10+ Debt Collection Agreement Examples to Download

Companies, businesses, or even on a personal level know that if you owe someone or a company money, there will be a time when you must return the money or pay your debt. Renting out places that your tenants may be occupying is considered a job that you would be collecting debt from. Some who do collect debt from others know that it is not always sunshine and rainbows. Collecting debt from others may not sound like the best idea or the best kind of job in the world. But for some who do have to collect debt from others, it can also get quite a hassle, especially when the promises being made are only made through word of mouth and not through written documents like an agreement. In order to get a good idea of what a debt collection agreement is about, let’s take a look at some examples below. See 8+ Debt Agreement Contract Example.

10+ Debt Collection Agreement Examples

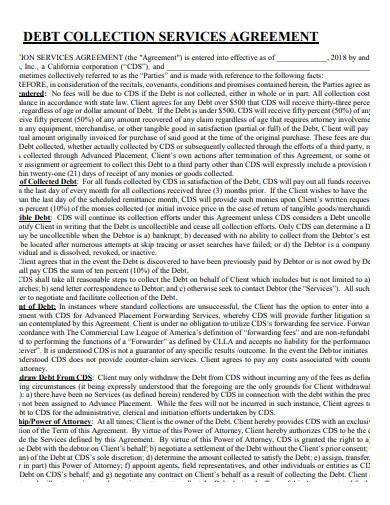

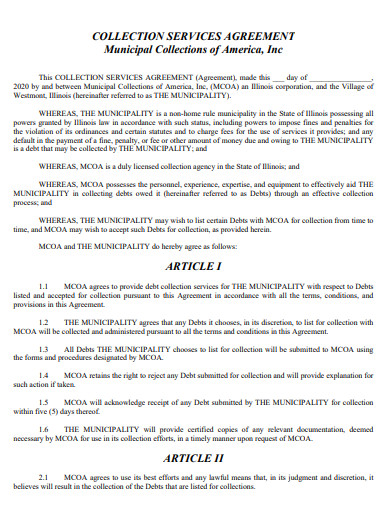

1. Debt Collection Services Agreement

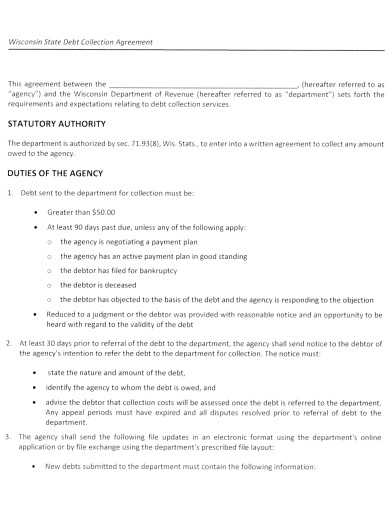

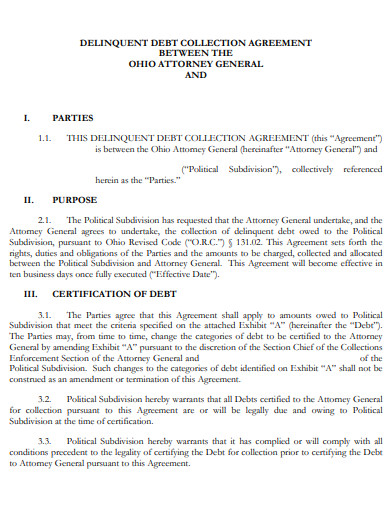

2. Sample Debt Collection Agreement

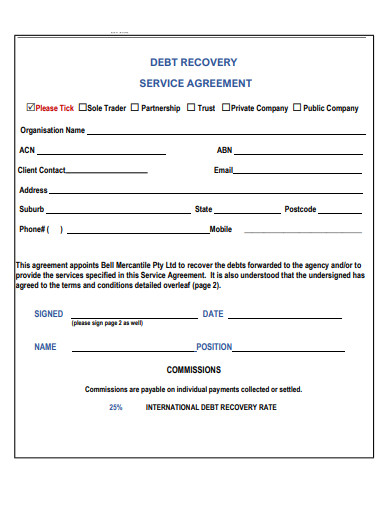

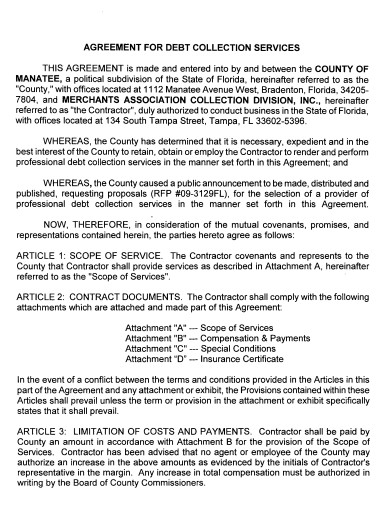

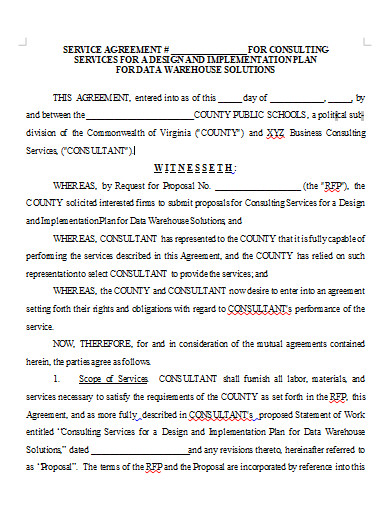

3. Sample Debt Collection Services Agreement

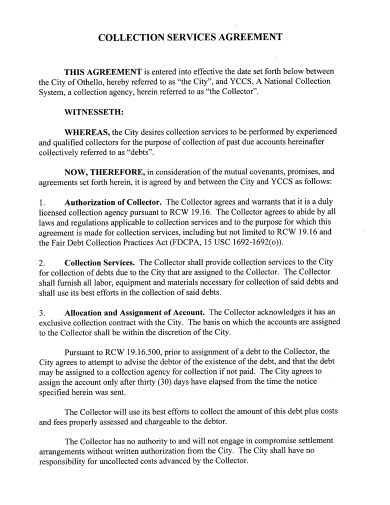

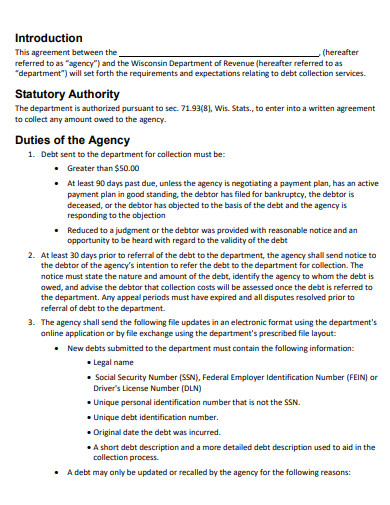

4. Simple Debt Collection Agreement

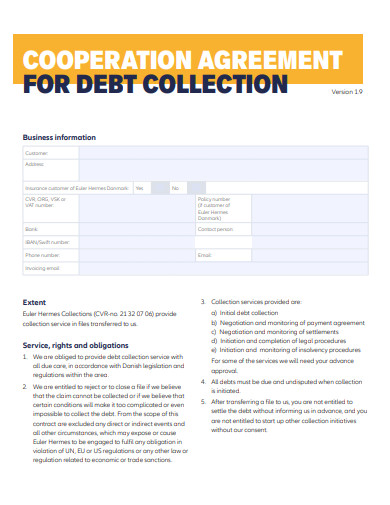

5. Coopertion Debt Collection Agreement

6. Formal Debt Collection Agreement

7. Debt Collection Agreement Format

8. Professional Debt Collection Agreement

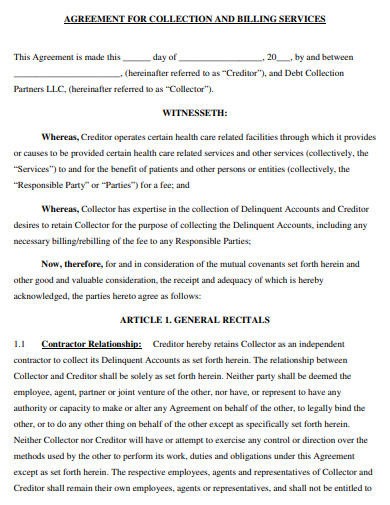

9. Debt Collection and Billing Services Agreement

10. Basic Debt Collection Agreement

11. Printable Debt Collection Agreement

What Is a Debt Collection Agreement?

