25+ Billing Address Examples

A billing address is a crucial element in the buying process, serving as a key piece of information for completing transactions. Whether you’re purchasing commodities, products, or services online or offline, the billing address you provide ensures that payment processes run smoothly and securely. This address is not only used to verify the identity of the cardholder but also plays a vital role in the delivery of services and product invoices. Understanding the importance of a billing address can help you manage your purchases more efficiently, ensuring a seamless shopping experience.

What is Billing Address?

Billing Address Format

Full Name

The name of the cardholder or account holder.

Street Address or P.O. Box

The precise location or postal box where bills and statements are sent.

City

The city where the cardholder resides.

State/Province

The state or province of the address.

Postal Code

The postal or ZIP code for the area.

Country

The country where the address is located.

Billing Address Example

Name: John Doe

Street Address: 123 Main St., Apartment 4B

City: Springfield

State: IL

Postal Code: 62704

Country: USA

Examples of Billing Address

Billing Address Examples for Credit Card

When entering a billing address for a credit card, it’s crucial to provide accurate information that matches the records on file with your card issuer. Here are several examples of correctly formatted billing addresses for credit cards:

Example 1: Standard U.S. Address

Name: Jane Smith

Street Address: 456 Elm Street

City: New York

State: NY

ZIP Code: 10001

Country: United States

Phone Number: (212) 555-7890

Example 2: Address with Apartment Number

Name: Robert Johnson

Street Address: 789 Oak Avenue

Secondary Address Line: Apt. 12C

City: San Francisco

State: CA

ZIP Code: 94102

Country: United States

Phone Number: (415) 555-1234

Example 3: International Address

Name: Emily Zhang

Street Address: 23 Nanjing Road

City: Shanghai

Province/State: Shanghai

Postal Code: 200000

Country: China

Phone Number: +86 21 5555 1234

Example 4: Address with Suite Number

Name: Michael Brown

Street Address: 321 Pine Street

Secondary Address Line: Suite 1500

City: Chicago

State: IL

ZIP Code: 60601

Country: United States

Phone Number: (312) 555-6789

Example 5: Address with PO Box

Name: Laura Davis

Street Address: PO Box 987

City: Houston

State: TX

ZIP Code: 77002

Country: United States

Phone Number: (713) 555-4321

Example 6: Canadian Address

Name: Liam Wilson

Street Address: 123 Maple Street

City: Toronto

Province: ON

Postal Code: M5H 2N2

Country: Canada

Phone Number: (416) 555-8765

Example 7: UK Address

Name: Sarah Johnson

Street Address: 10 Downing Street

City: London

Postal Code: SW1A 2AA

Country: United Kingdom

Phone Number: +44 20 7123 4567

Example 8: Australian Address

Name: James Taylor

Street Address: 15 Collins Street

City: Melbourne

State: VIC

Postal Code: 3000

Country: Australia

Phone Number: +61 3 5555 6789

Billing Address Examples Debit Card

When entering a billing address for a debit card, accuracy is essential to ensure successful transactions. Here are several examples of correctly formatted billing addresses for debit cards:

Example 1: Standard U.S. Address

Name: John Doe

Street Address: 123 Maple Street

City: Springfield

State: IL

ZIP Code: 62704

Country: United States

Phone Number: (217) 555-1234

Example 2: Address with Apartment Number

Name: Alice Johnson

Street Address: 456 Oak Street

Secondary Address Line: Apt. 5B

City: Denver

State: CO

ZIP Code: 80203

Country: United States

Phone Number: (303) 555-5678

Example 3: International Address

Name: Carlos Mendez

Street Address: Av. Insurgentes 123

City: Mexico City

State: CDMX

Postal Code: 01000

Country: Mexico

Phone Number: +52 55 5555 6789

Example 4: Address with Suite Number

Name: Emily White

Street Address: 789 Pine Street

Secondary Address Line: Suite 300

City: Seattle

State: WA

ZIP Code: 98101

Country: United States

Phone Number: (206) 555-9876

Example 5: Address with PO Box

Name: David Brown

Street Address: PO Box 1234

City: Miami

State: FL

ZIP Code: 33101

Country: United States

Phone Number: (305) 555-4321

Example 6: Canadian Address

Name: Chloe Smith

Street Address: 678 Elm Street

City: Vancouver

Province: BC

Postal Code: V6B 1A1

Country: Canada

Phone Number: (604) 555-1234

Example 7: UK Address

Name: Oliver Taylor

Street Address: 22 Baker Street

City: London

Postal Code: NW1 6XE

Country: United Kingdom

Phone Number: +44 20 1234 5678

Example 8: Australian Address

Name: Sophie Brown

Street Address: 35 George Street

City: Sydney

State: NSW

Postal Code: 2000

Country: Australia

Phone Number: +61 2 5555 1234

Billing Address Examples for Business

When entering a billing address for a business, accuracy is key to ensure successful transactions. Here are eight examples of correctly formatted billing addresses for businesses:

