9+ Audit Confidentiality Agreement Examples

In every entity, an audit is necessary, whether internal or external audit, in order to monitor the entity’s operations and processes and to make sure that there is a material misstatement in the financial statement and important papers of a certain entity. Auditing would also increase the integrity and credibility of an entity.

People would expect high from the company and many will trust in the performance and services of the entity since they know that it has a good reputation and credibility based on the results of the audit. Audit results must be transparent and must be available for everyone who are related parties or interested parties. You may also see non-disclosure confidentiality agreement examples.

However, there are certain contents such as the company’s proprietary information audited by an internal or external auditor that must be kept confidential especially to third parties and competitors. More on these discussions will be presented in the succeeding sections. You may also like employee confidentiality agreement examples.

Here are examples of audit confidentiality agreement that you might find useful whenever you are going to create one. Check them out in the next section.

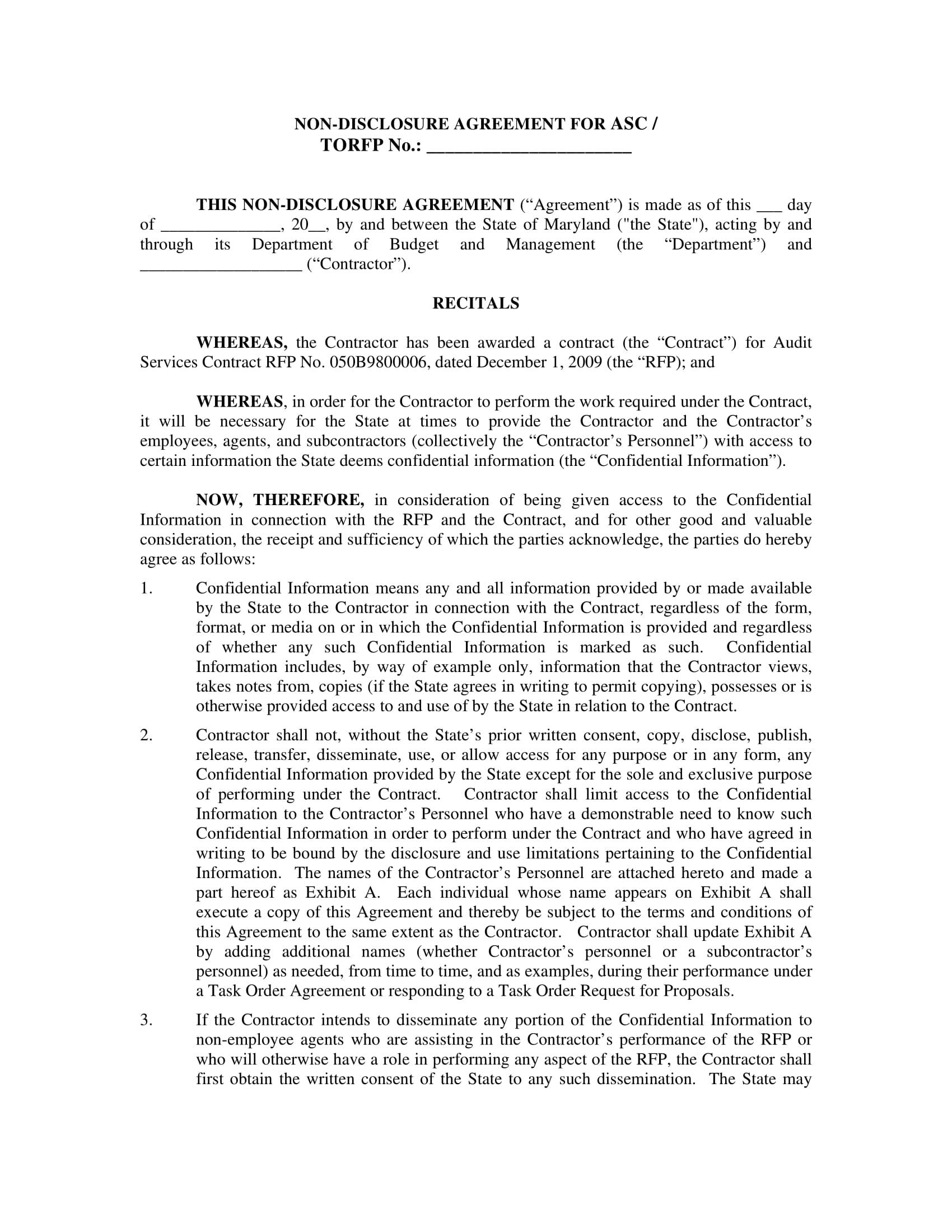

ASC Audit Confidentiality Agreement Example

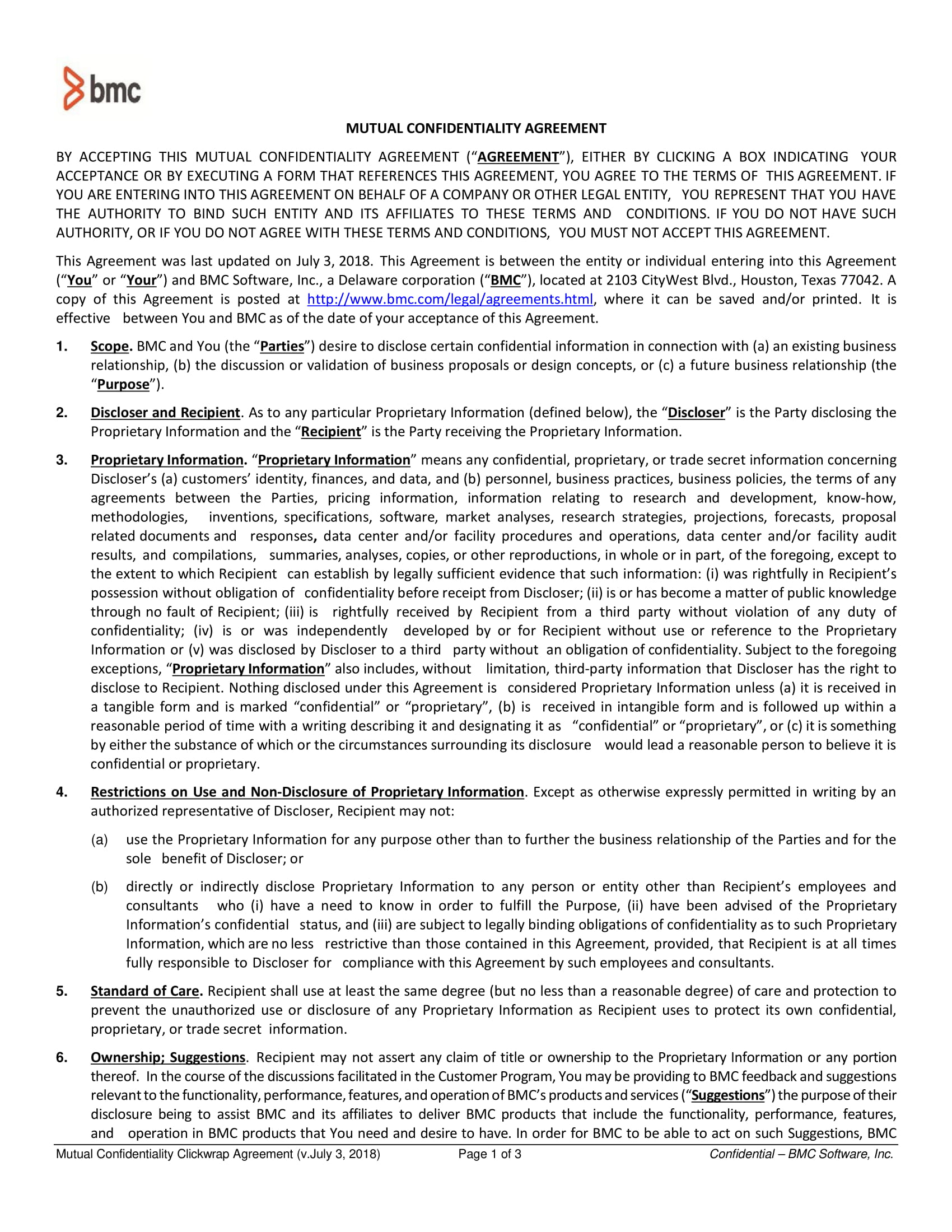

BMC Mutual and Audit Confidentiality Agreement Example

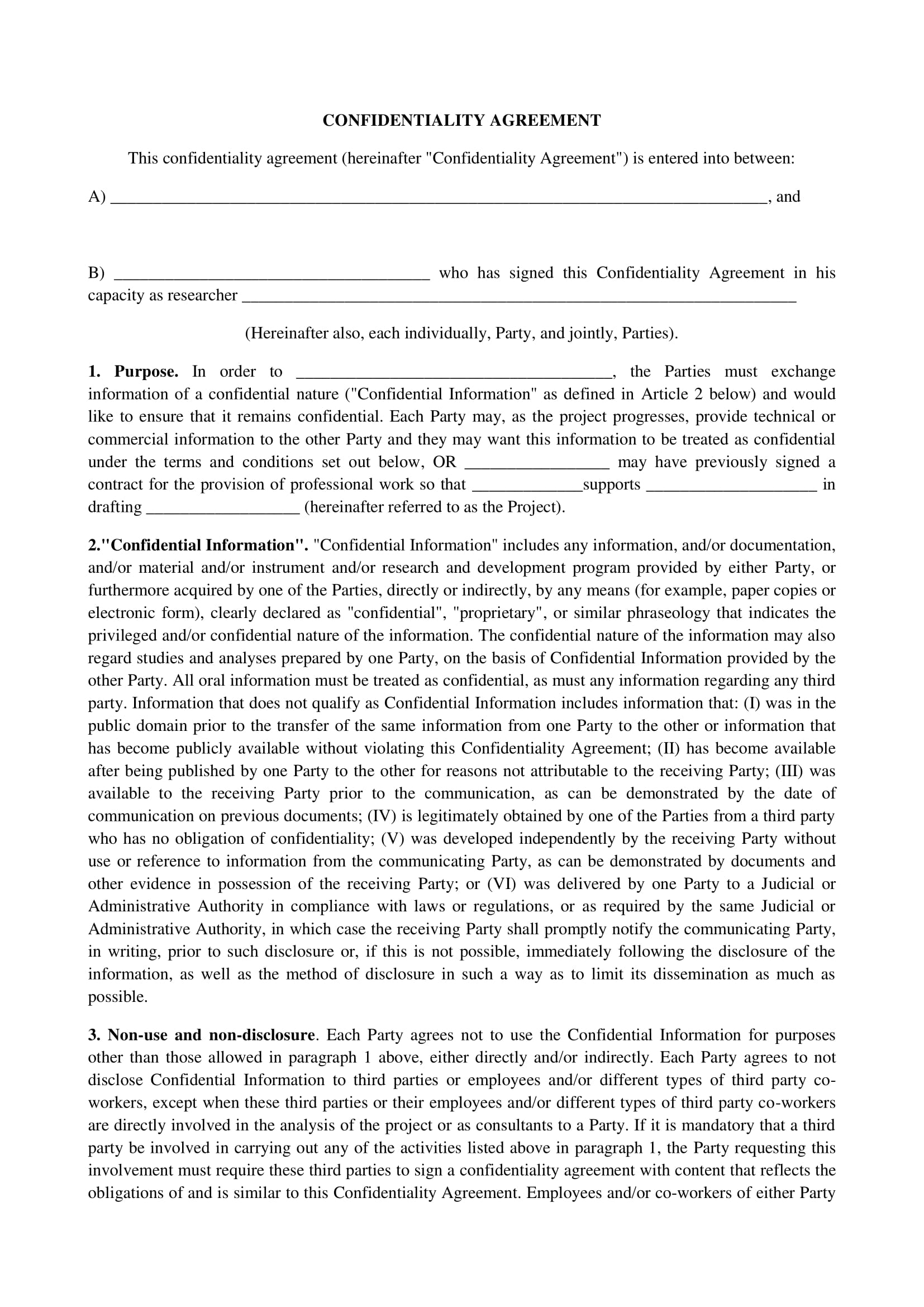

Clear Audit Confidentiality Agreement Example

