9+ Bank Authorization Letter Examples to Download

It is not all the time that you are available to do or perform transaction with regard to your account in the bank. There are instances when you need someone to act in behalf of you to do the things that you might be doing. This could be because of emergency situations and time constraints.

Hence, you must send your proxy, representative, or substitute in order to do the task for you. That person will have powers, duties, and obligations granted upon him or her and will have limitations with regard to that powers.

In order to clarify and be specific with the terms and general agreement regarding the authorization, an authorization letter must be made. The authorization letter must contain all the stipulation in the agreement including the powers, tasks, as well as limitation of the proxy. In this way, the transaction will run smoothly. This will also prevent misunderstanding and confusion among the parties involved.

What is Bank Authorization Letter?

A Bank Authorization Letter is a formal document that allows a person or organization to act on behalf of another individual regarding banking transactions. This letter is used when the account holder is unable to visit the bank personally and needs to authorize someone else to perform specific banking tasks.

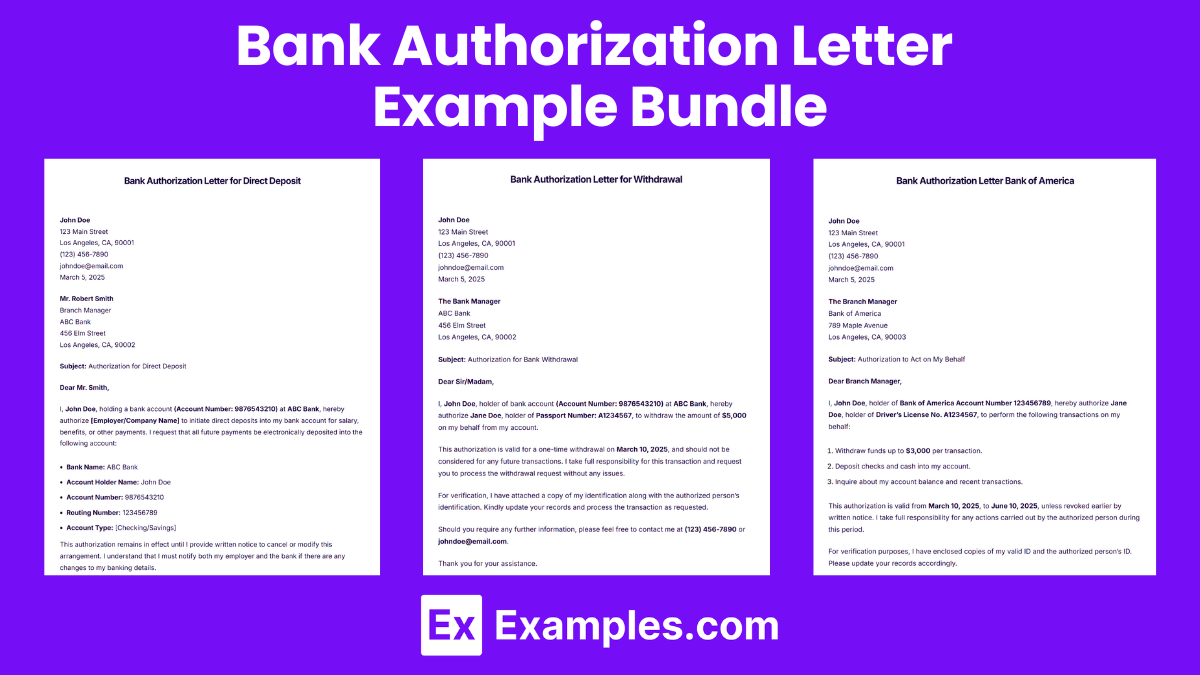

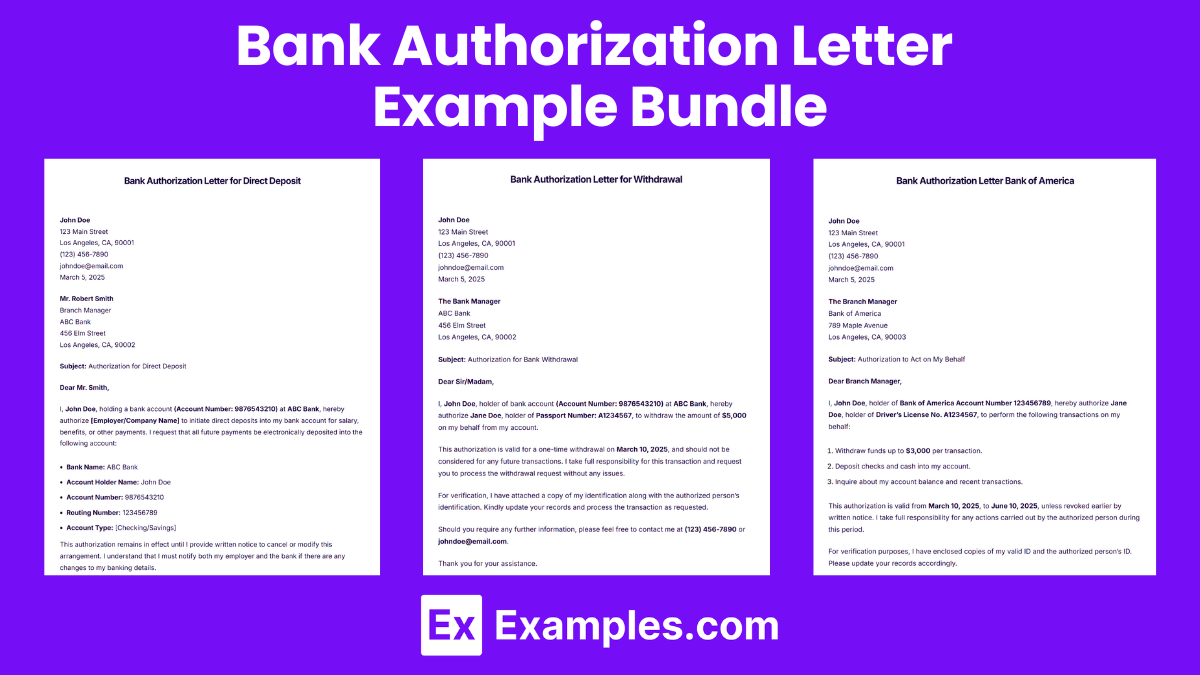

Bank Authorization Letter Example Bundle

Bank Authorization Letter Format

1. Sender’s Information

(Your Name)

(Your Address)

(City, State, ZIP Code)

(Your Phone Number)

(Your Email Address)

(Date)

2. Recipient’s Information

(Bank Manager’s Name) [if known]

(Bank Name)

(Bank Branch Address)

(City, State, ZIP Code)

3. Subject

Authorization for Banking Transactions

4. Salutation

Dear [Bank Manager’s Name],

5. Body of the Letter

I, (Your Full Name), holding a bank account (Account Number: [Your Account Number]) at (Bank Name), hereby authorize (Authorized Person’s Name), holder of (Authorized Person’s ID/Passport Number), to act on my behalf for the following banking transactions:

- (Specify the tasks, e.g., withdraw cash, deposit checks, inquire about account details, etc.)

- (Mention any other specific actions permitted)

This authorization is valid from (Start Date) to (End Date), unless revoked earlier by written notice. I take full responsibility for any actions carried out by the authorized person within this period.

For identification purposes, I have attached copies of valid ID proofs for both myself and (Authorized Person’s Name). Kindly update your records and allow the authorized person to perform the permitted transactions.

Please feel free to contact me at (Your Contact Number) or (Your Email Address) for any verification.

