10+ Financial Assessment Examples to Download

It goes without saying, having enough money to support yourself or your family is every single person’s dream. It is never easy having to struggle with finding cash, especially if you need one for an emergency or simply to save on a rainy day. There are some companies and banks who do offer financial as well as government agencies who help out those who may be of need. But for this to happen, they often begin assessing a person to check if they fall under the category of financial help. This also rings true for companies, banks, and investments. To know more about what a financial assessment is, check out the article below.

10+ Financial Assessment Examples

1. Financial Risk Assessment Template

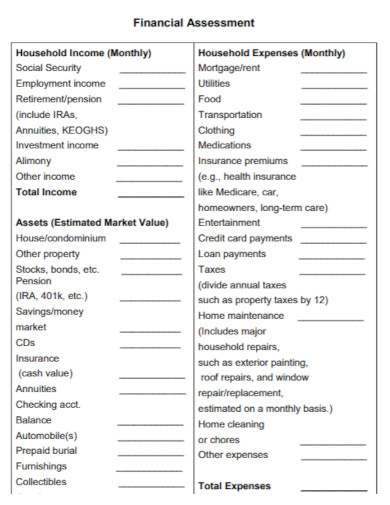

2. Standard Financial Assessment

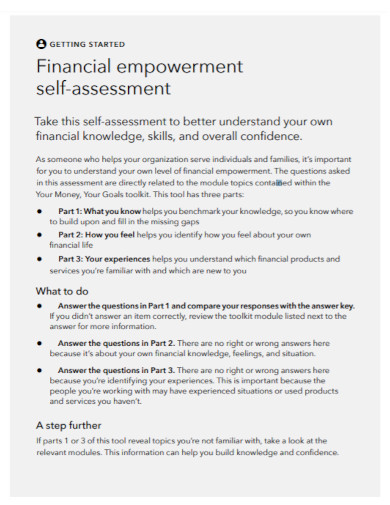

3. Financial Empowerment Self Assessment

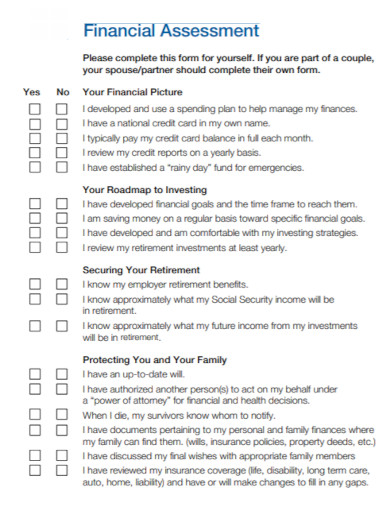

4. Formal Financial Assessment

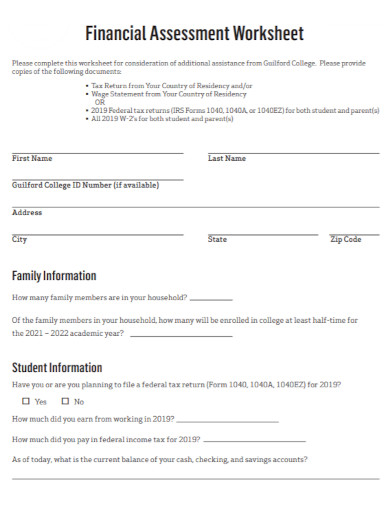

5. Financial Assessment Worksheet

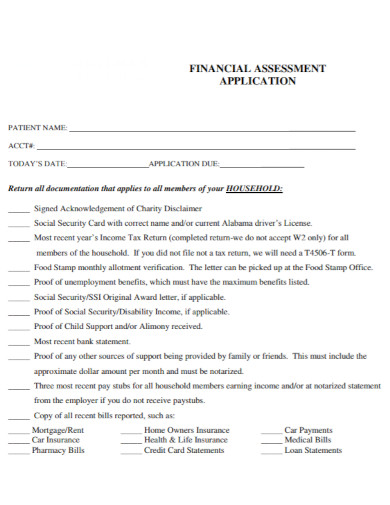

6. Financial Assessment Application

7. Income Based Financial Assessment

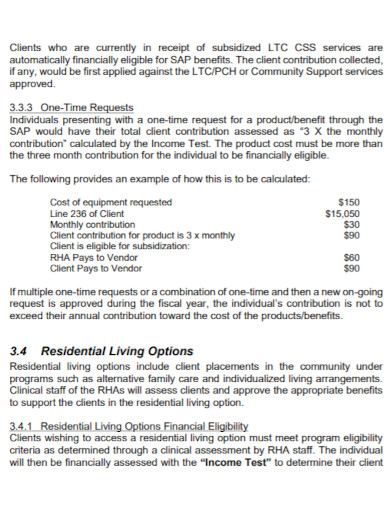

8. Residential Financial Assessment

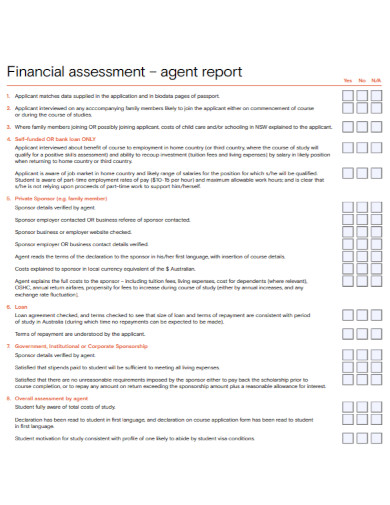

9. Financial Assessment Agent Report

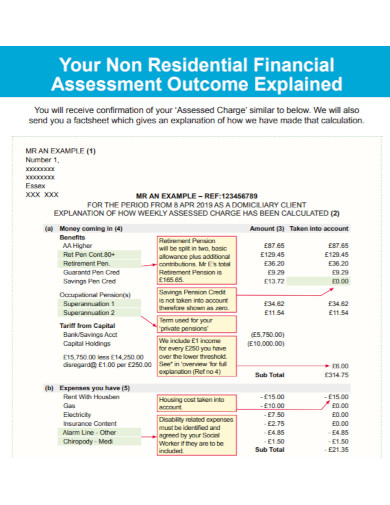

10. Financial Assessment Reports

11. Financial Assessment Supplement

What Is a Financial Assessment?

A financial assessment is made usually by banks or companies who invest. This kind of assessment is used to assess the financial aid a person has in order to see if their applications for financial aid can be possible or not. This is also often used to check and to see if the person can ask for financial help from the government. As not everyone who may look wealthy is wealthy as well as those who do not look poor are actually poor. A financial assessment can also be a good way to judge how well a person can budget their earnings especially if the person is working. Financial assessments are not only made for those who may be working, but it is also open to those who have no work, who may be suffering from an illness. This is only used to assess the amount of money they may earn or receive.

This is true especially if you are working. Financial assessments also help banks and companies choose who may be given the financial care and how much of that financial aid should be given. If the people assigned can see that you have enough to cover financial aid and expenses altogether, there is a higher chance of getting denied. However, if they notice through the assessment that you are struggling and would need assistance to pay for necessary things, companies, banks or any organization who gives out financial aid would surely give you the opportunity to help you. In addition to that, there are always risks to every financial assessment. Risks to having to give out money to a potential client who may be struggling. But these types of risks can be managed as long as the information about the client is given as well as the necessary information that can help the financial assessment run its course.

