5+ Bank Statement Examples to Download

One of the document that we periodically receive aside from billing statements for our utilities like water and electricity is the bank statement. These are documents provided in connection with any of our accounts in a financial institution. I could probably say you are all familiar with this along with medical and income statements. As humans, one of our priorities is our security. We want to feel safe and free from any threats to our lives including with our finances. We want to guard our hard-earned possessions because after all, we gave all of our efforts to obtain them. One of the ways to do this is securing a bank statement from the financial statement institution where you belong to keep track of all your transactions.

What is Bank Statement?

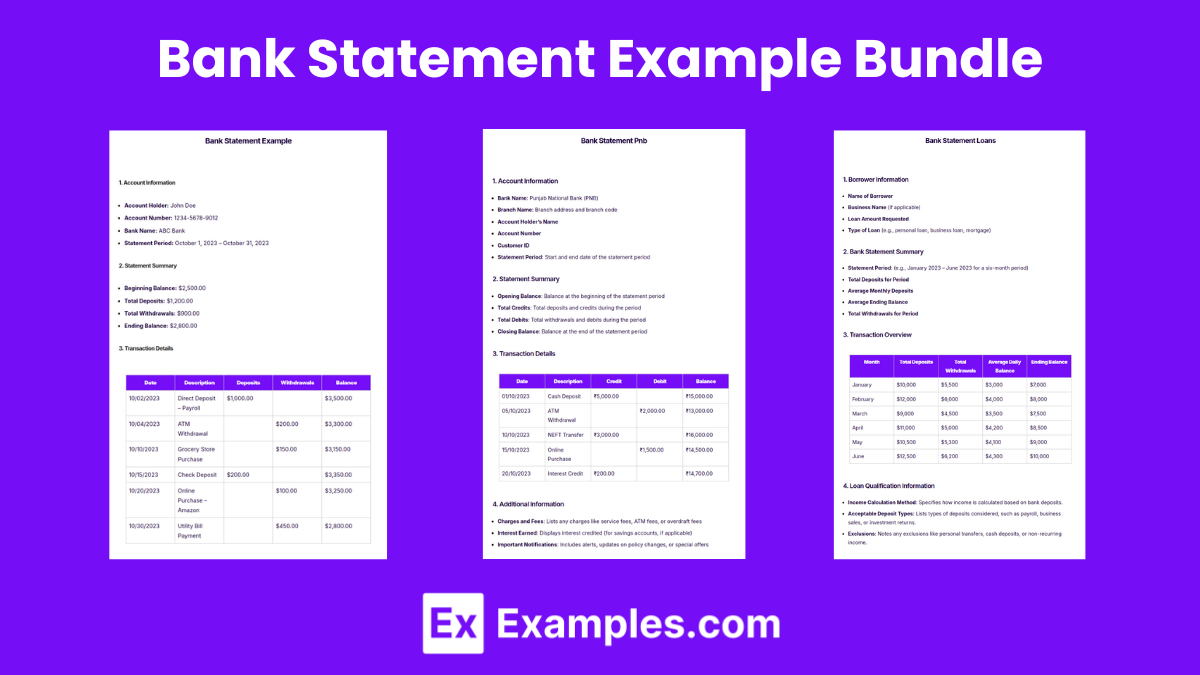

Bank Statement Example Bundle

Download Bank Statement bundle

Account Information

- Account Holder’s Name

- Account Number

- Bank’s Name and Contact Information

- Statement Period (Start Date and End Date)

Statement Summary

- Beginning Balance (Balance at the start of the statement period)

- Total Deposits/Credits (Sum of all deposits and credits during the period)

- Total Withdrawals/Debits (Sum of all withdrawals and debits during the period)

- Ending Balance (Balance at the end of the statement period)

Transaction Details

Date Description Deposits/Credits Withdrawals/Debits Balance 10/01/2023 ATM Deposit $500.00 $1,500.00 10/05/2023 Online Transfer $200.00 $1,300.00 10/12/2023 Grocery Store $150.00 $1,150.00

Additional Information

- Fees and Charges: Lists any fees, such as service fees or overdraft charges.

- Interest Earned (if applicable): Details any interest accrued during the statement period.

- Important Notices: May include general updates, terms changes, or promotional offers from the bank.

Contact Information

- Customer Service Contact: Phone number and email for customer inquiries.

- Bank Branch Address: Physical address of the bank’s branch.

