Government intervention in markets is a pivotal topic in AP Microeconomics, focusing on how government actions like taxes, subsidies, price controls, and regulations impact economic outcomes. These interventions aim to correct market failures, promote equity, or achieve social objectives but can also introduce inefficiencies such as deadweight loss, shortages, and surpluses. Understanding these effects allows students to analyze the delicate balance between free markets and government policies, critically evaluating the trade-offs involved in economic decision-making.

Learning Objectives

When studying “The Effects of Government Intervention in Markets” for AP Microeconomics, you should aim to understand the reasons behind government intervention, such as correcting market failures and promoting equity. Learn how tools like taxes, subsidies, price ceilings, and price floors affect supply and demand, equilibrium prices and quantities, and overall market efficiency. Be able to analyze these impacts using graphs, evaluate changes in consumer and producer surplus, and recognize potential unintended consequences like deadweight loss and black markets.

Introduction

In a free market economy, prices and quantities of goods and services are determined by the forces of supply and demand. However, governments often intervene in markets to achieve economic and social objectives. Understanding the effects of government intervention is crucial for the AP Microeconomics exam, as it encompasses key concepts such as efficiency, equity, and the role of public policy in correcting market failures.Reasons for Government Intervention

Reasons for Government Market Intervention

- Correcting Market Failures: Markets sometimes fail to allocate resources efficiently due to externalities, public goods, or information asymmetries.

- Redistributing Income and Wealth: To promote equity, governments may redistribute resources through taxation and welfare programs.

- Stabilizing the Economy: Through fiscal and monetary policies, governments aim to reduce economic fluctuations.

- Promoting Economic Growth: Governments may invest in infrastructure, education, and technology to enhance productivity.

- Protecting Consumers and Producers: Regulations may be implemented to ensure safety, quality, and fair competition.

Types of Government Intervention

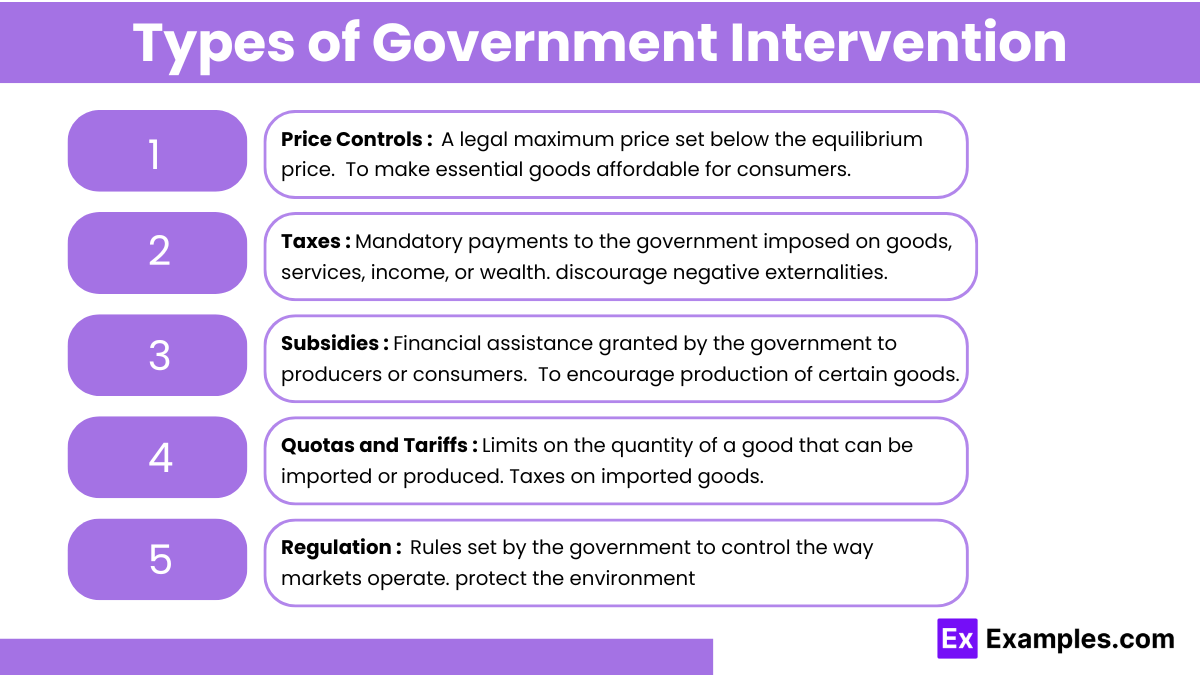

A. Price Controls

i. Price Ceilings

- Definition: A legal maximum price set below the equilibrium price.

