In AP Microeconomics, understanding the distinction between public and private goods is crucial for analyzing market efficiency and government intervention. Private goods are excludable and rival, efficiently provided by markets, while public goods are non-excludable and non-rival, often requiring government provision due to the free-rider problem. Mastering this concept is essential for success on the AP Microeconomics exam.

Free AP Microeconomics Practice Test

Learning Objectives

In studying "Public and Private Goods" for AP Microeconomics, you should learn to differentiate between public and private goods based on characteristics like excludability and rivalry. Analyze the free-rider problem associated with public goods and how it leads to market failure. Evaluate the role of government in providing public goods and correcting under-provision. Explore examples of private and public goods in the real world, and understand how their consumption affects resource allocation and economic efficiency. Additionally, learn how mixed goods, such as common resources, fit into this framework and their implications for policy decisions.

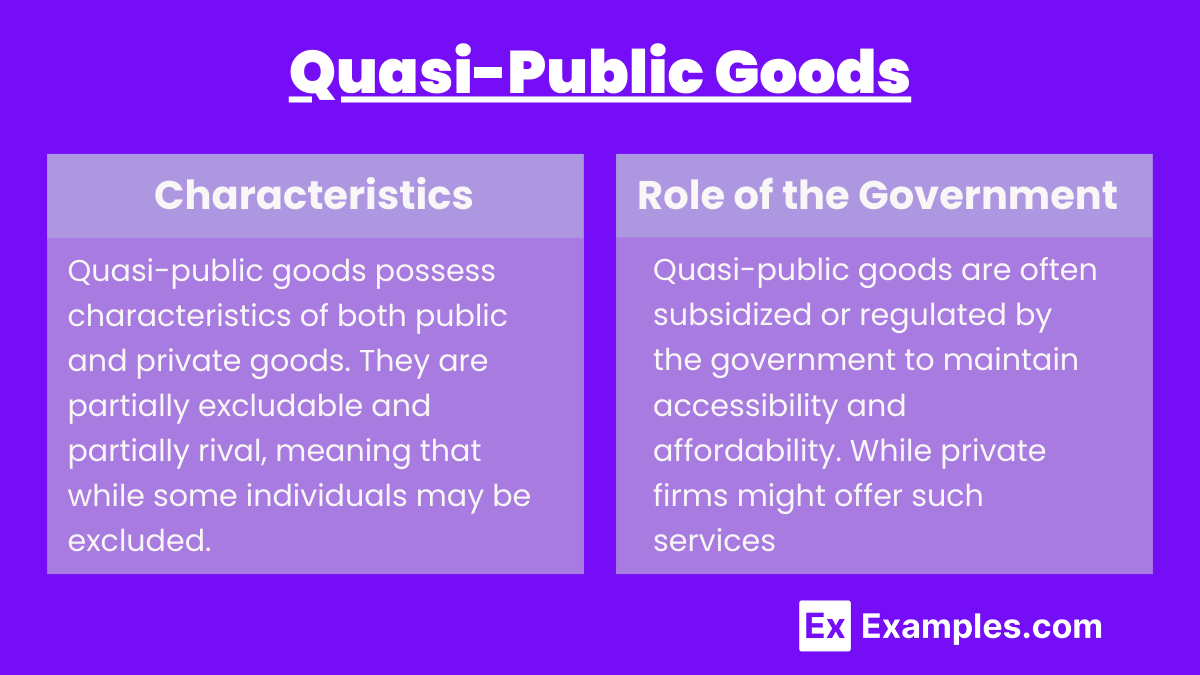

1. Quasi-Public Goods

Characteristics: Quasi-public goods possess characteristics of both public and private goods. They are partially excludable and partially rival, meaning that while some individuals may be excluded, others may still benefit from them. In addition, one person's use may reduce the good's availability to others, but not to the same extent as with purely private goods.

Examples: Examples of quasi-public goods include education, healthcare, and toll roads. In the case of education, for example, students benefit from attending school without significantly reducing the quality for others, though capacity limits do exist. Similarly, toll roads exclude people who don't pay, but the road is still accessible to many users without much congestion (up to a point).