What is a debt collection agreement? So a debt collection agreement is a legally binding document that is between the person or the company who owes money or are in debt and the creditor or the debt collector agency or company. A debt collection does not only mean that it is written in an agreement format, but it can also be written as an agreement letter. See 16+ Agreement Letter for Payment Examples – PDF, DOC Examples. The agreement consists of the dates of expected payment or when the debt can be collected. In addition to that, a debt collection agreement consists of the information that the debt collector has over the debtor and the amount owed that needs to be paid. Whether it is with interest or not. In order to make a debt collection agreement, you must also have to have the information required for it. With that, let’s move on to how to create a debt collection agreement. See 12+ Payment Agreement Examples in PDF MS Word | Apple Pages.

How to Write a Debt Collection Agreement

What goes in a debt collection agreement or a debt collection letter? When you make an agreement, you would also have the most generic of information like the terms and conditions and the signatures. But with debt collection agreements, there is some information that can be added in order to make it. With that being said, here are some steps on how to write a debt collection agreement. See 22+ Letter of Agreement Examples – PDF, DOC Examples.

1. The Complete Names of Debtor and Creditor

To start the agreement, you must have the complete names of the debtor or debtors if there is more than one. The name of the creditor or the name of the creditor’s company must also be written at the very top of the agreement. This is to certify the agreement is based on the debtor and the creditor, and the amount of money that debtor has to pay.

2. The Date of the Agreement or the Letter

Whether you are writing an agreement or a letter, you must always remember to write down the date of when you made it. This is an important part of the overall agreement or letter. This is also a way for you or the debtor to trace back to when the debtor has borrowed any money from you, the creditor.

