13+ Real Estate Market Analysis Examples

Selling a real estate property, be it a home, apartment, or office building, isn’t as simple as having a garage sale or selling an item online. Before you can even dub a real estate property as “For Sale,” it has to undergo certain processes, which is quite a lot of paperwork. One of those processes is a real estate market analysis. So, if you’re about to sell a property, stick around. In this blog, we’ll show you a list of our Real Estate Market Analysis Examples and Templates. And after that, we’ll discuss more about real estate market analysis.

13+ Real Estate Market Analysis Examples & Templates

1. Real Estate Market Analysis Template

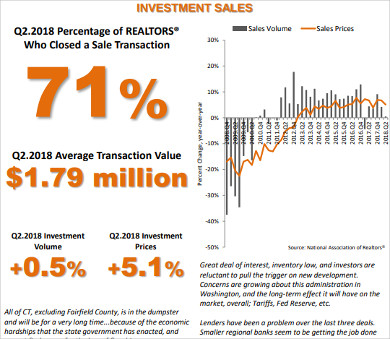

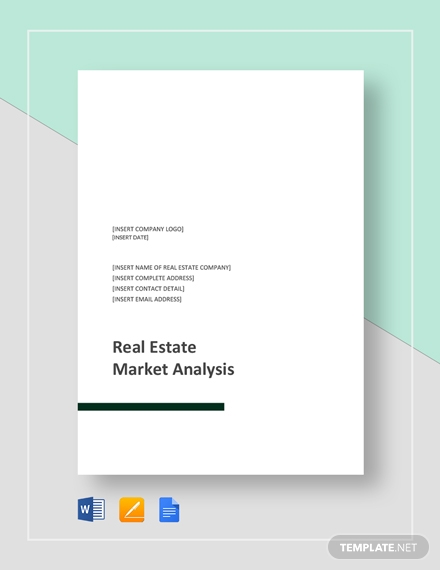

2. Commercial Real Estate Market Analysis Example

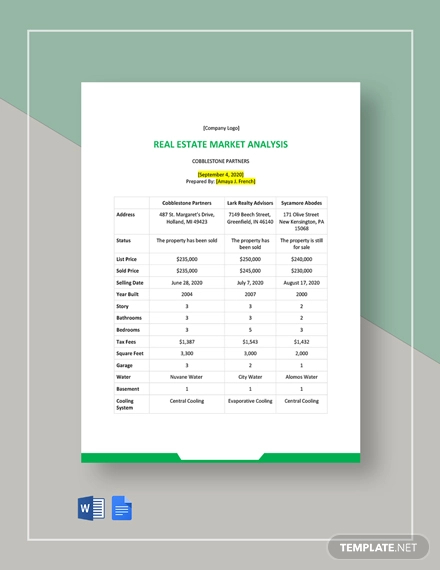

3. Real Estate Market Valuation and Analysis

4. Housing Market Analysis Example

5. Free Sample Real Estate Market Analysis Example

6. Free Basic Real Estate Market Analysis

7. Free Simple Real Estate Market Analysis Template

8. Real Estate Market Analysis Example

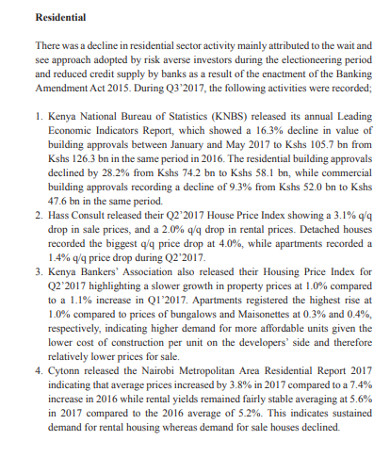

9. Residential Real Estate Market Analysis

10. Real Estate Property Market Analysis

11. General Real Estate Market Analysis

12. Real Estate Market Valuation and Analysis

13. Commercial Real Estate Market Analysis

14. Real Estate Investment Project Risk Analysis

What Is a Real Estate Market Analysis?

Real estate market analysis is the process of studying the value of real estate properties in an area and their attributes. Its purpose is to help a real estate seller in determining the best possible price for the property he or she is selling. That said, you can say that real estate market analysis complements pricing strategy for real estate properties. Moreover, you can also call real estate marketing analysis as home market analysis. That’s if the real estate property a seller is selling is a residential property.

How to Do a Real Estate Market Analysis

The importance of real estate market analysis is at a high level if you’re a seller. You can’t sell your property without conducting it first. If it’s your first time being a seller, don’t get too pressured about it. We’ll walk you through the basic steps in conducting a real estate market analysis.

Step 1: Study the Neighborhood Around Your Property’s Area

First, you must study the neighborhood that surrounds your property. Gather data, previous reports, or graphs about how many properties were sold, how many are still for sale, how big they are, and other relevant trends. This step will help you get a clear picture of the current state of your local real estate market.

Step 2: Select Properties That are Comparable

After gathering info about other properties in the area, determine those that are comparable. Comparable properties are those with a similar structure, set of amenities, and size to the property you’re selling. The sellers of those properties are your competitors. That’s because you’re basically selling the same product with them. Their properties are the ones you should keep an eye on. To be specific, those are the properties that you should compare with your property.

Step 3: Calculate the Average Value of Comparable Properties

The value of your property should be on the same spectrum as the comparable properties. For that, you need to calculate their average value. List each of their total prices, add them, and divide by how many comparable properties you’ve listed. That should give you their average value.

Moreover, make sure to keep whatever information you have about the comparable properties, especially their respective prices. You might need them for future references.

Step 4: Determine Your Property’s Price and Get It Ready

Once you’ve calculated the comparable properties’ average value, that’s the time to determine your property’s price. In doing so, you need to either add or subtract the average value to get your property’s value. You must adjust it depending on how your property’s quality, size, and other features differ from the comparables. But make sure that it’s still on the same spectrum. And if you have the budget, you can make some renovations to your property to increase its value, at least for a bit. After determining the price, you can start processing the paperwork to put your property on the market.

FAQs

Is it possible for the real estate market to crash in 2021?

First of all, it’s possible for any industry to crash in any given year. But very, very unlikely. For such a thing to happen, there has to be a somewhat apocalyptic force. The same goes for the real estate industry. So to answer the question: It’s very unlikely for the real estate market to crash in 2021. According to HousingWire, home prices are increasing at a rate of over 6%, which makes the assumption of the real estate market crashing in 2021 unrealistic.

Is it good to buy a house in 2021?

According to a Forbes article, it’s predicted that home sales activity in 2021 will outpace that of 2020’s. However, supply and demand levels in the housing market are imbalanced. That means buyers will be competing against each other to purchase residential properties. And there’s likely to be price appreciation. With that in mind, buying a house in 2021 will be difficult. But if you’re a home seller, 2021 could be a good year for you.

What is the best month to sell a house property?

According to The Mortgage Reports, May is the best year to sell a house. Sellers can sell their property 18.5 days faster and make 5.9% more money.

Real estate is a good business. Achieving success in such a business is just a matter of strategy and timing. And you can also mix in a little bit of luck as well. But the bottom line is you have to play your cards right. You don’t need to have a plethora of real estate market analysis tools at your disposal. All you need is our Sample Real Estate Market Analysis Templates. Download them now!