Role of the Government: Quasi-public goods are often subsidized or regulated by the government to maintain accessibility and affordability. While private firms might offer such services, governments intervene to ensure these goods remain available to a broader population due to their partial public nature.

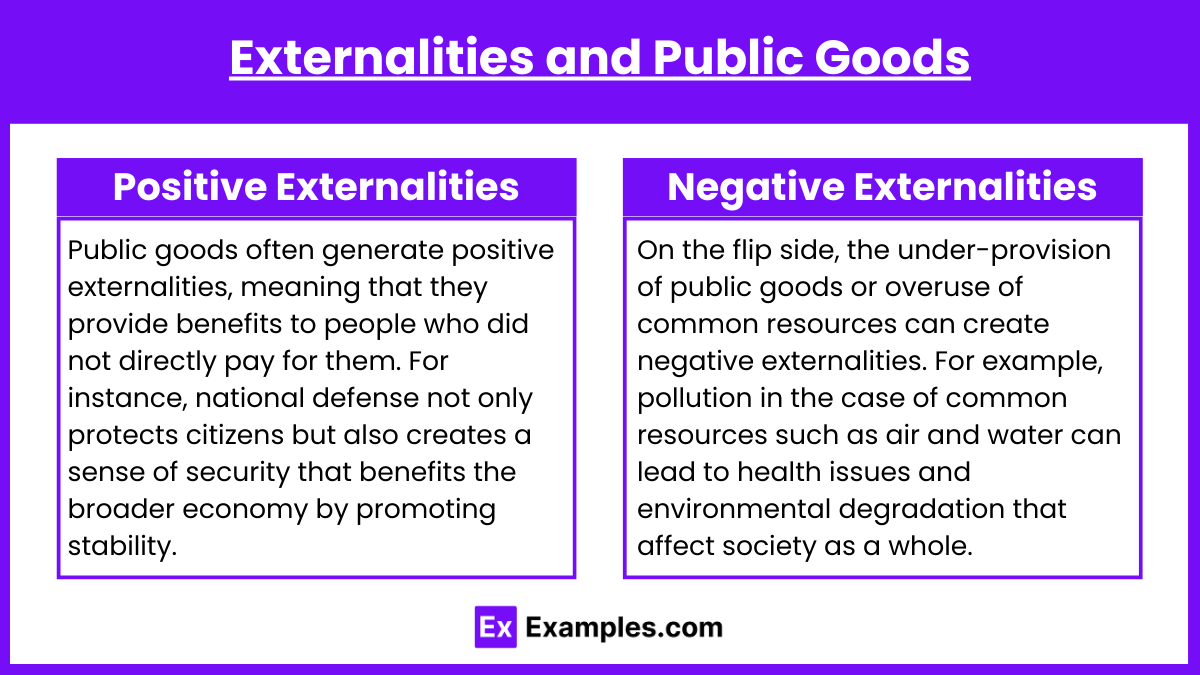

2. Externalities and Public Goods:

Positive Externalities: Public goods often generate positive externalities, meaning that they provide benefits to people who did not directly pay for them. For instance, national defense not only protects citizens but also creates a sense of security that benefits the broader economy by promoting stability.

Negative Externalities: On the flip side, the under-provision of public goods or overuse of common resources can create negative externalities. For example, pollution in the case of common resources such as air and water can lead to health issues and environmental degradation that affect society as a whole.