Example 1: Standard U.S. Business Address

Business Name: ABC Corporation

Attention: John Doe

Street Address: 123 Business Road

City: Boston

State: MA

ZIP Code: 02108

Country: United States

Phone Number: (617) 555-1234

Email: john.doe@abccorp.com

Example 2: Business Address with Suite Number

Business Name: XYZ Enterprises

Attention: Jane Smith

Street Address: 456 Corporate Blvd

Secondary Address Line: Suite 300

City: Los Angeles

State: CA

ZIP Code: 90017

Country: United States

Phone Number: (213) 555-5678

Email: jane.smith@xyzenterprises.com

Example 3: International Business Address

Business Name: Global Solutions Ltd.

Attention: Carlos Fernandez

Street Address: Calle de la Industria 123

City: Madrid

Postal Code: 28010

Country: Spain

Phone Number: +34 91 555 7890

Email: carlos.fernandez@globalsolutions.com

Example 4: Business Address with PO Box

Business Name: Innovation Hub

Attention: Emily Clark

Street Address: PO Box 987

City: Austin

State: TX

ZIP Code: 73301

Country: United States

Phone Number: (512) 555-8765

Email: emily.clark@innovationhub.com

Example 5: Canadian Business Address

Business Name: Maple Leaf Technologies

Attention: Liam Wilson

Street Address: 789 Tech Avenue

City: Toronto

Province: ON

Postal Code: M5H 2N2

Country: Canada

Phone Number: (416) 555-4321

Email: liam.wilson@mapleleaftech.ca

Example 6: UK Business Address

Business Name: London Consulting

Attention: Sarah Johnson

Street Address: 10 Downing Street

City: London

Postal Code: SW1A 2AA

Country: United Kingdom

Phone Number: +44 20 7123 4567

Email: sarah.johnson@londonconsulting.co.uk

Example 7: Australian Business Address

Business Name: Sydney Innovations

Attention: James Taylor

Street Address: 15 Collins Street

City: Melbourne

State: VIC

Postal Code: 3000

Country: Australia

Phone Number: +61 3 5555 6789

Email: james.taylor@sydneyinnovations.com.au

Example 8: Business Address with Floor Number

Business Name: Tech Solutions Inc.

