10+ Repayment Agreement Examples to Download

When you were a student, you may have encountered an issue with student loans, which for some may be a huge problem, especially when you have no idea as to how to repay them. You may also have noticed that you are given a document that states how you can and when you should be paying your student loans. Which is not something to be ashamed about, since it was done for something good. Loans that were either too high or too much that it may seem or look impossible to even repay back. It is not only students who do suffer from these problems, but even employees who take out loans for personal reasons. This will also depend on where and who they will be borrowing money for and for what reason. If you are going to be borrowing money from legal places, you will also be given a repayment agreement to sign with.

10+ Repayment Agreement Examples

1. Repayment Agreement Template

2. Letter Agreement on Repayment Schedule Template

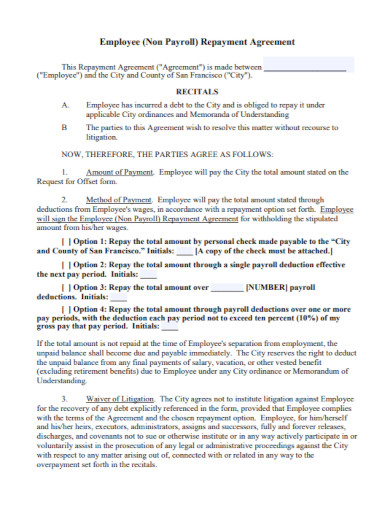

3. Employee Repayment Agreement

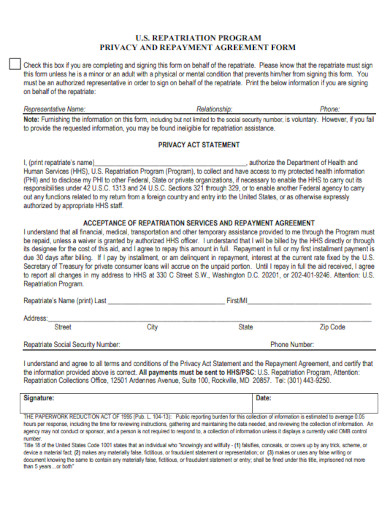

4. Repayment Agreement Form

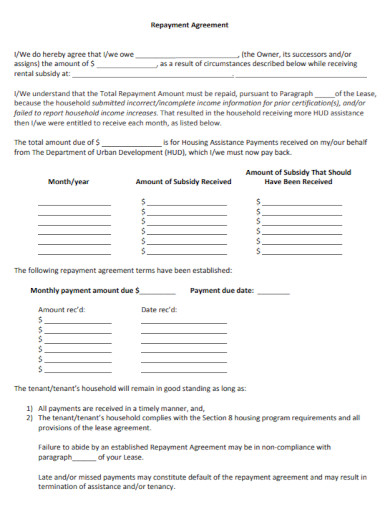

5. Basic Repayment Agreement

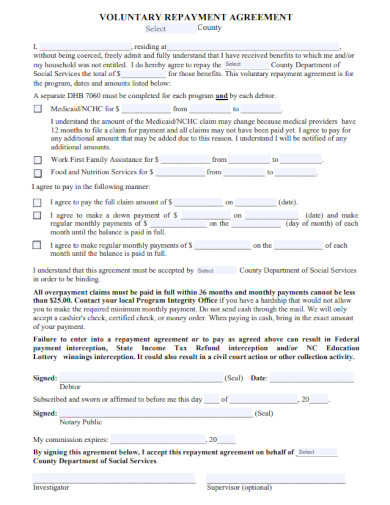

6. Voluntary Repayment Agreement

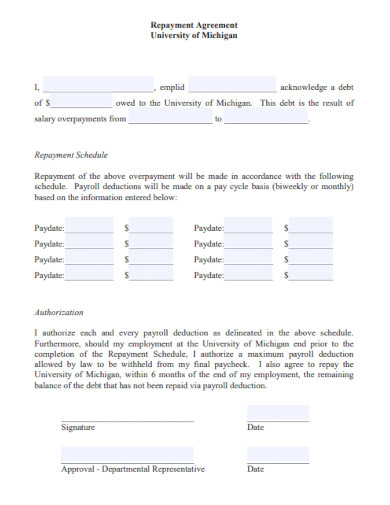

7. University Repayment Agreement

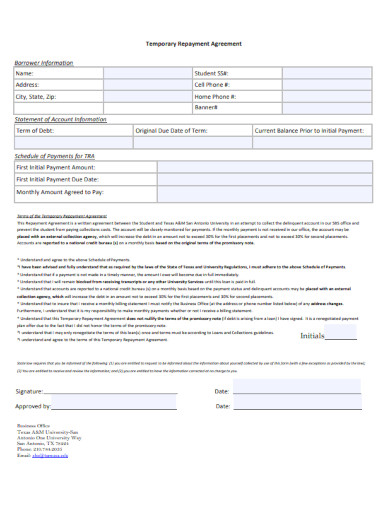

8. Temporary Repayment Agreement

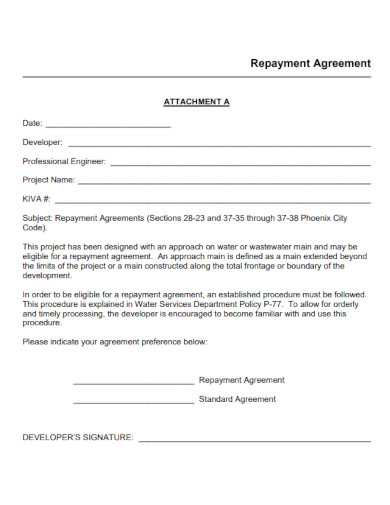

9. Repayment Agreement Example

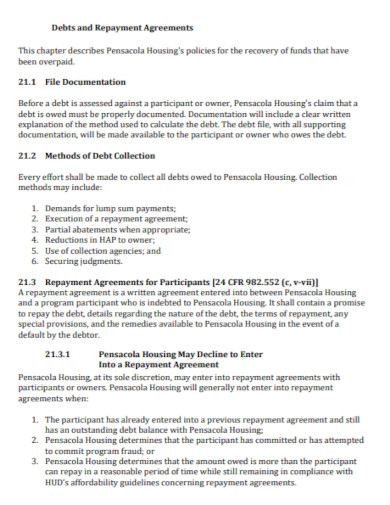

10. Debts and Repayment Agreement

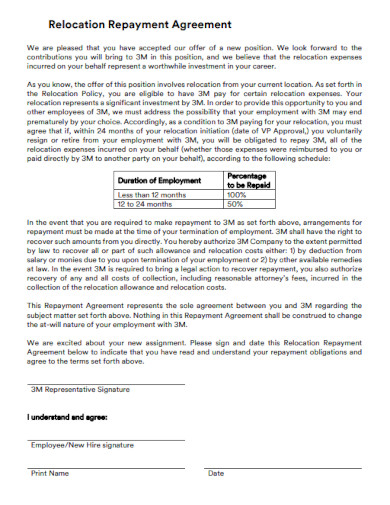

11. Relocation Repayment Agreement

What Is a Repayment Agreement?

When we think of repayment agreement, we think of a documented agreement that is used in order to explain the guidelines of when and how the repayment will work. So to think of that as an idea, we can say that a repayment agreement is a document that binds two or more people to the agreement. The agreement consists of the terms and conditions just like any other ordinary agreement you may have encountered. It also consists of the dates that are necessary for the repayment to be expected, the interest if there is any, and the amount that has been borrowed to be repaid.

How to Make a Repayment Agreement

If you are a company who hands out loans to students or employees, you will know by now that agreements are a part of the package. However, if you are a person who hands out loans to others and will also want to be repaid, you will also need to know what should be in the agreement. To make a repayment agreement, whether it be in the form of a letter or the actual agreement, you must also have the following details to the document.

1. The Creditor and Debtor’s Complete Information

