10+ Escrow Agreement Examples to Download

Real estate, construction, and software development projects often require security deposits from clients. This is to reassure the product and service providers of the clients’ commitment to pursue the project. A signed contract for deed, for example, details the purchase transaction of a property without going through the mortgage lender process and taxes right from the start to closing. Among its stipulations is the provision of a security deposit form or agreement and deposit receipt to guarantee the said transaction. In addition, the inclusion of an escrow is necessary. If you want to learn more, skim through our relevant article and our different escrow agreement examples below.

10+ Escrow Agreement Examples

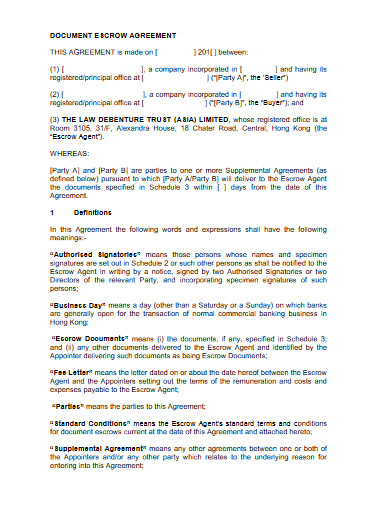

1. Escrow Agreement Template

2. Source Code Escrow Agreement Template

3. Real Estate Escrow Agreement Template

4. Construction Escrow Agreement

5. Insurance Company Escrow Agreement

6. Three Party Escrow Agreement

7. Model Internal Escrow Agreement

8. Cash Escrow Agreement

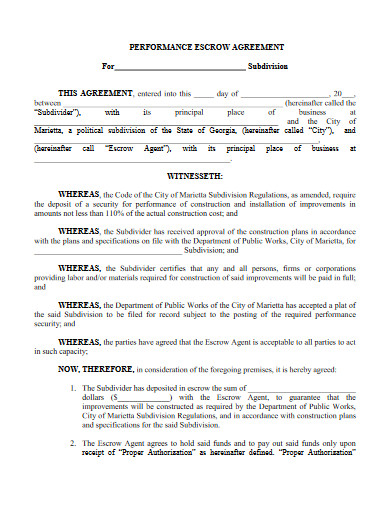

9. Performance Escrow Agreement

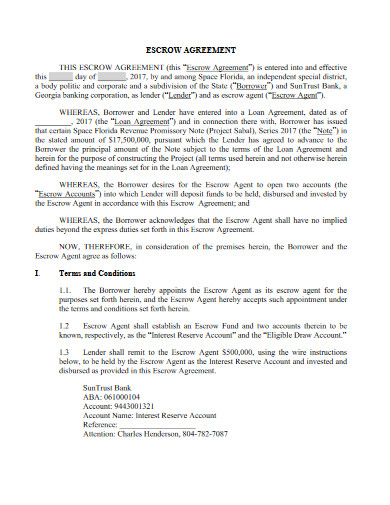

10. General Escrow Agreement

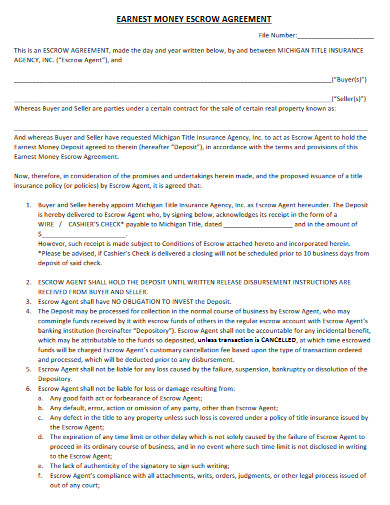

11. Earnest Money Escrow Agreement

What Is an Escrow Agreement?