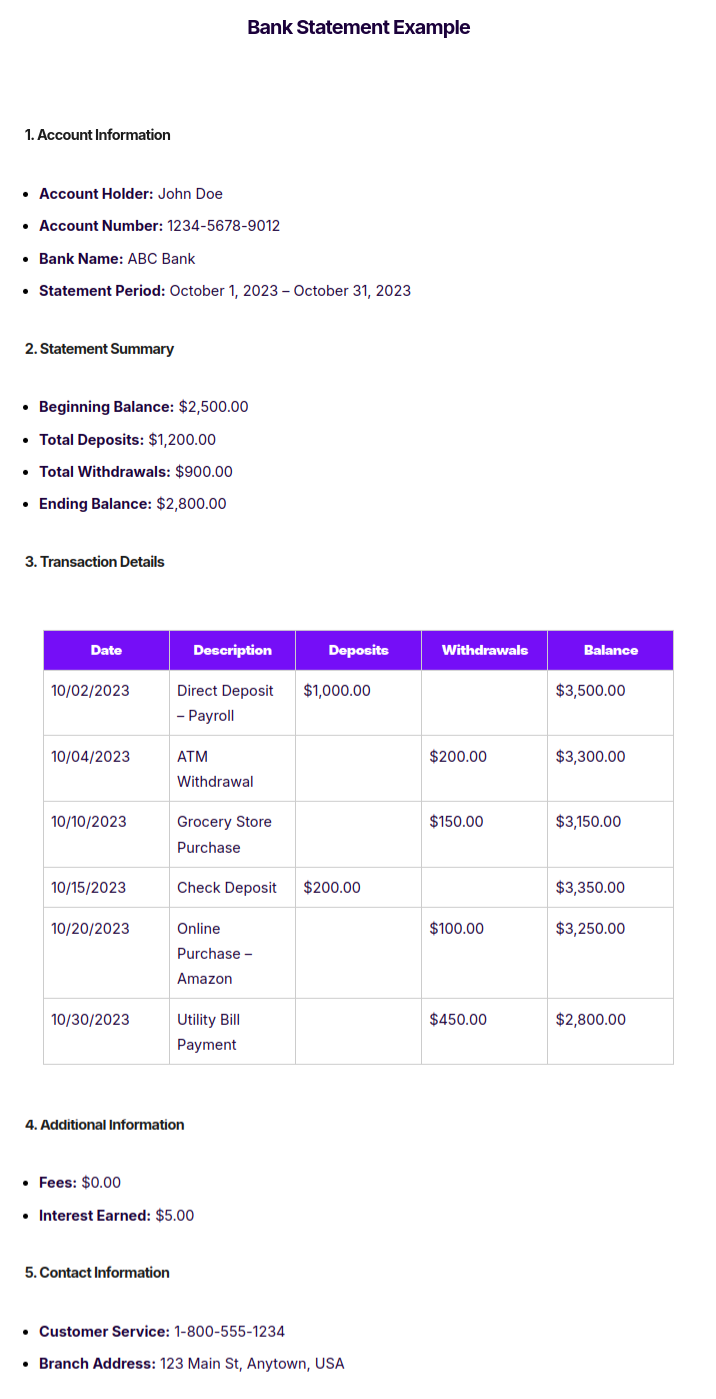

Bank Statement Example

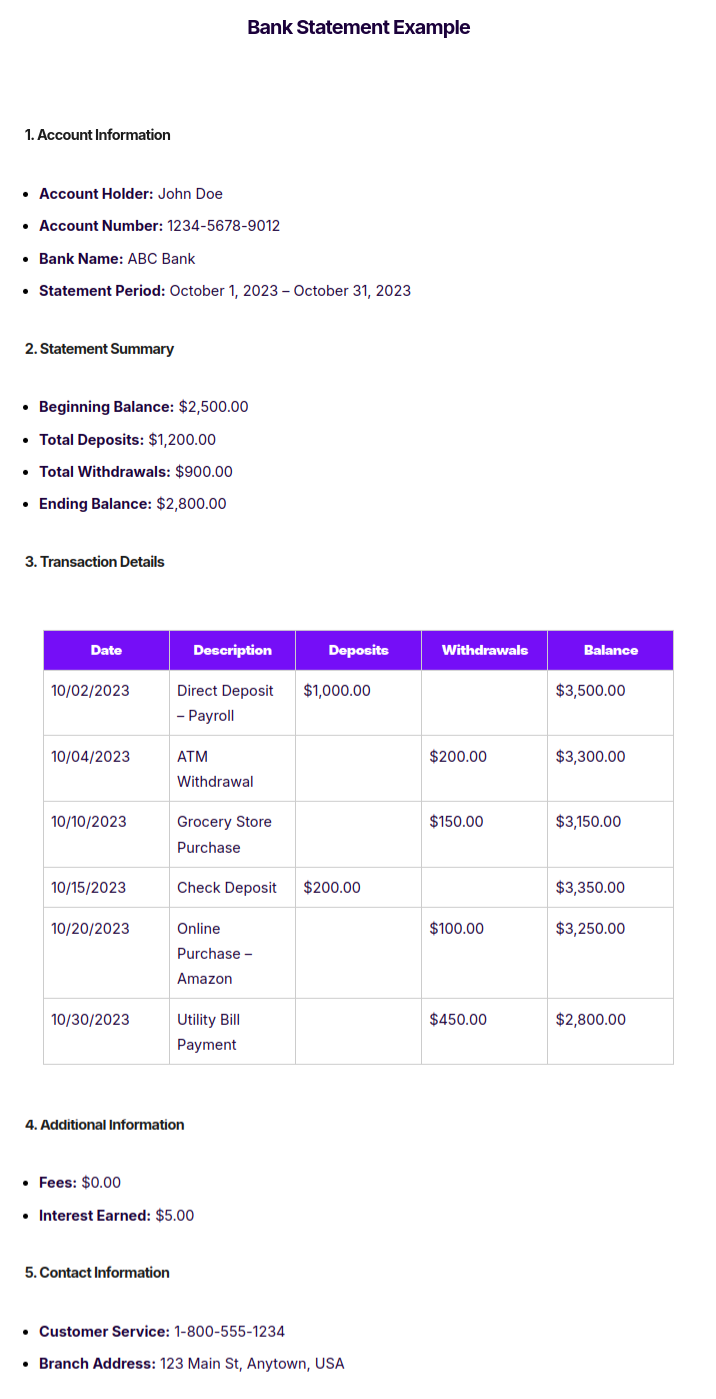

1. Account Information

- Account Holder: John Doe

- Account Number: 1234-5678-9012

- Bank Name: ABC Bank

- Statement Period: October 1, 2023 – October 31, 2023

2. Statement Summary

- Beginning Balance: $2,500.00

- Total Deposits: $1,200.00

- Total Withdrawals: $900.00

- Ending Balance: $2,800.00

3. Transaction Details

| Date | Description | Deposits | Withdrawals | Balance |

|---|---|---|---|---|

| 10/02/2023 | Direct Deposit – Payroll | $1,000.00 | $3,500.00 | |

| 10/04/2023 | ATM Withdrawal | $200.00 | $3,300.00 | |

| 10/10/2023 | Grocery Store Purchase | $150.00 | $3,150.00 | |

| 10/15/2023 | Check Deposit | $200.00 | $3,350.00 | |