Thank you for your cooperation.

6. Closing

Sincerely,

(Your Name)

(Your Signature)

7. Attachments

✔ Copy of Account Holder’s ID

✔ Copy of Authorized Person’s ID

Bank Authorization Letter Example

John Doe

123 Main Street

Los Angeles, CA, 90001

(123) 456-7890

johndoe@email.com

March 5, 2025

Mr. Robert Smith

Branch Manager

ABC Bank

456 Elm Street

Los Angeles, CA, 90002

Subject: Authorization for Banking Transactions

Dear Mr. Smith,

I, John Doe, holding a bank account (Account Number: 9876543210) at ABC Bank, hereby authorize Jane Doe, holder of Passport Number: A1234567, to act on my behalf for the following banking transactions:

- Withdraw cash up to a limit of $5,000 per transaction.

- Deposit checks and cash into my account.

- Inquire about my account balance and transaction history.

This authorization is valid from March 10, 2025, to June 10, 2025, unless revoked earlier by written notice. I take full responsibility for any actions carried out by the authorized person within this period.

For identification purposes, I have attached copies of valid ID proofs for both myself and Jane Doe. Kindly update your records and allow the authorized person to perform the permitted transactions.

Please feel free to contact me at (123) 456-7890 or johndoe@email.com for any verification.

Thank you for your cooperation.

Sincerely,

John Doe

(Signature)

Attachments:

