7+ Beneficiary Statement in Real Estate Examples to Download

A beneficiary statement is a statement which carries information about a loan. It is often issued by a lender, disclosing the remaining unpaid balance on a mortgage note(or mortgage loan) as of the date specified, along with its interest rate, and other information concerning such loan.

A lender may issue a beneficiary statement upon request, and may of course depend on the circumstances or reasons for request, such as when the borrower decides to sell the property, or is applying for another mortgage or loan, among other circumstances wherein a beneficiary statement is needed.

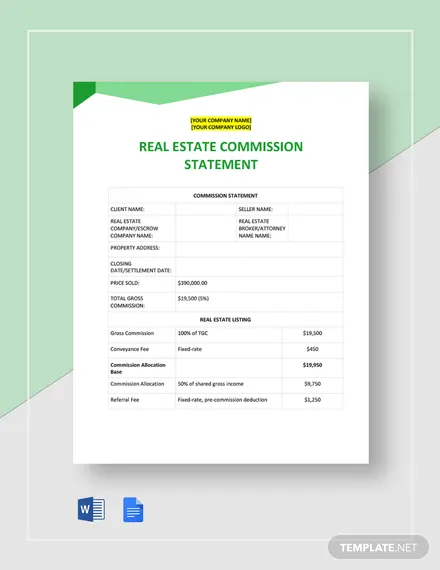

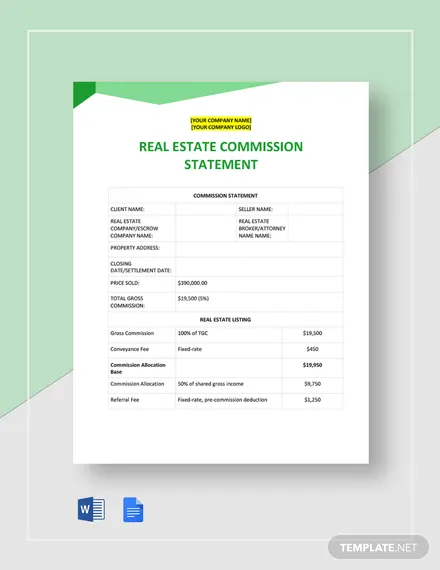

Real Estate Commission Statement

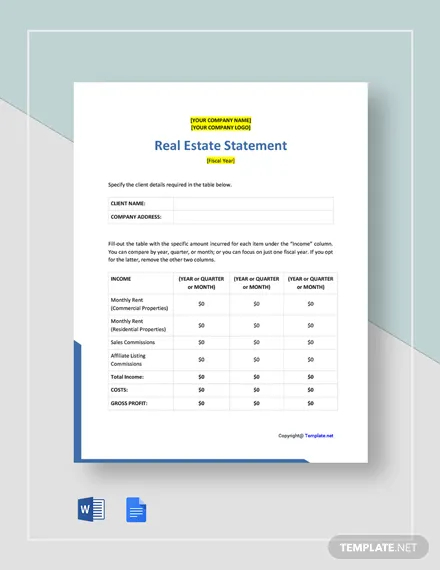

Real Estate Financial Statement Example

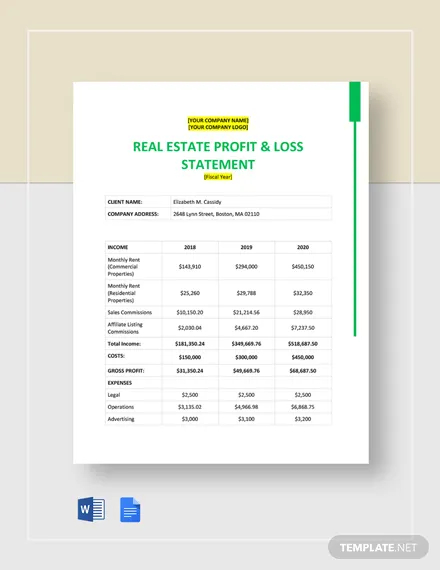

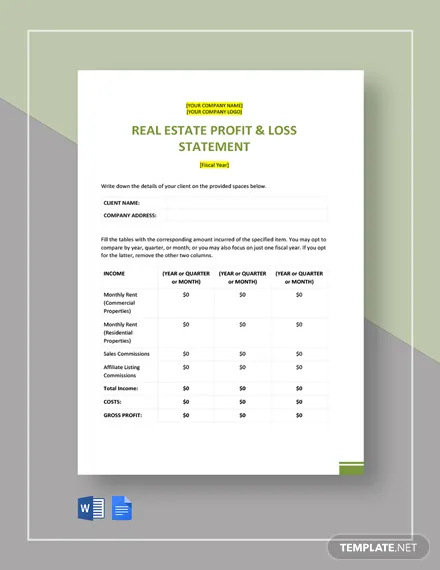

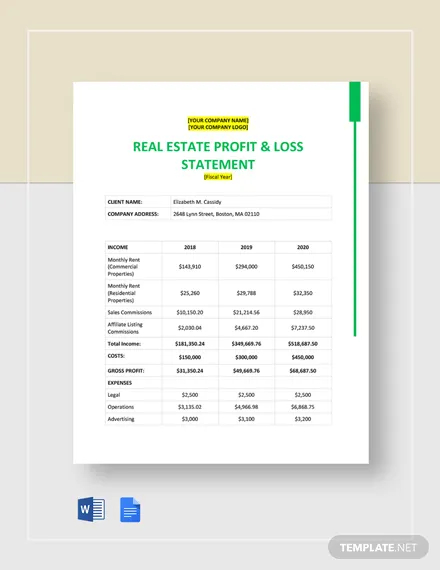

Real Estate Profit And Loss Statement Example

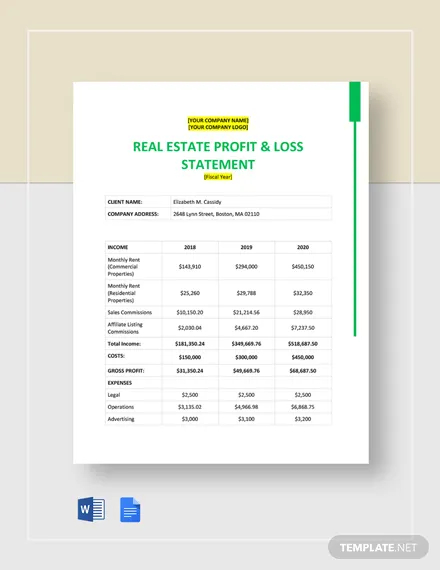

Real Estate Agent Profit And Loss Statement Example

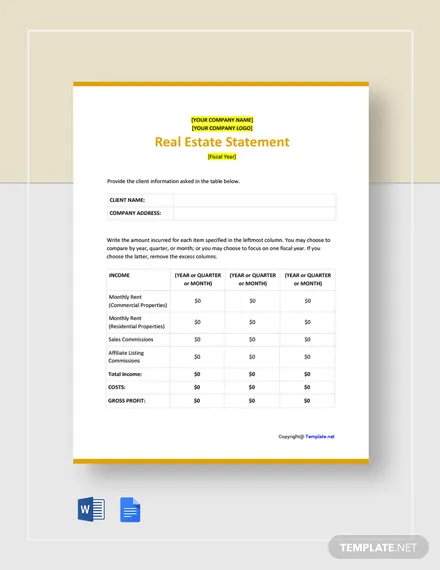

Free Basic Real Estate Statement Template

Free Simple Real Estate Statement Example

Free Blank Real Estate Statement Template

What to Include in a Beneficiary Statement

Contents of a beneficiary statement may vary from one lender to another, and from one area to another. Still, a typical beneficiary statement includes the following information:

- Name of the lender (or lending organization), along with their address and contact details.

- Name of the borrower (or borrowers), including his/her address and contact details.

- Account number of the current mortgage loan.

- Total amount of loan balance to be paid including interest rate.

- Amount of the remaining unpaid balance as of date.

- Interest rate of such balance.

- Due date of mortgage loan.

- Any additional charges incurred at a specific time frame (e.g. statement preparation/issuance fee).

As mentioned, information may vary from one beneficiary statement to another. Thus, it is important to know and understand the laws and rules regarding beneficiary statements in your area. Also see different formats like statements in pdf, statements in doc.

Difference between a Beneficiary Statement and a Loan Statement

A loan statement is a document which discloses the details of the loan, including the terms of such loan. This is basically similar to a beneficiary statement. However, a beneficiary statement may also serve as a requirement when a borrower applies for another loan.

Information included on both statements are somewhat similar. Some lenders may consider accepting loan statement instead of a beneficiary statement. Others, however, may have a strict policy that the borrower needs to present a beneficiary statement of previous loans as a requirement for another loan application.

