8+ Debt Repayment Agreement Examples

“Your debt is repaid” You must have heard this line before. People often go into debt for different reasons. May it be to pay off student loans, to pay off mortgage, or to pay off medical bills. What reason may it be, when you ask for a loan or when you are in debt with the bank or with a company whose business is lending, there is no denying that you will be signing a debt repayment agreement. You may have noticed it as a piece of paper with terms and conditions before you are given the opportunity to loan, or basically to have debt. But what is a debt repayment agreement? What is it for? Why do you need it? To know more about a debt repayment agreement and what to expect from it, check out these examples now.

8+ Debt Repayment Agreement Examples

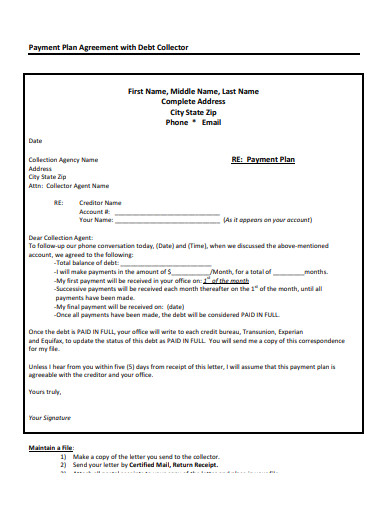

1. Debt Repayment Agreement

2. Sample Debt Repayment Agreement

3. Simple Debt Repayment Agreement

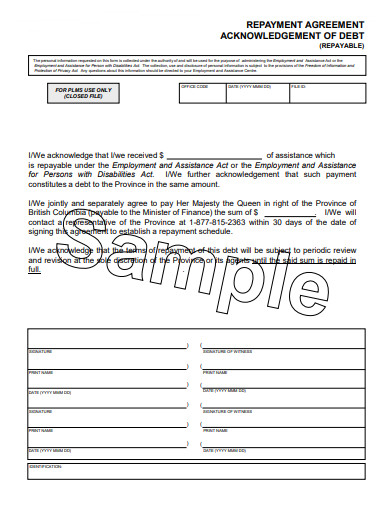

4. Repayment Agreement Acknowledgement of Debt

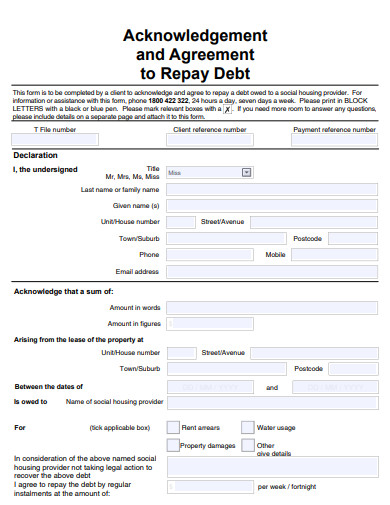

5. Debt Repayment Agreement Example

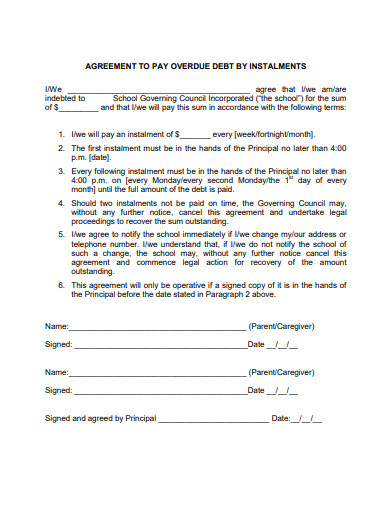

6. Formal Debt Repayment Agreement

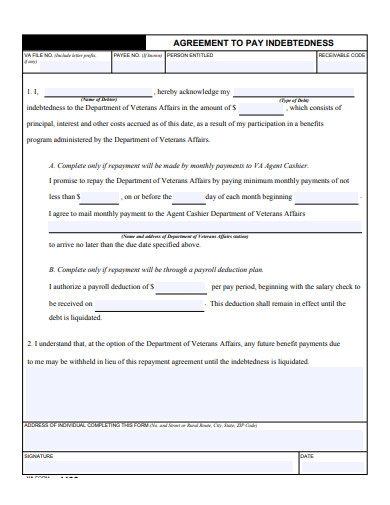

7. Basic Debt Repayment Agreement

8. Debt Repayment Agreement Format

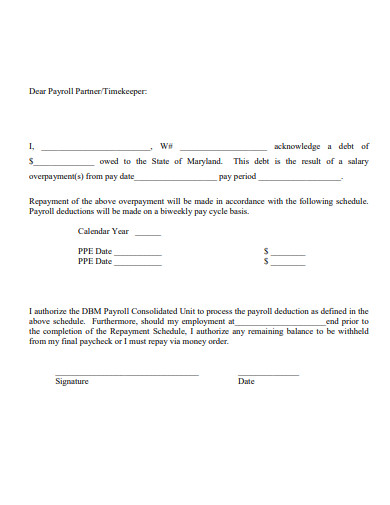

9. Employee Debt Repayment Agreement

What Is a Debt Repayment Agreement?

An agreement is an important document. We may have encountered that in any way, shape or form. A debt repayment agreement is a specific kind of agreement. A debt repayment agreement is a document made between the debtor and the collector. The agreement consists of the parties’ names, information and the amount of money that is going to be collected by the collector from the debtor. In addition to that, the purpose of the debt repayment agreement is to make sure that the debtor has fully consented to the agreement terms when they were planning on getting a loan and when it comes to paying it back with interest if there is any at a specific time and date.

How to Make a Debt Repayment Agreement

Whether you are making a letter format or an ordinary agreement format, there is no denying the fact that you will need the following information in them. The agreement is mostly the usual or the most common format when you want your debt repayment message across. So without further ado, here are some procedures or some simple steps in making that debt repayment agreement.

1. Choose a Format or a Template

Choose a format and a template that suits your needs. Since there are a lot of types of templates and each template may have a different format. Select the one that will satisfy your needs. When you have selected the format and the template, it’s time to move to the next step. For more ideas on where to select a template, check out the examples above.