✔ Copy of John Doe’s ID

✔ Copy of Jane Doe’s ID

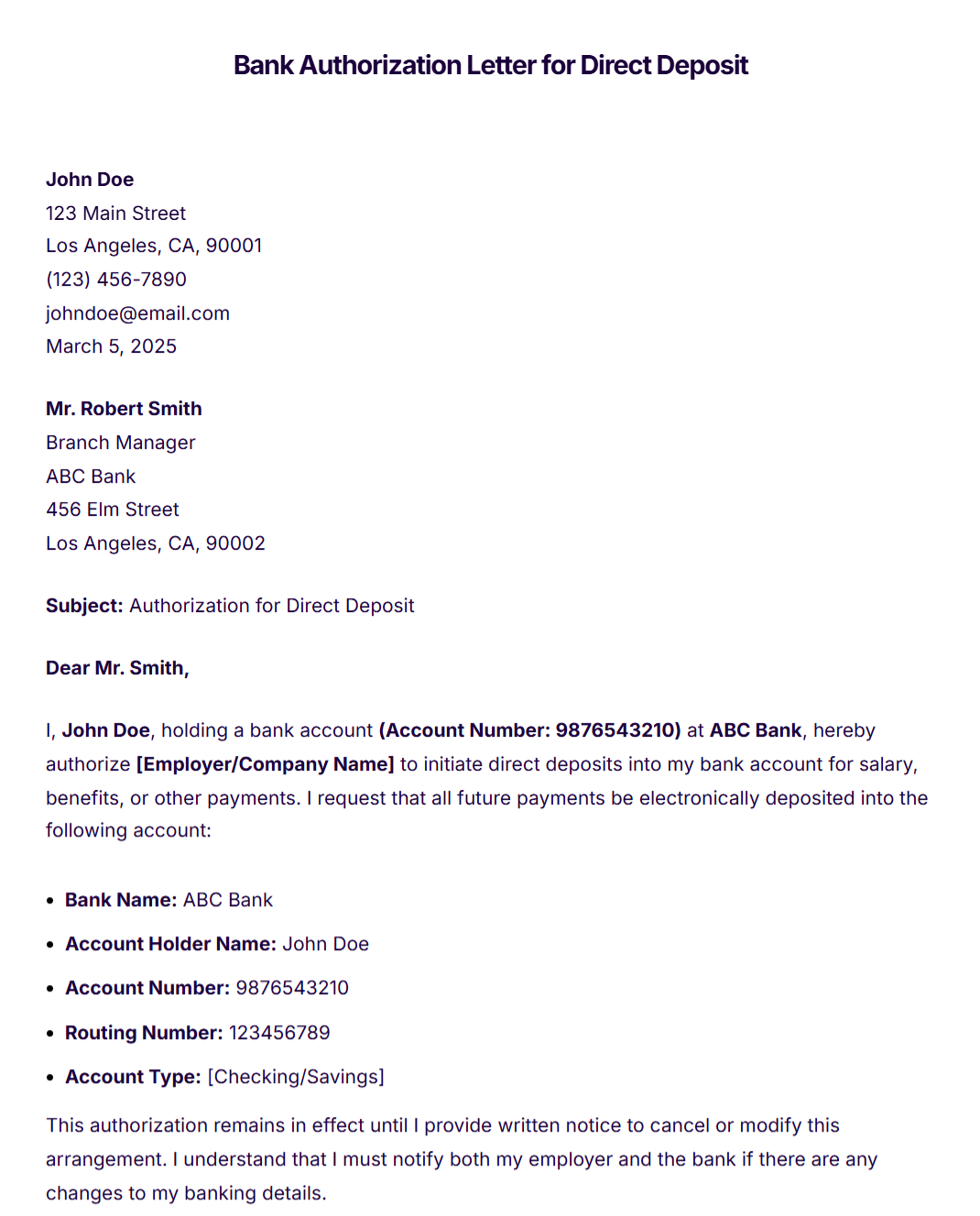

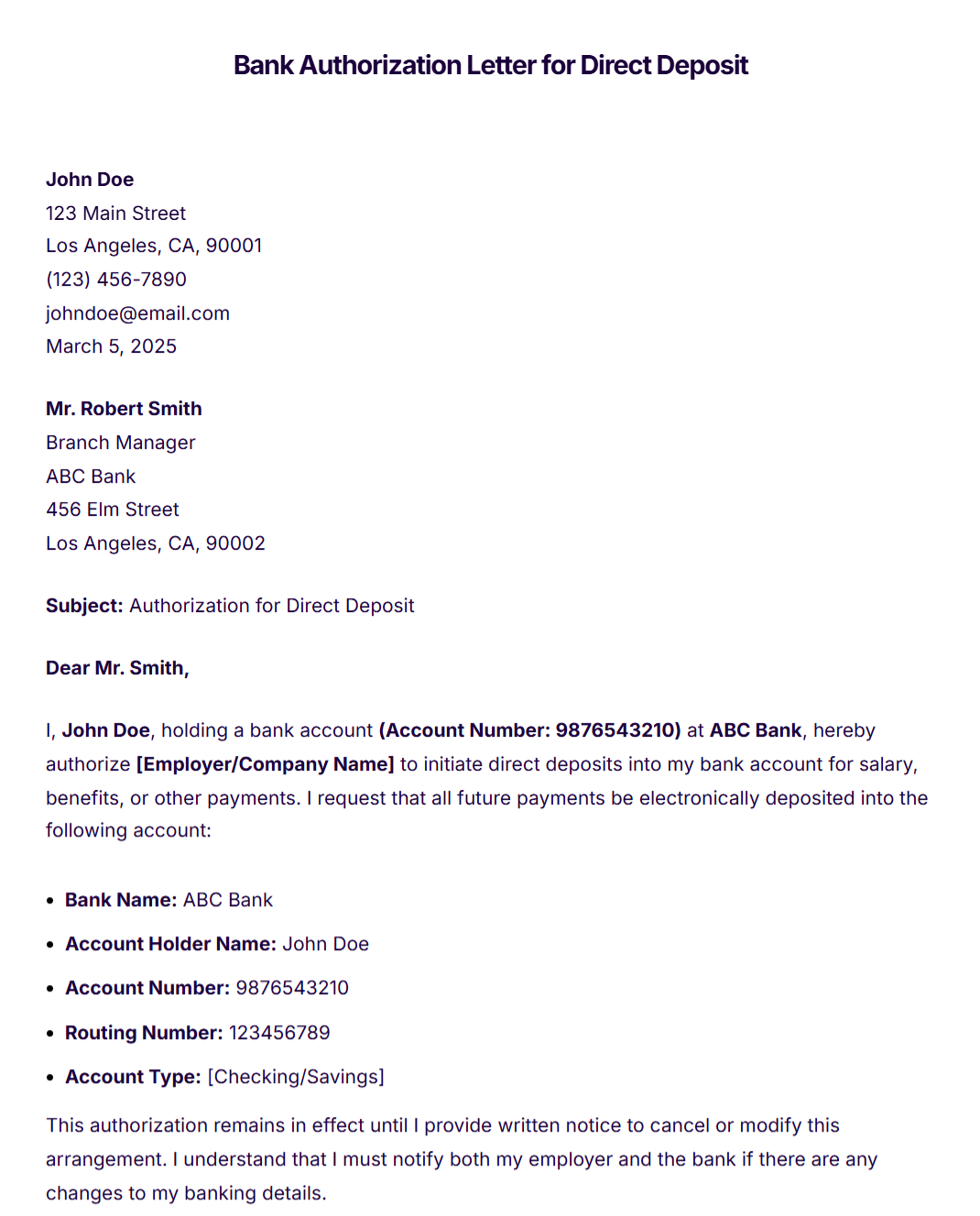

Bank Authorization Letter for Direct Deposit

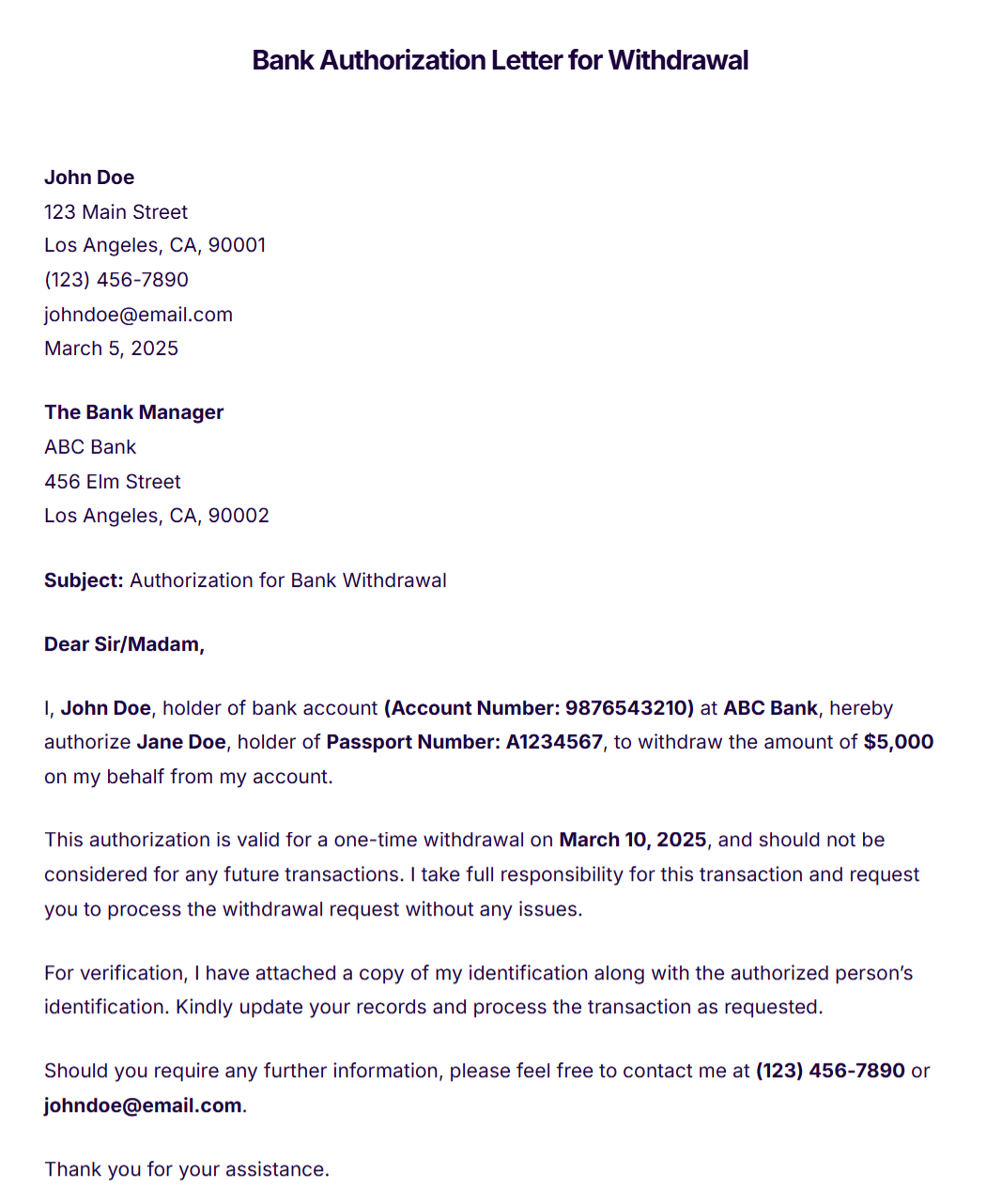

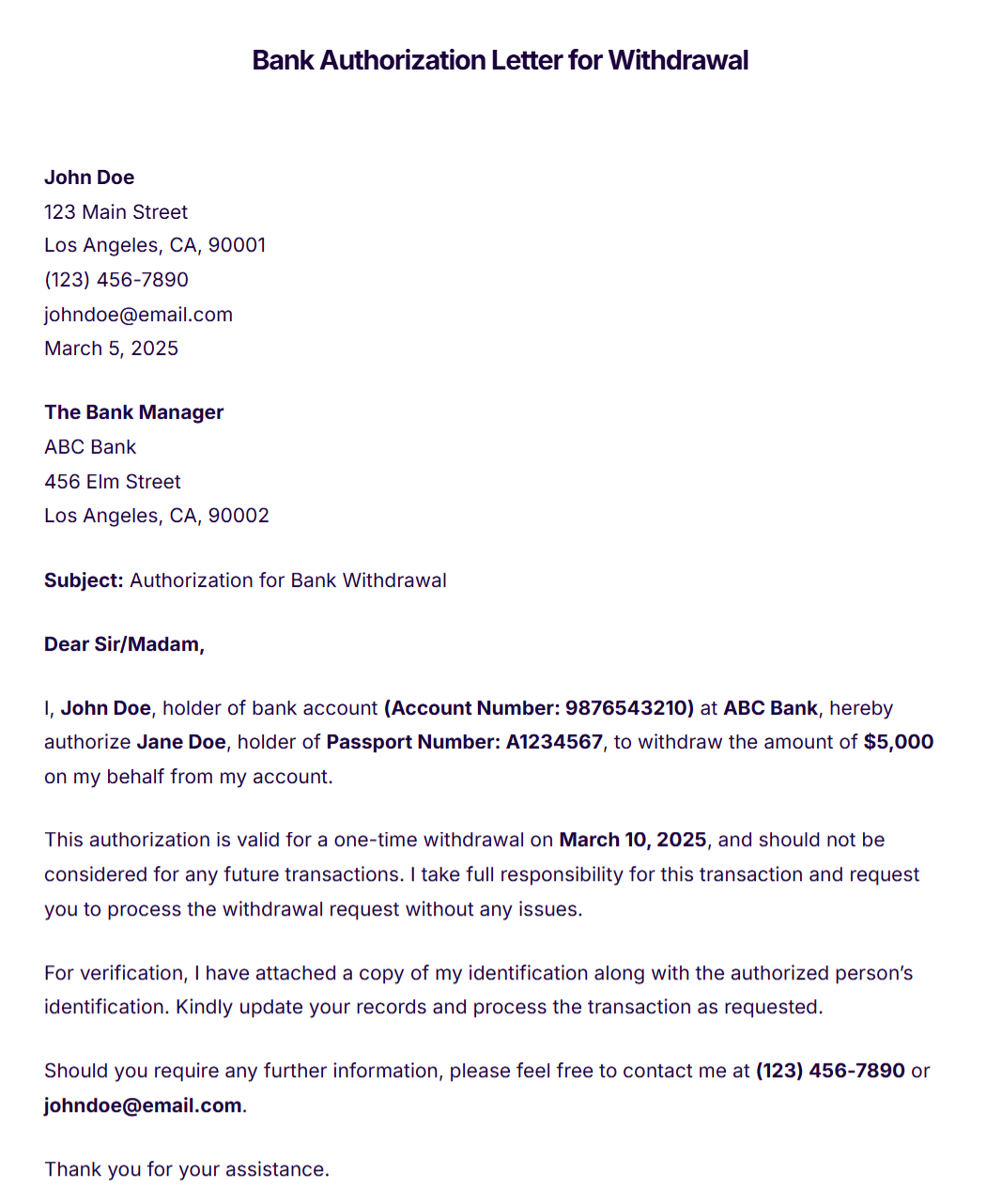

Bank Authorization Letter for Withdrawal

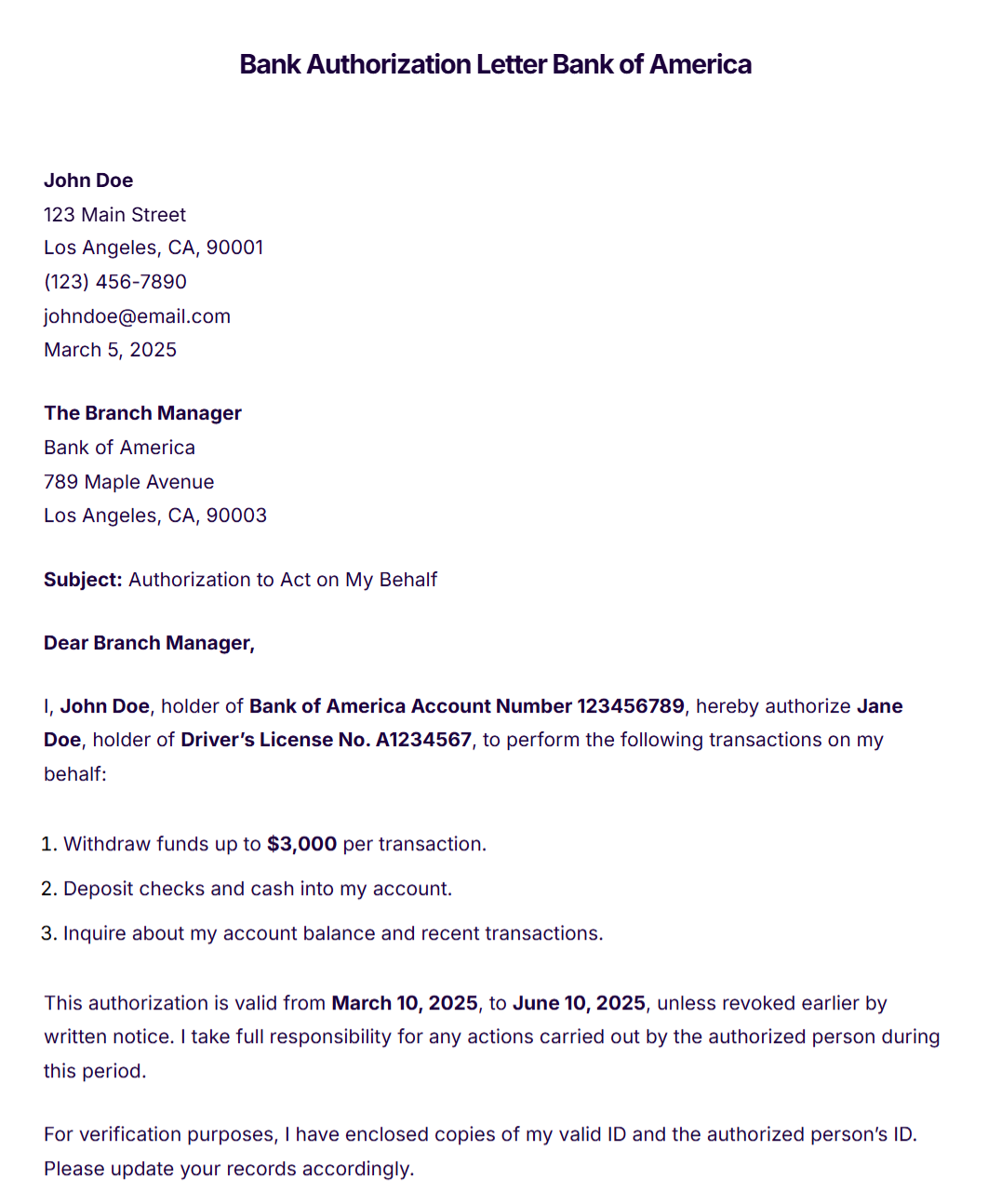

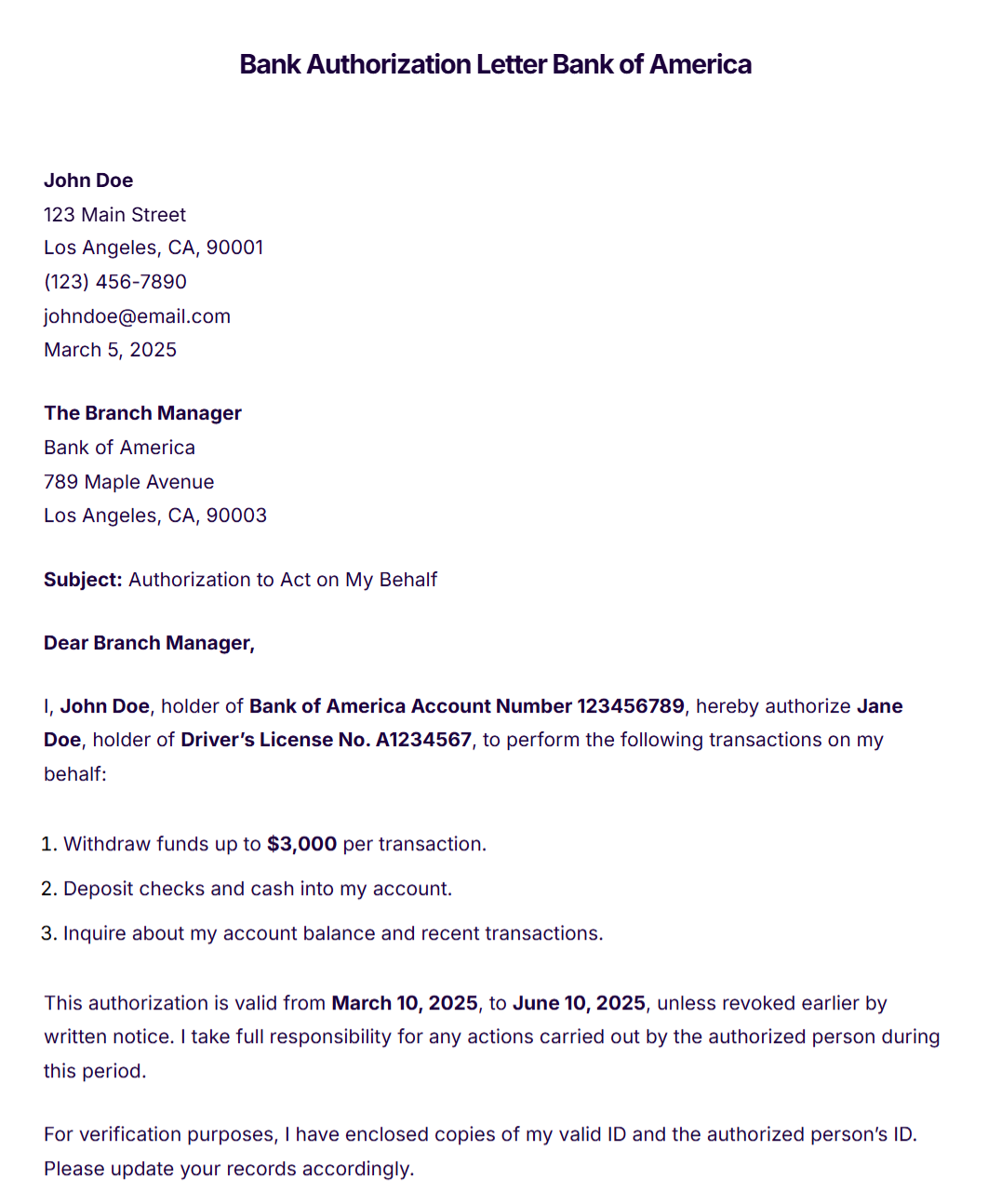

Bank Authorization Letter Bank of America

- Bank Authorization Letter Wells Fargo

- Bank Authorization Letter for Partnership Form

- Bank Authorization Letter for Cheque Deposit

- Bank Authorization Letter for Employee

- Bank Authorization Letter for Company Representative

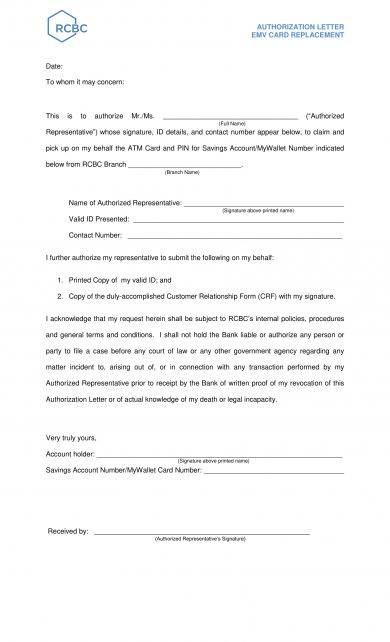

Bank Authorization Letter for Authorized Representative Example

Clear Bank Authorization Letter Example

Direct Deposit Bank Authorization Letter Example

Formal Bank Authorization Letter Example

Methods in Authorizing Someone to Make Transactions

At times when you cannot personally make transaction with your bank, you can request someone to do the task for you. An authorization letter is needed so the identity of the proxy can be verified by the bank. Authorization letters would also give details with regard to the tasks needed to be accomplished by the proxy.

If you are authorizing someone else to handle money in your bank account or to make transactions with your bank, most banks give several options for your authorization. You can give the person financial power of attorney and specify which transactions or tasks they are allowed to make. Alternatively, you can change your account to give access to some trusted persons. You may also see authorization letter for a child to travel examples.

Every bank has its own requirements and forms regarding authorization that you need to fill out; hence, it is better if you contact your bank directly to find out what method is best for your situation.

Here is a brief discussion of each of the methods that you can use.

1. Granting Financial Power of Attorney

Granting financial power of attorney for limited transactions. Commonly, banks will now allow someone who is not not listed on your account to make transactions in your name unless you have given explicit permission that they can make such transaction. You may also see notice letter examples.

