10+ Equipment Loan Agreement Examples

Not all businesses have the financial means to buy every equipment that they need to produce their products or perform their services. Lucky for them, other organizations offer equipment rental or leasing. Through them, entrepreneurs also have the opportunities to make loans, such as personal loans, small business loans, and even an item loan. With these opportunities, business people can have their much-needed vehicles, farm equipment, medical equipment, construction equipment, and other types of machinery. And just like any other commercial transaction, both the borrowers and the financier have to produce a document that records every detail of the deal, like a company property agreement or an equipment loan agreement. Learn more about the agreement with our examples and article below.

10+ Equipment Loan Agreement Examples

1. Equipment Loan Agreement Template

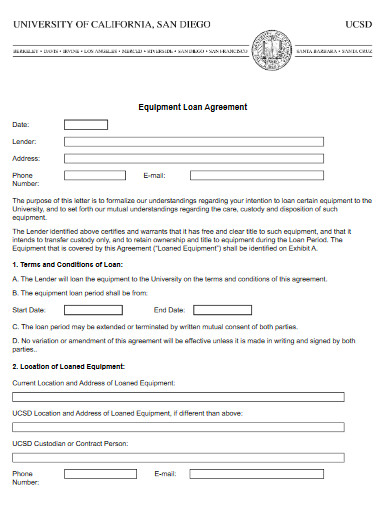

2. University Equipment Loan Agreement

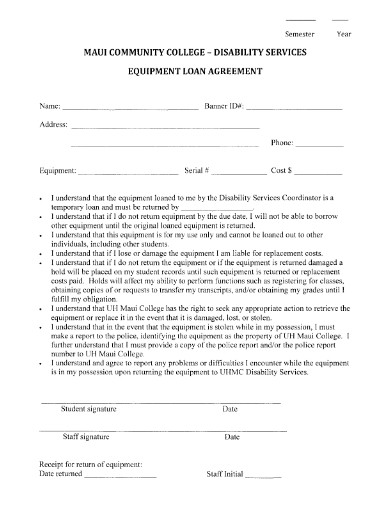

3. Disability Services Equipment Loan Agreement

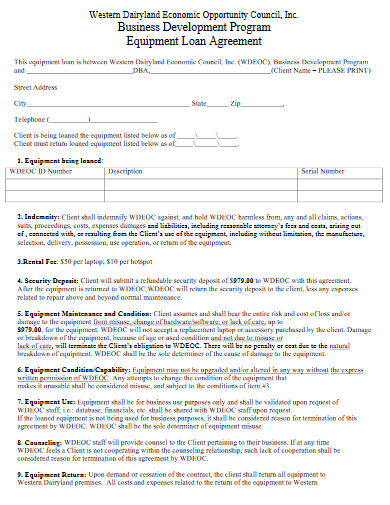

4. Business Equipment Loan Agreement

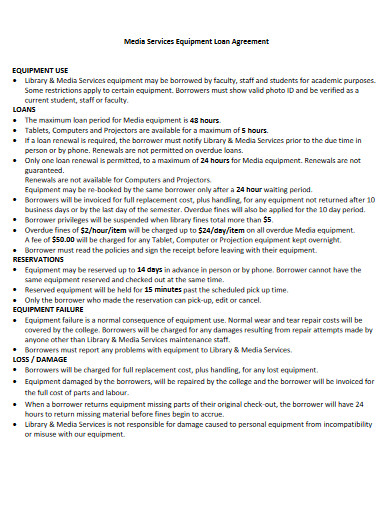

5. Media Services Equipment Loan Agreement

