Articles of Incorporation – 12+ Examples, Importance, Pdf

Articles of incorporation is usually a requirement if you want to register a corporation. Hence, it is truly necessary for you to have this document at hand so that you can have a charter for your corporation to be established and recognized Corporations can be formed and established if the business will operate in the particular state or location where it filed its articles of incorporation. If you would like your business to be formed and be registered as a corporation, you have to make sure that you will follow corporate laws, general policies, and regulations.

What Are Articles of Incorporation?

Articles of Incorporation are legal documents filed with a state government to legally create a corporation. They outline essential details such as the company’s name, purpose, structure, and stock information. These documents establish the corporation as a separate legal entity, enabling it to enter contracts, incur debts, and own property independently of its owners.

Examples of Articles of Incorporation

Articles of Incorporation Examples for Business

- Tech Startup

- Company Name: Innovatech Inc.

- Purpose: To develop and sell innovative software solutions.

- Principal Office Address: 123 Innovation Drive, Silicon Valley, CA.

- Registered Agent: Jane Doe, 123 Innovation Drive, Silicon Valley, CA.

- Shares: 1,000,000 shares of common stock.

- Restaurant Chain

- Company Name: Tasty Bites Inc.

- Purpose: To operate a chain of fast-casual restaurants.

- Principal Office Address: 456 Culinary Street, New York, NY.

- Registered Agent: John Smith, 456 Culinary Street, New York, NY.

- Shares: 500,000 shares of common stock.

- Consulting Firm

- Company Name: Bright Solutions LLC.

- Purpose: To provide business consulting services.

- Principal Office Address: 789 Strategy Lane, Chicago, IL.

- Registered Agent: Emily Johnson, 789 Strategy Lane, Chicago, IL.

- Shares: 200,000 shares of common stock.

- Online Retailer

- Company Name: ShopEase Corp.

- Purpose: To sell consumer goods online.

- Principal Office Address: 321 E-Commerce Blvd, Seattle, WA.

- Registered Agent: Mark Thompson, 321 E-Commerce Blvd, Seattle, WA.

- Shares: 2,000,000 shares of common stock.

- Manufacturing Company

- Company Name: BuildRight Manufacturing Inc.

- Purpose: To manufacture and distribute construction materials.

- Principal Office Address: 654 Industrial Road, Houston, TX.

- Registered Agent: Sarah Lee, 654 Industrial Road, Houston, TX.

- Shares: 1,500,000 shares of common stock.

Example of Articles of Incorporation for LLC

Company Name:

- Sunshine Ventures LLC

Purpose:

- To engage in the business of real estate investment and management, including buying, selling, leasing, and managing residential and commercial properties.

Principal Office Address:

- 789 Prosperity Street, Miami, FL, 33101

Registered Agent:

- Name: John Doe

- Address: 789 Prosperity Street, Miami, FL, 33101

Duration:

- Perpetual

Members:

- Member 1: Jane Smith

- Address: 123 Ocean Drive, Miami, FL, 33101

- Member 2: Robert Johnson

- Address: 456 Sunset Blvd, Miami, FL, 33101

Management:

- The LLC will be managed by its members.

Initial Capital Contributions:

- Jane Smith: $50,000

- Robert Johnson: $50,000

Effective Date:

- Upon filing with the Florida Department of State

Signature of Organizer:

- Name: Alice Brown

- Address: 101 Palm Ave, Miami, FL, 33101

- Date: June 11, 2024

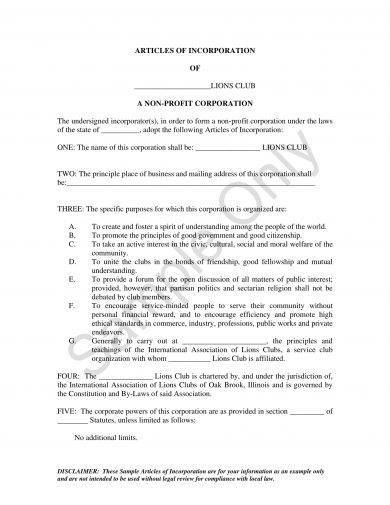

Articles of Incorporation Example for Non-Profit

Name of Organization:

- Helping Hands Foundation

Purpose:

- To provide educational resources and support to underprivileged children to enhance their academic and personal development.