2. Add the Debtor and the Collector’s Information

Next, add the debtor and the collector’s information. This includes the name of both parties, and their contact information. If they are associated with a company, add the name of the company as well. This information is necessary in order to make the letter or the agreement complete.

3. The Amount Owned and Acknowledgement

Third, the acknowledgement of the debt repayment. Whether you are using the letter format and template or the agreement format and template. The acknowledgement should still be written or should still be in any of them. The next thing to expect is the amount of money that has been loaned or owed. The amount should be stated correctly. However, if you add interest to the debt, you must also placed how much the interest is and how much is the total amount of the money being owed with interest.

4. The Repayment and the Dates

Lastly, the repayment and the dates. Whether you are going to be telling the debtor the instructions of how you need to be paid. Add the dates of when they should be paying, and if there are any late payments, will there be some interest to them as well.

FAQs

What is a debt repayment agreement?

A debt repayment agreement is a document that binds two parties together. The debtor and the collector. The agreement consists of the parties’ names, information and the amount of money that is going to be collected by the collector from the debtor.

Why do you need a debt repayment agreement?

The agreement is important in order to have a written proof of the loan made by the debtor to the collector.

Which is better to hand in to your debtor, a letter or an agreement?

Both of them are okay as long as your intent is there. However, the most common practice is to hand in an agreement. The letter can be written as a reminder to pay the debt.

It goes without saying, when you owe someone or when you are in debt, do not wait for the exact date to pay it off. This is a good practice to show to the collectors that you can be trusted when it comes to paying off debts.

8+ Debt Repayment Agreement Examples

“Your debt is repaid” You must have heard this line before. People often go into debt for different reasons. May it be to pay off student loans, to pay off mortgage, or to pay off medical bills. What reason may it be, when you ask for a loan or when you are in debt with the bank or with a company whose business is lending, there is no denying that you will be signing a debt repayment agreement. You may have noticed it as a piece of paper with terms and conditions before you are given the opportunity to loan, or basically to have debt. But what is a debt repayment agreement? What is it for? Why do you need it? To know more about a debt repayment agreement and what to expect from it, check out these examples now.