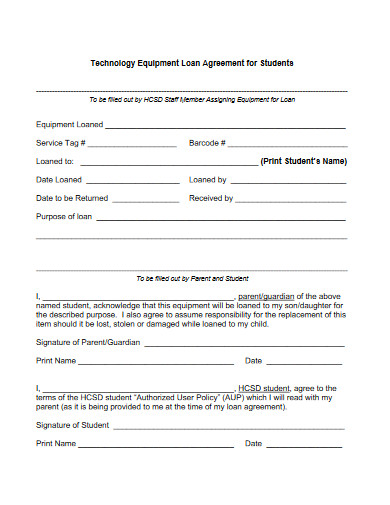

6. Technology Equipment Loan Agreement

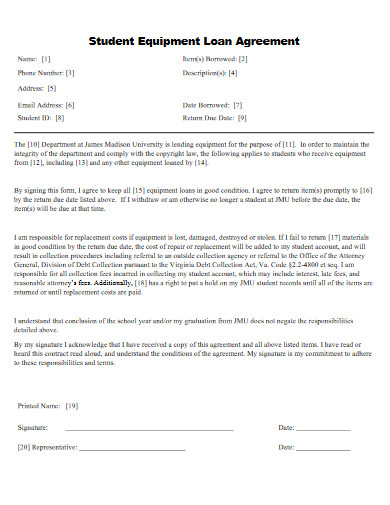

7. Student Equipment Loan Agreement

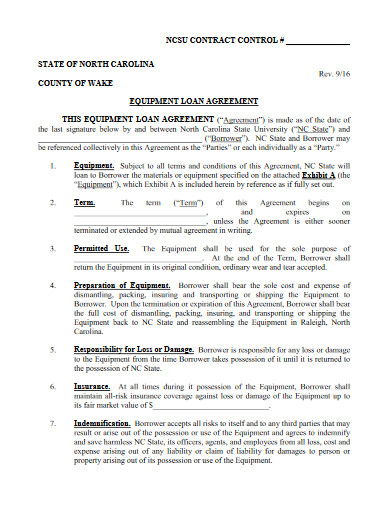

8. Equipment Loan Agreement Example

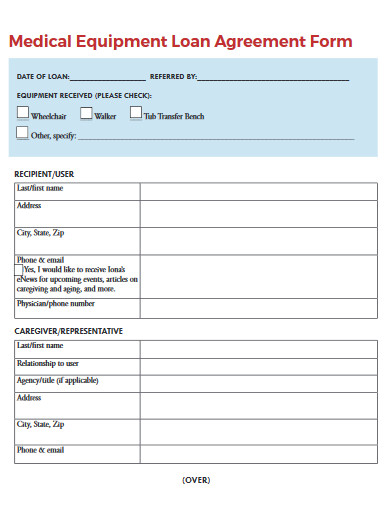

9. Medical Equipment Loan Agreement Form

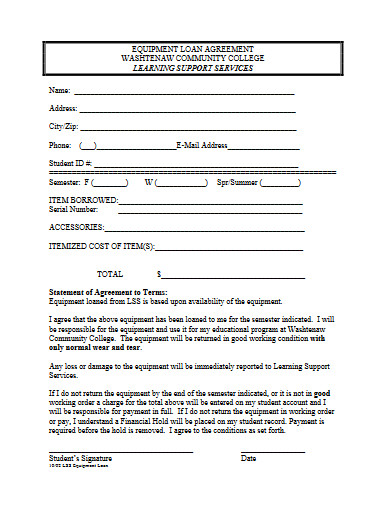

10. College Equipment Loan Agreement

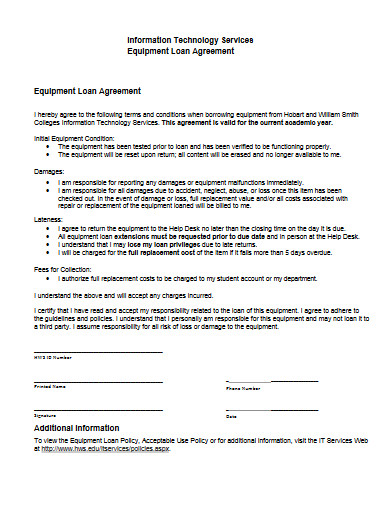

11. IT Services Equipment Loan Agreement

What Is an Equipment Loan Agreement?

An equipment loan agreement is a legal document that binds an individual or organization and a lender in fulfilling their equipment procurement obligations. According to Tyler Heaps of the blog site, Lendio, the benefits of such a transaction can be summarized into four. First, it can be obtained without much of a hassle. Second, most of these loans do not require down payments. Third, it immediately counts up to your net value. Ultimately, it improves company revenue, especially if the loaned equipment is leveraged properly. Because of these advantages, it won’t be surprising to know why many start-ups and established businesses lookout to get into an agreement with equipment rental companies.