An escrow agreement is a legal document that outlines a depositor and a certain seller, landlord, or lessor’s engagement with a third party, called an escrow agent. The document highlights the terms and conditions on which the said agent will get hold of the first two parties’ security deposit or earnest money formulated under their security deposit agreement or deposit agreement. The escrows main task is to track whether or not both parties have met the stipulations stated in the aforementioned agreement. If the two parties are successful in keeping the upfront intact after the agreed completion date, the appointed escrow will deliver the held security deposit or earnest money back to the depositor.

Real Estate Escrow

At most times, an escrow is necessary for any home purchase. In a real estate transaction, properties and financial assets will be put under “in escrow” status before the entire purchase deal goes through. Once a home buyer and seller gets into a real estate purchase agreement, both parties have to create an escrow account where they will put their security deposits. Once the purchase and sale agreement becomes a success, the escrow agent has to release the deposit back to the home buyer. Through this process, both the home buyer and seller can be at ease knowing that a trustworthy independent party can lessen the possibility of financial violations on their contract or agreement.

How To Create an Escrow Agreement

Agreements follow certain standards. But unlike most agreements, writers or attorneys have to make an escrow agreement only after a legal contract or a property sale agreement takes effect. Nevertheless, the person in charge of preparing such a document still has to follow the said technical writing standards and those of writing contracts and agreements. Below, we provide you with an outline that can give you the must-have sections and their proper order.

1. Set Out the Purpose

Start your escrow agreement by setting out your statement of purpose. This should clearly define the short-term goal that you and the other parties are trying to achieve, such as the accommodation of the security deposits.

2. Name the Involved Parties

Include in your first section the basic information of the parties involved in your agreement. Escrow agreements should consist of three parties, including the seller, landlord, or lessor, the buyer, and the escrow agent.

If you’re the buyer and you’re not sure where to hire an escrow agent, you can ask banks if they provide escrow services. You can also search for such agents online or reach out to a title insurance agency.

3. Enumerate Fund Release Conditions

Whichever party you belong to, you have to enumerate the conditions of fund release to ensure that your actions are understood. For example, security deposits are only released from the buyers to the escrow agent once they understand and accept the overall escrow agreement.

4. Run Through the Duties and Liabilities of Escrow Agent

Once you have successfully enumerated the conditions about releasing funds, cite all of the agent’s duties and liabilities. For your information, an escrow agent’s major duties include keeping track of the contract or agreement progress and conducting follow-ups with the depositor and seller. On the other hand, the liabilities may include the loss of security deposit and the failure to become aware of the contract changes.

5. Create Payment Terms

Escrow agents have service fees. For this reason, you must incorporate a clause that details the payment terms. Most escrow agents charge 1% to 2% of the total purchase amount with the addition of another USD 250. So, for a USD 1 million sales price, the agent will most likely get USD 2,250.

6. Elaborate Dispute Resolutions

Agreements can go wrong in so many ways. With that being said, you must find ways to counter these or mitigate their negative effects. The most common dispute for escrow agreements is when both parties refuse to accept written authorizations that state the release of the earnest money. The most viable resolution to this is to freeze the escrow account until the buyer and seller make the final decisions. To know more, we highly recommend checking out your organization’s dispute resolution policy.

FAQs:

What are the best ways to avoid an escrow dispute?

According to The Closing Agent, the best ways to keep away from escrow disputes include the following:

– Avoid hasty buying decision

– Learn to let go of unclear contract

– Complete due diligence

– Retain contract contingencies

– Get a better understanding of earnest money

– Adhere to contract schedules

What are the common escrow problems?

Evan Kaplan of Endpoint pointed out that the top three escrow agents’ problems are lending problems, defects listed in the property inspection reports, and disclosures of property hazard.

How to get an escrow account?

To set up an escrow account, both the property buyer and seller have to visit a professional title agent, mortgage loan officer, or a real estate lawyer.

Entrusting your money to someone else is, without a doubt, a big risk, especially the one that you’ve allotted for a certain purchase. But sometimes, it has to be necessarily taken to have a mediator that can protect the money from you or the other party. And to protect yourselves from the mediator, himself, you have to produce an agreement that details the terms and conditions of his actions, and the consequences of non-observance.