Profit maximization is a fundamental concept in AP Microeconomics that examines how firms determine the optimal level of production and pricing to achieve the highest possible financial gain. By analyzing costs and revenues, businesses aim to identify the point where the difference between total revenue and total cost is greatest. This involves understanding marginal costs and marginal revenues, enabling firms to make informed decisions about resource allocation, production levels, and strategic planning. Mastering profit maximization helps students grasp how companies sustain competitiveness and ensure long-term success in the market.

Learning Objectives

In studying “Profit Maximization” for AP Microeconomics, you should focus on understanding how firms determine the optimal output level where marginal cost (MC) equals marginal revenue (MR) to maximize profit. Learn to analyze different market structures and how they influence a firm’s profit-maximizing decisions. You should also grasp how changes in cost and revenue impact profitability and how firms react to market signals in both the short run and long run to achieve maximum profit.

1. What is Profit Maximization?

Profit Maximization is the process by which a firm determines the price and output level that returns the greatest profit. A firm aims to produce at a level where the difference between total revenue (TR) and total cost (TC) is maximized.

- Profit (π) = Total Revenue (TR) − Total Cost (TC)

- Total Revenue (TR) = Price (P) × Quantity Sold (Q)

- Total Cost (TC) = Fixed Costs (FC) + Variable Costs (VC)

Key Objective: Choose the output level where the additional revenue from selling one more unit equals the additional cost of producing that unit.

2. The Profit Maximization Condition: MR = MC

To maximize profit, firms follow the rule:

Marginal Revenue (MR)=Marginal Cost (MC)

Definitions:

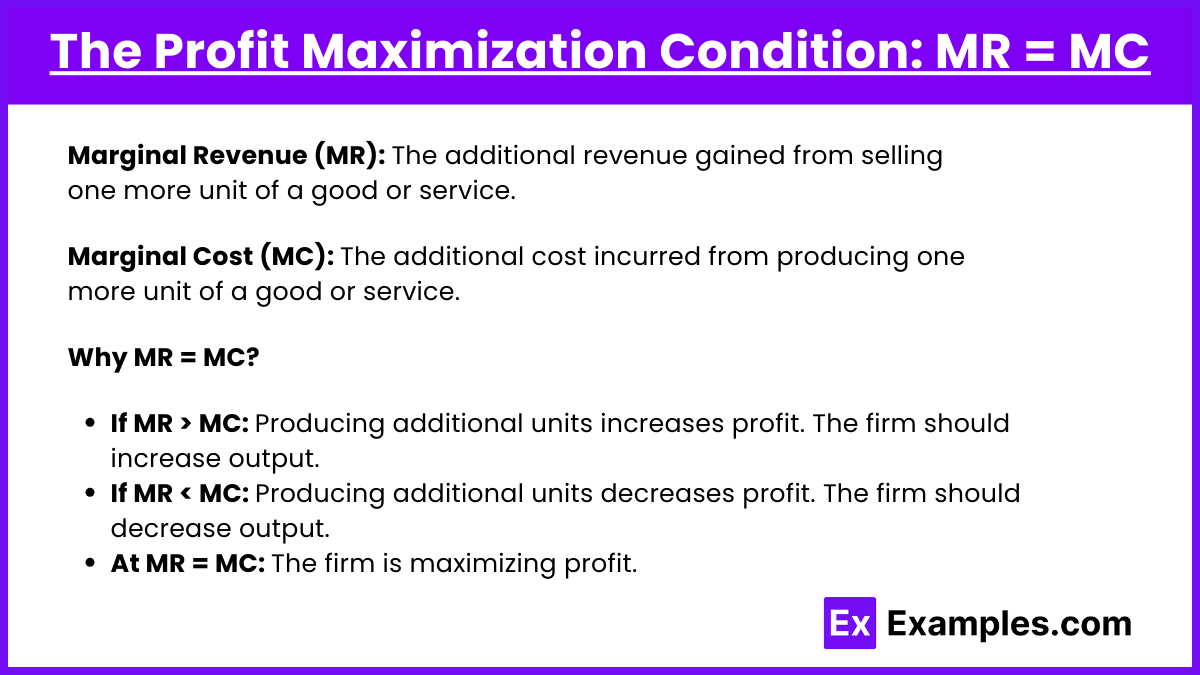

- Marginal Revenue (MR): The additional revenue gained from selling one more unit of a good or service.