In legal terms, this means that you are granting the person financial power of attorney (FPOA) by signing a legal document stating and clearly specifying what transactions he or she is allowed to make on your behalf. When you give someone FPOA, this means that you are authorizing them to make withdrawals, write checks for you, and take other actions and transactions in your behalf. You may also like email cover letter examples.

You can set a limit to the FPOA, the limit on what the person can do with your account. You just need to specify the transaction that they are allowed to do. On the other hand, if you want to give the person a longer-term access to your account, you may grant a durable FPOA for the person, enabling him or her to make decisions for you and handle your finances in the event that you become incapacitated or physically absent. You may also check out business proposal letter examples.

Secure a power of attorney form. Sometimes called a third party authorization form, a power of attorney form can be secured from the bank.

You can ask your bank to give you a power of attorney form as most of the major bank have a specific power of attorney form readily available. You must fill out the information on to whom you are granting the power of attorney, which transactions you want the person to be able to take, the limitations that you set, and the duration or range of time they are authorized to have access to your account. You might be interested in business reference letter examples.

You can either visit your bank in person to speak to an agent or an appropriate person or visit your bank’s website and obtain a power of attorney form online if they have provided such electronically. Then, fill out the form and submit it following your bank’s instruction. You may also see application letter examples & samples.

Create your own power of attorney form. There are certain banks that do not have a specific power of attorney form. In this case, you can create your own power of attorney form and list what transactions the person is allowed to make as well as the limitation. You need to follow your state’s law in order for the document to be legally valid. Then, execute or sign the power of attorney form with the person to whom you are giving the form. You may also like how to write an official letter.

It is better that a lawyer will help you draw up the form to ensure that it is created in line with the state’s law. Furthermore, the execution of the document must be done according to your state’s laws for there are different laws by the different states; some state would require the form to have a witness while other required the document to be notarized. You may also check out simple resignation letter examples.