| 10/20/2023 | Online Purchase – Amazon | $100.00 | $3,250.00 | |

| 10/30/2023 | Utility Bill Payment | $450.00 | $2,800.00 |

4. Additional Information

- Fees: $0.00

- Interest Earned: $5.00

5. Contact Information

- Customer Service: 1-800-555-1234

- Branch Address: 123 Main St, Anytown, USA

Short Bank Statement Example

Account Information

- Account Holder: Jane Smith

- Account Number: 9876-5432

- Statement Period: September 1, 2023 – September 30, 2023

Statement Summary

- Beginning Balance: $1,000.00

- Total Deposits: $500.00

- Total Withdrawals: $300.00

- Ending Balance: $1,200.00

Transaction Details

| Date | Description | Deposits | Withdrawals | Balance |

|---|---|---|---|---|

| 09/05/2023 | Payroll Deposit | $500.00 | $1,500.00 | |

| 09/12/2023 | ATM Withdrawal | $100.00 | $1,400.00 | |

| 09/20/2023 | Restaurant Payment | $50.00 | $1,350.00 | |

| 09/28/2023 | Gas Station | $150.00 | $1,200.00 |

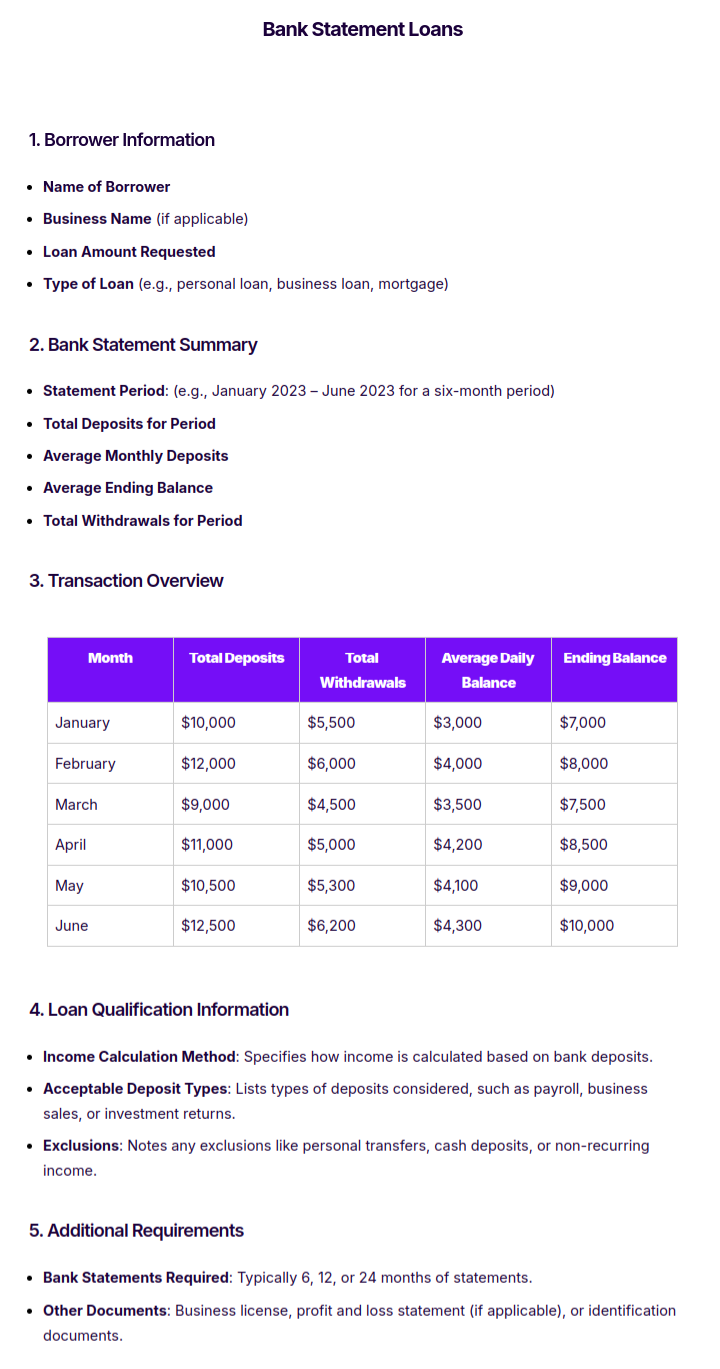

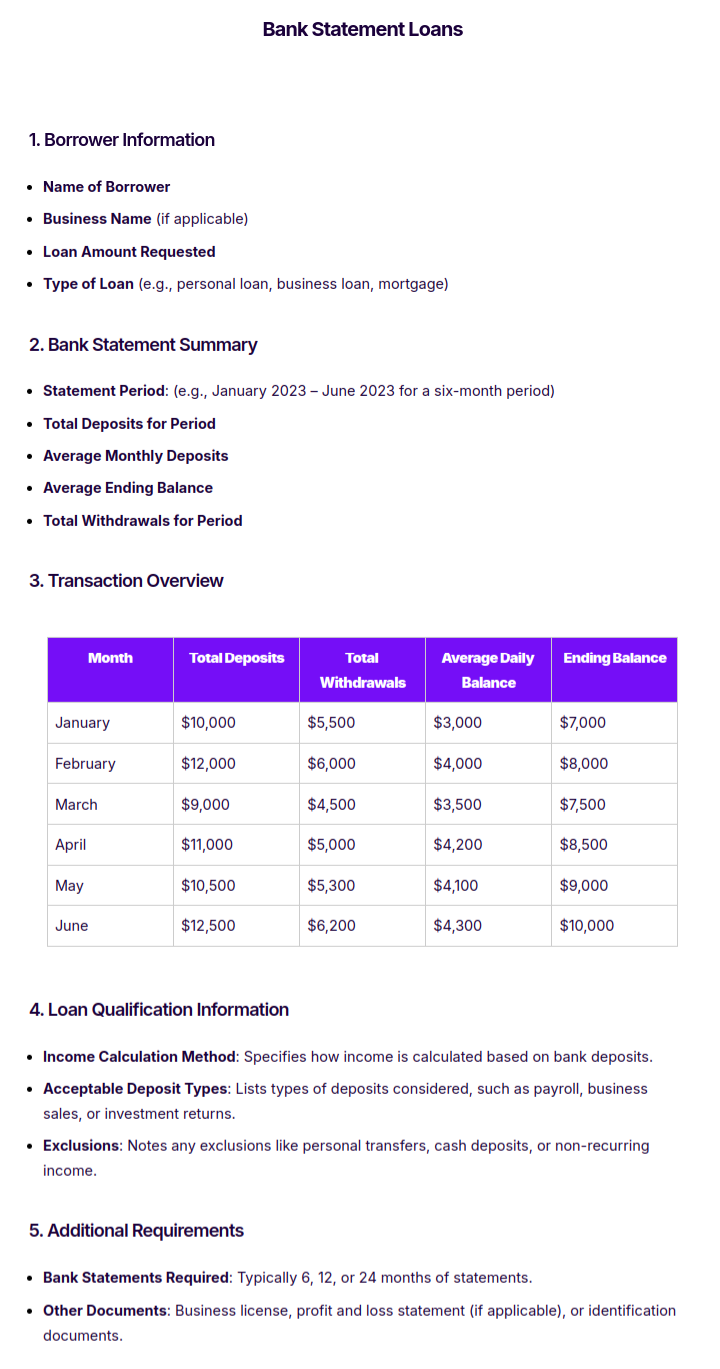

Bank Statement Loans

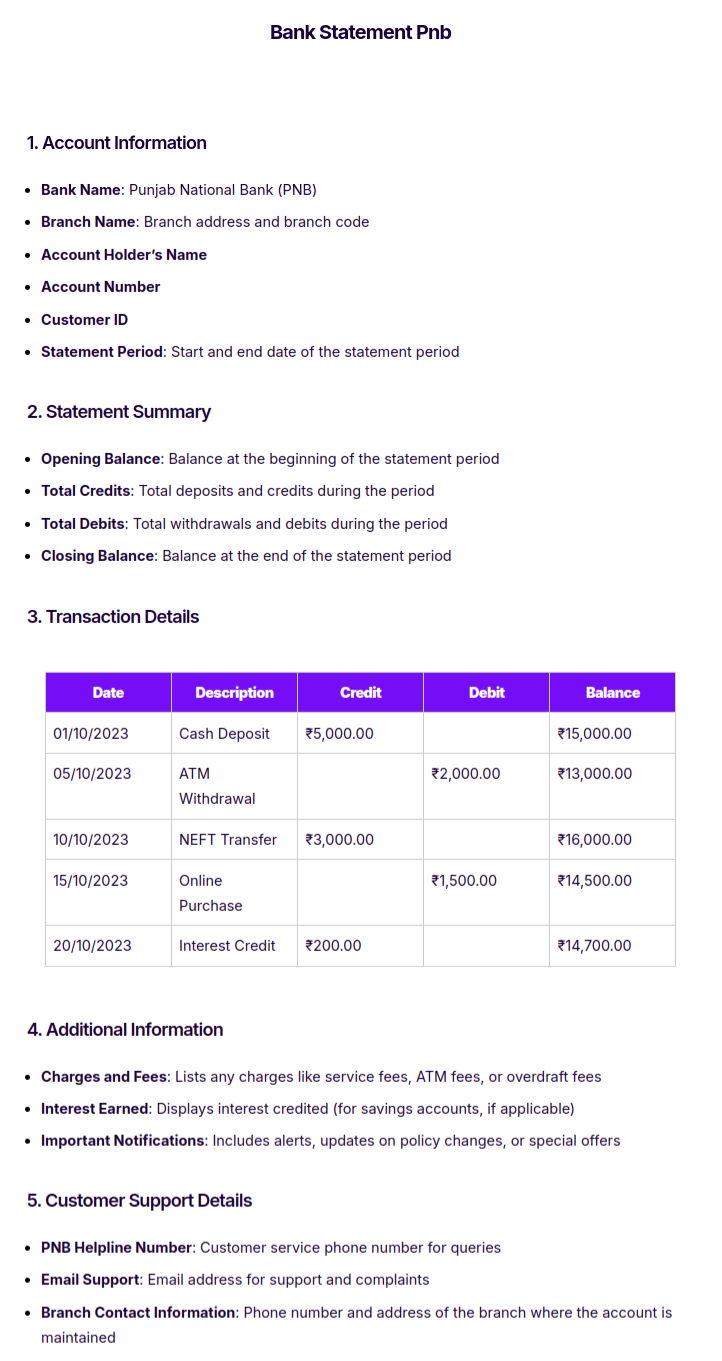

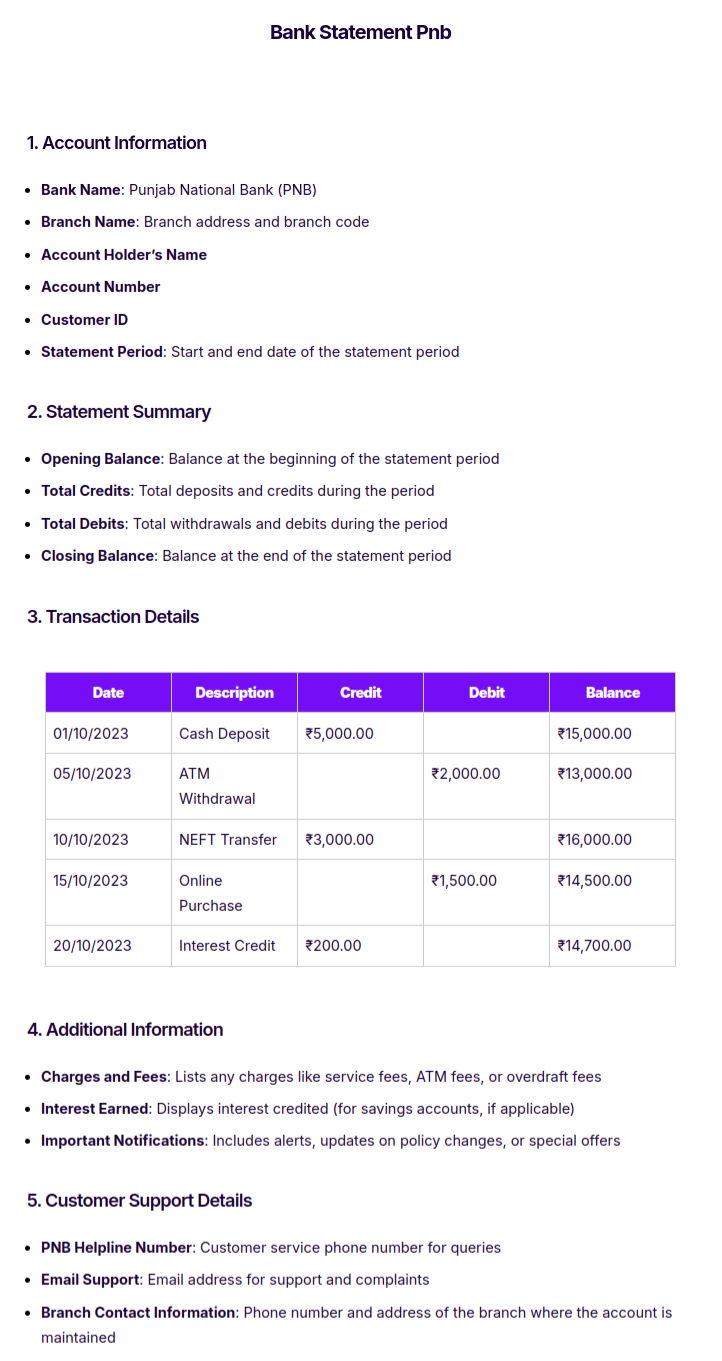

Bank Statement Pnb

5+ Bank Statement Examples

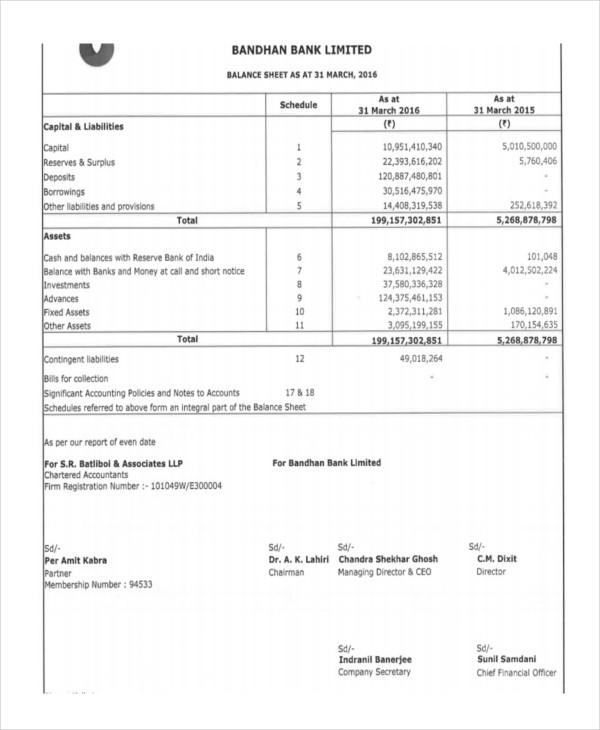

Bank Financial Statement

Bank Balance Statement

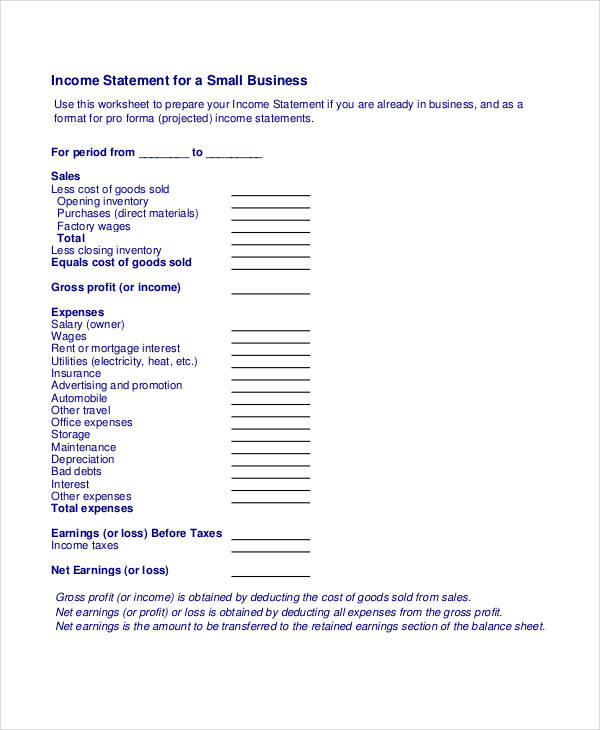

Bank Income Statement

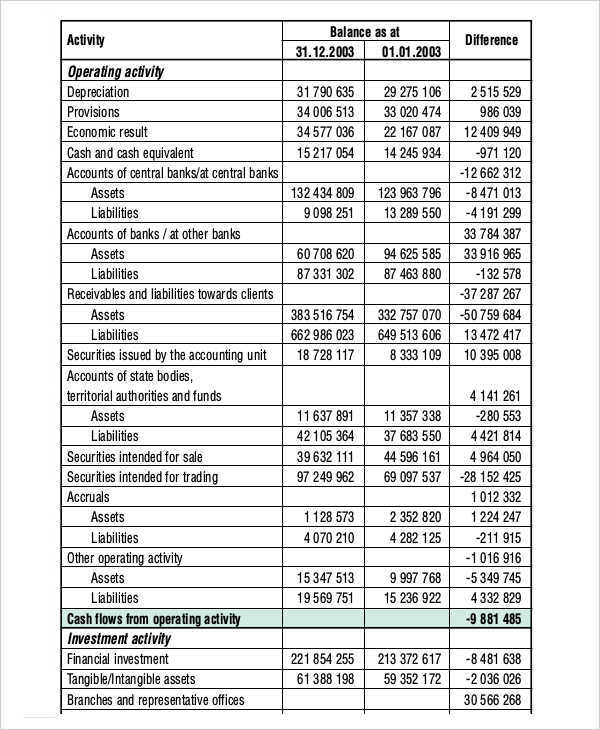

Monthly Bank Statement

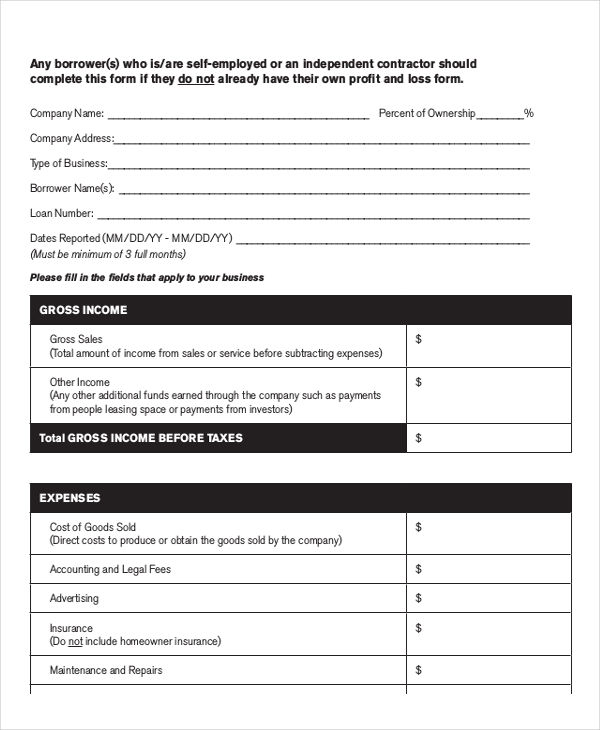

Profit and Loss Statement of Bank

How to write a bank statement

1. Start with Account Information

- Bank Name: Include the bank’s name and logo.

- Branch Information: Provide the branch address and branch code.