- Marginal Cost (MC): The additional cost incurred from producing one more unit of a good or service.

Why MR = MC?

- If MR > MC: Producing additional units increases profit. The firm should increase output.

- If MR < MC: Producing additional units decreases profit. The firm should decrease output.

- At MR = MC: The firm is maximizing profit. Producing beyond this point would decrease profit, and producing less would mean foregoing potential profit.

3. Graphical Representation of Profit Maximization Diagram

Profit Maximization Diagram

Since images can’t be displayed, here’s a description of the diagram:

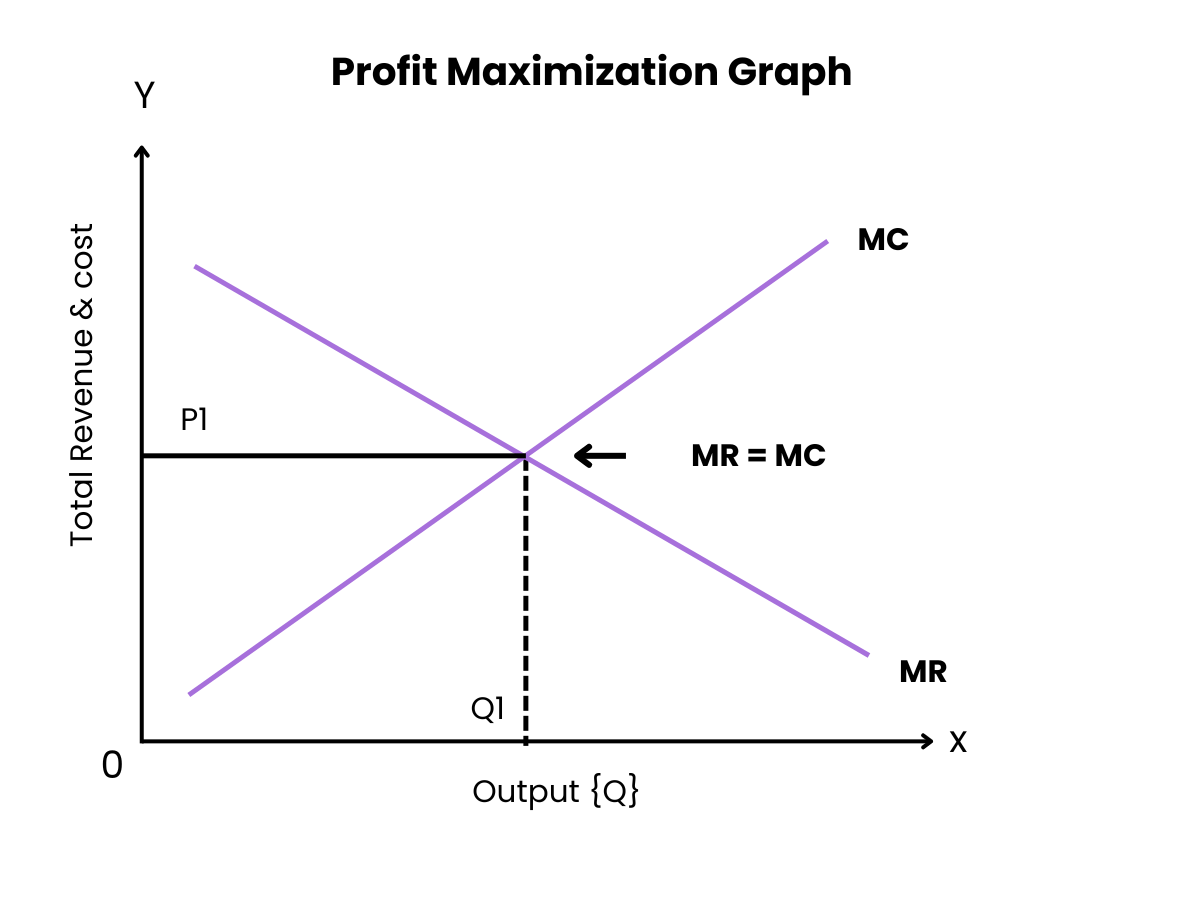

- Axes:

- Vertical Axis: Price and Cost

- Horizontal Axis: Quantity (Q)

- Curves:

- Marginal Revenue (MR): Downward sloping for monopolistic markets; horizontal for perfect competition.

