48+ Assets Examples to Download

There are many ways to obtain a significant amount of money. One of the best ways to obtain money is by managing one’s assets.

1. Accounting for Fixed Assets

2. Impairment of Assets

3. Financial Assets

4. Transactions in Nonfinancial Asset

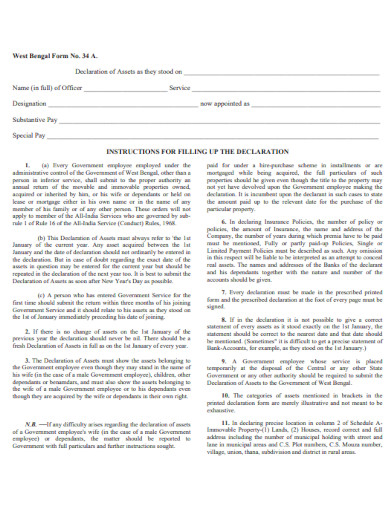

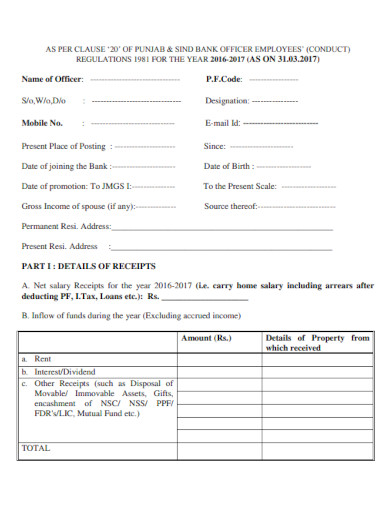

5. Declaration of Assets

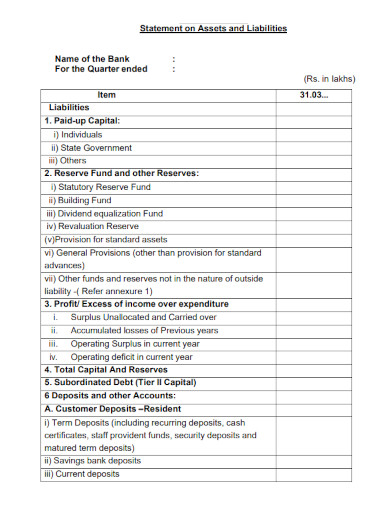

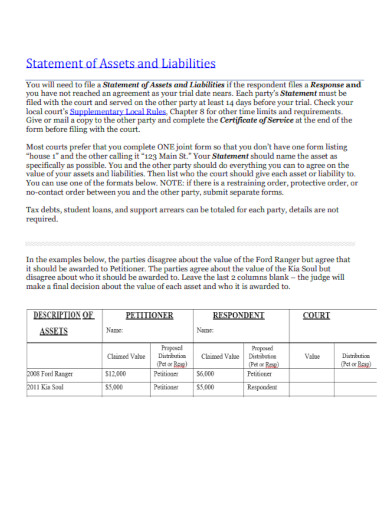

6. Statement on Assets and Liabilities

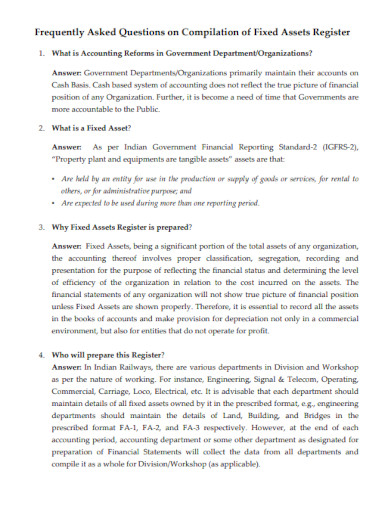

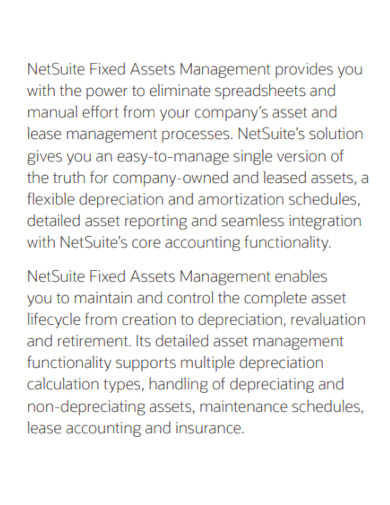

7. Fixed Assets

8. Financial Assets vs Physical Assets

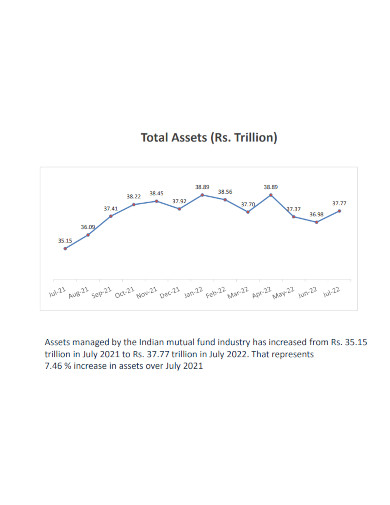

9. Total Assets

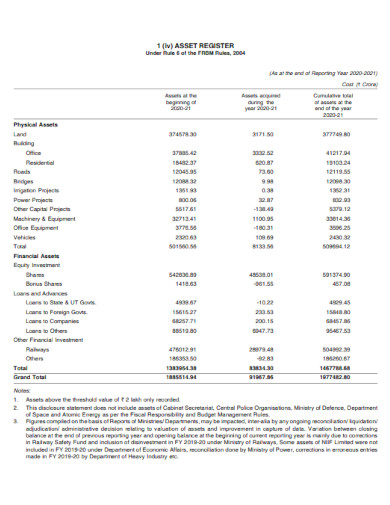

10. Assets Register

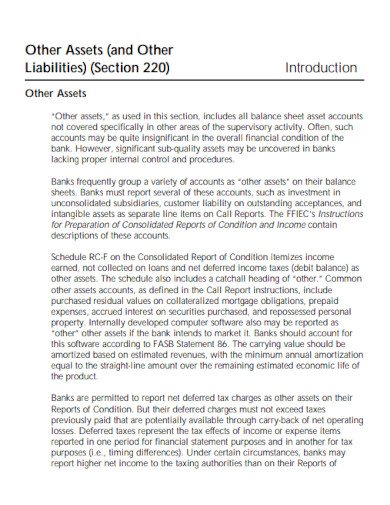

11. Other Assets

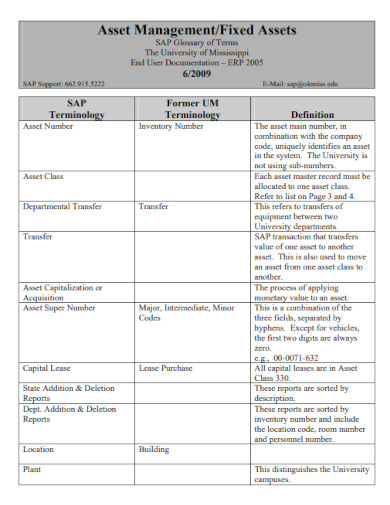

12. Assets Management

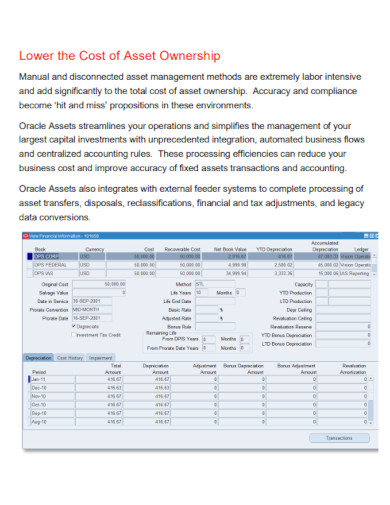

13. Lower the Cost of Asset Ownership

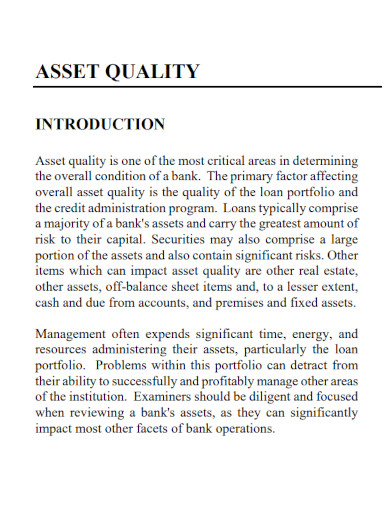

14. Assets Quality

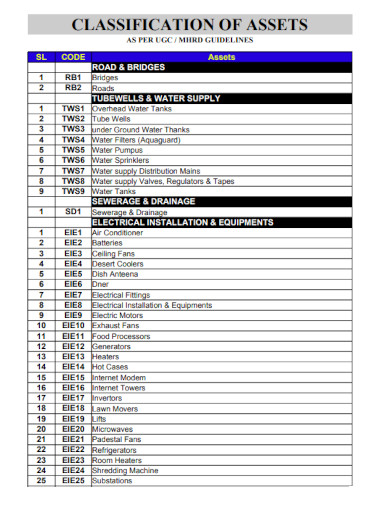