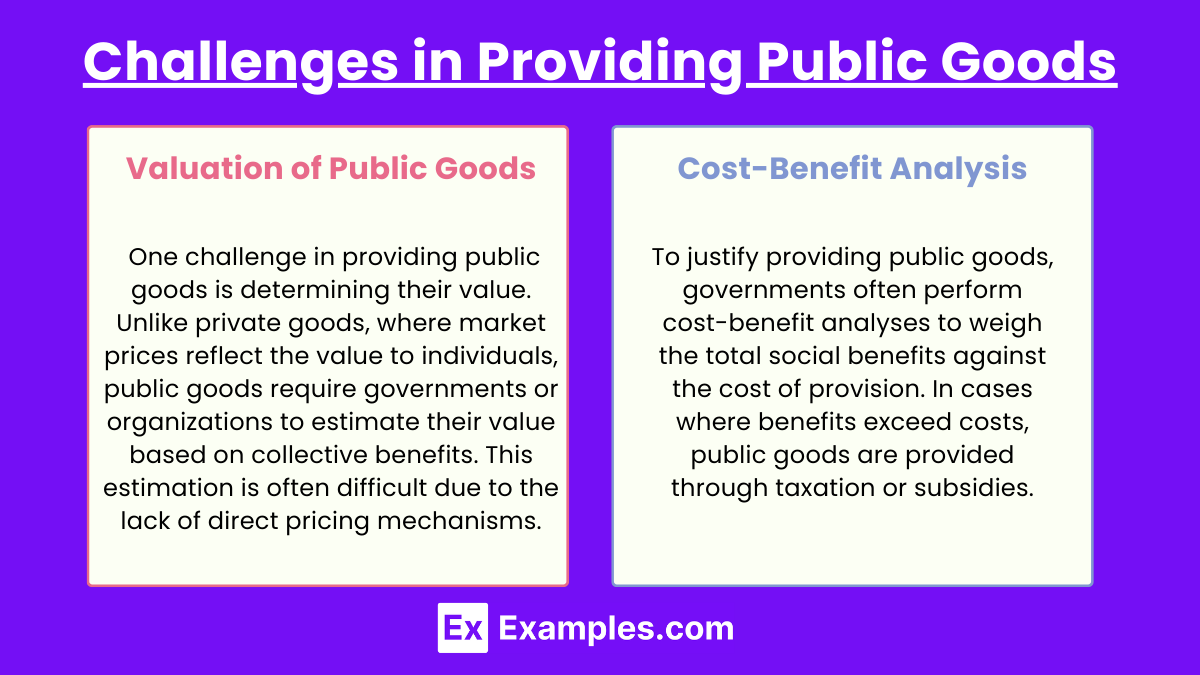

3. Challenges in Providing Public Goods:

Valuation of Public Goods: One challenge in providing public goods is determining their value. Unlike private goods, where market prices reflect the value to individuals, public goods require governments or organizations to estimate their value based on collective benefits. This estimation is often difficult due to the lack of direct pricing mechanisms.

Cost-Benefit Analysis: To justify providing public goods, governments often perform cost-benefit analyses to weigh the total social benefits against the cost of provision. In cases where benefits exceed costs, public goods are provided through taxation or subsidies.