- Account Holder’s Name: Full name of the account holder.

- Account Number: Last few digits of the account number for security (e.g., XXX-1234).

- Statement Period: Indicate the start and end dates of the statement period.

2. Add a Statement Summary

- Opening Balance: The balance at the beginning of the period.

- Total Credits (Deposits): Sum of all credits made during the period.

- Total Debits (Withdrawals): Sum of all debits made during the period.

- Closing Balance: The balance at the end of the period.

3. Include Transaction Details

List all transactions in a table format for clarity. The table should have the following columns:

| Date | Description | Credit (₹) | Debit (₹) | Balance (₹) |

|---|

- Date: Date when the transaction occurred.

- Description: Short description of the transaction (e.g., ATM withdrawal, deposit, online transfer).

- Credit: Amount credited (if applicable).

- Debit: Amount debited (if applicable).

- Balance: Updated account balance after each transaction.

4. Add Any Additional Information

- Fees and Charges: List any fees deducted, such as ATM fees, service charges, or overdraft fees.

- Interest Earned: Detail any interest credited, if applicable.

- Important Notices: Include any important updates, terms, or bank notices for the customer.

5. Provide Customer Support Contact Details

- Customer Service Phone Number: For account-related inquiries.

- Email and Website: For further support and self-service options.

- Branch Contact Information: Physical address and direct phone number of the branch.