15. Classification of Assets

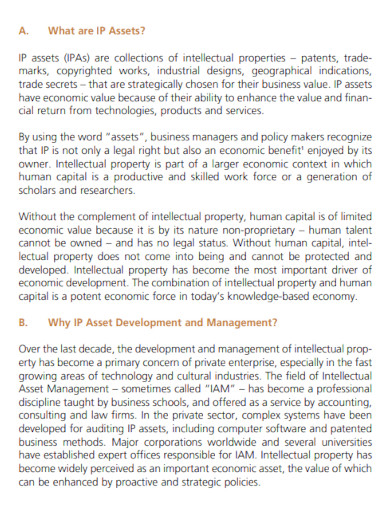

16. IP Assets

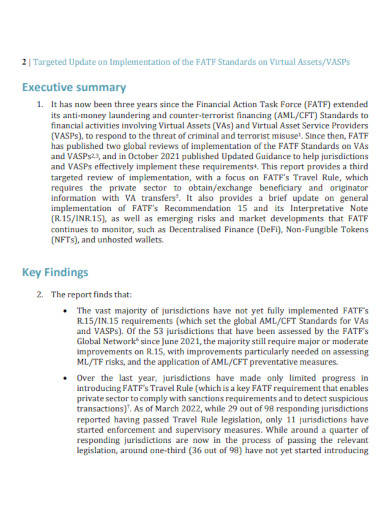

17. Virtual Assets

18. Assets Sample

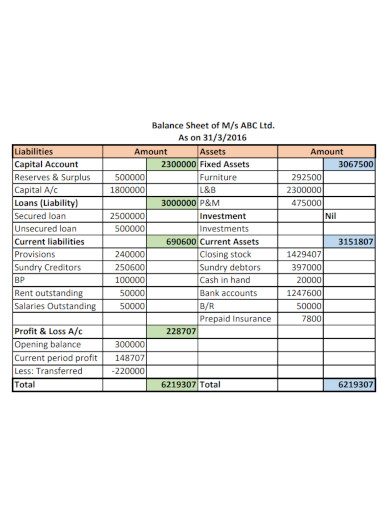

19. Balance Sheet Assets

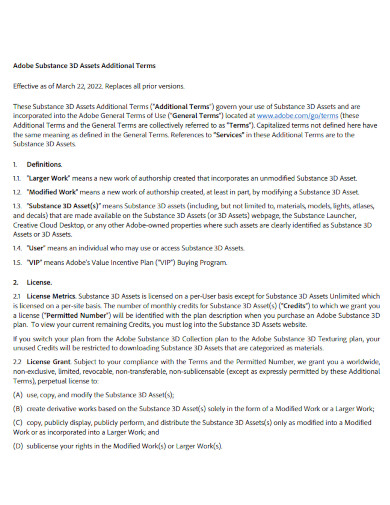

20. 3D Assets Additional Terms

21. Fixed Assets Management

22. Modern Assets

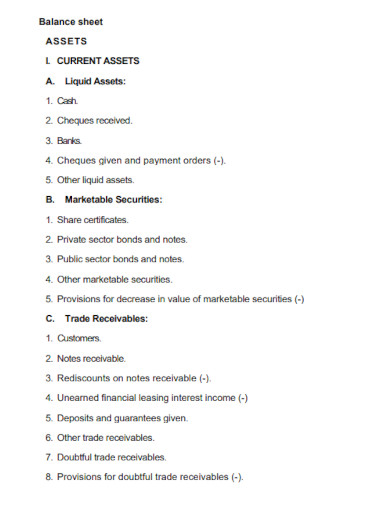

23. Balance Sheet Assets Example

24. The Fundamentals of Safe Assets

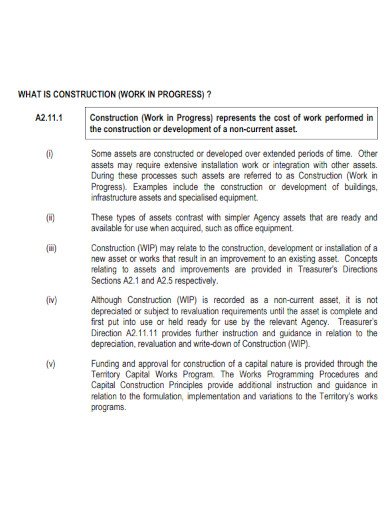

25. Accounting Assets Example

26. The Influence of Assets Structure

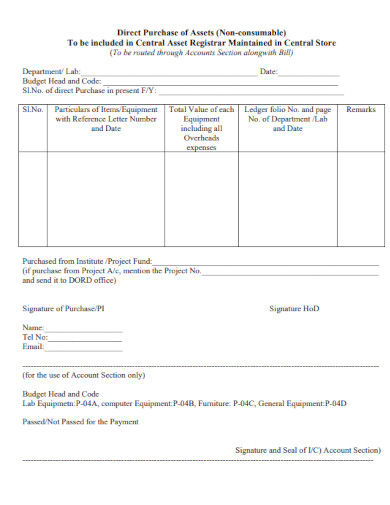

27. Direct Purchase of Assets

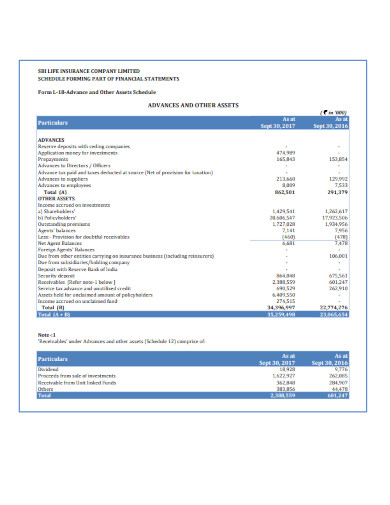

28. Advance and Other Assets

29. Stranded Assets in Agriculture

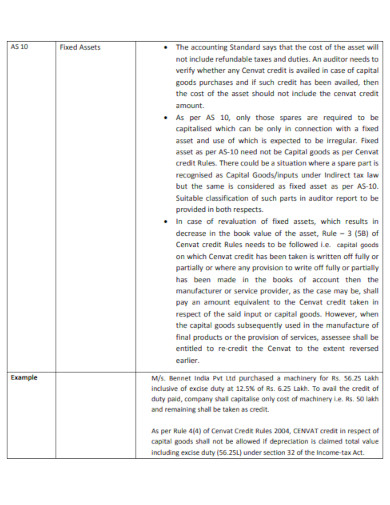

30. Fixed Assets Example PDF

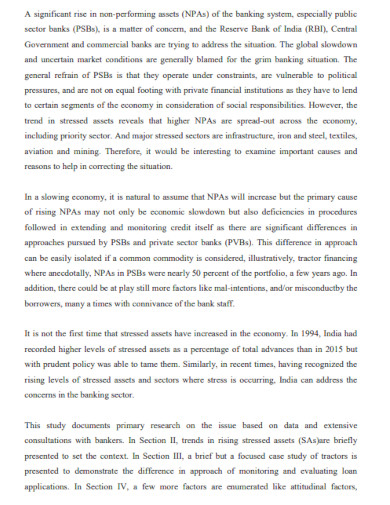

31. Stressed Assets

32. Bank Assets

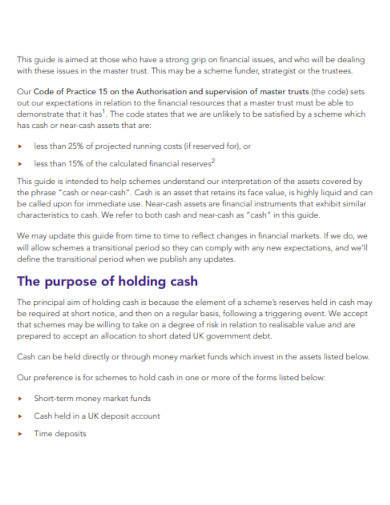

33. Cash and Near-Cash Assets

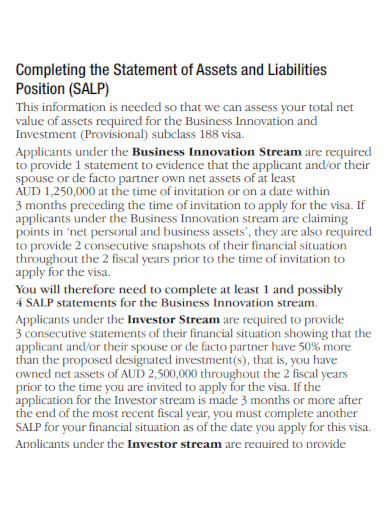

34. Statement of Assets and Liabilities Position