Still, in requesting a beneficiary statement from a previous lender (or lending company), the lender may charge a certain amount for the issuance of such document. It is thus necessary for the borrower to inquire whether the lending company where he/she intends to apply for a loan would consider a loan statement to avoid such additional payment from the previous lender.

Purpose of a Beneficiary Statement

Beneficiary statements are issued with the intention of informing both the lender and the borrower of the status of the loan under the borrower’s name.

As discussed, a beneficiary statement can be requested by the borrower for several reasons, usually in applying for another loan. Because beneficiary need statements serve as a note including information regarding the borrower’s current loan status, it serves as one of the documents which help other lenders to decide whether such borrower is worthy of being granted another loan.

That being said, it is required that a beneficiary statement contains correct and accurate information regarding a borrower’s loan, meaning the information needs to be checked twice by both the issuer (previous lender) and the borrower upon issuance and receipt respectively.

7+ Beneficiary Statement in Real Estate Examples to Download

A beneficiary statement is a statement which carries information about a loan. It is often issued by a lender, disclosing the remaining unpaid balance on a mortgage note(or mortgage loan) as of the date specified, along with its interest rate, and other information concerning such loan.

A lender may issue a beneficiary statement upon request, and may of course depend on the circumstances or reasons for request, such as when the borrower decides to sell the property, or is applying for another mortgage or loan, among other circumstances wherein a beneficiary statement is needed.

Real Estate Commission Statement

Details

File Format

Word

Google Docs

Pages

Size: A4, US

Real Estate Financial Statement Example

Details

File Format

Word

Google Docs

Pages

Size: A4, US

Real Estate Profit And Loss Statement Example

Details

File Format

Word

Google Docs

Pages

Size: A4, US

Real Estate Agent Profit And Loss Statement Example

Details

File Format

Word

Google Docs

Pages

Size: A4, US

Free Basic Real Estate Statement Template

Details

File Format

Word

Google Docs

Pages

Size: A4, US

Free Simple Real Estate Statement Example

Details

File Format

Word

Google Docs

Pages

Size: A4, US

Free Blank Real Estate Statement Template

Details

File Format

Word

Google Docs

Pages

Size: A4, US

What to Include in a Beneficiary Statement

Contents of a beneficiary statement may vary from one lender to another, and from one area to another. Still, a typical beneficiary statement includes the following information:

Name of the lender (or lending organization), along with their address and contact details.

Name of the borrower (or borrowers), including his/her address and contact details.

Account number of the current mortgage loan.

Total amount of loan balance to be paid including interest rate.

Amount of the remaining unpaid balance as of date.

Interest rate of such balance.

Due date of mortgage loan.

Any additional charges incurred at a specific time frame (e.g. statement preparation/issuance fee).

As mentioned, information may vary from one beneficiary statement to another. Thus, it is important to know and understand the laws and rules regarding beneficiary statements in your area. Also see different formats like statements in pdf, statements in doc.

Difference between a Beneficiary Statement and a Loan Statement

A loan statement is a document which discloses the details of the loan, including the terms of such loan. This is basically similar to a beneficiary statement. However, a beneficiary statement may also serve as a requirement when a borrower applies for another loan.

Information included on both statements are somewhat similar. Some lenders may consider accepting loan statement instead of a beneficiary statement. Others, however, may have a strict policy that the borrower needs to present a beneficiary statement of previous loans as a requirement for another loan application.

Still, in requesting a beneficiary statement from a previous lender (or lending company), the lender may charge a certain amount for the issuance of such document. It is thus necessary for the borrower to inquire whether the lending company where he/she intends to apply for a loan would consider a loan statement to avoid such additional payment from the previous lender.

Purpose of a Beneficiary Statement

Beneficiary statements are issued with the intention of informing both the lender and the borrower of the status of the loan under the borrower’s name.

As discussed, a beneficiary statement can be requested by the borrower for several reasons, usually in applying for another loan. Because beneficiary need statements serve as a note including information regarding the borrower’s current loan status, it serves as one of the documents which help other lenders to decide whether such borrower is worthy of being granted another loan.

That being said, it is required that a beneficiary statement contains correct and accurate information regarding a borrower’s loan, meaning the information needs to be checked twice by both the issuer (previous lender) and the borrower upon issuance and receipt respectively.