Attention: Olivia Martin

Street Address: 100 Innovation Drive

Secondary Address Line: Floor 5

City: New York

State: NY

ZIP Code: 10001

Country: United States

Phone Number: (212) 555-6789

Email: olivia.martin@techsolutions.com

More Examples on Billing Address

1. Change of Billing Address

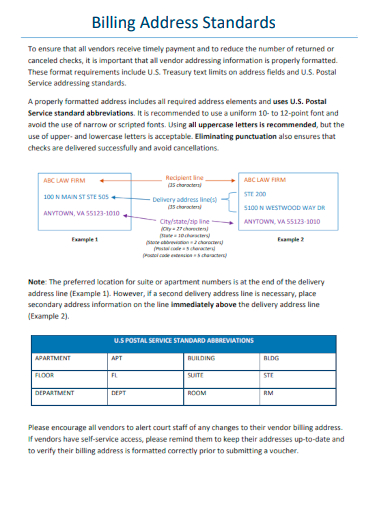

2. Billing Address Standards

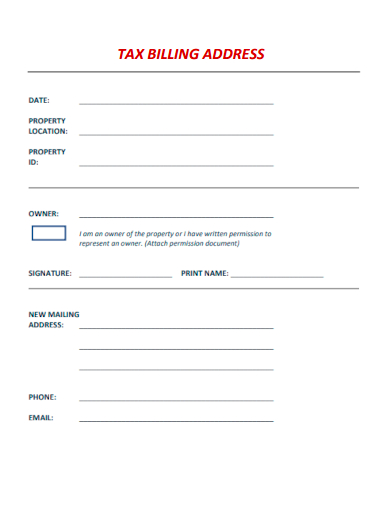

3. Tax Billing Address

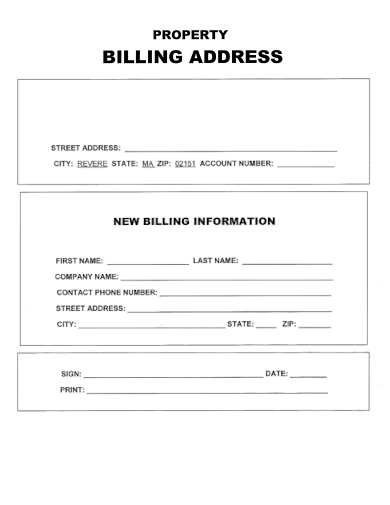

4. Property Billing Address

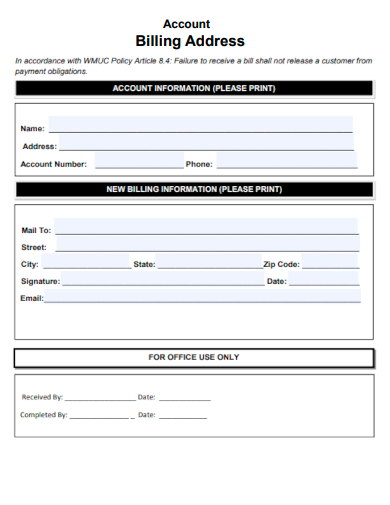

5. Account Billing Address

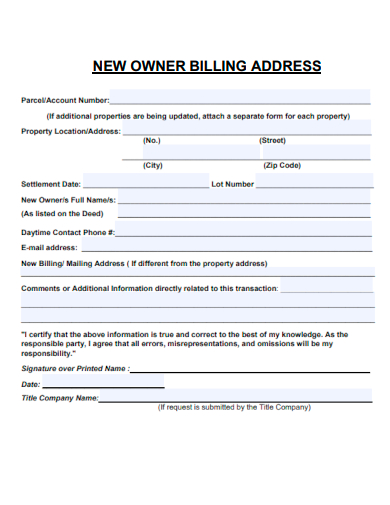

6. New Owner Billing Address

What is Your Billing Address Used For?

A billing address is a crucial piece of information used in various financial and administrative contexts. Here’s an in-depth look at the primary uses of a billing address:

1. Verification of Payment Information

The billing address is primarily used to verify the identity of the person making a transaction. When you make a purchase online or over the phone, the billing address you provide is cross-checked with the address on file with your bank or credit card issuer. This helps ensure that the transaction is legitimate and helps prevent fraud.

2. Credit Card and Debit Card Transactions

During the payment process, the billing address is compared with the address on record with the credit card or debit card company. This Address Verification System (AVS) is an additional security measure to confirm that the person using the card is the legitimate cardholder.

3. Billing and Invoicing

Companies use your billing address to send invoices, receipts, and statements. This address is where they will send any financial documents related to your account or purchases. It ensures that you receive all necessary documentation for your records.

4. Subscription Services

For services that require regular payments, such as magazine subscriptions, streaming services, or software licenses, the billing address is used to manage and verify recurring transactions. It ensures that the payments are consistently processed and correctly attributed to your account.

5. Shipping and Delivery

Although the billing address is primarily used for financial verification, it can also be used as the shipping address if you do not specify a separate delivery address. Some companies may require the billing and shipping addresses to be the same for the first order to prevent fraud.

6. Account Setup and Maintenance

When setting up an account with a new service provider, your billing address is required to establish your identity and financial information. It is also used for account maintenance, such as updating your payment methods or changing your subscription plans.

7. Insurance Policies

For insurance services, the billing address is used to send policy documents, renewal notices, and bills. It ensures that you receive all important information regarding your insurance coverage and payments.

8. Loyalty Programs and Rewards

Some businesses use the billing address to track purchases and award points in loyalty programs. This address helps them maintain accurate records of your transactions and ensure that you receive any rewards or benefits you are entitled to.

9. Legal and Tax Purposes

In some cases, the billing address is used for legal and tax documentation. For example, when you purchase items that are tax-deductible, the billing address on the receipt can be used to verify the transaction for tax reporting purposes.

How to Check Your Billing Address

Ensuring that your billing address is accurate and up-to-date is essential for smooth financial transactions. Here are various methods to check your billing address:

1. Credit Card Statement

Your billing address is typically listed on your monthly credit card statements. You can access these statements either in paper form (if mailed to you) or online via your credit card issuer’s website or app.

Steps:

- Locate your latest credit card statement.

- Look for the section with your personal details.