Present the document to your bank. Now that you have already filled out the form and signed according to the requirements of your state laws, you may now return to your bank and meet with an agent to submit the form and make your intentions clear with regard to the authorization. Once processed and approved, the proxy can now be authorized to make the transactions you laid out. You might be interested in two weeks notice letter examples.

2. Adjusting Your Account

Open a convenience account. There are several states that provide the option of opening convenience accounts in which the other person, or the proxy, would have access to the account, but he or she is only authorized to use it for some transactions on your behalf. He may use the account to pay your bills, but they are not allowed to withdraw cash to be used for their own purposes. You may also see complaint letter examples & samples.

However, not all the states are giving this option. So make sure that your state’s laws permit convenience accounts. Furthermore, you must contact your bank to find out whether a convenience account will meet your needs or else ask for an advice.

You may add someone as a co-owner. As opposed to the first one where not all the banks are giving the option of opening a convenience account, adding a co-owner is an option for every and all bank. You may create a joint account for you and your co-owner where your co-owner can have the same ability to make transactions as you do. You can visit your bank and talk to a bank representative or go online to add another person to your account. You may also like offer letter examples.

In adding a co-owner, you must fill out the forms that are signed by both parties and submit it to the authorized bank personnel. After the completion and submission, the other person can now be granted an unlimited access to the joint account.

Be cautious in giving full access to your account. Having a joint account is risky for both parties as adding a co-owner gives that person free reign to use your account in whatever way they please. Hence, you must be careful in choosing the person whom you entrusted your money with. Choose someone that you already know so well and whom you trusted to be your co-owner. You may also check out thank-you letter examples.