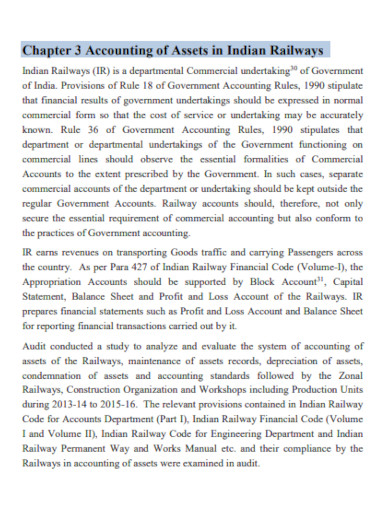

35. Assets in Railways

36. Financial Assets Example

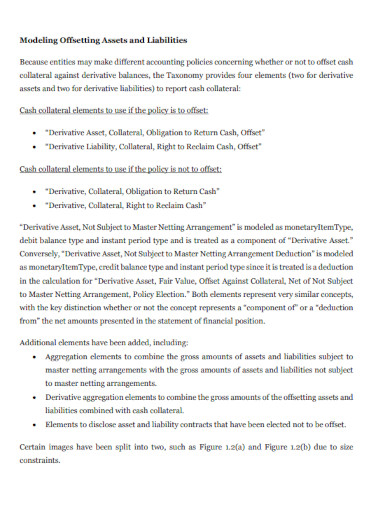

37. Modeling Offsetting Assets

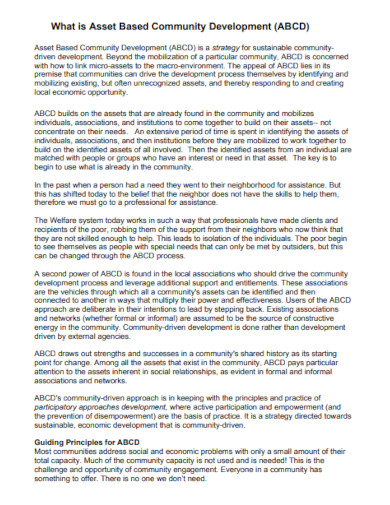

38. Asset Based Community Development

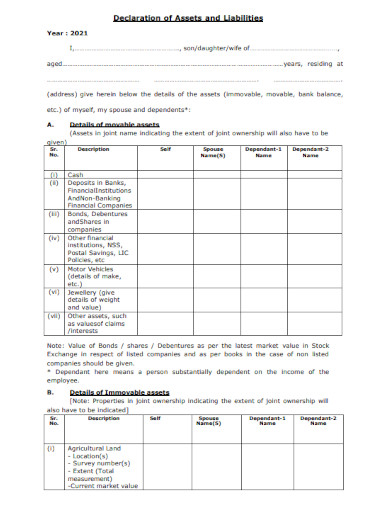

39. Declaration of Assets and Liabilities

40. Digital Assets

41. Non-Financial Assets of Household

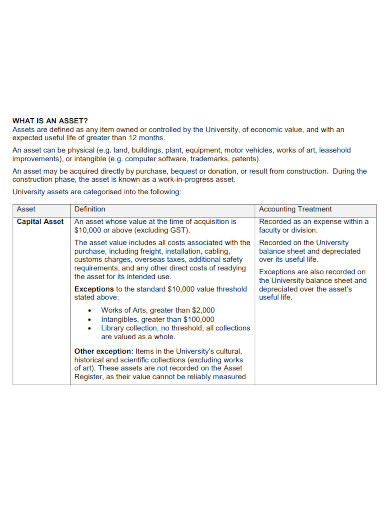

42. Assets Format

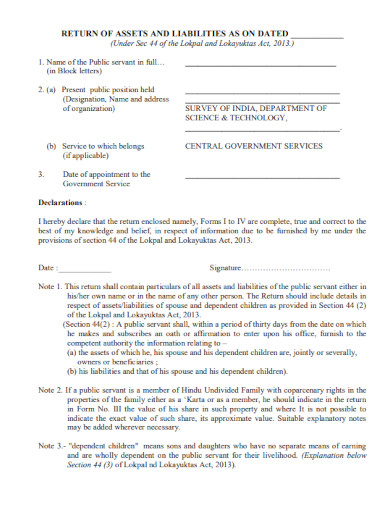

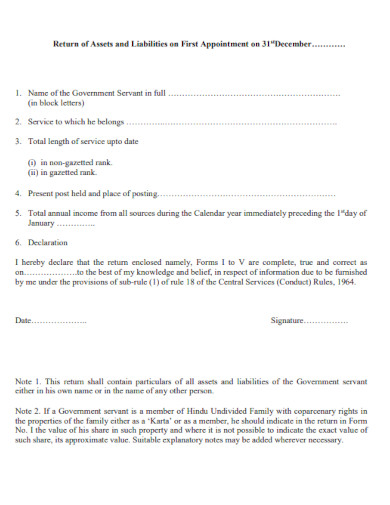

43. Return of Assets

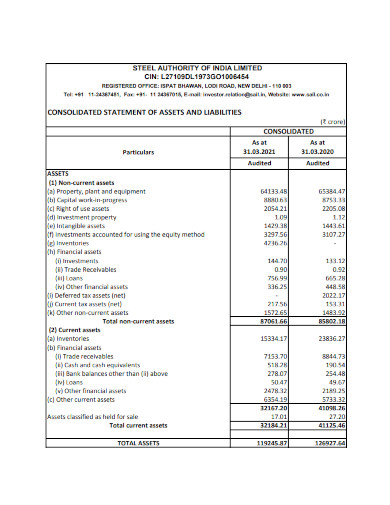

44. Consolidated Balance Sheet Assets

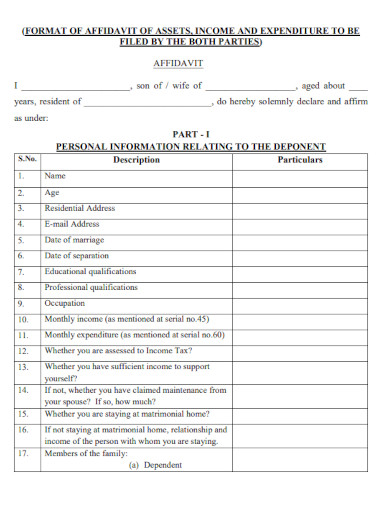

45. Affidavit of Assets

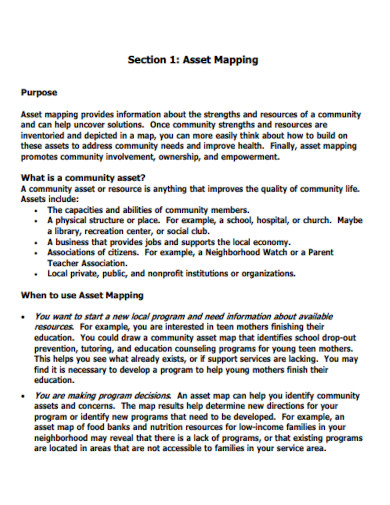

46. Asset Mapping

47. Assets in PDF

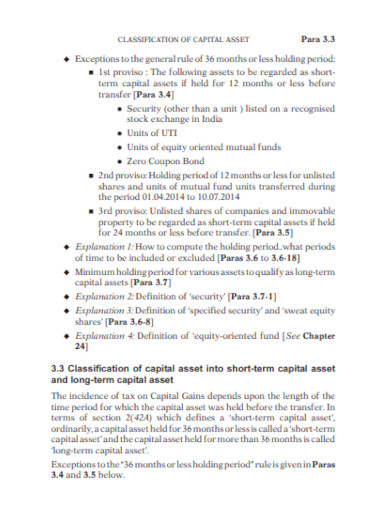

48. Classifications of Capital Assets

49. Return of Assets Sample

50. Fixed Assets Register

What Are Assets

An asset is a resource or item that can procure revenue and monetary value for the owner of said resource or item. If you want to consider a resource an asset you must ensure that the resource or item is a property you own.