- Verify the billing address listed.

2. Bank Account Statement

Similar to credit card statements, your billing address can also be found on your bank account statements. These statements are available in paper form or online.

Steps:

- Access your latest bank account statement.

- Check the personal information section.

- Confirm the billing address.

3. Online Banking or Credit Card Account

Most financial institutions offer online banking or online account management systems where you can view and update your personal information, including your billing address.

Steps:

- Log in to your online banking or credit card account.

- Navigate to the “Account Settings” or “Profile” section.

- Look for “Address” or “Contact Information.”

- Verify the billing address listed.

4. Mobile Banking App

If you use a mobile banking app, you can check your billing address directly from your smartphone.

Steps:

- Open your bank or credit card issuer’s mobile app.

- Log in with your credentials.

- Go to the “Settings” or “Profile” section.

- Check the billing address displayed.

5. Customer Service

If you’re unable to find your billing address through online methods, contacting customer service is a reliable option. Customer service representatives can verify and update your billing address for you.

Steps:

- Call the customer service number on the back of your credit card or on your bank’s website.

- Verify your identity by answering security questions.

- Ask the representative to confirm your billing address.

6. Bank Branch Visit

Visiting a local branch of your bank or credit card issuer is another way to check and update your billing address.

Steps:

- Visit the nearest branch of your bank or credit card issuer.

- Speak to a customer service representative or teller.

- Provide identification and request to verify your billing address.

7. Recent Receipts or Invoices

If you have recently made a purchase using your credit card or bank account, your billing address may be listed on the receipt or invoice.

Steps:

- Review recent purchase receipts or invoices.

- Look for the billing address section.

- Verify the address listed.

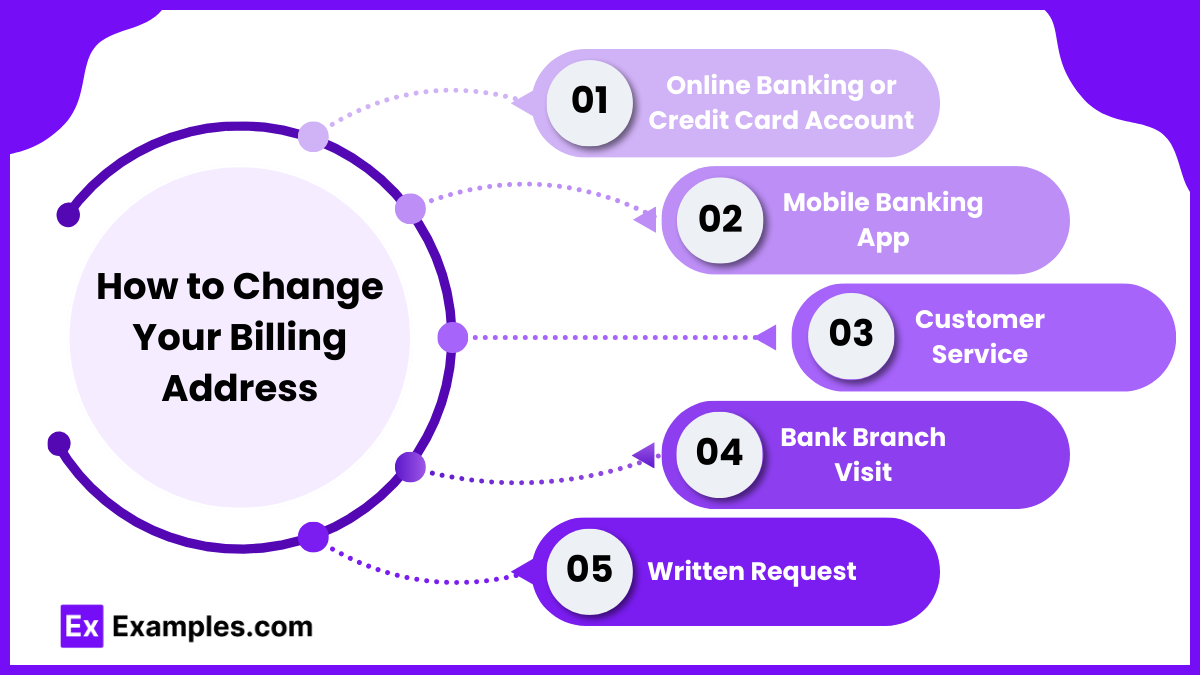

How to Change Your Billing Address

Keeping your billing address up-to-date is essential for successful transactions and account management. Here’s a step-by-step guide on how to change your billing address:

1. Online Banking or Credit Card Account

Most banks and credit card issuers allow you to change your billing address online through their website or mobile app.