3. Self-Authorizing Someone to Use Your Account

Authorize someone to make a deposit. When you want to authorize someone to make deposits in your behalf, you can specify this in your authorization letter.

However, if all you want to do is to allow someone to deposit money in your account in your behalf, most of the banks would allow people to do this without special authorization in which you need not write an official authorization letter or fill out forms. If you are not sure whether or not your bank is authorizing third-party deposits, you may contact your bank regarding this matter.

Authorize someone to make a withdrawal. Apart from authorizing someone to make deposits in your behalf, you can also authorize someone to make a withdrawals for you. This means that you are giving the person an access to your account and your account information. This is a way of self-authorizing someone to make transactions with regard to your account.

However, some banks might have explicit policies with regard to this matter to prevent non-account holders from making transactions, and it is recommended to use FPOA or listing the person as a co-owner. In this way, risks relating to the access of your account will be controlled and prevented.

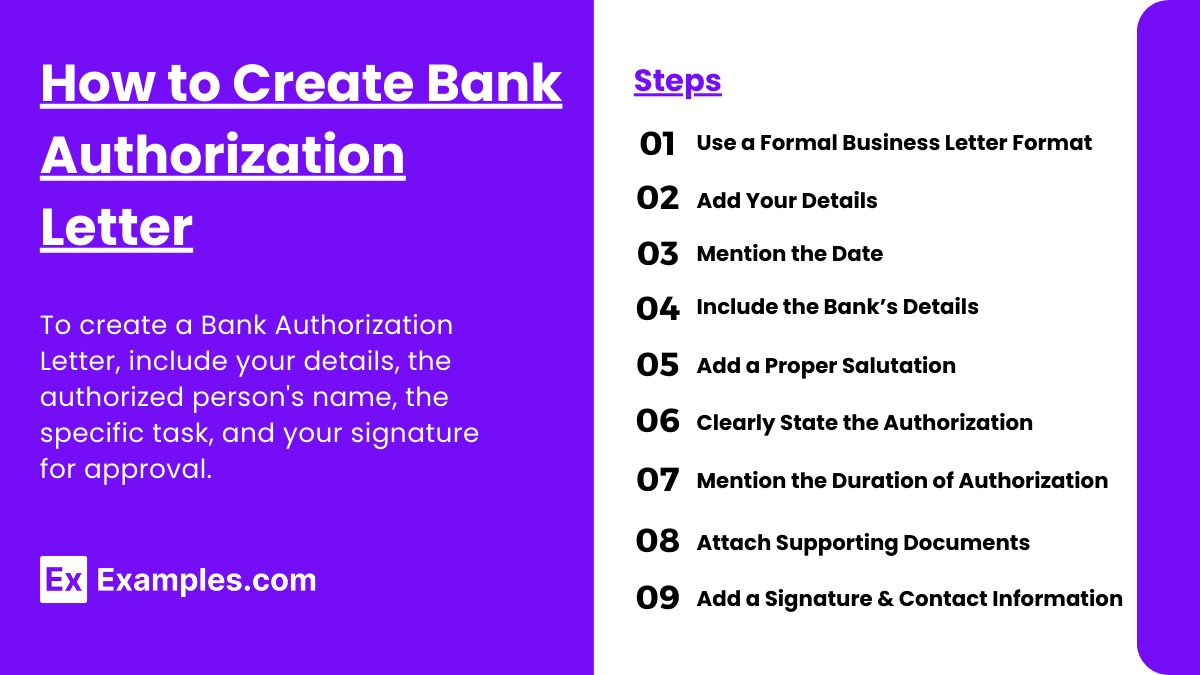

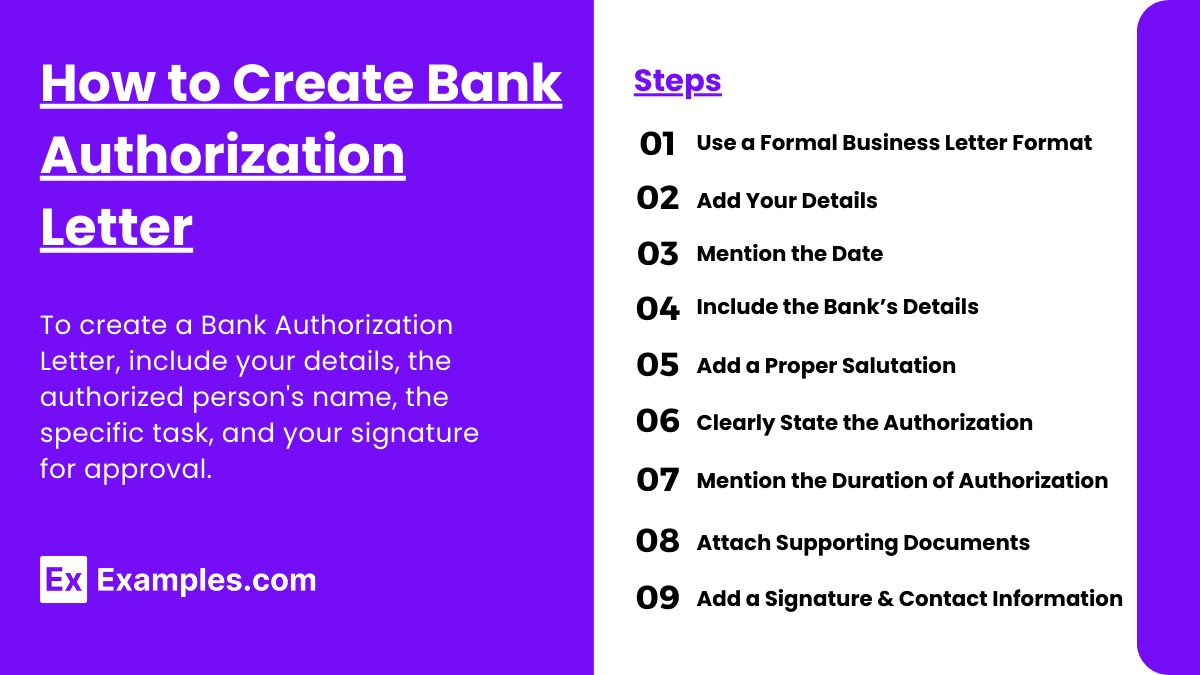

How to Create Bank Authorization Letter

1. Use a Formal Business Letter Format

A bank authorization letter should be formal and structured correctly. Use a professional tone throughout the letter.

2. Add Your Details (Sender’s Information)

Start with your full name, address, contact number, and email at the top of the letter.

3. Mention the Date

Write the date on which you are drafting the letter.

4. Include the Bank’s Details

Write the bank’s name, branch name, and address.

5. Add a Proper Salutation

Address the bank properly, such as “To The Branch Manager” or “To Whom It May Concern.”

6. Clearly State the Authorization

- Mention the name of the authorized person.

- Provide their ID details for verification.

- Specify the reason for authorization.

- Outline the specific actions they are permitted to perform (e.g., withdrawing cash, requesting account statements, etc.).

7. Mention the Duration of Authorization

If applicable, specify whether the authorization is temporary or permanent.

8. Attach Supporting Documents

Include copies of identification documents (yours and the authorized person’s) to verify authenticity.

9. Add a Signature & Contact Information

Sign the letter and provide your contact details for any further verification.

Tips to Create Bank Authorization Letter

✅ Use a formal and professional tone.

✅ Keep the letter clear and to the point.