Sample Transaction Table

| Date | Description | Credit (₹) | Debit (₹) | Balance (₹) |

|---|---|---|---|---|

| 01/10/2023 | Salary Credit | 50,000.00 | 75,000.00 | |

| 05/10/2023 | Grocery Purchase | 2,500.00 | 72,500.00 | |

| 10/10/2023 | Utility Bill Payment | 1,200.00 | 71,300.00 | |

| 15/10/2023 | ATM Withdrawal | 5,000.00 | 66,300.00 | |

| 20/10/2023 | Interest Credit | 200.00 | 66,500.00 |

Importance of Bank Statement

1. Financial Tracking and Budgeting

- Bank statements help account holders monitor their spending habits, income, and overall financial health.

- By reviewing regular statements, individuals can create more accurate budgets and identify areas for saving or reducing expenses.

2. Proof of Income

- A bank statement serves as an official record of deposits, which is often required as proof of income for loan applications, rental agreements, or other financial transactions.

- For self-employed individuals, bank statements may substitute for pay stubs to demonstrate consistent income.

3. Transaction Verification

- Statements allow account holders to review all deposits, withdrawals, and fees, making it easy to spot unauthorized transactions or errors.

- Regularly reviewing bank statements helps detect fraud or suspicious activity quickly, allowing for prompt action.

4. Loan and Credit Applications

- Lenders often require recent bank statements to assess an applicant’s financial stability and cash flow before approving loans or credit.

- Statements provide a clear picture of an individual’s financial behavior, which helps lenders determine creditworthiness.

5. Tax Preparation and Documentation

- Bank statements are essential for accurate tax preparation, as they provide records of income, deductible expenses, and potential taxable interest.

- Statements are also helpful for maintaining documentation required for tax audits.

6. Business Financial Management

- For businesses, bank statements help in tracking cash flow, managing expenses, and ensuring accurate financial reporting.

- They are also essential for reconciling accounts, verifying income, and assessing business performance over time.

7. Dispute Resolution

- In case of discrepancies, a bank statement serves as evidence when resolving disputes with banks, vendors, or other parties.

- Having access to detailed records of transactions helps settle disagreements quickly and accurately.

FAQS

What information is included in a bank statement?

A bank statement typically includes the account holder’s name, account number, statement period, and details of all transactions (deposits, withdrawals, fees) during that period. It also provides beginning and ending balances.

How often are bank statements issued?

Most banks issue statements monthly, though some may provide them quarterly. Many banks also offer electronic statements, which can be accessed online anytime.

Can I access my bank statements online?

Yes, most banks provide online access to statements through their websites or mobile apps. You can typically download, view, or print statements for various past periods.

Why is it important to review my bank statement regularly?

Reviewing your bank statement helps you track spending, detect errors, and identify fraudulent activity. It also assists in budgeting, financial planning, and confirming all transactions are accurate.

How long should I keep my bank statements?

It’s generally recommended to keep bank statements for at least one year. For tax purposes, it’s wise to keep them for up to three years, especially if they contain information related to deductible expenses.

5+ Bank Statement Examples to Download

One of the document that we periodically receive aside from billing statements for our utilities like water and electricity is the bank statement. These are documents provided in connection with any of our accounts in a financial institution. I could probably say you are all familiar with this along with medical and income statements. As humans, one of our priorities is our security. We want to feel safe and free from any threats to our lives including with our finances. We want to guard our hard-earned possessions because after all, we gave all of our efforts to obtain them. One of the ways to do this is securing a bank statement from the financial statement institution where you belong to keep track of all your transactions.

What is Bank Statement?

Bank Statement Example Bundle

Download Bank Statement bundle

Account Information

Account Holder’s Name

Account Number

Bank’s Name and Contact Information

Statement Period (Start Date and End Date)

Statement Summary

Beginning Balance (Balance at the start of the statement period)

Total Deposits/Credits (Sum of all deposits and credits during the period)

Total Withdrawals/Debits (Sum of all withdrawals and debits during the period)

Ending Balance (Balance at the end of the statement period)

Transaction Details

Date

Description

Deposits/Credits

Withdrawals/Debits

Balance

10/01/2023

ATM Deposit

$500.00

$1,500.00

10/05/2023

Online Transfer

$200.00

$1,300.00

10/12/2023

Grocery Store

$150.00

$1,150.00

Additional Information

Fees and Charges: Lists any fees, such as service fees or overdraft charges.

Interest Earned (if applicable): Details any interest accrued during the statement period.

Important Notices: May include general updates, terms changes, or promotional offers from the bank.

Contact Information

Customer Service Contact: Phone number and email for customer inquiries.

Bank Branch Address: Physical address of the bank’s branch.