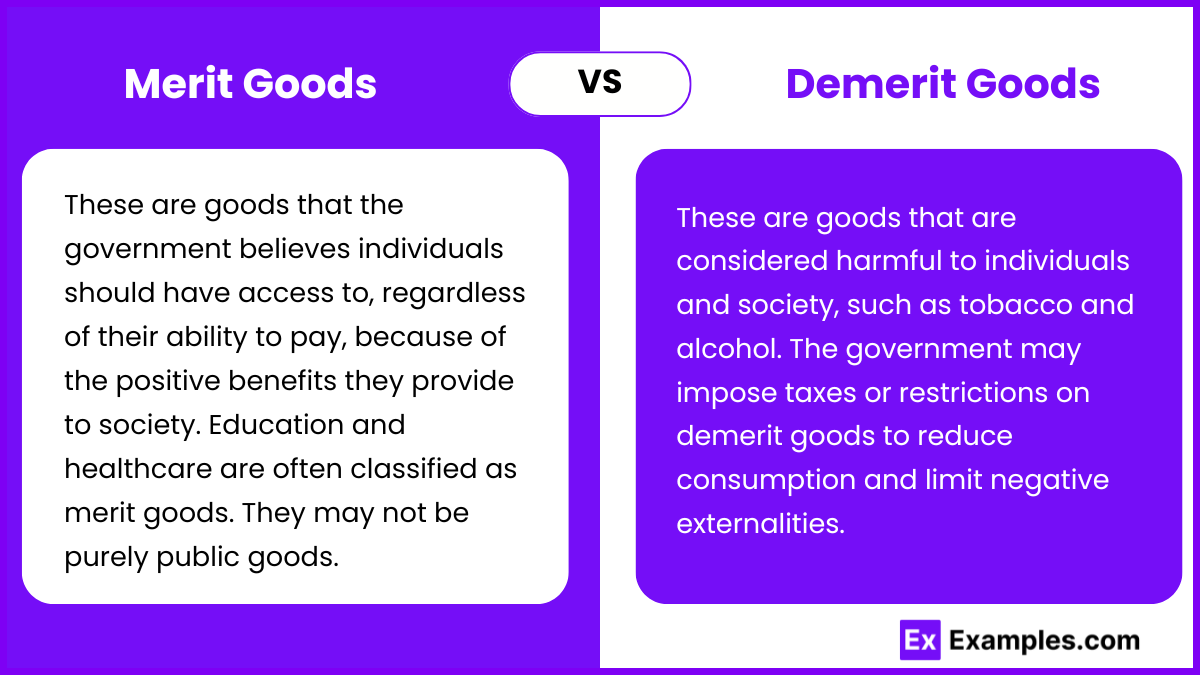

4. Merit Goods vs Demerit Goods:

Merit Goods: These are goods that the government believes individuals should have access to, regardless of their ability to pay, because of the positive benefits they provide to society. Education and healthcare are often classified as merit goods. They may not be purely public goods, but governments still provide them due to their social value.

Demerit Goods: These are goods that are considered harmful to individuals and society, such as tobacco and alcohol. The government may impose taxes or restrictions on demerit goods to reduce consumption and limit negative externalities.

5. Public Goods and Global Issues:

Global Public Goods: Certain goods, like the environment and clean air, transcend national borders and are considered global public goods. These require international cooperation for provision and preservation because the benefits (or negative effects) are shared globally. Climate change mitigation is a classic example of a global public good where collective action is necessary to ensure environmental sustainability.

Challenges in Provision: Global public goods often face significant challenges due to differing national interests and the free-rider problem at an international level, where countries may benefit from global efforts without contributing equally to their provision.

Examples

Example 1: Public Good – National Defense

National defense is non-excludable and non-rival. Everyone in the country benefits from protection, regardless of individual contribution, and one person's protection does not reduce another's.

Example 2: Private Good – Clothing

Clothing is both excludable and rival. Individuals purchase clothing for personal use, and once someone owns it, others cannot use it. The market efficiently provides this through supply and demand.

Example 3: Public Good – Street Lighting

Street lighting is non-excludable and non-rival. Everyone benefits from lit streets, and one person’s use does not diminish the availability or benefit of the light to others.

Example 4: Private Good – Food

Food is excludable and rival. Once purchased, only the buyer can consume it, and its consumption by one individual reduces the amount available for others, making it a typical private good.

Example 5: Public Good – Clean Air

Clean air is non-excludable and non-rival. Everyone benefits from pollution control measures, and one person’s enjoyment of clean air does not limit others from enjoying the same air quality.

MCQs

Question 1

Which of the following is a characteristic of a public good?

A. It is excludable.

B. It is rival in consumption.

C. It is non-excludable and non-rival.

D. It is only provided by private firms.

Answer: C. It is non-excludable and non-rival.

Explanation: Public goods are defined by two key characteristics: non-excludability (it is difficult to prevent people from using the good) and non-rivalry (one person’s use does not reduce the availability for others). National defense and street lighting are classic examples of public goods, which everyone can benefit from without reducing the benefits for others. Private goods, on the other hand, are excludable and rival in consumption.

Question 2

Which of the following is an example of a private good?

A. National defense

B. A public park

C. Food

D. Clean air

Answer: C. Food.

Explanation: Food is a classic example of a private good because it is both excludable and rival in consumption. A person must pay to consume it, and once it is consumed, it is no longer available for others. In contrast, national defense and clean air are public goods (non-excludable and non-rival), and public parks, though sometimes managed by governments, can vary in excludability based on access rules.

Question 3

What problem commonly arises when providing public goods like national defense or street lighting?

A. Overconsumption due to high demand

B. Free-rider problem

C. Government's inability to regulate their use

D. Private firms overproducing the goods

Answer: B. Free-rider problem.

Explanation: The free-rider problem occurs with public goods because they are non-excludable, meaning people can benefit from the good without paying for it. This often leads to underfunding or non-provision of the good by private firms, as individuals may avoid paying if they can still benefit without contributing. Government intervention is typically needed to fund and provide such goods through taxation.