✅ Mention the exact tasks the authorized person can perform.

✅ Specify the start and end date of authorization.

✅ Include your full name, account number, and contact details.

✅ Provide the authorized person’s full name and ID details.

✅ Attach copies of both your and the authorized person’s ID.

✅ Sign the letter and include your contact information.

✅ Keep a copy of the letter for your records.

✅ Submit the letter in person if possible, or confirm receipt with the bank.

✅ Check for spelling and grammar errors before sending.

Quick Recap

There are certain instances where we need someone to act on our behalf, a proxy or sub, to make transactions or run errands for us, especially in making bank transaction.

The person must be someone who we trust so well to do the task for us. To lay down the terms and conditions with regard to the proxy, an agreement must be made binding the parties. The basic agreement must contain stipulation with regard to the tasks to be performed by the proxy as well as the limitations to his or her powers.

There are several methods for authorizing someone to make transactions with the bank to act on your behalf, and these are as follows: granting financial power of attorney, adjusting your account, and self-authorizing someone to use your account. In these three cases, you give someone the permission to access and use your account to make transaction for you. You may also see official resignation letter examples.

Hence, you must carefully choose the person whom you can trust with your account especially because bank transactions would most of the time involve money.

If you are still unsure on what to write on your bank authorization letter, you may refer to the examples and templates given in the section above.

9+ Bank Authorization Letter Examples to Download

It is not all the time that you are available to do or perform transaction with regard to your account in the bank. There are instances when you need someone to act in behalf of you to do the things that you might be doing. This could be because of emergency situations and time constraints.

Hence, you must send your proxy, representative, or substitute in order to do the task for you. That person will have powers, duties, and obligations granted upon him or her and will have limitations with regard to that powers.

In order to clarify and be specific with the terms and general agreement regarding the authorization, an authorization letter must be made. The authorization letter must contain all the stipulation in the agreement including the powers, tasks, as well as limitation of the proxy. In this way, the transaction will run smoothly. This will also prevent misunderstanding and confusion among the parties involved.

What is Bank Authorization Letter?

A Bank Authorization Letter is a formal document that allows a person or organization to act on behalf of another individual regarding banking transactions. This letter is used when the account holder is unable to visit the bank personally and needs to authorize someone else to perform specific banking tasks.

Bank Authorization Letter Example Bundle

Bank Authorization Letter Format

1. Sender’s Information

(Your Name)

(Your Address)

(City, State, ZIP Code)

(Your Phone Number)

(Your Email Address)

(Date)

2. Recipient’s Information

(Bank Manager’s Name) [if known]

(Bank Name)

(Bank Branch Address)

(City, State, ZIP Code)

3. Subject

Authorization for Banking Transactions

4. Salutation

Dear [Bank Manager’s Name],

5. Body of the Letter

I, (Your Full Name), holding a bank account (Account Number: [Your Account Number]) at (Bank Name), hereby authorize (Authorized Person’s Name), holder of (Authorized Person’s ID/Passport Number), to act on my behalf for the following banking transactions:

(Specify the tasks, e.g., withdraw cash, deposit checks, inquire about account details, etc.)

(Mention any other specific actions permitted)

This authorization is valid from (Start Date) to (End Date), unless revoked earlier by written notice. I take full responsibility for any actions carried out by the authorized person within this period.

For identification purposes, I have attached copies of valid ID proofs for both myself and (Authorized Person’s Name). Kindly update your records and allow the authorized person to perform the permitted transactions.

Please feel free to contact me at (Your Contact Number) or (Your Email Address) for any verification.

Thank you for your cooperation.

6. Closing

Sincerely,

(Your Name)

(Your Signature)

7. Attachments

✔ Copy of Account Holder’s ID

✔ Copy of Authorized Person’s ID

Bank Authorization Letter Example

John Doe

123 Main Street

Los Angeles, CA, 90001

(123) 456-7890

johndoe@email.com

March 5, 2025

Mr. Robert Smith

Branch Manager

ABC Bank

456 Elm Street

Los Angeles, CA, 90002

Subject: Authorization for Banking Transactions

Dear Mr. Smith,

I, John Doe, holding a bank account (Account Number: 9876543210) at ABC Bank, hereby authorize Jane Doe, holder of Passport Number: A1234567, to act on my behalf for the following banking transactions:

Withdraw cash up to a limit of $5,000 per transaction.

Deposit checks and cash into my account.

Inquire about my account balance and transaction history.

This authorization is valid from March 10, 2025, to June 10, 2025, unless revoked earlier by written notice. I take full responsibility for any actions carried out by the authorized person within this period.

For identification purposes, I have attached copies of valid ID proofs for both myself and Jane Doe. Kindly update your records and allow the authorized person to perform the permitted transactions.

Please feel free to contact me at (123) 456-7890 or johndoe@email.com for any verification.

Thank you for your cooperation.

Sincerely,

John Doe

(Signature)

Attachments:

✔ Copy of John Doe’s ID

✔ Copy of Jane Doe’s ID

Bank Authorization Letter for Direct Deposit

Bank Authorization Letter for Withdrawal

Bank Authorization Letter Bank of America

Bank Authorization Letter for Authorized Representative Example

rcbc.com

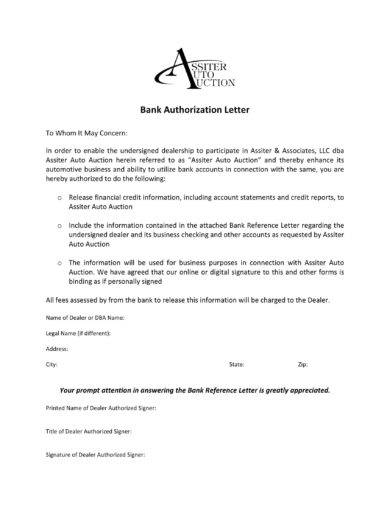

Clear Bank Authorization Letter Example

assiterautoauction.com

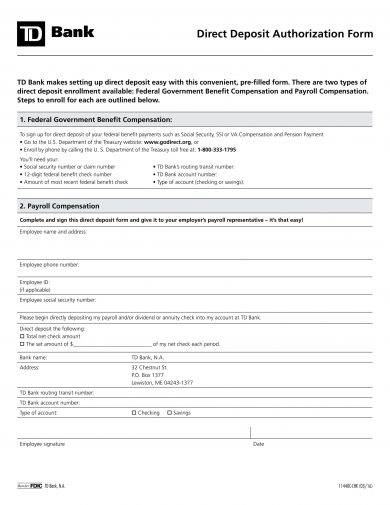

Direct Deposit Bank Authorization Letter Example

tdbank.com

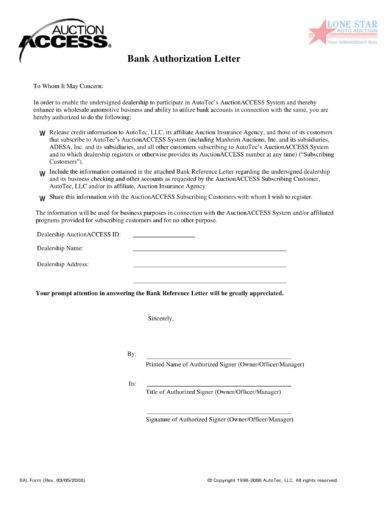

Formal Bank Authorization Letter Example

lsaalubbock.com

Methods in Authorizing Someone to Make Transactions

At times when you cannot personally make transaction with your bank, you can request someone to do the task for you. An authorization letter is needed so the identity of the proxy can be verified by the bank. Authorization letters would also give details with regard to the tasks needed to be accomplished by the proxy.