- Marginal Cost (MC): Typically U-shaped due to economies and diseconomies of scale.

- Average Total Cost (ATC): Also U-shaped, lying above MC when MC is rising.

- Profit Maximization Point:

- Intersection of MR and MC curves determines the profit-maximizing quantity (Q*).

- The price (P*) is determined by the demand curve at Q*.

- Profit Area:

- The vertical distance between ATC and Price at Q* multiplied by Q* represents total profit.

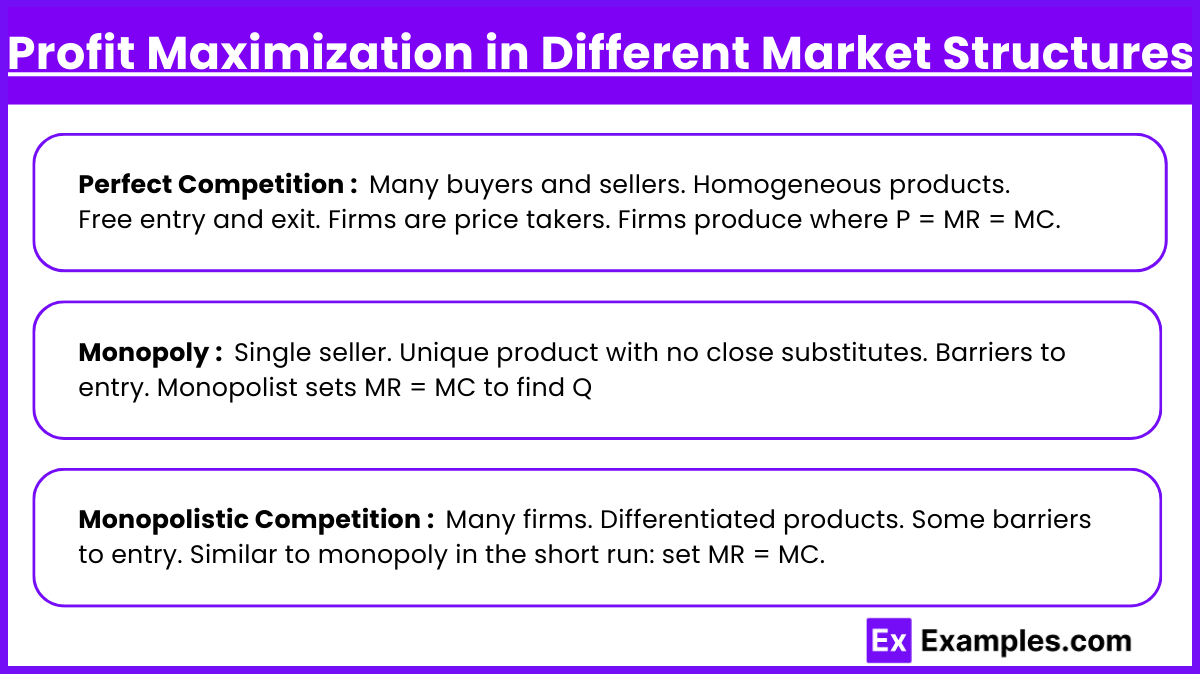

4. Profit Maximization in Different Market Structures

a. Perfect Competition

- Characteristics:

- Many buyers and sellers.

- Homogeneous products.

- Free entry and exit.

- Firms are price takers.

- Profit Maximization:

- Firms produce where P = MR = MC.

- In the long run, economic profit tends to zero due to free entry and exit.

b. Monopoly

- Characteristics:

- Single seller.

- Unique product with no close substitutes.

- Barriers to entry.

- Profit Maximization:

- Monopolist sets MR = MC to find Q*.

- Determines P* from the demand curve at Q*.

- Typically results in higher prices and lower quantities compared to perfect competition, leading to potential deadweight loss.

c. Monopolistic Competition

- Characteristics:

- Many firms.

- Differentiated products.

- Some barriers to entry.

- Profit Maximization:

- Similar to monopoly in the short run: set MR = MC.

- In the long run, free entry drives economic profits to zero, with firms producing where P = ATC.