How to Differentiate Assets from Liabilities

We need to keep an inventory of all the resources we have and figure out whether specific resources are either an asset or a liability. If you are still struggling to understand the concept of assets and asset management, you may read any of the asset articles, examples, samples, and PDFs in the list above.

1.) List Down the Resources You Own

Begin by taking inventory of all the resources you own. This means that you have to both write down the intangible resources you own and take note of the physical resources you have. It is best to create a list of your resources in Google Sheets or a physical notebook.

2.) Denote the Value the Your Resources Have

After writing down all the resources you own on, you must denote all the monetary value the asset has provided. This is so you can easily visualize the amount of value a specific asset will provide to you.

3.) Check if the Resource Has a Maintaining Cost

When you have denoted the value of the resources you own, you must check whether the resource has a maintenance cost. An example of a resource that will have a maintenance cost is a house. This is because each house brings a specific amount of monetary value while still having upkeep to maintain the quality or the ownership of the house.

4.) Calculate Whether the Value Outweighs the Maintaining Cost

After you have checked if the resource has a maintenance cost, you must then compare and contrast the value brought by the resource with the cost entailed by said resource. If the value outweighs the cost, then the resource is considered an asset, but if the cost outweighs the value then the resource is considered a liability.

FAQs

Why is it important for us to keep our assets?

Assets and liabilities are closely interrelated concepts. Assets are valuable resources that a person or a company has that can be considered their property. This is important because these are the resources that will bring you revenue and provide a specific amount of value to the person or the company owning