8+ Debt Repayment Agreement Examples

1. Debt Repayment Agreement

Details

File Format

Word

Pages

Google Docs

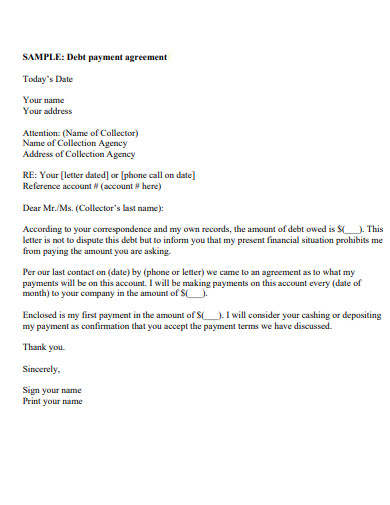

2. Sample Debt Repayment Agreement

debtcounselingcorp.org

Details

File Format

PDF

Size: 12 KB

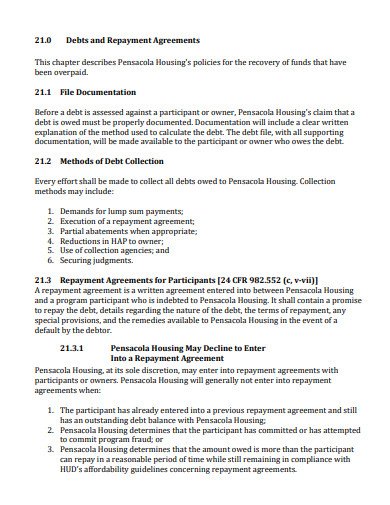

3. Simple Debt Repayment Agreement

cityofpensacola.com

Details

File Format

PDF

Size: 445 KB

4. Repayment Agreement Acknowledgement of Debt

gov.bc.ca

Details

File Format

PDF

Size: 45 KB

5. Debt Repayment Agreement Example

facs.nsw.gov.au

Details

File Format

PDF

Size: 174 KB

6. Formal Debt Repayment Agreement

saasso.asn.au

Details

File Format

PDF

Size: 56 KB

7. Basic Debt Repayment Agreement

va.gov

Details

File Format

PDF

Size: 606 KB

8. Debt Repayment Agreement Format

consumerslaw.com

Details

File Format

PDF

Size: 27 KB

9. Employee Debt Repayment Agreement

dbm.maryland.gov

Details

File Format

PDF

Size: 40 KB

What Is a Debt Repayment Agreement?

An agreement is an important document. We may have encountered that in any way, shape or form. A debt repayment agreement is a specific kind of agreement. A debt repayment agreement is a document made between the debtor and the collector. The agreement consists of the parties’ names, information and the amount of money that is going to be collected by the collector from the debtor. In addition to that, the purpose of the debt repayment agreement is to make sure that the debtor has fully consented to the agreement terms when they were planning on getting a loan and when it comes to paying it back with interest if there is any at a specific time and date.

How to Make a Debt Repayment Agreement

Whether you are making a letter format or an ordinary agreement format, there is no denying the fact that you will need the following information in them. The agreement is mostly the usual or the most common format when you want your debt repayment message across. So without further ado, here are some procedures or some simple steps in making that debt repayment agreement.

1. Choose a Format or a Template

Choose a format and a template that suits your needs. Since there are a lot of types of templates and each template may have a different format. Select the one that will satisfy your needs. When you have selected the format and the template, it’s time to move to the next step. For more ideas on where to select a template, check out the examples above.

2. Add the Debtor and the Collector’s Information

Next, add the debtor and the collector’s information. This includes the name of both parties, and their contact information. If they are associated with a company, add the name of the company as well. This information is necessary in order to make the letter or the agreement complete.

3. The Amount Owned and Acknowledgement

Third, the acknowledgement of the debt repayment. Whether you are using the letter format and template or the agreement format and template. The acknowledgement should still be written or should still be in any of them. The next thing to expect is the amount of money that has been loaned or owed. The amount should be stated correctly. However, if you add interest to the debt, you must also placed how much the interest is and how much is the total amount of the money being owed with interest.

4. The Repayment and the Dates

Lastly, the repayment and the dates. Whether you are going to be telling the debtor the instructions of how you need to be paid. Add the dates of when they should be paying, and if there are any late payments, will there be some interest to them as well.

FAQs

What is a debt repayment agreement?

A debt repayment agreement is a document that binds two parties together. The debtor and the collector. The agreement consists of the parties’ names, information and the amount of money that is going to be collected by the collector from the debtor.

Why do you need a debt repayment agreement?

The agreement is important in order to have a written proof of the loan made by the debtor to the collector.

Which is better to hand in to your debtor, a letter or an agreement?

Both of them are okay as long as your intent is there. However, the most common practice is to hand in an agreement. The letter can be written as a reminder to pay the debt.

It goes without saying, when you owe someone or when you are in debt, do not wait for the exact date to pay it off. This is a good practice to show to the collectors that you can be trusted when it comes to paying off debts.