Whether or not you are writing the agreement in the form of a letter or editing through a blank agreement, you will always have to notice the first things found on top. The creditor and the debtor’s complete information. Your full and complete information as well as that of the debtor should be found in the agreement. No shortcuts, no abbreviations as much as possible.

2. The Amount of Money That Is Lent

When you write the letter, make sure to write that this is to acknowledge the debtor of the amount of money they loaned from you the creditor. However, if you are writing the agreement, a short description of how much of the money is being lent in both numeral form and in words. See to it that the amount of money that the debtor owed from you is the exact amount. The total amount should be placed as well.

3. Give the Total Including the Interest Rate

The total including the interest rate should be specified in both the letter and the agreement. Write the total amount of the money being loaned and the interest rate if there is any. The total amount should also be stated as to when it can be repaid, how it can be repaid and with or without the interest rates.

4. Date of the Repayment and the Instructions

Give the date of the repayment, whether you will want it to be monthly or quarterly. As well as some instructions to how the payment should be made. Where the payment should be done and how to know if the payment is already being made.

FAQs

What is a repayment agreement?

A repayment agreement is a document. It can also be a letter or both. A repayment agreement is a document in the form of an agreement or a letter that binds and explains the payment of the loans being made.

Why is a repayment agreement needed?

When you loan from either a bank or a legit lending company, you must always understand that these kinds of things will need to be bound by word, letter, and of course an agreement. To explain and to give out the consequences in case the debtor may not want to pay.

Can a repayment agreement be a letter and an agreement?

Yes, you can write the repayment agreement in a blank documented agreement or a letter. As long as the information necessary are present as well.

Lending money from people for a personal reason is okay. But when you loan money, you must also know when to repay them. When you are bound to an agreement in the form of a letter or the document, you must also follow the terms and conditions, and the instructions in order to lessen the problem of paying back with a huge interest.

![10+ Repayment Agreement Examples [ Employee, University, Relocation ]](https://images.examples.com/wp-content/uploads/2022/02/10-Repayment-Agreement-Examples-Employee-University-Relocation-.jpg)