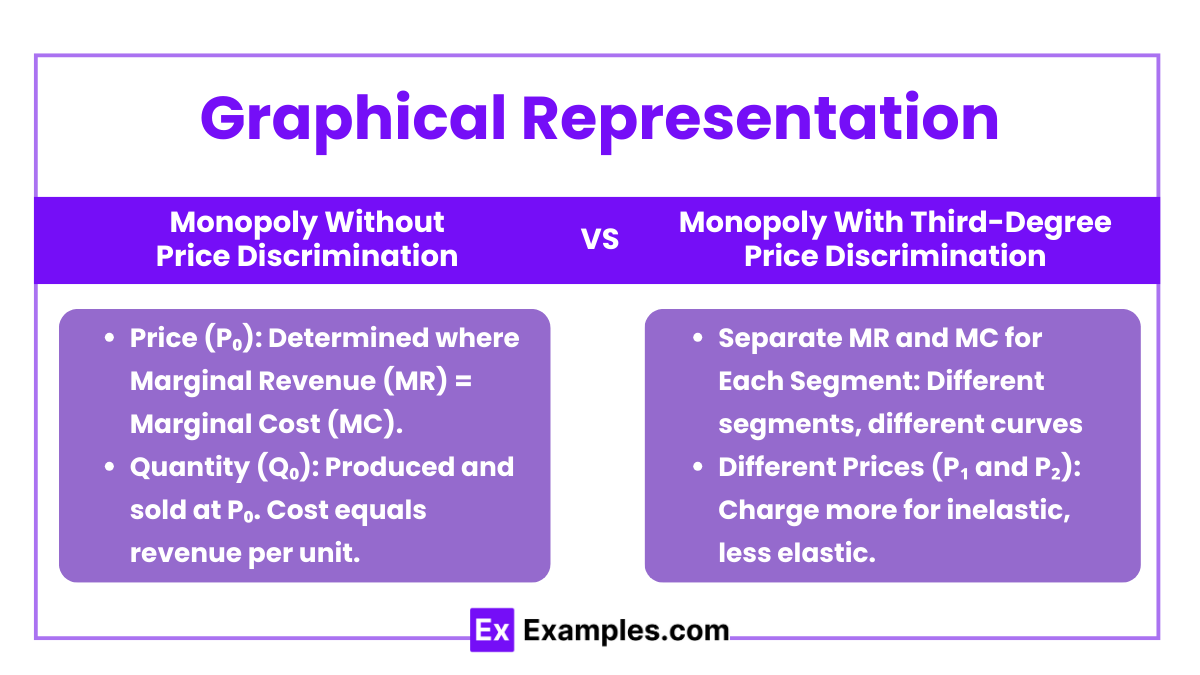

4. Graphical Representation

Understanding the graphical analysis of price discrimination helps visualize how firms maximize profits.

Monopoly Without Price Discrimination:

Price (P₀): Determined where Marginal Revenue (MR) = Marginal Cost (MC).

Quantity (Q₀): Produced and sold at P₀.

Monopoly with Third-Degree Price Discrimination:

Separate MR and MC for Each Segment: Each market segment has its own demand curve.

Different Prices (P₁ and P₂): Higher price for inelastic segment (P₁) and lower price for elastic segment (P₂).

Increased Quantity in Each Segment: Q₁ and Q₂ compared to Q₀.

Examples

Example 1. Airline Ticket Pricing (Third-Degree Price Discrimination)

Airlines commonly engage in third-degree price discrimination by charging different prices to distinct groups of consumers based on their willingness to pay. For instance, business travelers often book last-minute flights and are less sensitive to price changes, allowing airlines to charge higher fares. In contrast, leisure travelers typically plan trips well in advance and are more price-sensitive, prompting airlines to offer discounted tickets for early bookings. Additionally, airlines may offer special rates for students, seniors, or members of loyalty programs. By segmenting the market into these distinct groups and tailoring prices accordingly, airlines maximize their revenue by capturing varying levels of consumer surplus from each segment.

Example 2. Movie Theaters and Discount Pricing (Third-Degree Price Discrimination)

Movie theaters frequently implement third-degree price discrimination by offering discounted ticket prices to specific demographic groups such as students, seniors, and children. For example, a standard adult ticket might be priced higher, while tickets for students and seniors are sold at a reduced rate. This strategy allows theaters to attract a broader audience, including those who might not afford regular prices, thereby increasing overall attendance and revenue. By recognizing that different groups have varying price sensitivities, movie theaters effectively segment their market and adjust prices to cater to each group's willingness to pay.

Example 3. Software Licensing Models (Second-Degree Price Discrimination)

Software companies often use second-degree price discrimination through tiered licensing models, where different versions of a product are offered at varying price points based on features and usage levels. For example, a company might offer a basic version of its software with essential features at a lower price, a standard version with additional functionalities at a moderate price, and a premium version with all features and dedicated support at a higher price. Additionally, volume licensing discounts are provided to businesses purchasing large quantities of licenses, incentivizing bulk purchases. This approach allows consumers to self-select the version that best fits their needs and budget, enabling the software company to capture more consumer surplus by catering to diverse preferences and willingness to pay.