Bank Statement Example

1. Account Information

Account Holder: John Doe

Account Number: 1234-5678-9012

Bank Name: ABC Bank

Statement Period: October 1, 2023 – October 31, 2023

2. Statement Summary

Beginning Balance: $2,500.00

Total Deposits: $1,200.00

Total Withdrawals: $900.00

Ending Balance: $2,800.00

3. Transaction Details

Date | Description | Deposits | Withdrawals | Balance |

|---|---|---|---|---|

10/02/2023 | Direct Deposit – Payroll | $1,000.00 | $3,500.00 | |

10/04/2023 | ATM Withdrawal | $200.00 | $3,300.00 | |

10/10/2023 | Grocery Store Purchase | $150.00 | $3,150.00 | |

10/15/2023 | Check Deposit | $200.00 | $3,350.00 | |

10/20/2023 | Online Purchase – Amazon | $100.00 | $3,250.00 | |

10/30/2023 | Utility Bill Payment | $450.00 | $2,800.00 |

4. Additional Information

Fees: $0.00

Interest Earned: $5.00

5. Contact Information

Customer Service: 1-800-555-1234

Branch Address: 123 Main St, Anytown, USA

Short Bank Statement Example

Account Information

Account Holder: Jane Smith

Account Number: 9876-5432

Statement Period: September 1, 2023 – September 30, 2023

Statement Summary

Beginning Balance: $1,000.00

Total Deposits: $500.00

Total Withdrawals: $300.00

Ending Balance: $1,200.00

Transaction Details

Date | Description | Deposits | Withdrawals | Balance |

|---|---|---|---|---|

09/05/2023 | Payroll Deposit | $500.00 | $1,500.00 | |

09/12/2023 | ATM Withdrawal | $100.00 | $1,400.00 | |

09/20/2023 | Restaurant Payment | $50.00 | $1,350.00 | |

09/28/2023 | Gas Station | $150.00 | $1,200.00 |

Bank Statement Loans

Bank Statement Pnb

5+ Bank Statement Examples

Bank Financial Statement

centralbank.ie

Bank Balance Statement

bandhanbank.com

Bank Income Statement

rbcroyalbank.com

Monthly Bank Statement

nbs.sk

Profit and Loss Statement of Bank

chase.com

How to write a bank statement

1. Start with Account Information

Bank Name: Include the bank’s name and logo.

Branch Information: Provide the branch address and branch code.

Account Holder’s Name: Full name of the account holder.

Account Number: Last few digits of the account number for security (e.g., XXX-1234).

Statement Period: Indicate the start and end dates of the statement period.

2. Add a Statement Summary

Opening Balance: The balance at the beginning of the period.

Total Credits (Deposits): Sum of all credits made during the period.

Total Debits (Withdrawals): Sum of all debits made during the period.

Closing Balance: The balance at the end of the period.

3. Include Transaction Details

List all transactions in a table format for clarity. The table should have the following columns:

Date | Description | Credit (₹) | Debit (₹) | Balance (₹) |

|---|

Date: Date when the transaction occurred.

Description: Short description of the transaction (e.g., ATM withdrawal, deposit, online transfer).

Credit: Amount credited (if applicable).

Debit: Amount debited (if applicable).

Balance: Updated account balance after each transaction.

4. Add Any Additional Information

Fees and Charges: List any fees deducted, such as ATM fees, service charges, or overdraft fees.

Interest Earned: Detail any interest credited, if applicable.

Important Notices: Include any important updates, terms, or bank notices for the customer.

5. Provide Customer Support Contact Details

Customer Service Phone Number: For account-related inquiries.

Email and Website: For further support and self-service options.

Branch Contact Information: Physical address and direct phone number of the branch.

Sample Transaction Table

Date | Description | Credit (₹) | Debit (₹) | Balance (₹) |

|---|---|---|---|---|

01/10/2023 | Salary Credit | 50,000.00 | 75,000.00 | |

05/10/2023 | Grocery Purchase | 2,500.00 | 72,500.00 | |

10/10/2023 | Utility Bill Payment | 1,200.00 | 71,300.00 | |

15/10/2023 | ATM Withdrawal | 5,000.00 | 66,300.00 | |

20/10/2023 | Interest Credit | 200.00 | 66,500.00 |

Importance of Bank Statement

1. Financial Tracking and Budgeting

Bank statements help account holders monitor their spending habits, income, and overall financial health.

By reviewing regular statements, individuals can create more accurate budgets and identify areas for saving or reducing expenses.

2. Proof of Income

A bank statement serves as an official record of deposits, which is often required as proof of income for loan applications, rental agreements, or other financial transactions.

For self-employed individuals, bank statements may substitute for pay stubs to demonstrate consistent income.

3. Transaction Verification

Statements allow account holders to review all deposits, withdrawals, and fees, making it easy to spot unauthorized transactions or errors.

Regularly reviewing bank statements helps detect fraud or suspicious activity quickly, allowing for prompt action.

4. Loan and Credit Applications

Lenders often require recent bank statements to assess an applicant’s financial stability and cash flow before approving loans or credit.

Statements provide a clear picture of an individual’s financial behavior, which helps lenders determine creditworthiness.

5. Tax Preparation and Documentation

Bank statements are essential for accurate tax preparation, as they provide records of income, deductible expenses, and potential taxable interest.

Statements are also helpful for maintaining documentation required for tax audits.

6. Business Financial Management

For businesses, bank statements help in tracking cash flow, managing expenses, and ensuring accurate financial reporting.

They are also essential for reconciling accounts, verifying income, and assessing business performance over time.

7. Dispute Resolution

In case of discrepancies, a bank statement serves as evidence when resolving disputes with banks, vendors, or other parties.

Having access to detailed records of transactions helps settle disagreements quickly and accurately.

FAQS

What information is included in a bank statement?

A bank statement typically includes the account holder’s name, account number, statement period, and details of all transactions (deposits, withdrawals, fees) during that period. It also provides beginning and ending balances.

How often are bank statements issued?

Most banks issue statements monthly, though some may provide them quarterly. Many banks also offer electronic statements, which can be accessed online anytime.

Can I access my bank statements online?

Yes, most banks provide online access to statements through their websites or mobile apps. You can typically download, view, or print statements for various past periods.

Why is it important to review my bank statement regularly?

Reviewing your bank statement helps you track spending, detect errors, and identify fraudulent activity. It also assists in budgeting, financial planning, and confirming all transactions are accurate.

How long should I keep my bank statements?

It’s generally recommended to keep bank statements for at least one year. For tax purposes, it’s wise to keep them for up to three years, especially if they contain information related to deductible expenses.