The Contents of a Confidentiality Agreement

There are certain items or ideas in your entity that must be kept confidential especially when your success depends on its secrecy and to stay on top of the competition with the other businesses.You must keep those information out of your competitor’s hands or in the wrong hands to reduce the risk of divulging your secrets. You may also see basic non-disclosure agreement examples.

To reduce this risk, you must have a general contract between you and the firm or individual auditing your financial statements, a confidentiality agreement or a nondisclosure agreement, that is designed to protect your company’s proprietary information. The one responsible for the contents of the agreement is the contract law attorney, but there common contents that must be included in the agreement and these are as follows.

1. Proprietary Information

There are proprietary information with regard to your company that must be kept in private. However, you must disclose this as the general agreement itself. For example, if you are a running a restaurant, you might state that the ingredients of your meal must be kept confidential. Another example is if you are a supplier of canvas panels, you might state that the techniques in creating the canvas must not be divulged in public.

Lastly, if you have the most demanded cupcake in town, you can state that the recipe must not be shared with the others.

2. Time Limits

In your simple agreement, it must contain a stipulation with regard to the length of time the information must be kept confidential. You may state that the auditor must not disclose the information for his time as an auditor and for an extended time after his time as an auditor ends. If you want to require greater sensitivity, you might want to state in the stipulation a longer period.

3. Legal Remedies

Your audit confidentiality agreement must also include proposed legal remedies for a breach of the agreement or contract. You must include a clause stating that an employee who breaches the agreement will be liable for a certain monetary amount plus damages resulting from the breach, as well as the legal costs incurred by taking the matter to court and any other expenses relating to the breach of agreement or contract.

4. Limitations

If you want to ask someone to keep a trade secret during the audit, it is fitting and proper that the audit confidentiality agreement must be legal and enforceable. For example, if your trade secret with regard to illegally hacking into computers of your competitors and private individuals, you cannot ask the auditor to stay silent regarding these activities.

Take extra few steps to keep your proprietary information private for if you openly tell others regarding your trade secrets, it is no longer a secret and the court might not view the information as a secret. Moreover, if the auditor already knew the information before signing the agreement, the basic agreement might have a binding effect. You can have him sign an additional clause stating that he did not have prior knowledge of your trade secret.

5. Non-Compete Clause

It is already a protocol in an audit that they must not use your trade secret against you, but you can still state in the agreement a non-compete clause stating that the audit information must not be used by the auditor by any means against you or to start their own business. You must specify the length of time this will be in effect. You can also let the auditor sign a separate form if you do not wish for this clause to be included in your audit confidentiality clause.

6. Signatures

For your agreement to be valid, it requires signatures from the related parties to the agreement. Both parties, the one auditing the financial statement and the company being audited, must have a representative to sign the document. You may also sign other parties with access to the company’s proprietary information to sign a simple confidentiality agreement as well such as the employees, contractors, business associates, and distributors.

An electronic signature can also be accepted in lieu of traditional handwritten signatures. You can let the signatories type their names in the signature box and copy and paste a scanned or cropped image of their respective signatures. There are also instances when you send a confidentiality agreement digitally as an email attachment. In this case, you can insert an “I accept” button and the terms of the simple contract when they click that button.