Quick Facts About Equipment Financing

Wealthy individuals or organizations can finance almost every aspect of a business, even the equipment. And believe it or not, it’s actually a thing. Here are some quick facts about equipment financing.

1. An equipment loan’s interest can only go as high as 2%.

2. The procured equipment is the collateral.

3. Most financiers adopt behavioral assessments rather than looking into the financial capabilities of the borrowers.

4. Equipment financing can be acquired in advance and without any cost, making it easier for entrepreneurs to acquire the necessary equipment even with short notice.

5. Loaning for the procurement of old equipment and new equipment are entertained the same.

6. A piece of equipment that is purchased at a private seller is a great deal of savings.

7. The taxes that come with the financing may vary on the procured equipment.

How To Create an Equipment Loan Agreement

When making an agreement, you have to make sure that all areas of a business arrangement get covered. Aside from that, there’s also a need for you to have each of its sections organized according to the standards. To help you prepare yours, check out our standard-based outline below.

1. Introduce Participants

Set forth your equipment loan agreement by introducing its participants. In terms of loans, the participants are composed of a financier and the borrower. The introduction of both parties is important to formally acknowledge the people who are subject to the later details. Moreover, instilling the complete basic information, such as names, addresses, and contact information of both parties, can protect them both when disputes arise.

2. State the Purpose

An important component of an agreement is the statement of purpose. This section answers the obvious question of a reader as to what the document is all about. Needless to say, an equipment loan agreement discusses the arrangement and responsibilities of both the financier and the borrower.

3. Set the Terms and Conditions

After stating your agreement’s purpose, create a list of your terms and conditions. This should include the accountability of the two parties. In addition, the schedule of when the equipment will be procured, as well as the schedule of when it will be delivered, should be incorporated.

4. Write Down Repayment Arrangement

Loans are sums of money that are borrowed for a certain purpose. We all know that what’s being borrowed has to be returned. In the world of business, the return should include interest, and the same should happen on your equipment loan agreement. However, there will be some cases when things go other ways. These ways should be anticipated ahead and discussed in this part of your agreement. A repayment schedule is sure to be taken into consideration.

5. Prepare Insurance Stipulations

Any business transaction’s paperwork that involves properties must consist of an insurance policy. This is to secure the safety of the procured equipment in case of damage or loss. For this part, an assumed third party, specifically the equipment’s seller would be indirectly involved to be held responsible for damaged properties’ replacements or repairs.

6. Create Force Majeure and Termination Clause

All business undertakings have risks. Some can be dealt with, and some are out of anyone’s control. Surely, these factors can’t be prevented. However, there are various ways to somehow resolve the issues or mitigate the damages caused by them. The resolutions or mitigation could be found in your organization’s termination policies and procedures of your data inventory.

7. Seal the Deal

An agreement should consist of an offer and acceptance. After those two are written down, both parties’ decisions must be acknowledged and finalized through the imprints of their signatures. As per standard, those marks are required.

FAQs:

What is the difference between an agreement and a contract?

An agreement refers to the understanding and agreement of two parties to partake in a business transaction. A contract, on the other hand, is an agreement with specified stipulations that are also enforceable by the law.

What is a force majeure?

A force majeure is a section in an agreement or contract that removes the liabilities of one party in cases of inevitable disasters.

What are the types of loans?

Loans have many variations. They include the following:

1. Debt Consolidation Loan

2. Home Equity Loan

3. Student Loan

4. Cash Advance

5. Mortgage

6. Family or Peer Loan

7. Auto Loan

8. Payday Loan

9. Personal Loan

10. Small Business Loan

11. Veteran Loan

12. Retirement and Insurance Loan

Businesses have many challenges to overcome before they can be successful in their endeavors. One of them is the acquisition of the equipment that is the essential in the production of goods or execution of services. But in every problem, there’s a resolution. And, the solution to any company’s problems on equipment is by partaking in an equipment loan agreement.