Principal Office Address:

- 123 Charity Lane, Springfield, IL, 62701

Registered Agent:

- Name: Mary Johnson

- Address: 123 Charity Lane, Springfield, IL, 62701

Duration:

- Perpetual

Incorporators:

- Incorporator 1: Alice Smith

- Address: 456 Community Drive, Springfield, IL, 62701

- Incorporator 2: John Doe

- Address: 789 Service Road, Springfield, IL, 62701

Board of Directors:

- Director 1: Emily White

- Address: 101 Volunteer Ave, Springfield, IL, 62701

- Director 2: Michael Green

- Address: 202 Philanthropy Street, Springfield, IL, 62701

- Director 3: Sarah Black

- Address: 303 Generosity Blvd, Springfield, IL, 62701

Non-Profit Status:

- The organization is organized exclusively for charitable, educational, and scientific purposes under Section 501(c)(3) of the Internal Revenue Code.

No Part of the Net Earnings:

- No part of the net earnings of the organization shall inure to the benefit of, or be distributable to its members, trustees, officers, or other private persons, except that the organization shall be authorized and empowered to pay reasonable compensation for services rendered and to make payments and distributions in furtherance of the purposes set forth in Article II hereof.

Dissolution Clause:

- Upon the dissolution of the organization, assets shall be distributed for one or more exempt purposes within the meaning of Section 501(c)(3) of the Internal Revenue Code, or shall be distributed to the federal government, or to a state or local government, for a public purpose.

Signature of Incorporators:

- Alice Smith

- Address: 456 Community Drive, Springfield, IL, 62701

- Date: June 11, 2024

- John Doe

- Address: 789 Service Road, Springfield, IL, 62701

- Date: June 11, 2024

More Articles of Incorporation Templates & Samples in PDF

1. Articles Of Incorporation Template

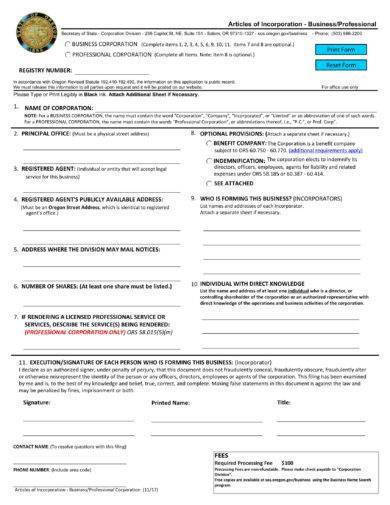

2. Business and Professional Articles of Incorporation Example

3. Structured Articles of Incorporation Example

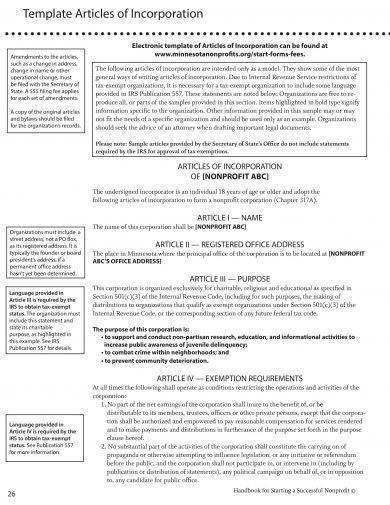

4. Annotated Model of Articles of Incorporation Example

5. Articles of Incorporation Template Example

6. Basic Articles of Incorporation Example

7. Articles of Incorporation Format Example

Importance of Articles of Incorporation

The Articles of Incorporation are fundamental documents that legally establish a business as a corporation or an LLC (Limited Liability Company). This document serves as a charter, providing critical information about the business to the state and the public. Here are the key reasons why the Articles of Incorporation are important:

1. Legal Recognition

Foundation of Legal Entity

- The Articles of Incorporation officially register the business with the state, transforming it from a concept into a recognized legal entity.

- This process gives the business the right to enter contracts, sue or be sued, and own assets.

2. Limited Liability Protection

Protects Personal Assets

- By incorporating, owners (shareholders or members) are typically protected from personal liability for business debts and obligations.

- This means creditors can only pursue the assets of the business, not the personal assets of the owners.

3. Credibility and Trust

Enhanced Business Image

- Incorporation adds credibility and can enhance the business’s reputation with customers, suppliers, and investors.

- It demonstrates a commitment to operating under formal business structures and regulations.

4. Access to Capital

Attracting Investors

- Corporations and LLCs often find it easier to attract investors and secure funding.

- Articles of Incorporation can allow the issuance of shares or membership interests, making it simpler to bring in investment.