- Purpose: To make essential goods affordable for consumers.

- Example: Rent control in housing markets.

ii. Price Floors

- Definition: A legal minimum price set above the equilibrium price.

- Purpose: To ensure fair income for producers.

- Example: Minimum wage laws in labor markets.

B. Taxes

- Definition: Mandatory payments to the government imposed on goods, services, income, or wealth.

- Purpose: To raise revenue and discourage negative externalities.

- Types:

- Excise Taxes: Per-unit taxes on specific goods.

- Ad Valorem Taxes: Taxes based on the value of the transaction.

C. Subsidies

- Definition: Financial assistance granted by the government to producers or consumers.

- Purpose: To encourage production or consumption of certain goods.

- Example: Subsidies for renewable energy sources.

D. Quotas and Tariffs

- Quotas: Limits on the quantity of a good that can be imported or produced.

- Tariffs: Taxes on imported goods.

- Purpose: To protect domestic industries and control the balance of trade.

E. Regulation

- Definition: Rules set by the government to control the way markets operate.

- Purpose: To ensure safety, protect the environment, and promote competition.

Effects of Government Intervention

A. Effects on Equilibrium Price and Quantity

- Price Ceilings: Lead to shortages as quantity demanded exceeds quantity supplied.

- Price Floors: Lead to surpluses as quantity supplied exceeds quantity demanded.

- Taxes: Increase the price buyers pay and decrease the price sellers receive, reducing the equilibrium quantity.

- Subsidies: Decrease the price buyers pay and increase the price sellers receive, increasing the equilibrium quantity.

B. Effects on Consumer and Producer Surplus

- Consumer Surplus: The difference between what consumers are willing to pay and what they actually pay.

- Producer Surplus: The difference between the price producers receive and the minimum they are willing to accept.

- Intervention: Generally reduces total surplus due to inefficiencies introduced.

C. Deadweight Loss

- Definition: The loss of total surplus that occurs because the quantity of a good that is bought and sold is below the market equilibrium quantity.

- Cause: Taxes, price controls, and other interventions distort market outcomes.

D. Market Efficiency

- Allocative Efficiency: When resources are distributed such that consumer and producer surplus are maximized.

- Government Intervention: Can lead to inefficiencies if it prevents markets from reaching equilibrium.

Examples

Example 1: Rent Control (Price Ceiling)

Rent control is a government policy that sets a maximum price landlords can charge for renting out a home, typically below the market equilibrium. The intention is to make housing more affordable for low-income tenants. However, this intervention often leads to a shortage of rental housing because at the lower price, more people want to rent apartments than there are units available. Landlords may also have less incentive to maintain or improve their properties due to reduced revenue, leading to a decline in housing quality. Additionally, a black market may emerge where landlords charge illegal fees to circumvent the price ceiling.

Example 2: Minimum Wage Laws (Price Floor)

The government establishes a legal minimum wage above the equilibrium wage in the labor market to ensure workers earn a living wage. While the policy aims to improve income equity, it can result in a surplus of labor, meaning unemployment. Employers may hire fewer workers or reduce working hours because the cost of labor has increased. This is particularly impactful on low-skilled workers and small businesses. In some cases, firms may substitute labor with automation to reduce costs, which can further exacerbate unemployment issues.

Example 3: Excise Taxes on Cigarettes (Taxation)

Governments often impose excise taxes on cigarettes to discourage smoking and generate revenue. This tax increases the cost of production, shifting the supply curve upward. As a result, the price consumers pay rises, and the quantity demanded decreases. While the intended effect is to reduce smoking rates for public health benefits, the tax can be regressive, disproportionately affecting low-income individuals who are more likely to smoke. Additionally, high cigarette taxes can lead to smuggling and black markets as consumers seek cheaper alternatives, undermining the policy’s effectiveness.