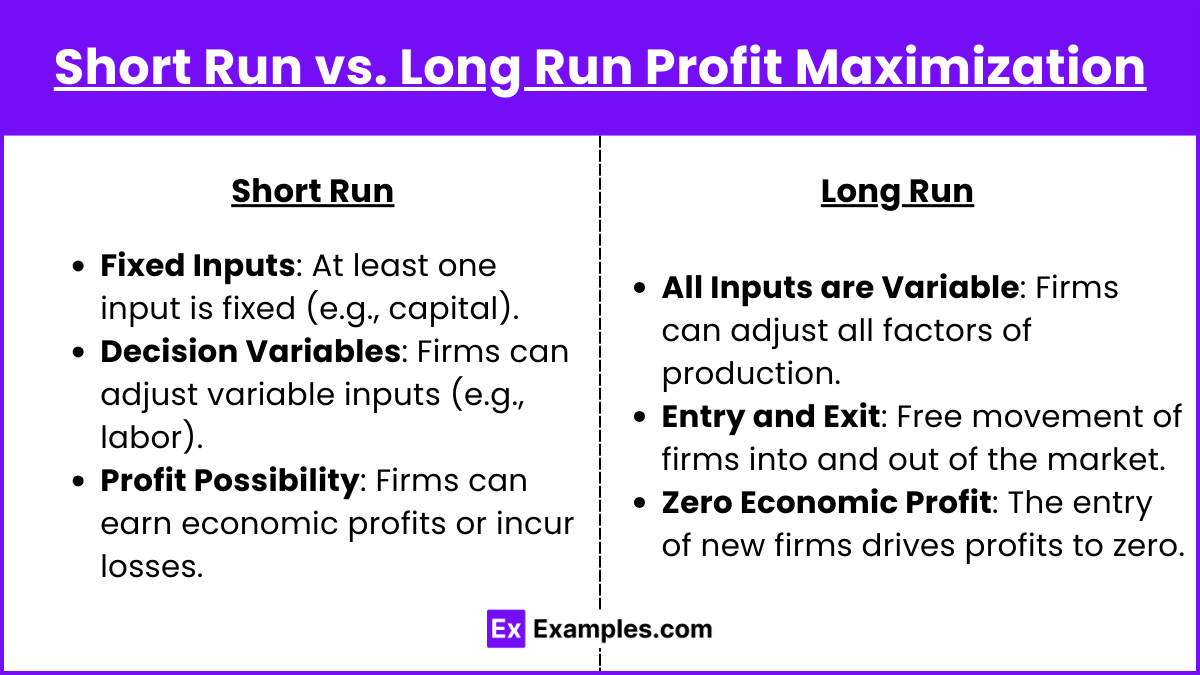

5. Short Run vs. Long Run Profit Maximization

a. Short Run

- Fixed Inputs: At least one input is fixed (e.g., capital).

- Decision Variables: Firms can adjust variable inputs (e.g., labor).

- Profit Possibility: Firms can earn economic profits or incur losses.

b. Long Run

- All Inputs are Variable: Firms can adjust all factors of production.

- Entry and Exit: Free movement of firms into and out of the market.

- Zero Economic Profit: In perfect competition, the entry of new firms drives profits to zero. In monopoly, barriers maintain potential for profits.

Examples

Example 1: Monopoly Pricing Strategy

A pharmaceutical company holding a patent for a life-saving drug operates as a monopolist in the market. To maximize profits, the company analyzes the demand curve for its drug and determines the price point where its marginal revenue equals its marginal cost. By setting the price higher than in competitive markets, the firm leverages its unique position to extract maximum possible revenue without deterring consumers excessively. This strategic pricing ensures that the company captures the highest profit margins while maintaining sufficient sales volume.

Example 2 : Perfect Competition Production Decision

A wheat farmer in a perfectly competitive market faces a scenario where the price of wheat is determined by the overall market supply and demand. To maximize profit, the farmer adjusts the quantity of wheat produced so that the marginal cost of producing an additional unit of wheat equals the market price. By doing so, the farmer ensures that resources are allocated efficiently, producing wheat up to the point where the cost of producing one more unit is exactly covered by the revenue it generates, thereby maximizing profits.