the said asset. If one were to lose their asset this would mean that their monetary value and status will depreciate in proportion to the value provided by the asset. Not only will the person’s or the company’s value decrease but they will also lose out on potential monetary income or revenue that will be generated from the asset.

What are common everyday examples of assets?

Common examples of assets we can find in our everyday life include houses, cars, certificates, stocks, equipment, and more the like. These are considered assets as they have a good resale value like houses, cars, and stocks, while also providing a specific need, While people can use other types of assets, like certificates and equipment, to generate income or revenue whether it is through the creation of a product or a service rendered. Just note that some assets have maintaining costs and opportunity costs that will either reduce or depreciate the value of the said asset. When deciding on whether or not you should keep a specific asset, it is important to take into consideration the amount of value held by the asset and whether or not it is worth keeping said asset.

Assets vs. liabilities; what are the differences between assets and liabilities?

Assets are items and resources that people or companies own to generate income or revenue. These assets can be both physical and intangible properties. Examples of intangible assets include copyrights, agreements, and contracts. Liabilities, on the other hand, will constantly lose value and will often cost the owner to lose monetary value. Often liabilities come in the form of debts as they will take money out of the person’s bank without providing any value. It is very important to pay out your liabilities as they can pile up the unnecessary spending of your monetary resources.

Assets are resources and items that can bring value, often monetary, to the person or company who owns the asset. A well-managed inventory of assets can help lift a person’s or company’s value to a certain degree. In conclusion, we need to keep track of our important assets and utilize said assets to increase our quality of life.