How to Write a Financial Assessment

Moving on to how writing a financial assessment in easy steps. As these tips can be quite helpful when you are planning on doing an assessment. Check out the ones below.

1. Understand the Reason for the Assessment

As this is a financial assessment, the first thing to do is to understand the reason for doing this type of assessment. To whom are you doing this for and what are you planning on getting out of the financial assessment.

2. Gather Data about Your Client

For your assessment to run smoothly, you need to gather data about your client. As each client differs in how they may apply for the financial loan. You must also be able to know their financial background.

3. Assess and Evaluate Your Results

Your gathered data from your client should be assessed and evaluated. The results should give you the exact answer of what you are looking for. In this case, the result should answer the question that made you do the assessment.

4. Treat Your Assessment with Utmost Care

Always remember that your assessment is used for understanding and for learning the reason for your clients to want to loan. Treat the results with care. Avoid having to show anyone of the answers or the results unless it is for company based, or bank based. Basically only if it helps the bank, company or the organization in the potential results of a person’s loan status.

5. Keep Things Professional

Always keep the data private. Keep the assessment at a professional level. Avoid having to do something wrong that may affect the chances of getting a good result on the assessment.

FAQs

Why is doing the assessment so important?

It is to understand the needs of a person. This case, it would be financial aid. For a person to know about the financial history of a person, one must do the assessment.

Is there a chance for the result of the assessment to change if the person needs the financial help?

The results of the financial assessment can also affect the potential loan of a client. Especially if the result may state that the client can afford anything without help, or the other way around. This may depend on what the bank loans may say or do.

What is a financial assessment?

It is a type of assessment that studies the financial issues of a potential client. It also tests the level of financial problems a person may face and find a way to resolve it.

How can it be helpful?

For people planning on asking for a loan, they are first assessed by the bank or by the loan management to see if they are able to pay back the loan or if they fully are able to pay without having to go through a loan.

Can anyone apply for the loan and still undergo the financial assessment?

Yes. Anyone who wishes to ask for financial help have to undergo through a financial assessment.

Financial assessments are helpful when a client wishes to have a chance to borrow or ask for financial help. This assessment lessens the risk of both parties having to lose something important.

![10+ Financial Assessment Examples [ Company, Bank, Investment ]](https://images.examples.com/wp-content/uploads/2021/07/10-Financial-Assessment-Examples-Company-Bank-Investment-.jpg)