Comprehensive Audit Confidentiality Agreement Example

DOH Performance Audit Confidentiality Agreement Example

IMS Reliance Audit Confidentiality Agreement Example

How to Perform an External Audit

To assess the company’s operation and internal control, external audits are performed by external auditors. These auditors are independent from the company that they are auditing and perform the audit of the simple financial statement of a company in accordance with specific laws or rules of a government entity.

A lot of user of the financial information such as the investors, customers, and government agencies rely on the external auditor to present an unbiased and independent audit report. They must have no personal or financial interest in the company to avoid bias information.

There are typical audit procedures that an auditor must perform when auditing the financial statement of a company and this involves the following:

1. Define the perimeters of the audit. There must be a certain area that must be focused in an audit. This scope must be clearly defined.

2. Meet with company management to define the perimeters. After you have defined the perimeters of the audit, you can meet with the management to discuss this perimeter. You must discuss this with the appropriate personnel or those that are tasked to overlook on a certain area. You may also see non-disclosure agreement examples.

3. Research about the company. You may search in media reports, message boards, and other places around the Web that you might find relevant with regard to the audit process. This can be useful when you are conducting audits related to issues other than accounting for the research could yield some important data relevant to the different aspects of a company. You may also like mutual confidentiality agreement examples.

4. Gather relevant information. You may have searched a lot of information, but you must only gather those that are relevant in your audit. You may ask an access to both paper documents and any electronic systems that the company are using to store their relevant information such as file cabinets, internal electronic storage, or remote server. You may also check out HIPAA confidentiality agreement examples.

5. Read the gathered and relevant data. After you have gathered the relevant data, you can read this data and include hard copies and soft copies or electronic files. This will provide a foundation for understanding what to look for and where to find what you need.

6. Prepare a list of questions and present it to the entity you are auditing. Their might be questions you encountered that you are reading through the data you have gathered. This may allow you to find more information that will help you understand more and fill in gaps in the data you have already reviewed. You might be interested in teacher confidentiality agreement examples.

7. Organize the data as well as the responses to the questions. Gather the responses and combine them with the relevant data you gathered.

8. Assess and analyze the data. You must interpret the gathered data and identify areas that requires additional attention.

9. Make suggestions for improvement. After you have already assessed the company’s financial statement, you can offer advice on how to improve existing systems so that the operation is more in compliance with industry standards. You may also see business agreement examples.

10. Make sure all evaluations and suggestions meet the legal standards and regulations where the organization is operating. Recheck if all your general assessments and suggestions meet industry standard for this might affect your reputation or credibility as an auditor if you fail to do so. You may also like

Mercury Audit Confidentiality Agreement Example

PINE Audit Confidentiality Agreement Example

Simple Audit Confidentiality Agreement Example

TietoEnator Audit Confidentiality Agreement Example

Brief Recap

In having an audit confidentiality agreement, the following items must be included in its content: proprietary information, time limits, legal remedies, limitations, non-compete clause, and signatures. These are essential for the completeness and validity of the standard agreement. Make sure that you are double-checking each item in order to avoid typographical, grammatical, and any material errors.

You must also know the process in an external audit, whether you may be an auditor or the company being audited for you to have a background and an overview on the audit process as well as the items needed to be audited.

The usual audit process involves the following: define the perimeters of the audit, meet with company management to define the perimeters, research about the company, gather relevant information, read the gathered and relevant data, prepare a list of questions and present it to the entity you are auditing, organize the data as well as the responses to the questions, assess and analyze the data, make suggestions for improvement, make sure all evaluations and suggestions meet the legal standards and regulations where the organization is operating. You may also see non-compete agreement examples.

We do hope that you learned a lot from this article with regard to audit confidentiality agreement as well as the process of audit that you can use in the future regarding auditing.