5. Perpetual Existence

Business Continuity

- Corporations and LLCs can continue to exist beyond the lifespan or involvement of their original founders.

- This ensures business operations can continue uninterrupted in case of an owner’s departure or death.

6. Tax Advantages

Potential Tax Benefits

- Depending on the structure (S-Corp, C-Corp, or LLC), businesses may benefit from various tax advantages.

- Incorporation can provide opportunities for tax deductions and benefits that are not available to sole proprietorships or partnerships.

7. Formal Structure and Governance

Organizational Clarity

- The Articles of Incorporation establish the governance structure, including the roles and responsibilities of directors, officers, and shareholders.

- This clarity helps in maintaining order and making informed decisions.

8. Compliance and Regulation

State Compliance

- Filing the Articles of Incorporation ensures compliance with state laws and regulations, avoiding legal issues and penalties.

- Regular reporting and adherence to corporate formalities are essential for maintaining good standing.

9. Easier Transfer of Ownership

Smooth Transition

- The existence of shares or membership interests facilitates the transfer of ownership.

- This can be crucial for business succession planning and selling the business.

Where to File Articles of Incorporation

Filing Articles of Incorporation is a critical step in legally establishing your business as a corporation or an LLC. This document needs to be filed with the appropriate state authority. Here’s a detailed guide on where and how to file Articles of Incorporation in the United States.

1. State Secretary of State’s Office

Primary Filing Authority

- The most common place to file your Articles of Incorporation is with the Secretary of State’s office in the state where you plan to conduct business.

- Each state has its own procedures, forms, and fees for filing.

2. Online Filing

Convenient and Quick

- Many states offer online filing services through the Secretary of State’s website.

- Online filing is often faster and allows for easier tracking of your submission status.

3. Mail-In Filing

Traditional Method

- You can also file your Articles of Incorporation by mailing the completed forms to the Secretary of State’s office.

- Ensure you include the necessary fees and any additional required documentation.

4. In-Person Filing

Direct Submission

- Some states allow in-person filing at the Secretary of State’s office or designated locations.

- This method can sometimes expedite the processing of your documents.

5. Third-Party Service Providers

Professional Assistance

- There are various third-party service providers and legal services that can assist with preparing and filing your Articles of Incorporation.

- These services can be helpful if you are unfamiliar with the process or want to ensure accuracy.

6. State-Specific Requirements

Different States, Different Rules

- Each state has specific requirements and procedures for filing Articles of Incorporation. Below are examples of how to file in a few states:

California

- Online: California Secretary of State’s Online Filing Portal

- Mail: Secretary of State, Business Programs Division, P.O. Box 944260, Sacramento, CA 94244-2600

- In-Person: 1500 11th Street, Sacramento, CA 95814

New York

- Online: New York Department of State’s Online Filing Portal

- Mail: Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231

- In-Person: One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231

Texas

- Online: Texas Secretary of State’s Online Filing System

- Mail: Secretary of State, P.O. Box 13697, Austin, TX 78711-3697

- In-Person: 1019 Brazos St, Austin, TX 78701

Florida

- Online: Florida Department of State’s Online Filing Portal

- Mail: Department of State, Division of Corporations, P.O. Box 6327, Tallahassee, FL 32314

- In-Person: Clifton Building, 2661 Executive Center Circle, Tallahassee, FL 32301

What Can You See in the Content of a Basic Articles of Incorporation?

Articles of Incorporation are a crucial document for forming a corporation. They lay the foundation for the corporation’s structure and operations. Below are the essential components typically found in a basic Articles of Incorporation:

1. Name of the Corporation

The legal name of the corporation must be included. This name must be unique and distinguishable from other registered entities within the state.

2. Purpose of the Corporation

This section outlines the primary business activities the corporation will engage in. Some states allow for a general purpose statement, while others require specific activities to be listed.

3. Principal Office Address

The physical address of the corporation’s main office, including the street, city, state, and ZIP code.

4. Registered Agent and Office

Details of the registered agent who will receive legal documents on behalf of the corporation, including the agent’s name and address.

5. Incorporator Information

The names and addresses of the individuals responsible for creating the corporation, known as the incorporators.

6. Duration of the Corporation

Some corporations are established to exist indefinitely, while others may have a specified duration. This section will state the intended lifespan of the corporation.

7. Share Structure

Details on the corporation’s stock, including:

- Number of Authorized Shares: Total number of shares the corporation is authorized to issue.