Example 3: Cost-Cutting Measures in Manufacturing

An automobile manufacturer aims to maximize profits by reducing production costs without compromising quality. The company conducts a thorough analysis of its production processes and identifies areas where automation can replace manual labor, thereby lowering labor costs. Additionally, it negotiates bulk purchasing agreements with suppliers to reduce the cost of raw materials. By implementing these cost-cutting measures, the manufacturer decreases its overall expenses, thereby increasing its profit margins while maintaining competitive pricing for its vehicles.

Example 4: Optimal Product Mix in a Diversified Company

A technology conglomerate produces multiple products, including smartphones, laptops, and tablets. To maximize profits, the company performs a marginal analysis to determine the optimal allocation of resources among these products. It assesses the marginal revenue and marginal cost associated with each product line and allocates more resources to the products that offer higher marginal returns. By optimizing the product mix based on profitability, the conglomerate ensures that it focuses on the most lucrative segments, thereby enhancing overall profitability.

Example 5: Investment in Innovation and Technology

A software development firm seeks to maximize profits by investing in research and development (R&D) to create innovative products. By developing cutting-edge software solutions, the firm can differentiate itself from competitors, allowing it to charge premium prices. Additionally, investing in scalable cloud-based technologies reduces long-term operational costs and improves efficiency. These strategic investments not only increase the firm’s revenue through higher sales but also lower costs, leading to enhanced profit margins and sustainable long-term profitability.

Multiple Choice Questions

Question 1

A firm is in a perfectly competitive market. To maximize its profit, the firm should produce the quantity of output where:

A) Price equals Average Total Cost (P = ATC).

B) Marginal Revenue equals Marginal Cost (MR = MC).

C) Total Revenue is maximized.

D) Average Variable Cost is minimized.

Answer: B) Marginal Revenue equals Marginal Cost (MR = MC).

Explanation: In a perfectly competitive market, firms are price takers, meaning the price (P) is determined by the market and equals both marginal revenue (MR) and average revenue (AR). To maximize profit, a firm should produce up to the point where the additional revenue from selling one more unit (MR) equals the additional cost of producing that unit (MC).

- Option A: When P = ATC, the firm is breaking even (normal profit), not necessarily maximizing profit.

- Option C: Maximizing total revenue does not account for costs, so it does not ensure profit maximization.

- Option D: Minimizing average variable cost pertains to cost efficiency but not directly to profit maximization.

Therefore, the correct condition for profit maximization is MR = MC.

Question 2

Which of the following scenarios indicates that a firm is not maximizing its profit?

A) Marginal Revenue is greater than Marginal Cost (MR > MC).

B) Price exceeds Average Total Cost (P > ATC).

C) Average Total Cost is decreasing (ATC is falling).

D) Total Revenue is greater than Total Cost (TR > TC).

Answer: A) Marginal Revenue is greater than Marginal Cost (MR > MC).

Explanation: When MR > MC, the firm can increase its profit by producing more units because the revenue from selling an additional unit exceeds the cost of producing it. This means the firm has not yet reached the profit-maximizing output level.

- Option B: If P > ATC, the firm is making a profit, but it does not necessarily indicate whether the firm is at the optimal output level for maximum profit.

- Option C: A decreasing ATC suggests economies of scale but does not directly relate to whether the firm is maximizing profit.

- Option D: When TR > TC, the firm is profitable, but like Option B, it does not confirm if profit is maximized.

Thus, MR > MC signifies that the firm can still increase profit by increasing production, indicating that it is not currently maximizing profit.

Question 3

In the short run, a monopolist maximizes profit by producing the quantity where:

A) Price equals Marginal Cost (P = MC).

B) Marginal Revenue equals Marginal Cost (MR = MC).

C) Average Total Cost is minimized (ATC is at its lowest point).

D) Total Revenue is maximized.

Answer: B) Marginal Revenue equals Marginal Cost (MR = MC).

Explanation: A monopolist, unlike a perfectly competitive firm, has market power and faces a downward-sloping demand curve. To maximize profit, the monopolist sets output where MR = MC, just like firms in other market structures. However, because the monopolist’s MR is less than the price (due to the downward-sloping demand curve), the price will be set above MC.

- Option A: Setting P = MC is characteristic of perfect competition, not monopoly. Monopolists set P > MC.

- Option C: Minimizing ATC relates to cost efficiency but does not ensure profit maximization.

- Option D: Maximizing TR ignores costs, so it does not necessarily lead to profit maximization.

Therefore, the monopolist maximizes profit by producing where MR = MC.