Example 4 : Subsidies for Renewable Energy (Subsidization)

To promote clean energy, governments provide financial assistance to renewable energy producers. Subsidies lower production costs, shifting the supply curve to the right, which reduces market prices and increases the quantity consumed. This intervention aims to make renewable energy more competitive with fossil fuels, encouraging both production and consumption. However, subsidies can lead to market distortions if they encourage overproduction or if companies become dependent on government support rather than improving efficiency. There’s also the opportunity cost of allocating government funds to subsidies instead of other public services.

Example 5 : Pollution Taxes (Correcting Negative Externalities)

Pollution taxes are imposed on firms that generate environmental pollution, a negative externality not reflected in market prices. By taxing the pollutant, the government internalizes the external cost, shifting the supply curve upward. This results in a higher market price and a lower quantity of the polluting good produced and consumed, moving the market toward the socially optimal level of output. While this intervention can significantly reduce environmental harm, it may increase production costs and prices for consumers. There’s also a risk that firms may relocate to countries with less stringent regulations, potentially harming the domestic economy.

Multiple Choice Questions

Question 1

Which of the following is a likely consequence of the government imposing a price ceiling below the equilibrium price in a competitive market?

A) Surplus of goods

B) Reduction in consumer surplus

C) Creation of a black market

D) Increase in producer surplus

Answer: C) Creation of a black market

Explanation: A price ceiling is a government-imposed limit on how high a price can be charged for a product. When a price ceiling is set below the equilibrium price (the price at which quantity demanded equals quantity supplied), it leads to several effects:

- Shortage: At the lower price, quantity demanded increases while quantity supplied decreases, resulting in a shortage of goods.

- Black Markets: Because the legal market cannot supply enough goods to meet demand at the lower price, a black market may emerge where the good is sold illegally at higher prices.

- Consumer Surplus: Initially, consumers may benefit from lower prices, but the shortage can lead to rationing, reducing overall consumer surplus.

- Producer Surplus: Producers receive a lower price and sell fewer goods, thus producer surplus decreases.

A surplus of goods (Option A) occurs when a price floor is set above equilibrium, not a ceiling. Reduction in consumer surplus (Option B) is incorrect because consumers generally gain from lower prices, though the shortage can complicate this. Increase in producer surplus (Option D) is incorrect because producers are worse off due to lower prices and reduced sales.

Question 2

How does a per-unit tax on producers typically affect the market equilibrium in a competitive market?

A) Shifts the demand curve to the left

B) Shifts the supply curve upward by the amount of the tax

C) Creates a price ceiling

D) Eliminates the tax incidence on consumers

Answer: B) Shifts the supply curve upward by the amount of the tax

Explanation: A per-unit tax on producers means that for each unit sold, producers must pay a specific amount to the government. This tax effectively increases the cost of production for each unit, which is represented graphically by shifting the supply curve upward (or to the left) by the amount of the tax.

- New Equilibrium: The upward shift in the supply curve leads to a new equilibrium where the price paid by consumers increases and the price received by producers decreases. The quantity traded in the market typically decreases.

- Tax Incidence: Both consumers and producers share the burden of the tax. The exact division depends on the elasticity of demand and supply.

Option A is incorrect because a per-unit tax on producers affects the supply side, not the demand side. Option C is unrelated as a price ceiling is a different form of intervention. Option D is incorrect because the tax incidence is shared between consumers and producers, not eliminated on consumers.

Question 3

Which of the following best describes a potential negative effect of government subsidies in a market?

A) Decrease in consumer surplus

B) Overproduction of the subsidized good

C) Increase in market price above equilibrium

D) Reduction in producer surplus

Answer: B) Overproduction of the subsidized good

Explanation: A government subsidy is a financial contribution provided to producers or consumers to encourage the production or consumption of a good. While subsidies can lead to positive outcomes, they can also have negative effects:

- Overproduction: Subsidies lower the effective cost of production, leading producers to supply more than the socially optimal quantity, resulting in overproduction. This can lead to inefficient allocation of resources.

- Deadweight Loss: Overproduction creates a deadweight loss, representing the loss of economic efficiency when the equilibrium outcome is not achievable or not achieved.

- Market Price: Subsidies can lead to a lower market price, which increases consumer surplus but may decrease producer surplus unless the subsidy offsets it.

Option A is incorrect because consumer surplus typically increases due to lower prices from subsidies. Option C is incorrect as subsidies usually lower market prices below equilibrium. Option D is incorrect because producer surplus generally increases due to higher effective prices received after the subsidy.