Steps:

- Log In:

- Go to your bank or credit card issuer’s website.

- Log in to your online banking or account management portal with your username and password.

- Navigate to Profile Settings:

- Find the “Account Settings,” “Profile,” or “Personal Information” section.

- Update Address:

- Locate the address section and enter your new billing address.

- Save the changes.

- Confirmation:

- Check for a confirmation message or email that your address has been updated.

2. Mobile Banking App

If you prefer using a mobile app, you can update your billing address directly from your smartphone.

Steps:

- Open the App:

- Open your bank or credit card issuer’s mobile app.

- Log In:

- Log in with your credentials.

- Find Profile Settings:

- Navigate to the “Settings,” “Profile,” or “Account Information” section.

- Update Address:

- Enter your new billing address and save the changes.

- Confirmation:

- Look for a confirmation notification or email.

3. Customer Service

If you’re unable to update your address online, you can contact customer service for assistance.

Steps:

- Call Customer Service:

- Find the customer service number on the back of your credit card or on your bank’s website.

- Verify Identity:

- Provide the necessary information to verify your identity, such as your account number, Social Security number, and answers to security questions.

- Request Address Change:

- Ask the representative to update your billing address.

- Confirmation:

- Confirm the change with the representative and ask for a confirmation email or letter.

4. Bank Branch Visit

Visiting a local branch of your bank or credit card issuer is another way to update your billing address.

Steps:

- Visit the Branch:

- Go to the nearest branch of your bank or credit card issuer.

- Speak to a Representative:

- Talk to a customer service representative or teller.

- Provide Identification:

- Show identification, such as a driver’s license or passport, and provide your account information.

- Request Address Change:

- Request to update your billing address.

- Confirmation:

- Confirm the change and ask for a receipt or confirmation document.

5. Written Request

Some banks and credit card issuers may accept written requests to change your billing address.

Steps:

- Write a Request:

- Write a letter requesting the change of your billing address. Include your account number, old address, new address, and your signature.

- Mail the Request:

- Mail the letter to the address provided by your bank or credit card issuer for such requests.

- Confirmation:

- Wait for a confirmation letter or email from the bank or credit card issuer.

How to fix Billing Address Errors

1. Review and Verify Your Billing Address

- Check Statements: Look at recent bank or credit card statements for your billing address.

- Login to Online Accounts: Compare the address on file with your bank or credit card issuer.

2. Correct the Billing Address Online

- Log In: Access your bank or credit card account online.

- Update Address: Navigate to the “Account Settings” or “Profile” section and update the address.

- Save Changes: Confirm the update and look for a confirmation message.

3. Contact Customer Service

- Call Customer Service: Use the number on the back of your card or on the bank’s website.

- Verify Identity: Provide your account number and answer security questions.

- Request Correction: Ask to update your billing address and confirm the change.

4. Visit a Local Branch

- Go to the Branch: Visit the nearest bank or credit card issuer’s branch.

- Speak to a Representative: Provide ID and account information.

- Request Address Correction: Explain the error and update the address.

- Get Confirmation: Confirm the change and ask for a receipt.

5. Verify and Update Linked Services

- Review Linked Accounts: Check services and subscriptions using your billing address.

- Update Information: Log in and update the address for each account.

- Confirm Changes: Look for confirmation messages or emails.

6. Monitor Statements and Transactions

- Check Statements: Regularly review your statements for accuracy.

- Monitor Transactions: Ensure transactions are processed correctly.

- Report Issues: Immediately report any discrepancies.

Billing Address vs. Shipping Address

| Aspect | Billing Address | Shipping Address |

|---|---|---|

| Purpose | Used for verifying the cardholder’s identity and processing payments. | Used for delivering purchased items. |

| Associated With | Bank or credit card issuer. | Retailers, shipping carriers. |

| Contains | – Full Name – Street Address – City – State/Province – ZIP/Postal Code – Country – Phone Number | – Full Name – Street Address – City – State/Province – ZIP/Postal Code – Country – Phone Number |

| Verification | Used to verify payment details and prevent fraud. | Used to ensure correct delivery of goods. |

| Updates | Must be updated with the bank or credit card issuer when you move. | Must be updated with the retailer or shipping service when you move. |

| Common Issues | Incorrect address can lead to declined transactions. | Incorrect address can result in undelivered packages. |

| Example Use Case | Online shopping, paying bills, subscription services. | E-commerce deliveries, receiving packages. |

| Handling Errors | Contact your bank or credit card issuer to update. | Contact the retailer or shipping carrier to update. |