Example 4. Electricity Pricing by Utility Companies (Second-Degree Price Discrimination)

Utility companies, such as those providing electricity, often employ second-degree price discrimination through tiered pricing structures based on consumption levels. Typically, the first block of electricity usage is charged at a lower rate to cover basic needs, while higher usage blocks are priced at increasingly higher rates. For example, the first 500 kilowatt-hours (kWh) might be billed at a standard rate, the next 500 kWh at a higher rate, and any usage beyond that at an even higher rate. This structure encourages conservation among consumers who are sensitive to price changes and ensures that those who use more electricity contribute proportionately more to the utility's revenues. By aligning prices with consumption levels, utility companies can efficiently manage demand and maximize their profits.

Example 5. Personalized Pricing in Ride-Sharing Services (First-Degree Price Discrimination)

Some ride-sharing platforms and taxi services experiment with first-degree price discrimination by tailoring prices to individual consumers based on their specific willingness to pay. For instance, during peak hours or in high-demand areas, prices (often referred to as surge pricing) are dynamically adjusted based on real-time data about demand and supply. Additionally, drivers might negotiate fares directly with passengers in certain scenarios, allowing prices to vary according to the rider’s urgency, destination, or other personal factors. Although pure first-degree price discrimination is challenging due to information constraints, advancements in data analytics and machine learning enable ride-sharing companies to approximate personalized pricing strategies, thereby capturing more consumer surplus and increasing overall profitability.

Multiple Choice Questions

Question 1

Which of the following scenarios best exemplifies third-degree price discrimination?

A) A software company charges different prices based on the number of licenses purchased by a business.

B) A taxi driver negotiates fares individually with each passenger based on their destination and willingness to pay.

C) A movie theater offers discounted tickets to students and seniors while charging regular prices to adults.

D) An airline charges higher prices for last-minute bookings compared to those booked months in advance.

Answer: C) A movie theater offers discounted tickets to students and seniors while charging regular prices to adults.

Explanation:

Third-degree price discrimination involves charging different prices to different demographic groups based on their varying elasticities of demand. Firms segment the market into distinct groups (e.g., students, seniors, adults) and charge each group a different price.

Option A: This describes second-degree price discrimination, where prices vary based on the quantity purchased or the version of the product (e.g., bulk discounts).

Option B: This is an example of first-degree price discrimination, where each consumer is charged their maximum willingness to pay.

Option C: Correct. Offering discounts to specific demographic groups like students and seniors is a textbook example of third-degree price discrimination.

Option D: While this involves price variation, it's more akin to dynamic pricing based on booking time rather than segmenting the market into distinct groups.

Question 2

Which of the following is NOT a necessary condition for a firm to successfully implement price discrimination?

A) The firm must have some degree of market power.

B) The firm must be able to segment the market into distinct groups.

C) The firm's marginal cost must be the same for all consumers.

D) The firm must prevent or limit resale between consumer groups.

Answer: C) The firm's marginal cost must be the same for all consumers.

Explanation:

For successful price discrimination, a firm must meet specific conditions:

Market Power: The firm must have some control over prices, typically existing in monopoly or imperfectly competitive markets.

Market Segmentation: The firm must be able to segment consumers into distinct groups based on their willingness to pay or other characteristics.

Preventing Resale: The firm must ensure that consumers from lower-priced segments cannot resell the product to higher-priced segments, which would undermine the pricing strategy.

Option C states that the firm's marginal cost must be the same for all consumers. This is not a necessary condition for price discrimination. In reality, marginal costs can vary, but price discrimination focuses on varying prices based on willingness to pay rather than differences in production costs.

Question 3

What is one potential welfare effect of third-degree price discrimination compared to a single-price monopoly?

A) Total welfare decreases due to higher prices charged to all consumers.

B) Consumer surplus increases while producer surplus decreases.

C) Deadweight loss is eliminated entirely.

D) Producer surplus increases, and deadweight loss decreases.

Answer: D) Producer surplus increases, and deadweight loss decreases.

Explanation:

Third-degree price discrimination allows a firm to charge different prices to different consumer groups based on their elasticity of demand. Compared to a single-price monopoly, this strategy can lead to:

Increased Producer Surplus: By capturing more consumer surplus through differentiated pricing, the firm enhances its total profits.

Decreased Deadweight Loss: Price discrimination can lead to a more efficient allocation of resources. More consumers who were priced out under a single-price monopoly may now purchase the product at lower prices tailored to their willingness to pay, thereby reducing deadweight loss.

Option A: Incorrect. While some consumers pay higher prices, others benefit from lower prices, and overall welfare effects are mixed, not a blanket decrease.

Option B: Incorrect. Producer surplus actually increases, not decreases, under price discrimination.

Option C: Incorrect. Deadweight loss may decrease but is not entirely eliminated unless it's first-degree price discrimination in a perfectly competitive scenario, which is rare.

Option D: Correct. Producer surplus increases due to better capturing consumer surplus, and deadweight loss decreases as more consumers are able to purchase the good at prices closer to their willingness to pay.