- Classes of Shares: Different classes of stock (e.g., common, preferred) and their rights and privileges.

- Par Value: The nominal value of the shares.

8. Initial Directors

Names and addresses of the initial board of directors, who will manage the corporation until the first shareholder meeting.

9. Provisions for Internal Management

Optional clauses that outline specific rules or restrictions regarding the management of the corporation. This can include information on bylaws, meetings, and corporate governance.

10. Indemnification Provisions

Clauses that protect directors, officers, and employees from personal liability for actions taken on behalf of the corporation, under certain conditions.

11. Limitation of Director Liability

Provisions that limit the personal liability of directors to the corporation or its shareholders, within the bounds of state law.

12. Amendment Procedures

The process by which the Articles of Incorporation can be amended, typically involving board and shareholder approval.

13. Signatures

The incorporators must sign the document to validate it. Some states may also require notarization.

Why Do You Need to Make Articles of Incorporation?

Creating Articles of Incorporation is a fundamental step in establishing a corporation. This document is essential for several reasons, providing legal, operational, and strategic benefits. Here are the key reasons why you need to make Articles of Incorporation:

1. Legal Recognition

Establish Legal Entity: Articles of Incorporation legally establish the corporation as a distinct entity separate from its owners. This separation provides personal liability protection for shareholders.

Compliance with State Law: Filing this document is a legal requirement in most states for forming a corporation. It ensures the corporation operates within the state’s legal framework.

2. Personal Liability Protection

Limited Liability: By incorporating, the owners (shareholders) are generally protected from personal liability for the corporation’s debts and obligations. This means personal assets are safeguarded in case of business failures or lawsuits.

3. Credibility and Trust

Professional Image: Incorporating can enhance the business’s credibility with customers, suppliers, and investors. It demonstrates a commitment to formal business operations and long-term stability.

Investor Confidence: Potential investors often prefer corporations due to their structured governance and limited liability, making it easier to attract investment.

4. Perpetual Existence

Continuity: Unlike sole proprietorships or partnerships, a corporation can continue to exist independently of its founders or current owners. This perpetual existence allows for smoother succession planning and long-term planning.

5. Capital Acquisition

Stock Issuance: Corporations can raise capital by issuing stock. This flexibility in financing can be crucial for growth and expansion.

Access to Funding: Being incorporated can make it easier to obtain loans, grants, and other forms of funding, as many financial institutions view corporations as more stable and trustworthy.

6. Tax Benefits

Tax Advantages: Corporations may benefit from various tax deductions and incentives not available to other business structures. Depending on the type of corporation (e.g., S-corporation), there might be specific tax advantages.

7. Clear Organizational Structure

Defined Roles and Responsibilities: The Articles of Incorporation help establish a clear organizational structure, defining roles such as directors, officers, and shareholders. This clarity aids in efficient decision-making and governance.

8. Flexibility in Ownership

Transferability of Shares: Shares of a corporation can be easily transferred, bought, or sold, allowing for flexibility in ownership and investment.

9. Enhanced Business Opportunities

Contracts and Agreements: Some business opportunities and contracts may only be available to incorporated entities. Certain clients or partners might require a corporation status as a condition for doing business.

What is the purpose of Articles of Incorporation?

To legally establish a corporation and define its basic structure, purpose, and operational guidelines.

Why are Articles of Incorporation important?

They provide legal recognition, limited liability protection, and a formal structure for the corporation’s operations and governance.

What information is included in Articles of Incorporation?

Key details include the corporation’s name, purpose, principal office address, registered agent, incorporators, share structure, and initial directors.

How do I file Articles of Incorporation?

File with the state’s business filing office, typically the Secretary of State, along with the required filing fee.

Can I amend the Articles of Incorporation?

Yes, amendments can be made by filing a certificate of amendment with the state and obtaining board and shareholder approval.

What is a registered agent?

A registered agent is an individual or entity designated to receive legal documents and official correspondence on behalf of the corporation.

What is the difference between Articles of Incorporation and Bylaws?

Articles of Incorporation establish the corporation legally, while bylaws outline the internal rules and procedures for managing the corporation.

Are Articles of Incorporation public documents?

Yes, once filed, they become public records accessible through the state’s business filing office.

Do I need an attorney to prepare Articles of Incorporation?

While not required, consulting an attorney can ensure compliance with state laws and proper drafting of the document.

How long does it take to process Articles of Incorporation?

Processing times vary by state but typically range from a few days to several weeks, depending on the filing method and state workload.