3. The Amount of Money Being Owed

The amount of money being owed must also be stated. For each payment that has been made, the amount must also be written along with the date and the name of the person. Just in case the debtor had someone else to represent them to pay, all information must be added to update the agreement or the letter.

4. Terms and Conditions in the Contract

Lastly, the terms and conditions in the contract must be specific, clear and concise. The terms and conditions of the contract work just like any kind of agreement that you will make.

FAQs

What is a debt collection agreement?

So a debt collection agreement is a legally binding document that is between the person or the company who owes money or are in debt and the creditor or the debt collector agency or company. A debt collection does not only mean that it is written in an agreement format, but it can also be written as an agreement letter.

What are some ways to collect debt?

The most basic way to collect the debt from your debtors is asking them for it. But the most formal way you can address it is to write the agreement. You can write a letter stating about the agreement that you made with the debtor or you can write an agreement. See 22+ Promissory Note Examples – PDF, Word, Apple Pages Examples.

How do you make a debt collection agreement?

- The Complete Names of Debtor and Creditor

- The Date of the Agreement or the Letter

- The Amount of Money Being Owed

- Terms and Conditions in the Contract

It goes without saying, when you plan to collect some debt from your debtors, always make sure to have a letter or an agreement ready. Even if you plan to let someone borrow from you, it is always best to have a letter or an agreement they can sign to make sure that they pay on time or on the specific dates you set.