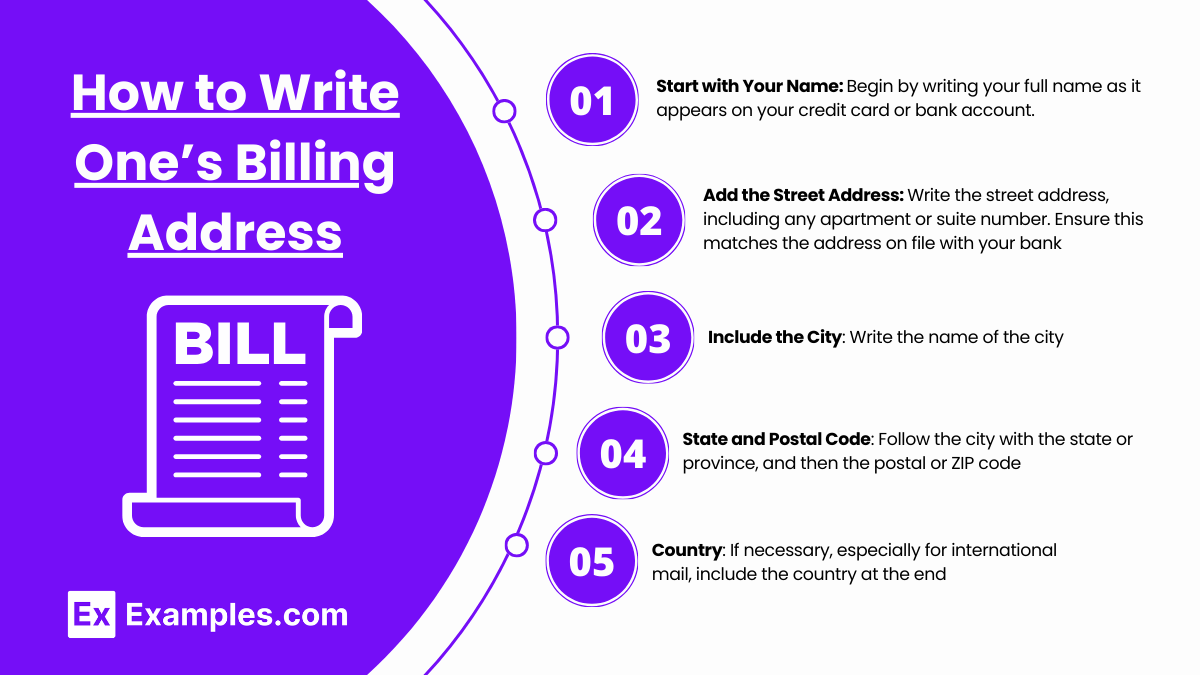

How to Write One’s Billing Address

Start with Your Name

Begin by writing your full name as it appears on your credit card or bank account.

Add the Street Address

Write the street address, including any apartment or suite number. Ensure this matches the address on file with your bank.

Include the City

Write the name of the city.

State and Postal Code

Follow the city with the state or province, and then the postal or ZIP code

Country

If necessary, especially for international mail, include the country at the end.

FAQs

Why is my billing address important?

Your billing address ensures that your payment information is verified, preventing fraud and ensuring successful transactions.

How do I find my billing address?

Check your bank or credit card statements, online banking profile, or contact customer service for assistance.

How can I update my billing address?

Update your billing address through your bank or credit card issuer’s website, mobile app, customer service, or by visiting a local branch.

What happens if my billing address is incorrect?

Incorrect billing addresses can lead to declined transactions, missed statements, and payment issues.

Can my billing and shipping address be different?

Yes, your billing address is used for payment verification, while your shipping address is used for delivering goods.

How long does it take to update a billing address?

Updating your billing address typically takes effect immediately or within a few business days, depending on the issuer.

Why was my transaction declined due to address mismatch?

An address mismatch means the billing address you entered does not match the address on file with your bank or card issuer.

Can I use a PO Box as my billing address?

Some banks and card issuers allow PO Boxes for billing addresses, but check with your specific institution.

How do I verify my billing address during online transactions?

Enter the exact address associated with your bank or credit card, including any apartment or suite numbers.

How do I change my billing address for multiple accounts?

Update each account individually through their respective customer service, websites, or mobile apps to ensure all your information is current.