If you are authorizing someone else to handle money in your bank account or to make transactions with your bank, most banks give several options for your authorization. You can give the person financial power of attorney and specify which transactions or tasks they are allowed to make. Alternatively, you can change your account to give access to some trusted persons. You may also see authorization letter for a child to travel examples.

Every bank has its own requirements and forms regarding authorization that you need to fill out; hence, it is better if you contact your bank directly to find out what method is best for your situation.

Here is a brief discussion of each of the methods that you can use.

1. Granting Financial Power of Attorney

Granting financial power of attorney for limited transactions. Commonly, banks will now allow someone who is not not listed on your account to make transactions in your name unless you have given explicit permission that they can make such transaction. You may also see notice letter examples.

In legal terms, this means that you are granting the person financial power of attorney (FPOA) by signing a legal document stating and clearly specifying what transactions he or she is allowed to make on your behalf. When you give someone FPOA, this means that you are authorizing them to make withdrawals, write checks for you, and take other actions and transactions in your behalf. You may also like email cover letter examples.

You can set a limit to the FPOA, the limit on what the person can do with your account. You just need to specify the transaction that they are allowed to do. On the other hand, if you want to give the person a longer-term access to your account, you may grant a durable FPOA for the person, enabling him or her to make decisions for you and handle your finances in the event that you become incapacitated or physically absent. You may also check out business proposal letter examples.

Secure a power of attorney form. Sometimes called a third party authorization form, a power of attorney form can be secured from the bank.

You can ask your bank to give you a power of attorney form as most of the major bank have a specific power of attorney form readily available. You must fill out the information on to whom you are granting the power of attorney, which transactions you want the person to be able to take, the limitations that you set, and the duration or range of time they are authorized to have access to your account. You might be interested in business reference letter examples.

You can either visit your bank in person to speak to an agent or an appropriate person or visit your bank’s website and obtain a power of attorney form online if they have provided such electronically. Then, fill out the form and submit it following your bank’s instruction. You may also see application letter examples & samples.

Create your own power of attorney form. There are certain banks that do not have a specific power of attorney form. In this case, you can create your own power of attorney form and list what transactions the person is allowed to make as well as the limitation. You need to follow your state’s law in order for the document to be legally valid. Then, execute or sign the power of attorney form with the person to whom you are giving the form. You may also like how to write an official letter.

It is better that a lawyer will help you draw up the form to ensure that it is created in line with the state’s law. Furthermore, the execution of the document must be done according to your state’s laws for there are different laws by the different states; some state would require the form to have a witness while other required the document to be notarized. You may also check out simple resignation letter examples.

Present the document to your bank. Now that you have already filled out the form and signed according to the requirements of your state laws, you may now return to your bank and meet with an agent to submit the form and make your intentions clear with regard to the authorization. Once processed and approved, the proxy can now be authorized to make the transactions you laid out. You might be interested in two weeks notice letter examples.

2. Adjusting Your Account

Open a convenience account. There are several states that provide the option of opening convenience accounts in which the other person, or the proxy, would have access to the account, but he or she is only authorized to use it for some transactions on your behalf. He may use the account to pay your bills, but they are not allowed to withdraw cash to be used for their own purposes. You may also see complaint letter examples & samples.

However, not all the states are giving this option. So make sure that your state’s laws permit convenience accounts. Furthermore, you must contact your bank to find out whether a convenience account will meet your needs or else ask for an advice.

You may add someone as a co-owner. As opposed to the first one where not all the banks are giving the option of opening a convenience account, adding a co-owner is an option for every and all bank. You may create a joint account for you and your co-owner where your co-owner can have the same ability to make transactions as you do. You can visit your bank and talk to a bank representative or go online to add another person to your account. You may also like offer letter examples.

In adding a co-owner, you must fill out the forms that are signed by both parties and submit it to the authorized bank personnel. After the completion and submission, the other person can now be granted an unlimited access to the joint account.

Be cautious in giving full access to your account. Having a joint account is risky for both parties as adding a co-owner gives that person free reign to use your account in whatever way they please. Hence, you must be careful in choosing the person whom you entrusted your money with. Choose someone that you already know so well and whom you trusted to be your co-owner. You may also check out thank-you letter examples.

3. Self-Authorizing Someone to Use Your Account

Authorize someone to make a deposit. When you want to authorize someone to make deposits in your behalf, you can specify this in your authorization letter.

However, if all you want to do is to allow someone to deposit money in your account in your behalf, most of the banks would allow people to do this without special authorization in which you need not write an official authorization letter or fill out forms. If you are not sure whether or not your bank is authorizing third-party deposits, you may contact your bank regarding this matter.

Authorize someone to make a withdrawal. Apart from authorizing someone to make deposits in your behalf, you can also authorize someone to make a withdrawals for you. This means that you are giving the person an access to your account and your account information. This is a way of self-authorizing someone to make transactions with regard to your account.

However, some banks might have explicit policies with regard to this matter to prevent non-account holders from making transactions, and it is recommended to use FPOA or listing the person as a co-owner. In this way, risks relating to the access of your account will be controlled and prevented.

How to Create Bank Authorization Letter

1. Use a Formal Business Letter Format

A bank authorization letter should be formal and structured correctly. Use a professional tone throughout the letter.

2. Add Your Details (Sender’s Information)

Start with your full name, address, contact number, and email at the top of the letter.

3. Mention the Date

Write the date on which you are drafting the letter.

4. Include the Bank’s Details

Write the bank’s name, branch name, and address.

5. Add a Proper Salutation

Address the bank properly, such as “To The Branch Manager” or “To Whom It May Concern.”

6. Clearly State the Authorization

Mention the name of the authorized person.

Provide their ID details for verification.

Specify the reason for authorization.

Outline the specific actions they are permitted to perform (e.g., withdrawing cash, requesting account statements, etc.).

7. Mention the Duration of Authorization

If applicable, specify whether the authorization is temporary or permanent.

8. Attach Supporting Documents

Include copies of identification documents (yours and the authorized person’s) to verify authenticity.

9. Add a Signature & Contact Information

Sign the letter and provide your contact details for any further verification.

Tips to Create Bank Authorization Letter

✅ Use a formal and professional tone.

✅ Keep the letter clear and to the point.

✅ Mention the exact tasks the authorized person can perform.

✅ Specify the start and end date of authorization.

✅ Include your full name, account number, and contact details.

✅ Provide the authorized person’s full name and ID details.

✅ Attach copies of both your and the authorized person’s ID.

✅ Sign the letter and include your contact information.

✅ Keep a copy of the letter for your records.

✅ Submit the letter in person if possible, or confirm receipt with the bank.

✅ Check for spelling and grammar errors before sending.

Quick Recap

There are certain instances where we need someone to act on our behalf, a proxy or sub, to make transactions or run errands for us, especially in making bank transaction.

The person must be someone who we trust so well to do the task for us. To lay down the terms and conditions with regard to the proxy, an agreement must be made binding the parties. The basic agreement must contain stipulation with regard to the tasks to be performed by the proxy as well as the limitations to his or her powers.

There are several methods for authorizing someone to make transactions with the bank to act on your behalf, and these are as follows: granting financial power of attorney, adjusting your account, and self-authorizing someone to use your account. In these three cases, you give someone the permission to access and use your account to make transaction for you. You may also see official resignation letter examples.

Hence, you must carefully choose the person whom you can trust with your account especially because bank transactions would most of the time involve money.

If you are still unsure on what to write on your bank authorization letter, you may refer to the examples and templates given in the section above.